What Is Cost per Unit?

Formula for Cost per Unit:

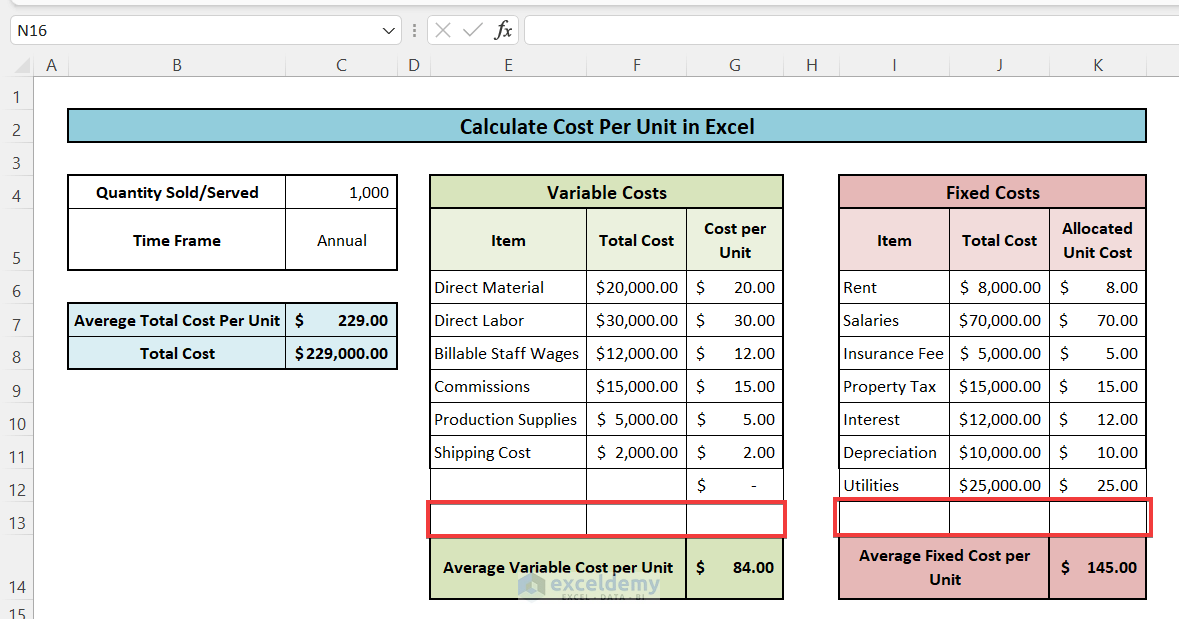

Cost per unit = (Total fixed costs + Total variable costs) / Total units produced

Fixed Cost:

Components of Fixed Cost:

- Rent or Lease Payments: The charge to pay for the assets which the company has either rented or leased for a certain period.

- Salaries: The fixed payment that disburses to the employees on a regular basis.

- Insurance Fee: The routine charge for any insurance service of the company.

- Property Tax: The tax that the company has to pay to the government according to the value of assets.

- Interest Payments: The charge that the business needs to pay on the loan taken by the company. It will become a fixed cost if the interest rate become fixed or the repayment amount is fixed for a period.

- Depreciation: Depreciation cost is the cost to overcome the gradual decrease of asset value over a time period.

- Utilities: It includes all other types of costs which the company has to pay after a time period regularly like electricity, gas, etc bills.

Variable Cost:

Components of Variable Cost:

- Direct Material: The raw materials that the product contains in itself.

- Direct Labor: The wages paid to the workers as per the amount of the unit produced. It is the variable cost when the workers are on a temporary contract which depends on the production volume. For the permanent workers, it will be listed as a fixed cost.

- Billable Staff Wages: Sometimes, the company does pay wages on the billable hours. It can be due to overtime of work or temporary hiring.

- Commissions: In business, to motivate the salespersons, the company pays a commission to them on the sold products.

- Production Supplies: The necessary tools and supplies which vary with the production level like machinery oils.

- Shipping Cost: During the shipping of a product, the company pays the shipping cost which varies with the number of units.

