What Is a Tally GST Invoice?

GST means Goods and Services Tax which is a value-added tax imposed on goods and services for domestic consumption.

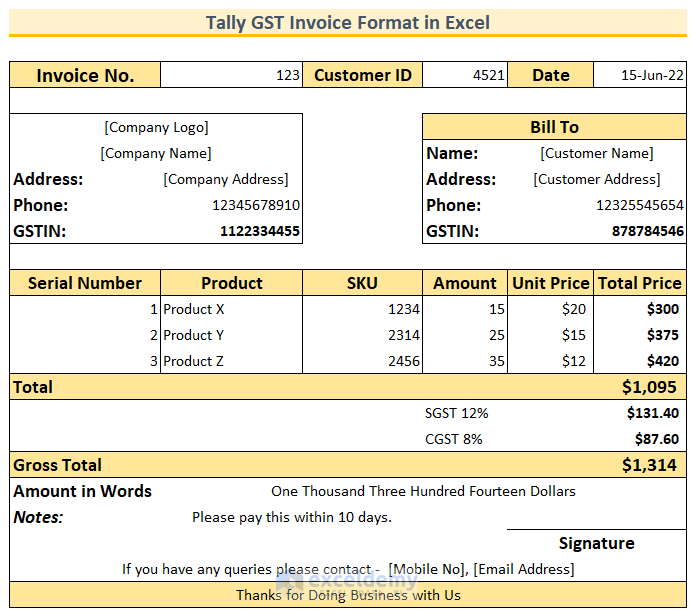

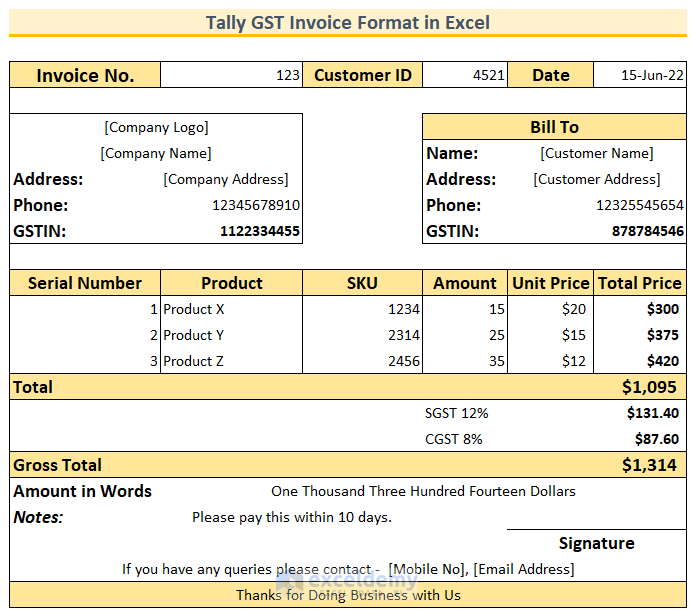

Here is some basic information that should be present in a tally GST invoice:

- Company Name, Logo, Phone Number, Address, and GSTIN

- Customer Name, Address, and Phone Number

- Invoice number and Date of issuance

- Applicable taxes such as – CGST, SGST, IGST, etc.

