The Net Present Value (NPV)

The Net Present Value (NPV) is a financial indicator used to evaluate the profitability of an investment.

The NPV formula is:

To calculate the present value based on future cash flows, use the following formula:

Future Value is the expected net cash inflow or outflows, r is the discount rate, and t is the number of time periods.

The expanded formula of the NPV is:

The Excel NPV Function

The NPV function is defined by the following syntax:

=NPV (rate, value1, [value2], ...)Arguments:

| Argument | Required/Optional | Explanation |

|---|---|---|

| rate | Required | Discount rate over one period. |

| value1 | Required | First value(s) representing cash flows. |

| value2 | optional | Second value(s) representing cash flows. |

The Excel XNPV Function

You can also calculate the NPV with the XNPV function. The XNPV function has the following syntax:

=XNPV(rate, values,dates)Arguments:

| Argument | Required/Optional | Explanation |

|---|---|---|

| rate | Required | defines the discount rate |

| values | Required | represents cash flows |

| dates | Required | cashflow dates |

Read More: XIRR vs IRR in Excel

How to Calculate the Net Present Value with the Excel NPV Function

Steps:

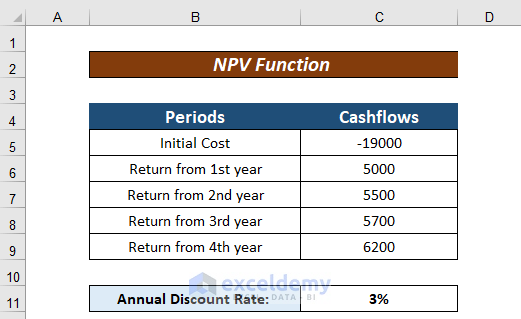

- Create a dataset with cashflow over a period of time.

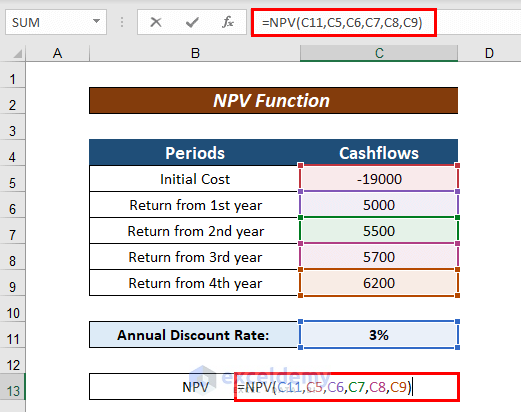

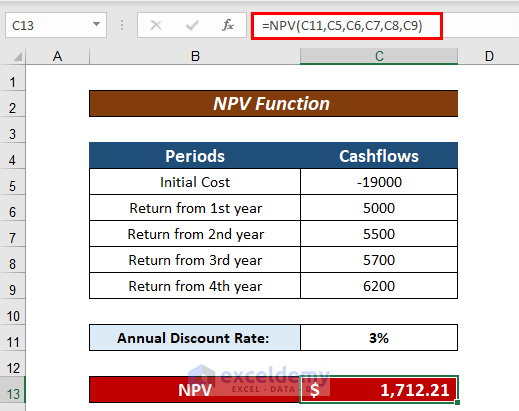

- Enter the following formula:

=NPV(D11,D5,D6,D7,D8,D9)D11 = Annual discount rate

C5, C6, C7, C8, C9 = Cashflow over a specific time interval

- Press ENTER to see the Net Present Value.