How to Calculate Cost per Unit in Excel: Step-by-Step Procedure

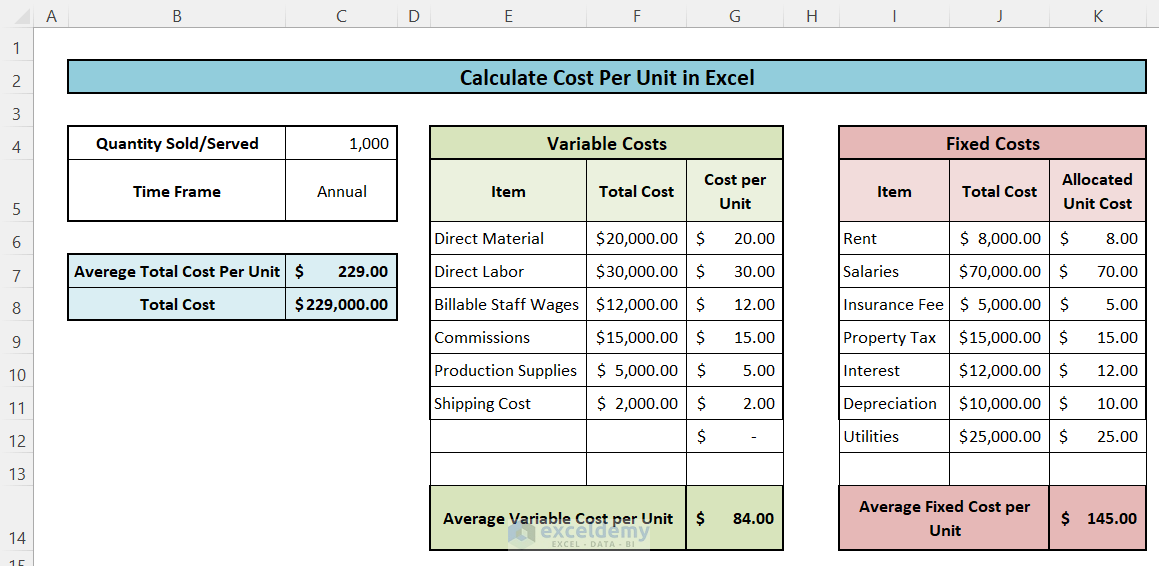

Here’s a simplified template that we’ll use to determine the cost per unit of a product.

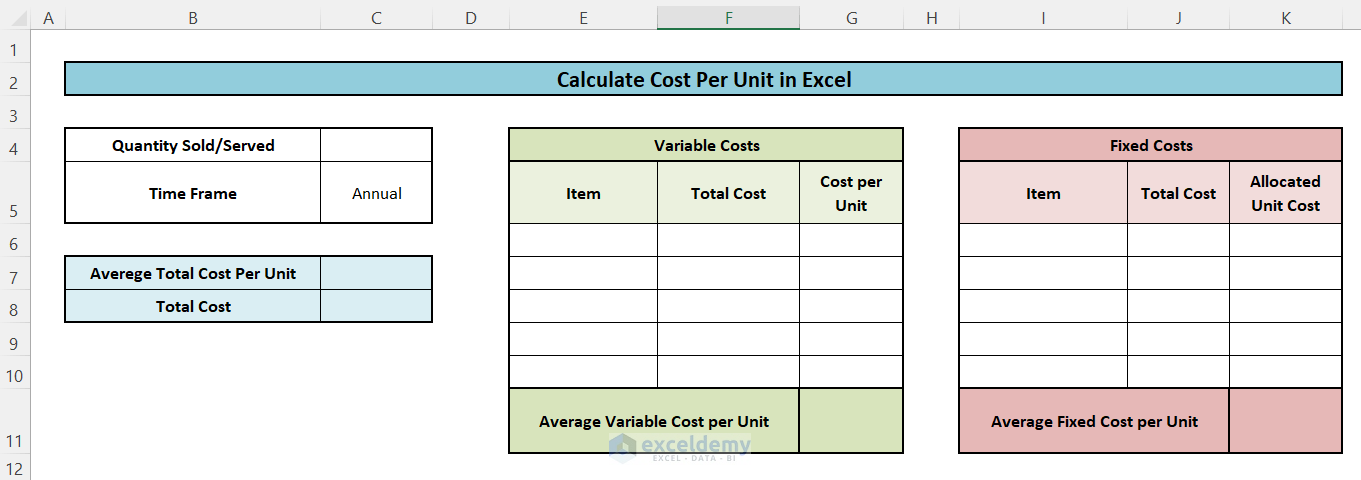

Step 1 – Make a Template Layout

- Make 2 tables for listing the fixed costs and variable costs.

