What Is the Annual Percentage Rate (APR)?

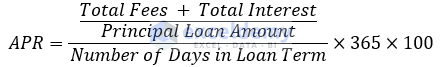

The Annual Percentage Rate, commonly known as APR, is the cost that the borrower must pay on the loan. It includes interest and all other costs or charges related to the loan. APR can be calculated using the formula given below.

Assume you have taken out a $500 loan at a 10% yearly interest rate. You need to pay extra $50 each year for taking the loan. But, the lender may charge you more fees associated with the loan making the APR, for say, 12%. Then, you need to pay $60 instead of $50.

APR calculation is crucial when comparing between different loan offers.

How to Calculate the Monthly Payment with APR in Excel

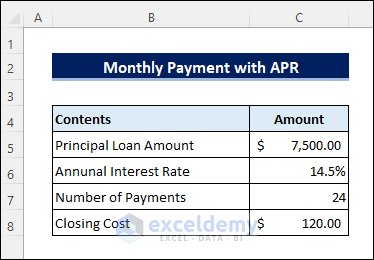

Assume you want to take a loan of $7500 at a 14.5% annual interest rate. You need to pay additional $120 as closing costs. You can repay the loan with monthly payments in 2 years.

Steps:

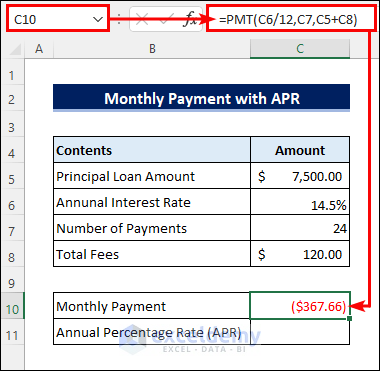

- Apply the following formula in cell C10 to calculate the monthly payment using the PMT function in Excel.

=PMT(C6/12,C7,C5+C8)- Add all the costs and charges with the principal loan amount in the formula.

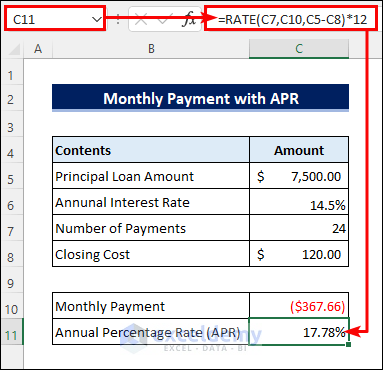

- Enter the following formula in cell C11 to calculate the APR using the Excel RATE function.

=RATE(C7,C10,C5-C8)*12- Subtract all the costs from the principal loan amount in the formula.

Things to Remember

- Your annual percentage rate or APR must be greater than the annual interest rate.

- Add the fees with the loan amount when calculating the monthly payment and subtract them when calculating the APR.

Download the Practice Workbook

Related Articles

- How to Calculate Loan Payment in Excel

- How to Calculate Balloon Payment in Excel

- How to Calculate Down Payment in Excel Using VLOOKUP

- How to Calculate Monthly Mortgage Payment in Excel

- How to Calculate a Lease Payment in Excel

- How to Calculate Coupon Payment in Excel

- How to Calculate Auto Loan Payment in Excel

- How to Calculate Car Payment in Excel

<< Go Back to Calculate Payment in Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!