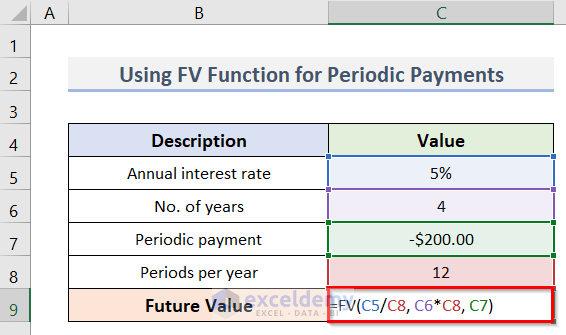

Method 1 – Calculate Future Value of Periodic Payments in Excel

Steps:

- Select the cell (C9) where you want to keep the future value.

- Calculate the future value of the given data type, the formula:

=FV(C5/C8, C6*C8, C7)

C5 refers to the Annual interest rate, C8 refers to the Periods per year, C6 denotes No. of years and C7 represents the Periodic payment respectively.

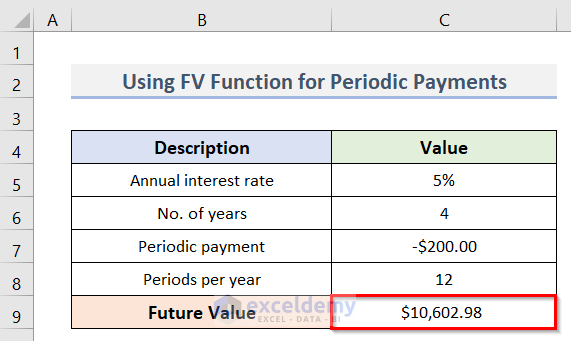

- Press Enter to get the desired Future Value.

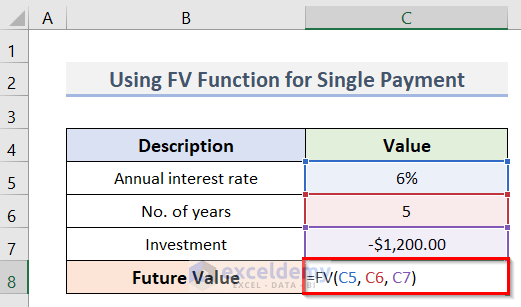

Method 2 – Count Future Value of Single Payment

Steps:

- Select the cell (C8) where we want to keep the Future Value.

- Calculate the future value of the given single payment, type the formula:

=FV(C5, C6, C7)

Cells C5, C6 and C7 denote the values of Annual interest rate, No. of years and Investment, respectively.

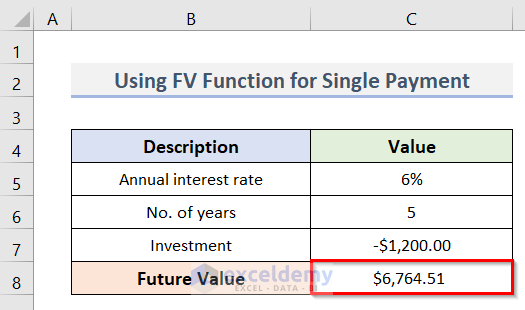

- Pressing Enter, you will be able to see the Future Value of the single payment.