- Input the quantity of production.

- Make a place to get the result of cost per unit of the product.

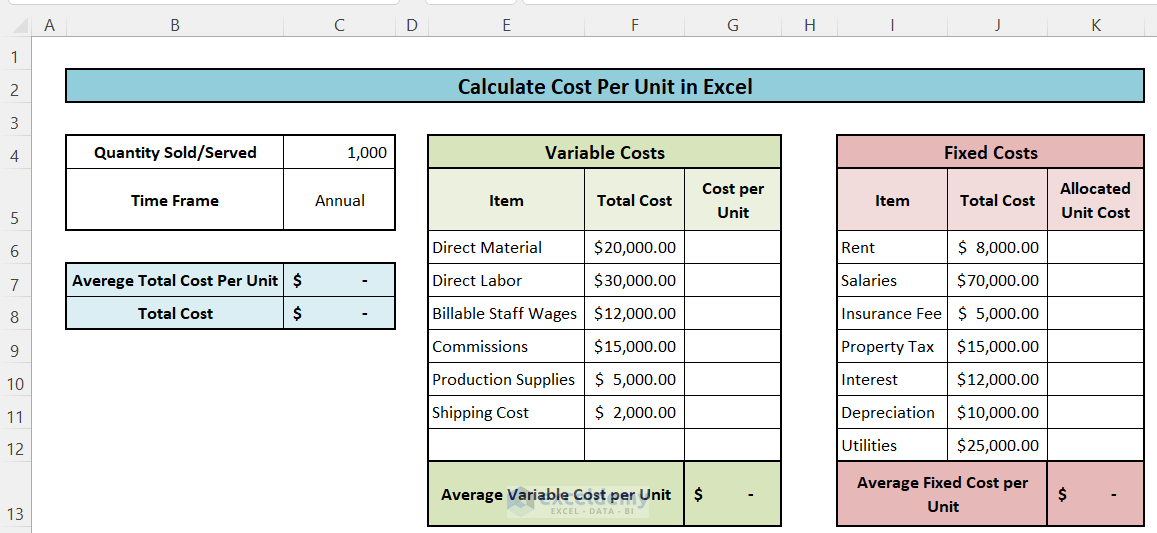

Step 2 – List All Costs and Corresponding Values

- Input the quantity of product manufactured in the time period.

- Input the list of fixed costs and variable costs with their amounts.