- Amount to be paid by the customers

- Signature from the in-charge

- Lastly, any additional notes regarding company policies

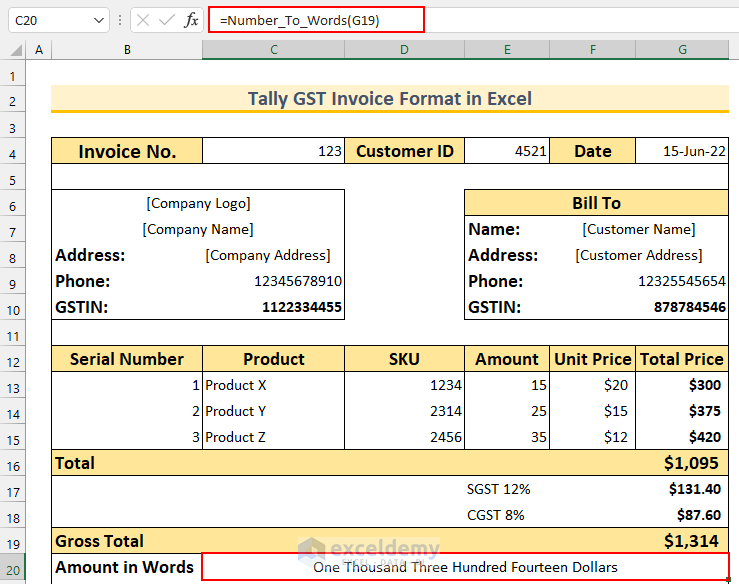

We’ll incorporate this information into our tally GST invoice format. Here is the final snapshot of our invoice format.

How to Create a Tally GST Invoice Format in Excel: 8 Quick Steps

Step 1 – Adding an Invoice Header

- Create the following fields at the top row of the invoice.

- Invoice No. – invoice number of the company.

- Customer ID – unique customer ID for the customers, this will help us to identify them later.

- Date – the date of issuance of the invoice.

![]()

Step 2 – Adding Company Details

- Add the company details to the top-left of the invoice.

- Company Logo – Add the company logo to make it more meaningful.

- Company Name – Obviously, we need to add the company name.

- Address – Location of the company.

- Phone – Phone number of the company.

- GSTIN – The GST Identification Number of the company.

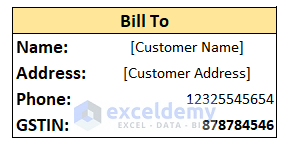

Step 3 – Including Customer Details

- Add the customer details to the invoice under the “Bill To” section with the following fields:

- Name – Name of the customer.

- Address – Location of the customer.

- Phone – Phone number of the customer.

- GSTIN – The GST Identification Number of the customer.

Read More: Tally Sales Invoice Format in Excel

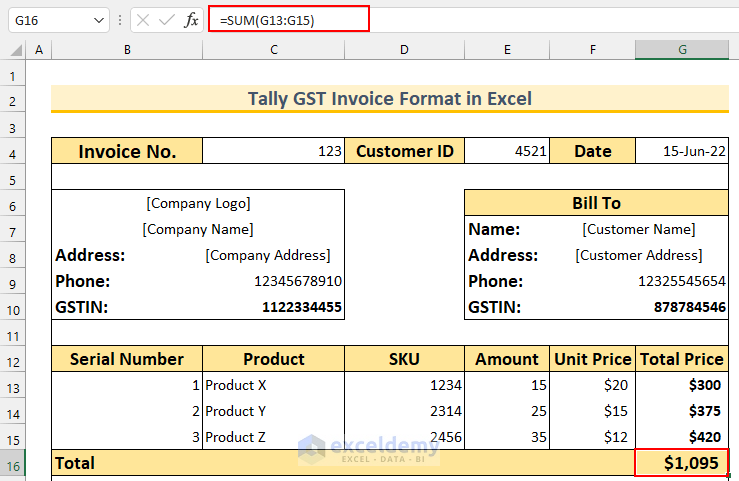

Step 4 – Description of the Products

- Add the following columns:

- Serial Number – Serial number of the products.

- Product – Names of the products.

- SKU – Product codes.

- Amount – The number of units purchased.

- Unit Price – Price of a single unit.

- Total Price – We use a formula here that is Total Price = Amount * Unit Price.

- Use the following formula in cell G16 (Total) and press Enter.

=SUM(G13:G15)

This formula adds the prices of the 3 products.

