Method 1 – Using Direct Method to Calculate Operating Cash Flow in Excel

The generic formula is:

Steps

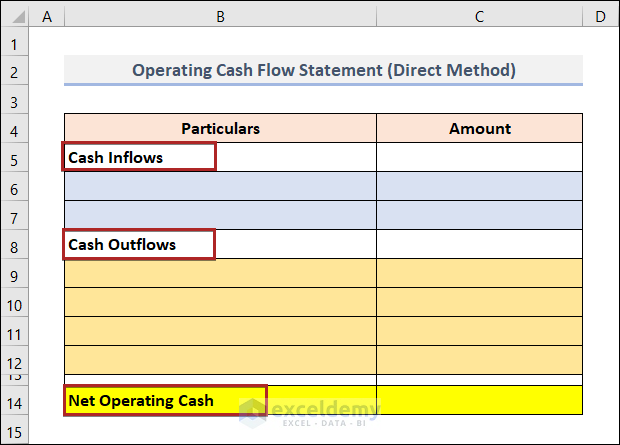

- Create a layout of the Operating Cash Flow Statement (Direct Method) as shown below.

- Include Cash Inflows, Cash Outflows, and Net Operating Cash.

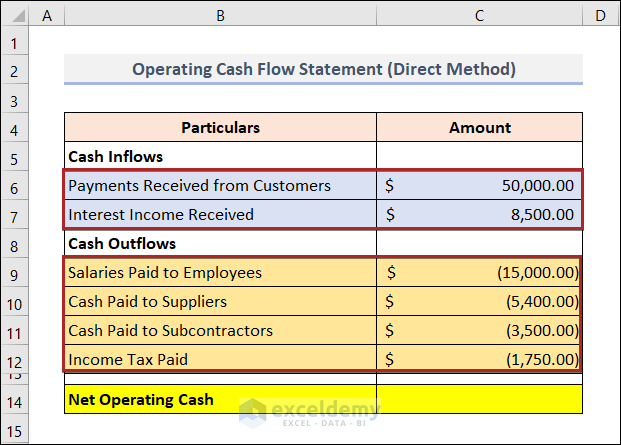

- Detail Cash Inflows and Outflows.

- Enter the amount of cash in Column C.

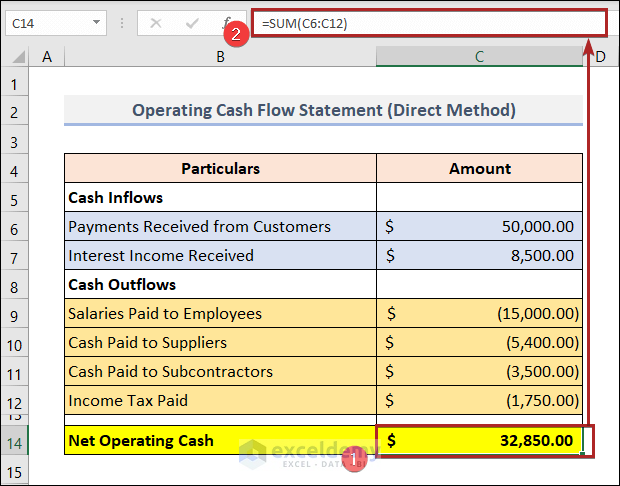

- Select C14 and use the following formula.

=SUM(C6:C12)

The amounts in B6:B12 were added. The amounts in B9:B12 are shown in parentheses (they have a negative value). They are subtracted while using the SUM function.

Read More: How to Calculate Payback Period in Excel (With Easy Steps)

Method 2 – Applying the Indirect Method to Calculate the Operating Cash Flow in Excel

The generic formula is:

The required components are:

Net Income: It is taken into account as a starting point.

Non-Cash Expenses: It includes Depreciation, Amortization, Stock-Based Compensation, Deferred Income Tax, and other non-cash items.

Assets and Liability: It contains Account Receivable, Inventory, Accounts Payable, Accrued Expenses, and Deferred Revenue.

The full form of the above formula is:

Steps

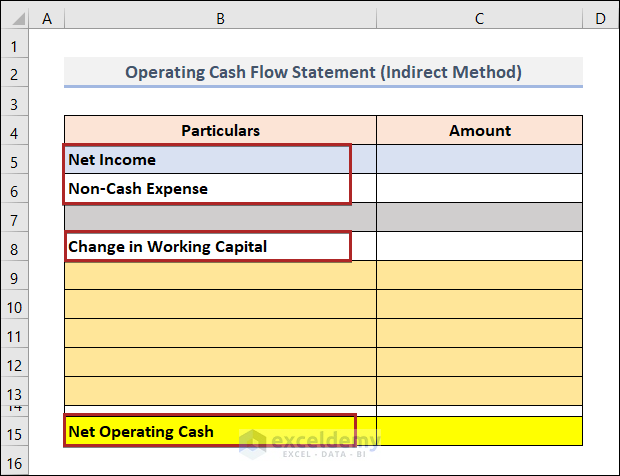

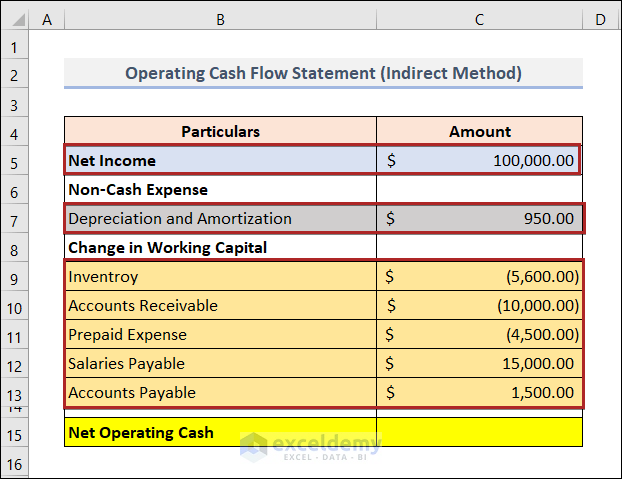

- Create a layout of the Operating Cash Flow Statement (Indirect Method) as shown below.

- Include Net Income, Non-Cash Expenses, Change in Working Capital, and Net Operating Cash.

Note: Here, Inventory, Accounts Receivable and Prepaid Expenses are negative. An increase in these elements subtracts them in the formula.

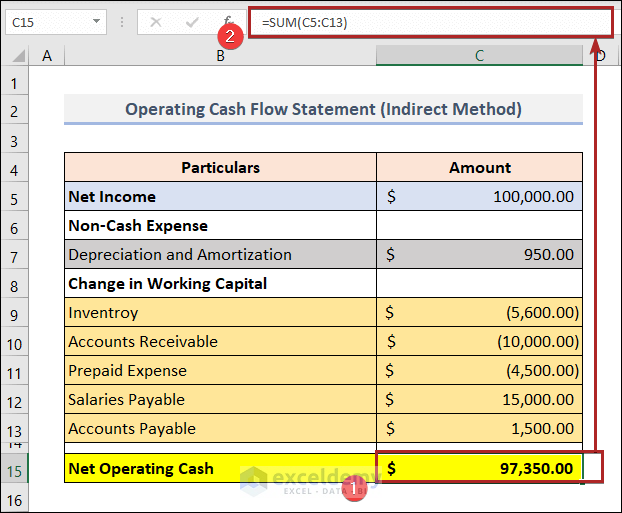

- Select C15 and use the following formula.

=SUM(C5:C13)

This is the output.

Read More: How to Calculate Payback Period with Uneven Cash Flows

How to Calculate the Free Cash Flow in Excel

The generic formula to calculate free cash flow is:

, which means:

Steps

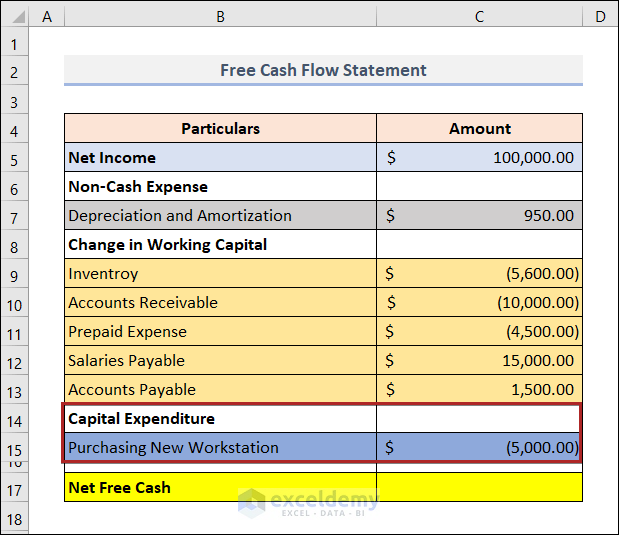

- Add rows to the previous worksheet.

- Add Capital Expenditure and detail Purchasing New Workstation.

- Enter the amounts in Column C.

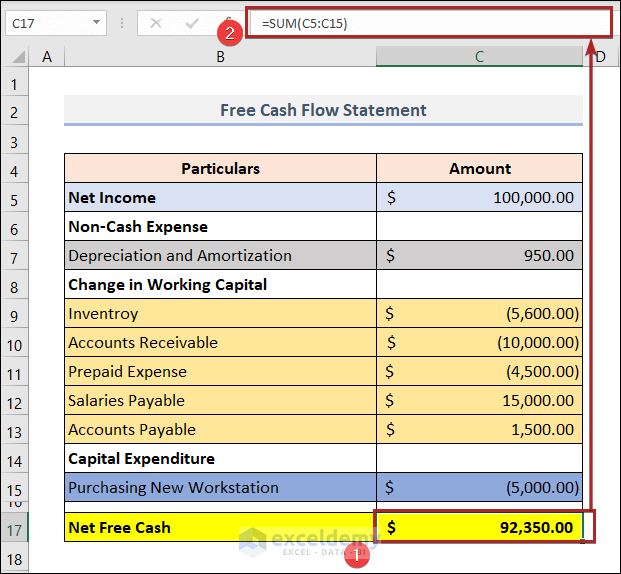

- Select C17 and enter the formula below.