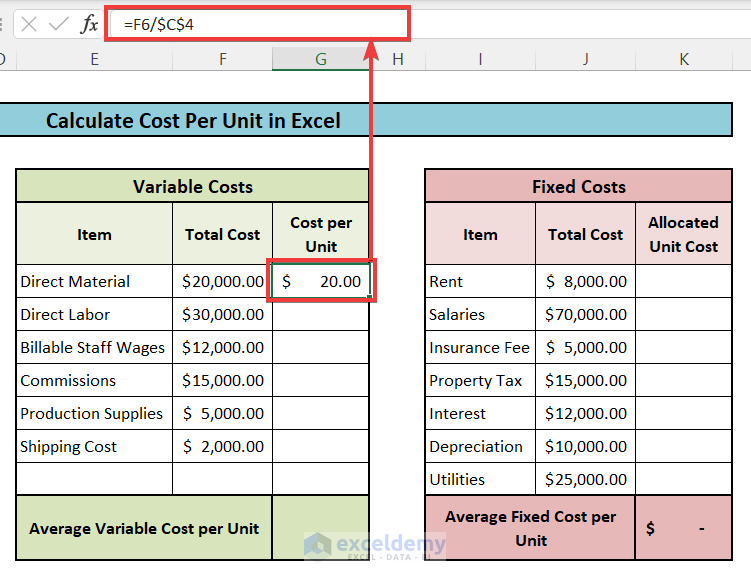

Final Step – Insert Formulas to Calculate Cost per Unit

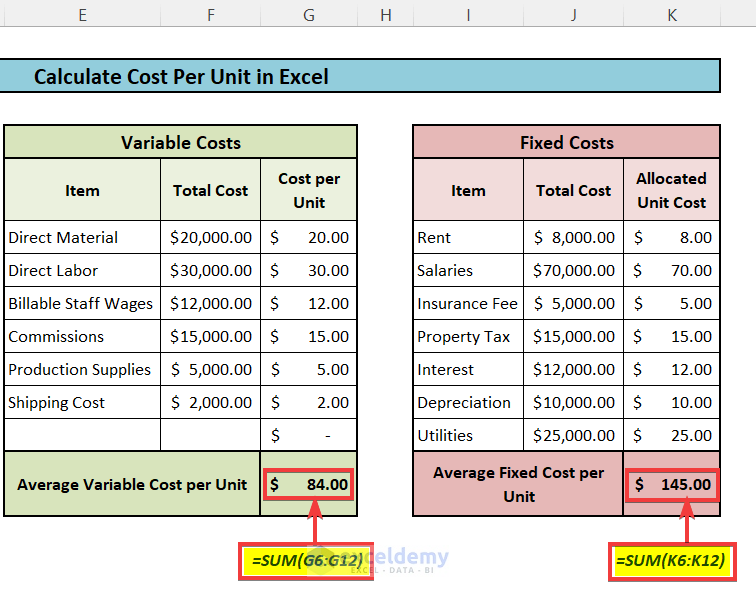

- Insert this formula into cell G6.

=F6/$C$4

- Paste the formula to the other cells by dragging the Fill Handle icon or use the shortcuts Ctrl + C and Ctrl + P to copy and paste.

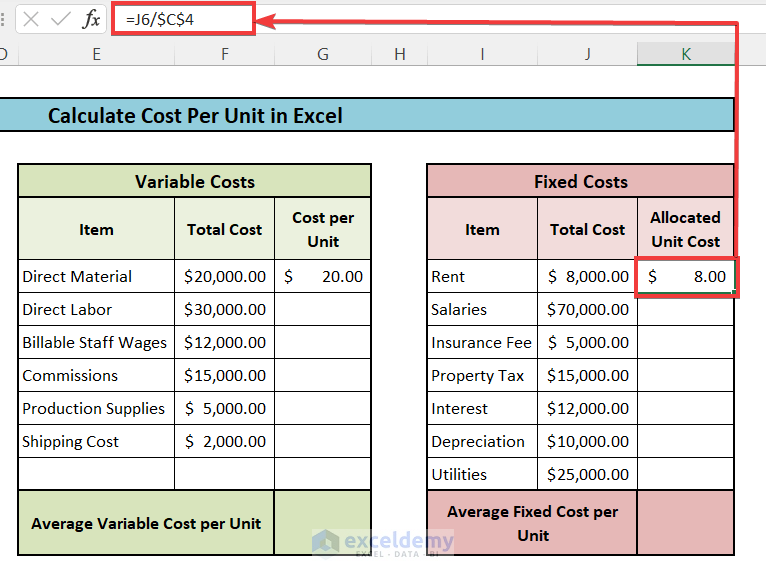

- Insert this formula into cell K6.

=J6/$C$4

- Insert this formula into cell G13 to get the total variable cost per unit.

=SUM(G6:G12)- Use this formula in cell K13 to get the total fixed cost per unit product.