Read More: Proforma Invoice Format in Excel with GST

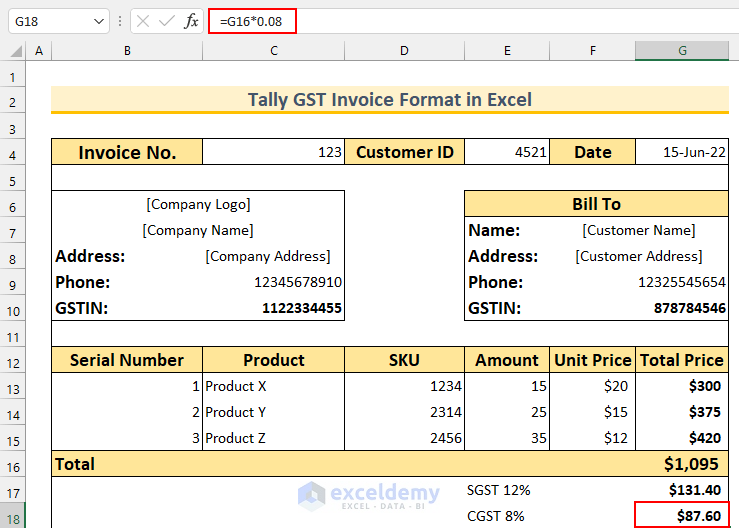

Step 5 – Adding GST Taxes

- Use the following formula in cell G17 and press Enter.

=G16*0.12

This formula finds 12% of the $1,095.

- Find the CGST by using the following formula in cell G18.

=G16*0.08

We calculated the CGST as 8% of $1,095.

Read More: How to Make GST Export Invoice Format in Excel

Step 6 – Calculating the Gross Total Using Formula

- Use the following formula in cell G19 and press Enter.

=ROUND(SUM(G16:G18),0)

We added the taxes with our value of $1,095. We rounded this figure using the ROUND function. As we want it to be rounded to the nearest integer, we have provided 0 in the formula.

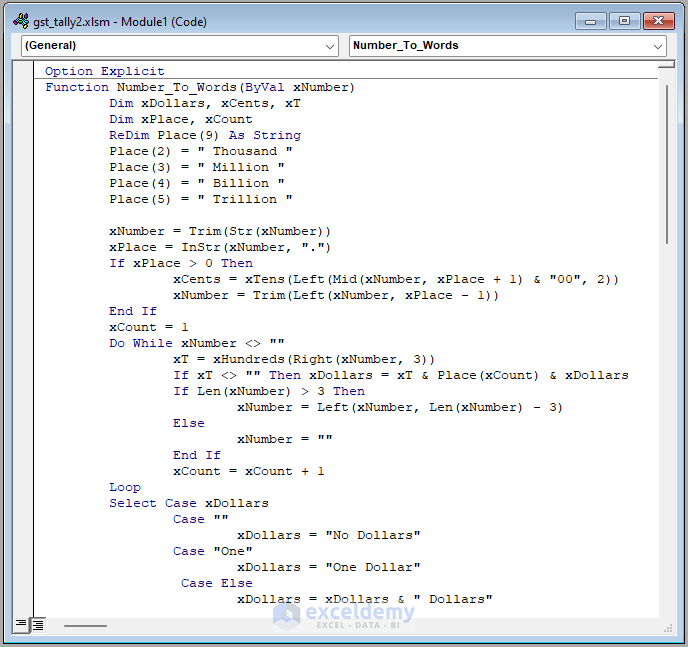

Step 7 – Automating Amount in Words Using VBA

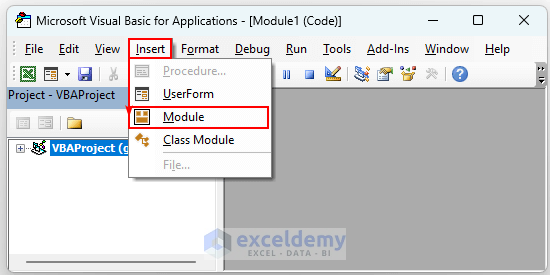

- Press Alt + F11 to bring up the VBA window.

- From Insert, select Module. We’ll put our code here.

- Insert the following code.

Option Explicit

Function Number_To_Words(ByVal xNumber)

Dim xDollars, xCents, xT

Dim xPlace, xCount

ReDim Place(9) As String

Place(2) = " Thousand "

Place(3) = " Million "

Place(4) = " Billion "

Place(5) = " Trillion "

xNumber = Trim(Str(xNumber))

xPlace = InStr(xNumber, ".")