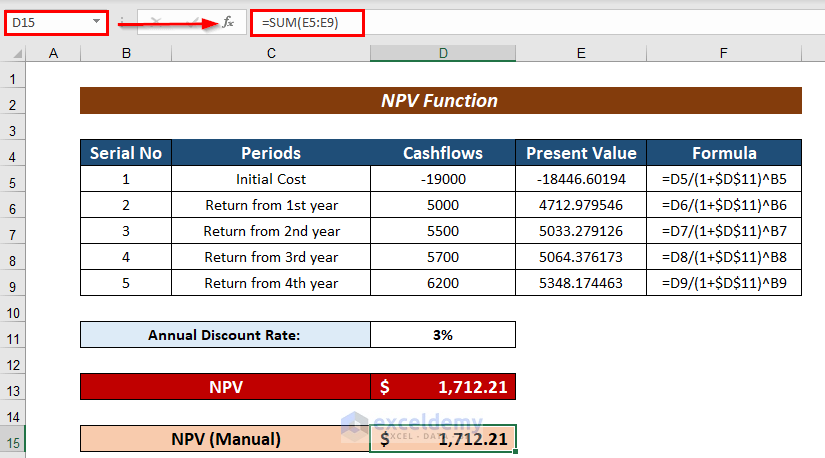

You can cross-match the result with a basic arithmetic formula: calculate the Present Value over the period of time and sum the values.

How to Calculate the Net Present Value with the Excel XNPV Function

Steps:

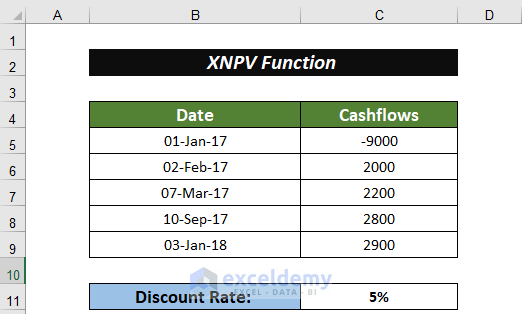

- Enter Date and Cashflow in separate columns.

- Consider the Discount Rate.

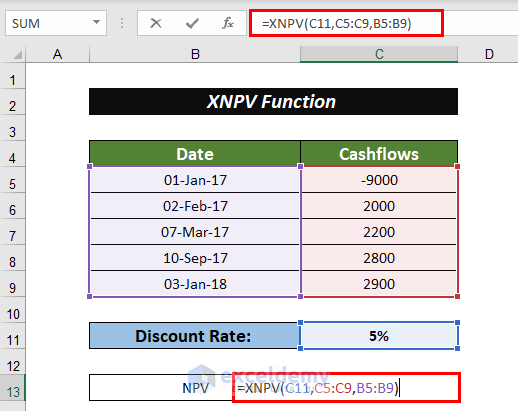

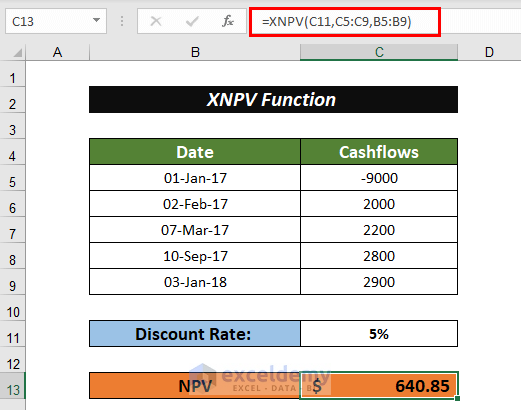

- Use the following formula:

=XNPV(C11,C5:C9,B5:B9)C11 = Discount Rate

C5:C9 = Cashflow in different periods of time.

B5:B9 = Date

- Press ENTER to see the Net Present Value.

Read More: How to Convert Percentage to Basis Points in Excel

Differences between the XNPV and the NPV Function

- The values in the NPV function are equally spaced in terms of the period of time.

- The Net Present Value calculation with the NPV function does not require dates.

- The XNPV function returns more accurate results, as it takes a set of dates.

Download Working File

Related Articles

- How to Calculate Profitability Index in Excel

- How to Calculate Tracking Error in Excel

- How to Calculate WACC in Excel

- How to Calculate Mileage Reimbursement in Excel

- How to Calculate Time Weighted Return in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Thanks a lot Taryn!!!

I m a Finance Student and need this formulas a Lot!!!!

You have very easily explained the concepts.!!!

Looking foreword for more:):):):):):)

You are most welcome. We are intending to do a financial functions tutorial series so lookout for that 🙂 Best of luck with your studies as well 🙂