Introduction to Provisional Balance Sheet

A Provisional balance sheet is a type of balance sheet that provides an initial snapshot of a company’s financial position. It is typically prepared at the beginning of a new accounting period before any actual transactions have taken place.

The purpose of a Provisional balance sheet is to give management and investors an early look at the company’s financial health, to inform decisions about how to allocate resources and make other strategic decisions.

Step by Step Procedure to Create a Provisional Balance Sheet Format in Excel

In order to create a Provisional balance sheet, we need to know two major factors:

- Assets

- Liabilities & Owner’s Equity

Assets

An asset is anything that can be converted into cash. It can be cash itself, or something that can be sold for cash.

Liabilities

Liabilities are items for which money is owed, or which have been borrowed. They are recorded on the company’s balance sheet and appear as negative numbers. Liabilities can be either present or long-term. Long-term liabilities are those that are not due for another calendar year, whereas current liabilities are those that are due within the current financial year.

Owner’s Equity

Owner’s equity mostly refers to the shareholders’ portion of the company’s value, and represents the proportional distribution of the company’s worth in the event of a sale.

So, in order to create a Provisional balance sheet, we can divide the whole procedure into the following sections:

- Assets Calculation

- Liabilities Calculation

- Owner’s Equity Calculation

- Verifying Balance Sheet

- Financial Summary from Balance Sheet

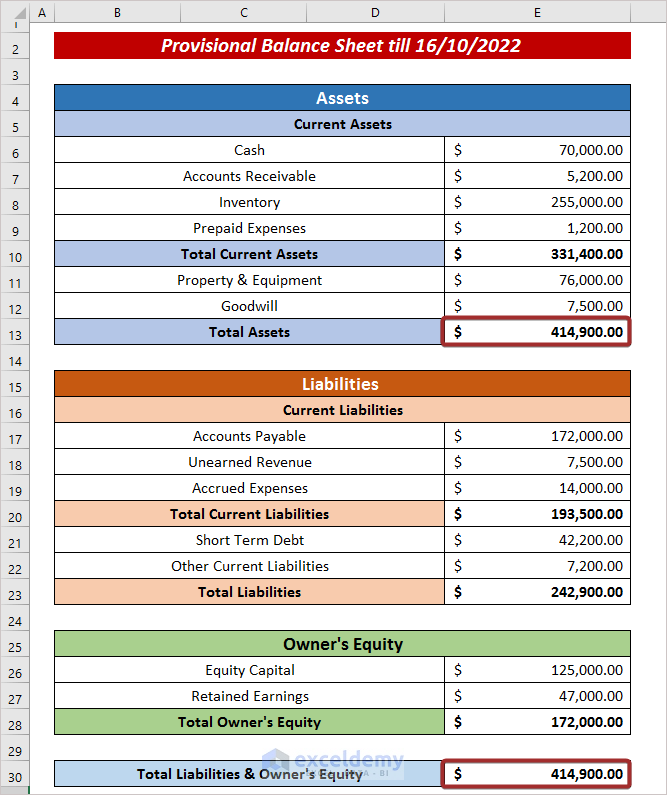

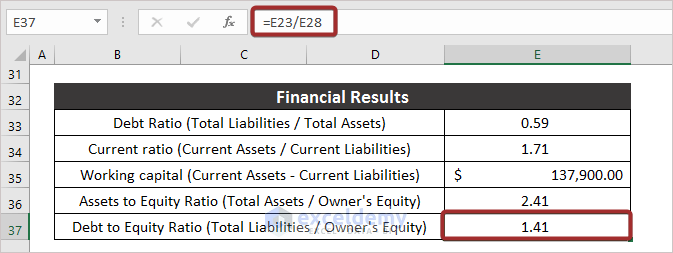

Final Results from A Provisional Balance Sheet

There are five main financial results we can derive from a Provisional balance sheet:

Debt Ratio: The ratio between total liabilities and total assets.

Current Ratio: The ratio between current assets and current liabilities.

Working Capital: The difference between current assets and current liabilities.