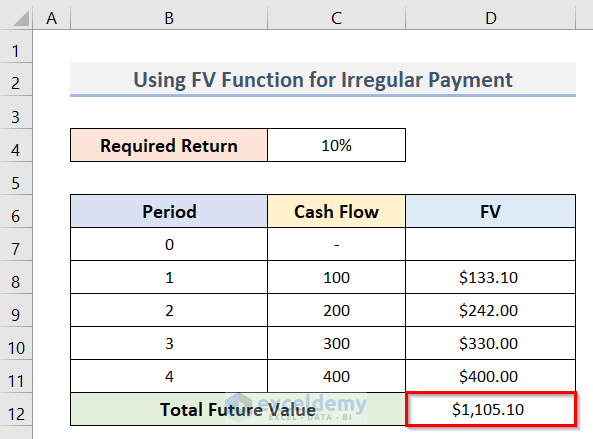

Method 3 – Irregular Cash Flow Future Value Calculation in Excel

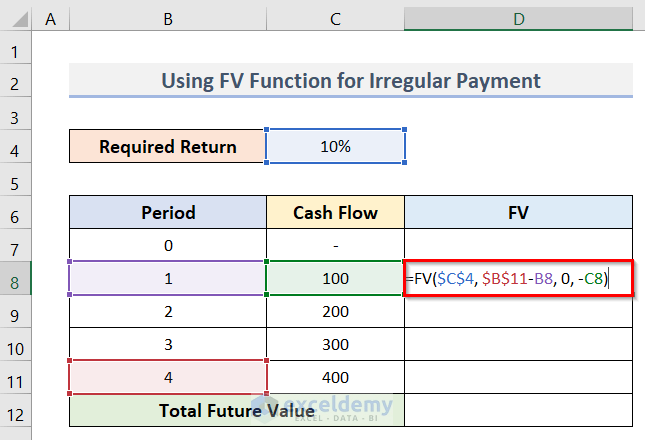

Steps:

- Select cell D8.

- Gain the future value of the cash flow in cell C8 type the formula:

=FV($C$4, $B$11-B8, 0, -C8)

C4 and B11 denote the Required Return and the final Period whereas B8 and C8 represent the specific Period and Cash Flow value. In this formula, we have used the dollar sign ($) to lock the respective cells. It will not shift when you copy the formula.

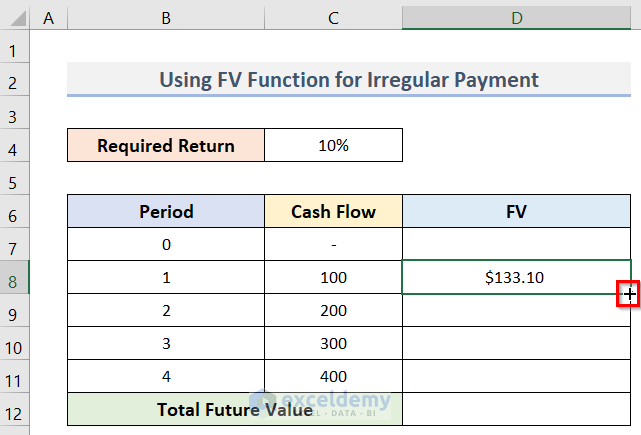

- Press Enter, we will get the future value of the respective cash flow.

- Get all the future values of the cash flows, we need to drag the cursor (+ sign) until we reach the final cash flow.

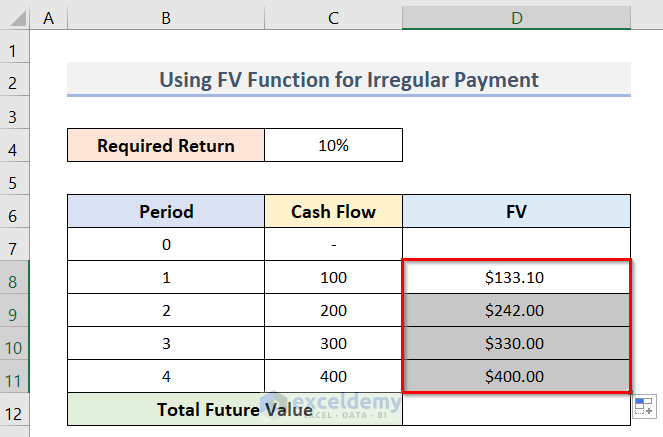

- We have got all the future values of the individual cash flows.