If xPlace > 0 Then

xCents = xTens(Left(Mid(xNumber, xPlace + 1) & "00", 2))

xNumber = Trim(Left(xNumber, xPlace - 1))

End If

xCount = 1

Do While xNumber <> ""

xT = xHundreds(Right(xNumber, 3))

If xT <> "" Then xDollars = xT & Place(xCount) & xDollars

If Len(xNumber) > 3 Then

xNumber = Left(xNumber, Len(xNumber) - 3)

Else

xNumber = ""

End If

xCount = xCount + 1

Loop

Select Case xDollars

Case ""

xDollars = "No Dollars"

Case "One"

xDollars = "One Dollar"

Case Else

xDollars = xDollars & " Dollars"

End Select

Select Case xCents

Case ""

xCents = ""

Case "One"

xCents = " and One Cent"

Case Else

xCents = " and " & xCents & " Cents"

End Select

Number_To_Words = xDollars & xCents

End Function

Function xHundreds(ByVal xNumber)

Dim xResult As String

If Val(xNumber) = 0 Then Exit Function

xNumber = Right("000" & xNumber, 3)

If Mid(xNumber, 1, 1) <> "0" Then

xResult = xDigit(Mid(xNumber, 1, 1)) & " Hundred "

End If

If Mid(xNumber, 2, 1) <> "0" Then

xResult = xResult & xTens(Mid(xNumber, 2))

Else

xResult = xResult & xDigit(Mid(xNumber, 3))

End If

xHundreds = xResult

End Function

Function xTens(tt)

Dim xResult As String

xResult = ""

If Val(Left(tt, 1)) = 1 Then

Select Case Val(tt)

Case 10: xResult = "Ten"

Case 11: xResult = "Eleven"

Case 12: xResult = "Twelve"

Case 13: xResult = "Thirteen"

Case 14: xResult = "Fourteen"

Case 15: xResult = "Fifteen"

Case 16: xResult = "Sixteen"

Case 17: xResult = "Seventeen"

Case 18: xResult = "Eighteen"

Case 19: xResult = "Nineteen"

Case Else

End Select

Else

Select Case Val(Left(tt, 1))

Case 2: xResult = "Twenty "

Case 3: xResult = "Thirty "

Case 4: xResult = "Forty "

Case 5: xResult = "Fifty "

Case 6: xResult = "Sixty "

Case 7: xResult = "Seventy "

Case 8: xResult = "Eighty "

Case 9: xResult = "Ninety "

Case Else

End Select

xResult = xResult & xDigit(Right(tt, 1))

End If

xTens = xResult

End Function

Function xDigit(dd)

Select Case Val(dd)

Case 1: xDigit = "One"

Case 2: xDigit = "Two"

Case 3: xDigit = "Three"

Case 4: xDigit = "Four"

Case 5: xDigit = "Five"

Case 6: xDigit = "Six"

Case 7: xDigit = "Seven"

Case 8: xDigit = "Eight"

Case 9: xDigit = "Nine"

Case Else: xDigit = ""

End Select

End Function

VBA Code Breakdown

- We are creating a custom function named Number_To_Words.

- We define the variable types.

- We use the VBA Case statement to apply the word converter for our numbers.

- We create 3 more functions – xHundreds, xTens, and xDigit to get the hundred, tens, and single-digit values, respectively.

- Save and close the Module.

- Use the following formula in cell G20.

=Number_To_Words(G19)

This formula converts the number to words as per the VBA code breakdown.

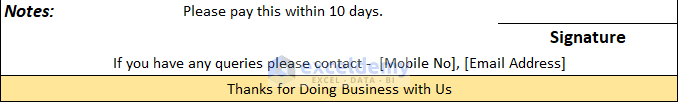

Step 8 – Adding Notes and the Footer Section

- Add Notes for the customer.

- Provide space to input the signature of the in-charge.

- Add the contact details of the company.

- Put a thank you note in a colored cell at the end.

Here’s the final tally GST invoice format.

Download the Template

Related Articles

- Create Non GST Invoice Format in Excel

- How to Create GST Rental Invoice Format in Excel

- How to Create Proforma Invoice for Advance Payment in Excel

- How to Create GST Bill Format in Excel with Formula

<< Go Back to Excel Invoice Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!