Assets to Equity Ratio: The ratio between total assets and owner’s equity.

Debt to Equity Ratio: The ratio between total liabilities and owner’s equity.

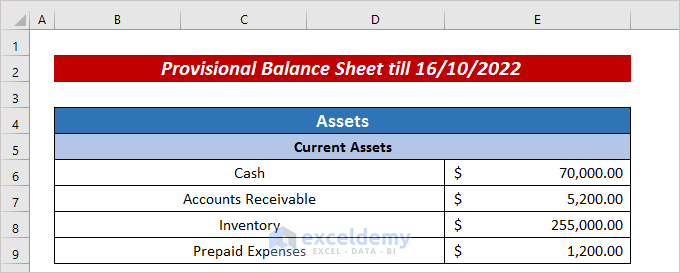

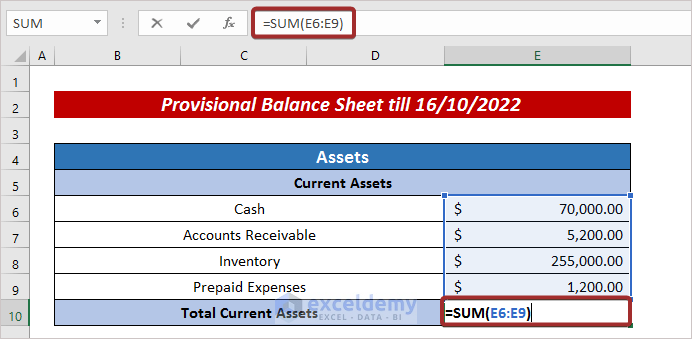

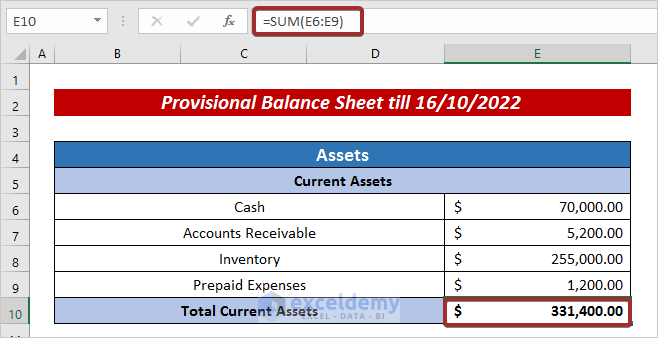

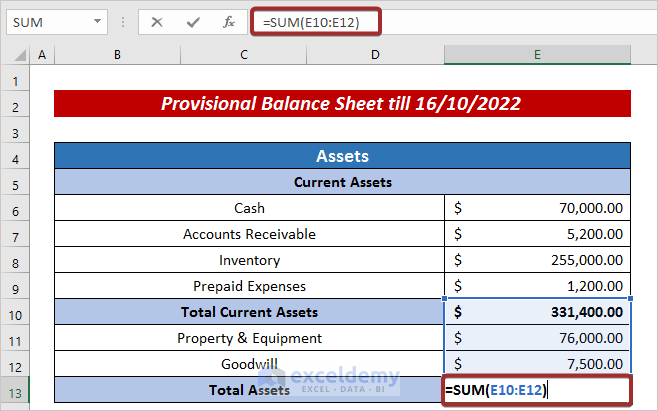

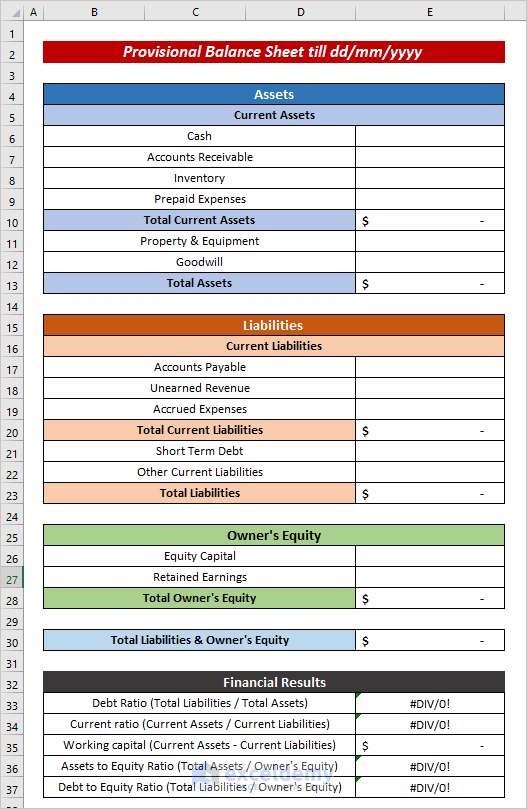

Step 1 – Assets Calculation

- Input the necessary Assets categories along with their corresponding values.

- In cell E10, calculate the Total Current Assets using the following formula:

=SUM(E6:E9)

- Press ENTER to return the Total Current Assets.