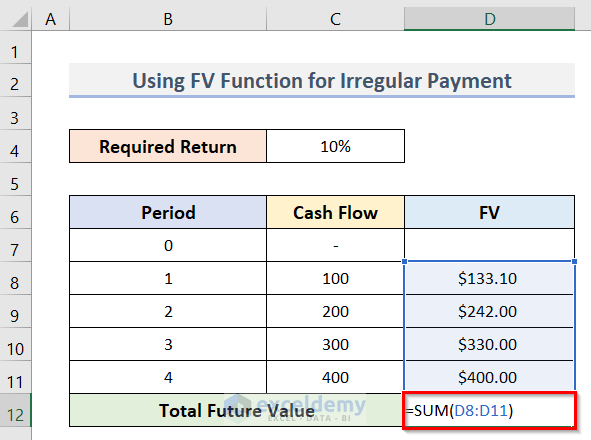

- Sum up the values of the individual cash flows to acquire the total future value. We are going to use the SUM function. Type the formula in cell D12:

=SUM(D8:D11)

D8:D11 represents the individual future values of the cash flows.

- Press Enter to get the total future value.

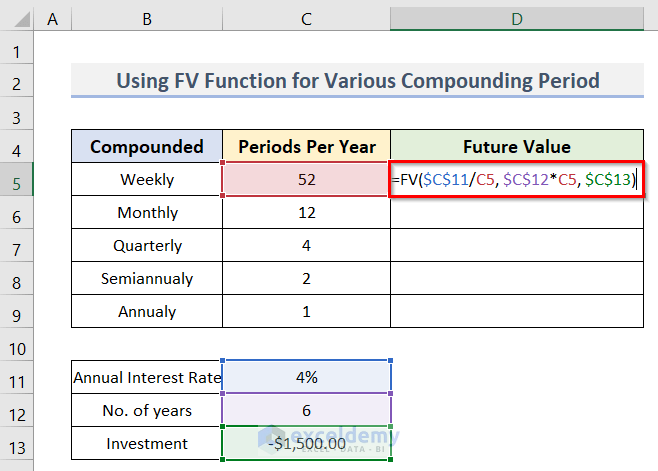

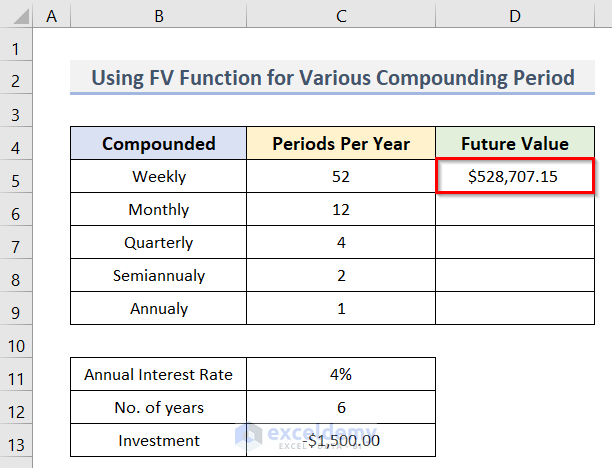

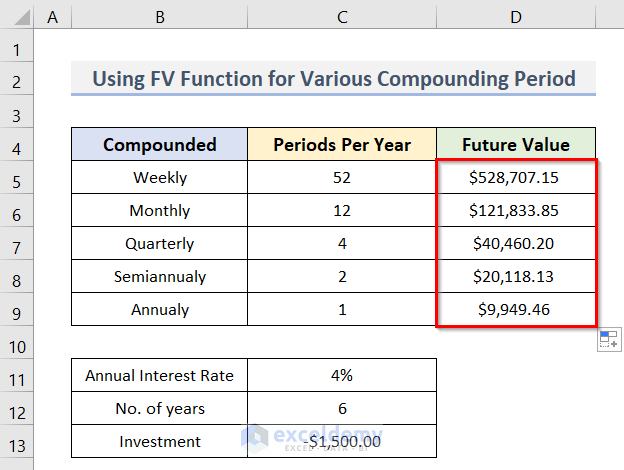

Method 4 – Get Future Value for Various Compounding Periods

Steps:

- Select cell D5.

- Get the weekly compounded future value, type the formula:

=FV($C$11/C5, $C$12*C5, $C$13)

We have used dollar signs ($) for the C11, C12 and C13 cells because we need to keep them unchanged after copying the formula for the cells below.