=SUM(C5:C15)

C17 indicates the amount of net free cash.

Read More: Calculating Payback Period in Excel with Uneven Cash Flows

How to Calculate the Cash Flow Forecast in Excel

The generic formula is:

Projected Inflows: The amount of money you anticipate within the specified time frame.

Projected Outflows: The costs and extra payments you’ll have to make within the specified time frame.

Steps

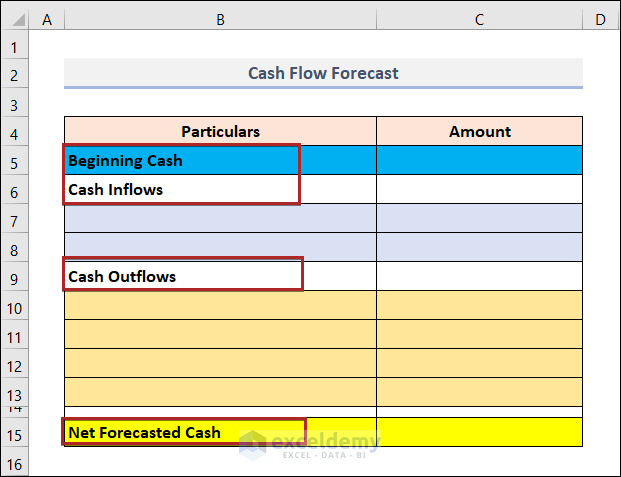

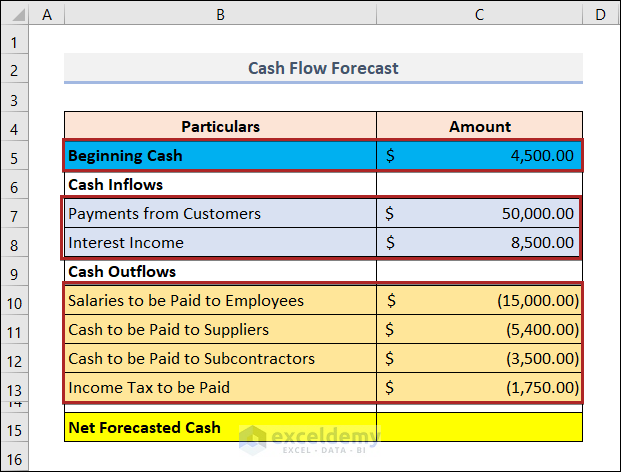

- Create a layout of the Cash Flow Forecast as shown below.

- Include Beginning Cash, Cash Inflows, and Cash Outflows.

- Enter details.

- Enter the amount of cash in column C.

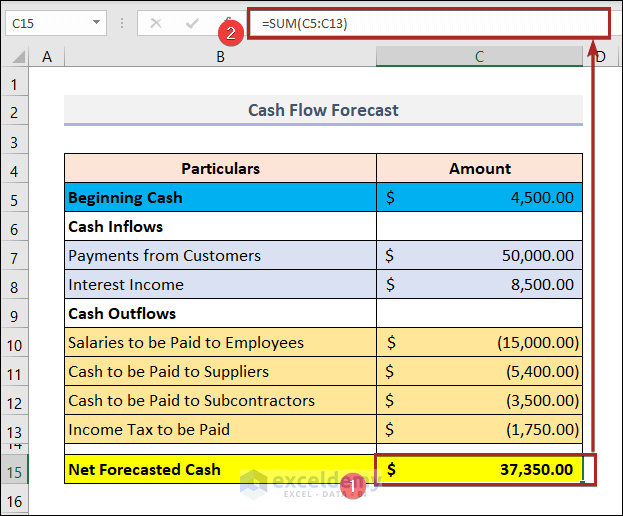

- Select C15 and enter the following formula.

=SUM(C5:C13)

C15 indicates the amount of net forecast cash.

Read More: How to Calculate Discounted Payback Period in Excel

Download Practice Workbook

Download the following Excel workbook.

Related Articles

- How to Calculate Incremental Cash Flow in Excel

- How to Forecast Cash Flow in Excel

- How to Calculate Cumulative Cash Flow in Excel

- How to Apply Discounted Cash Flow Formula in Excel

- How to Create a Cash Flow Waterfall Chart in Excel

<< Go Back to Excel Cash Flow Formula | Excel Formulas for Finance | Excel for Finance | Learn Excel