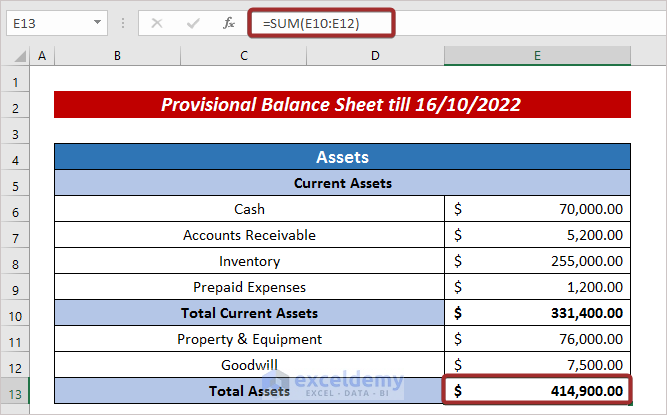

- Insert any additional assets.

- In cell E13, calculate the Total Assets by applying the following formula:

=SUM(E10:E12)

- Press ENTER to return the Total Assets.

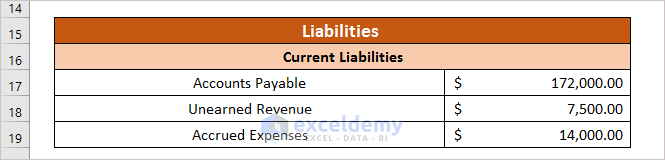

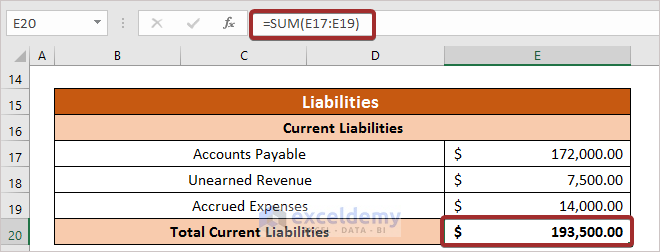

Step 2 – Liabilities Calculation

Next, we calculate the total Liabilities.

- Enter the necessary Liabilities categories and their corresponding values.

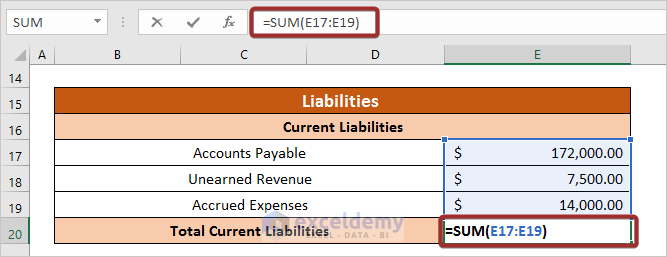

- In cell E20, enter the following formula to calculate the Total Current Liabilities:

=SUM(E17:E19)

- Press ENTER to return the Total Current Liabilities.

