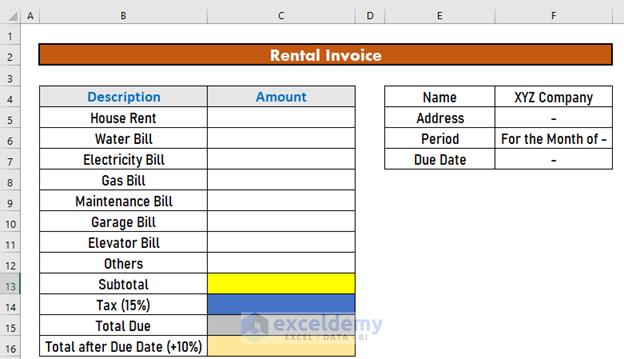

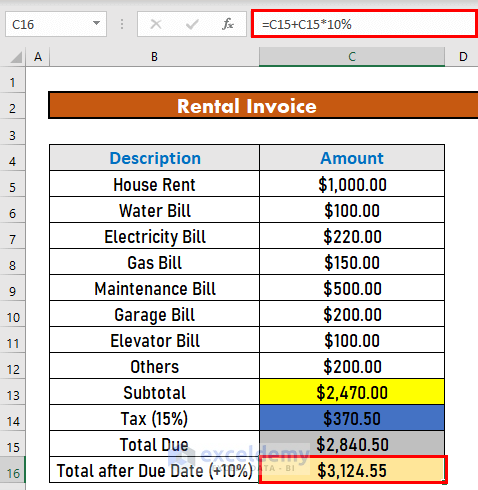

This is the sample dataset.

Step 1 – Enter the Invoice Details

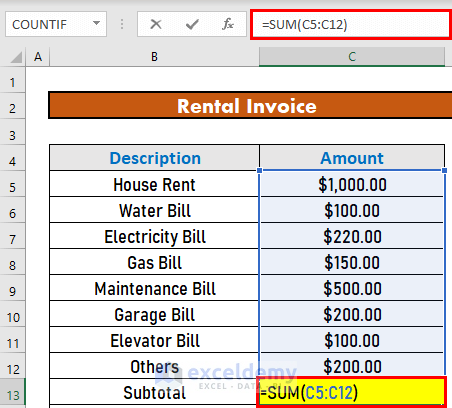

Step 2 – Calculate the Subtotal

- Go to C13 and use the following formula

=SUM(C5:C12)

- Press ENTER.

This is the output.

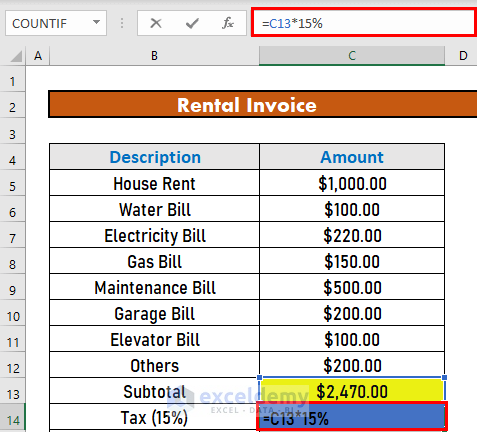

Step 3 – Calculate the Tax Amount

Consider a 15% tax:

- Go to C14 and use the formula:

=C13*15%

- Press ENTER to see the output.

Read More: Tally Sales Invoice Format in Excel

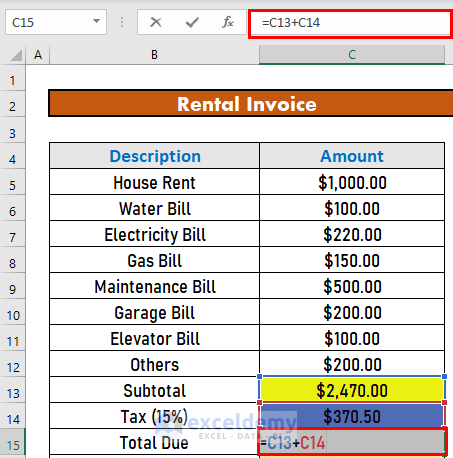

Step 4 – Determine the Total Due

- Go to C15 and use the following formula:

=C13+C14

- Press ENTER.

Step 5 – Calculate the Total Due After Due Date

Consider a penalty of 10% for late payment:

- Go to C16 and use the following formula

=C15+C15*10%

- Press ENTER to see the output.

Read More: How to Create Proforma Invoice for Advance Payment in Excel

Download Practice Workbook

Download the workbook and practice.

Related Articles

- Proforma Invoice Format in Excel with GST

- Create Non GST Invoice Format in Excel

- How to Make GST Export Invoice Format in Excel

- How to Create a Tally GST Invoice Format in Excel

- How to Create GST Bill Format in Excel with Formula

<< Go Back to Excel Invoice Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!