=SUM(K6:K12)

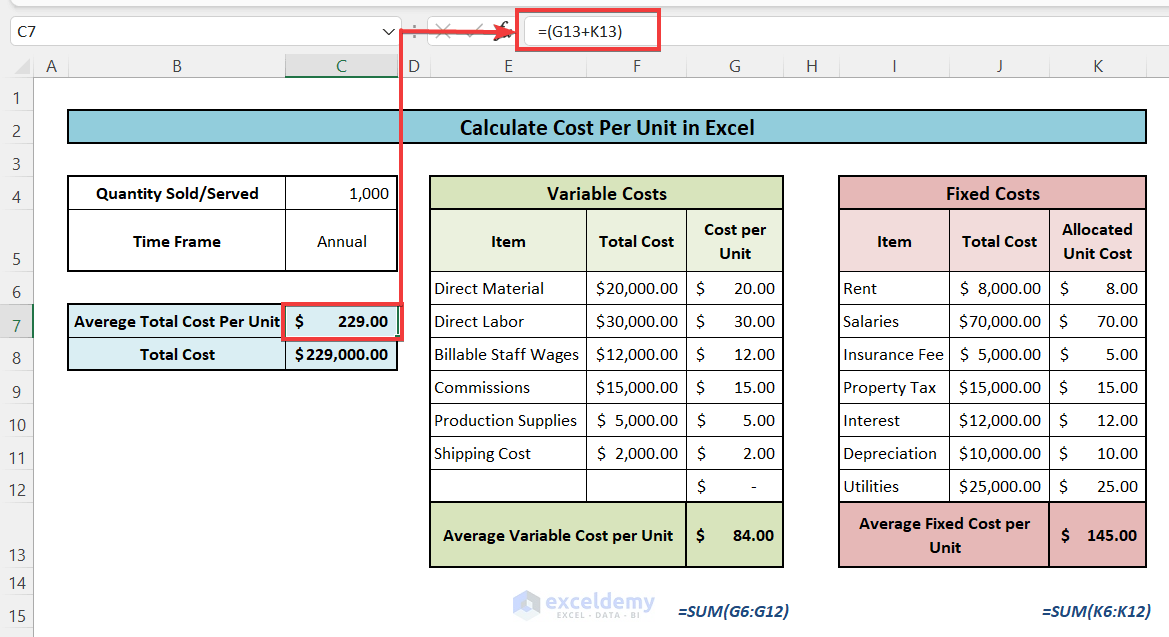

- Insert this formula into the cell C7:

= G13+K13

Things to Remember

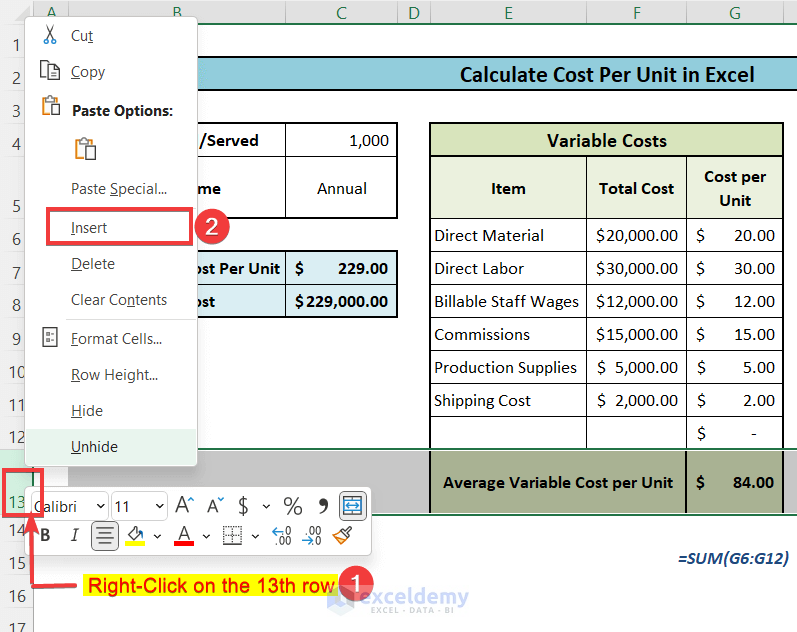

You can add new rows in the Fixed Cost and Variable Cost table to insert new costs without changing the formula.

- Right-click on the 13th row on the leftmost button.

- Select the Insert option.

- You’ll get a new row above the final sum.

- You can input new values and the rest of the table will be updated automatically.

Download the Free Template

<< Go Back to Cost | Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!