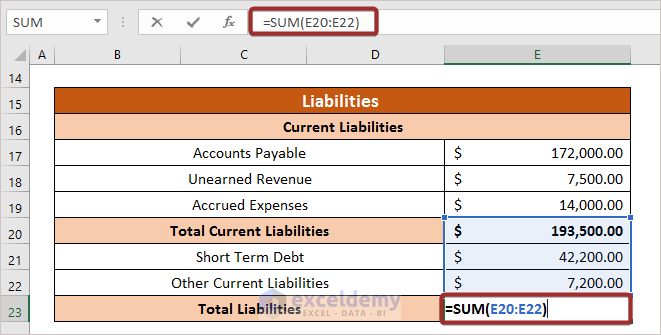

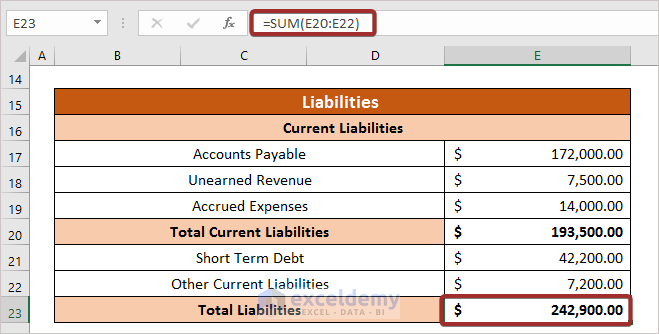

- Insert the other Liabilities.

- In cell E23, apply the following formula to derive the Total Liabilities:

=SUM(E20:E22)

- Press ENTER to return Total Liabilities.

Read More: How to Prepare Charitable Trust Balance Sheet Format in Excel

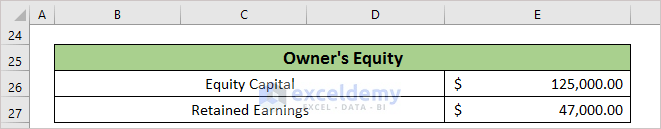

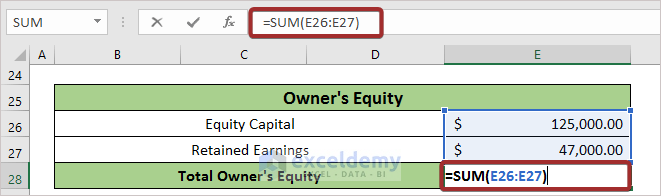

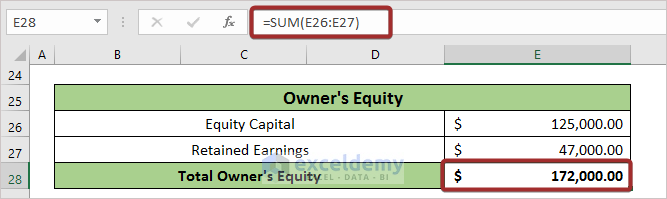

Step 3 – Owner’s Equity Calculation

- Enter the necessary Owner’s Equity categories and their corresponding values.

- In cell E28, enter the following formula to derive the Total Owner’s Equity:

=SUM(E26:E27)

- Press ENTER to return the desired result.