- Press the Enter key.

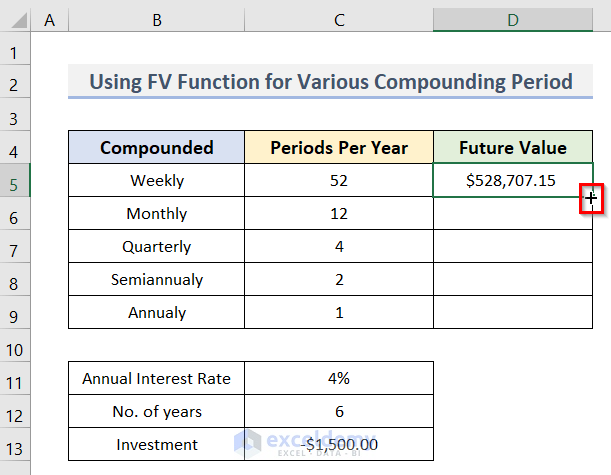

- Calculate the future value for the other compounding periods by dragging the cursor (+ sign placed at the bottom right corner of the cell) to the cell of the final compounding period.

- We calculated the future values of all types of compounding periods.

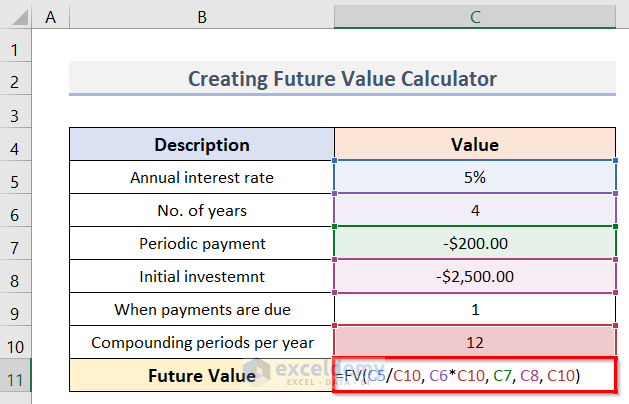

Method 5 – Create Future Value Calculator for Both Periodic & Single Payment

Define the arguments in this manner:

- rate (periodic interest rate): C5/C10 (annual interest rate / periods per year)

- nper (total number of payment periods): C6*C10 (number of years * periods per year)

- pmt (periodic payment amount): C7

- pv (initial investment): C8

- type (when payments are due): C9

- compounding periods per year: C10

To calculate the desired future value, we need to combine the arguments.

- Next, we need to select cell C11 and type the formula:

=FV(C5/C10, C6*C10, C7, C8, C10)

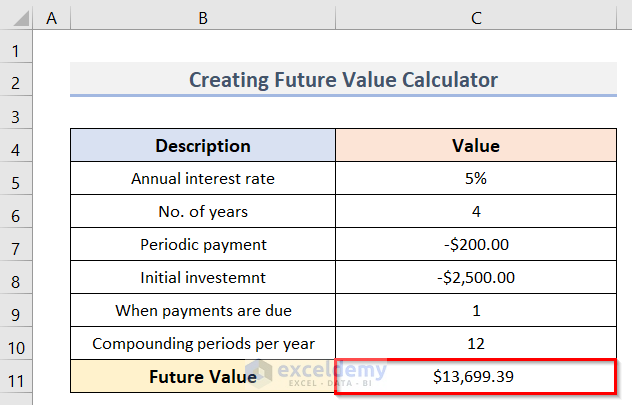

- Pressing the Enter key, the desired future value will be visible the same as in the picture below.

Download Practice Workbook

Download the practice workbook from here.

Related Articles

- How to Calculate Present Value of Uneven Cash Flows in Excel

- How to Calculate Present Value of Lump Sum in Excel

- Calculate NPV for Monthly Cash Flows with Formula in Excel

- How to Apply Present Value of Annuity Formula in Excel

- How to Calculate Present Value in Excel with Different Payments

<< Go Back to Time Value Of Money In Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!