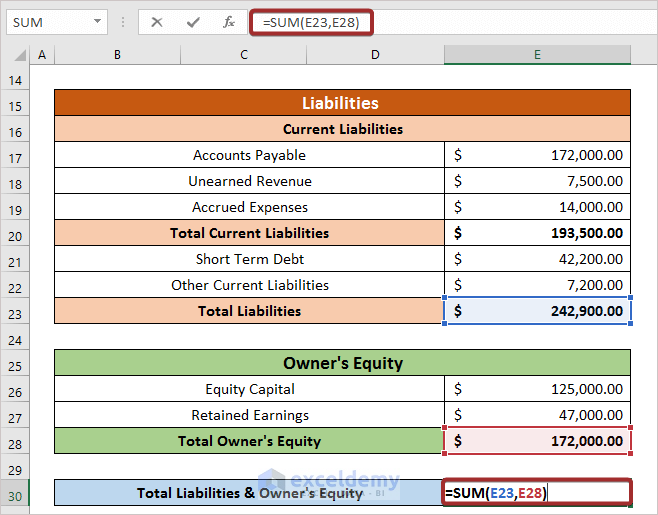

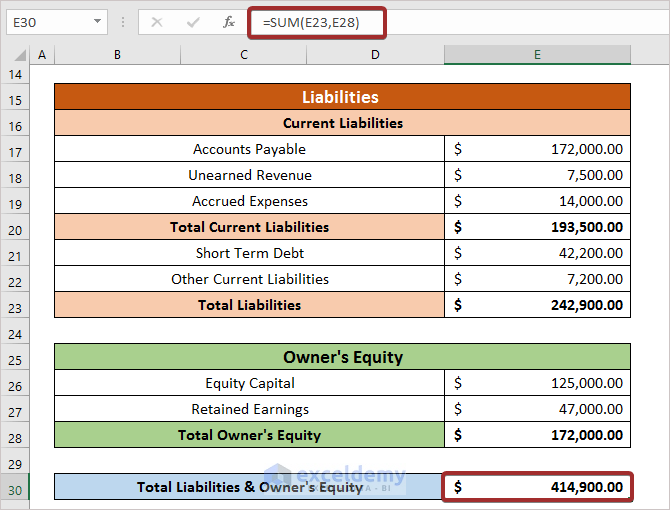

Step 4 – Verifying Balance Sheet

According to the balance sheet rule, the sum of Liabilities and Owner’s Equity should be equal to Assets. Let’s verify this:

- In cell E30, use the following formula to calculate the total value of Liabilities and Owner’s Equity:

=SUM(E23,E28)Here,

E23 = Total Liabilities

E28 = Total Owner’s Equity

- Press ENTER to return the output.

- Check if the value satisfies the following equation:

Read More: How to Create School Balance Sheet Format in Excel

Step 5 – Financial Summary from Balance Sheet

Now we can calculate the Financial Parameters to summarize the whole balance sheet.

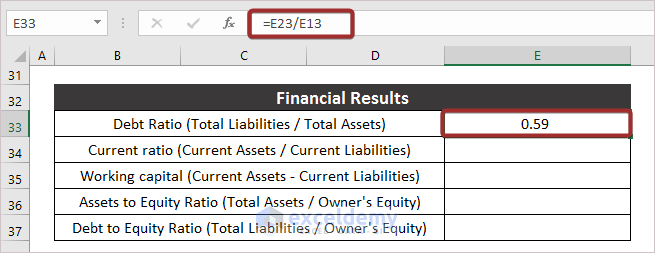

- To calculate the Debt Ratio, in cell E33 use the formula:

=E23/E13Here,

E23 = Total Liabilities

E13 = Total Assets

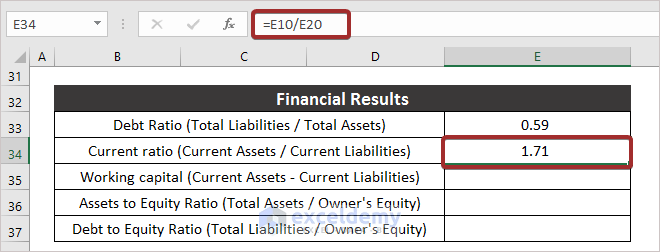

- To calculate Current Ratio, in cell E34 input the following formula:

=E10/E20Here,

E10 = Current Assets

E20 = Current Liabilities

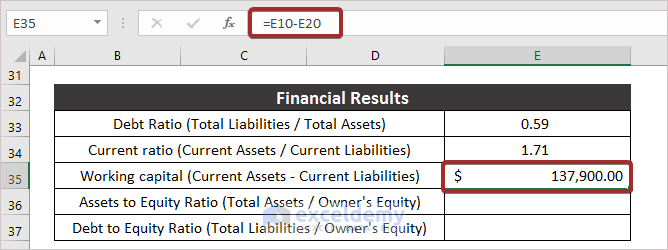

- To calculate Working Capital, in cell E35 enter the following formula:

=E10-E20Here,

E10 = Current Assets

E20 = Current Liabilities

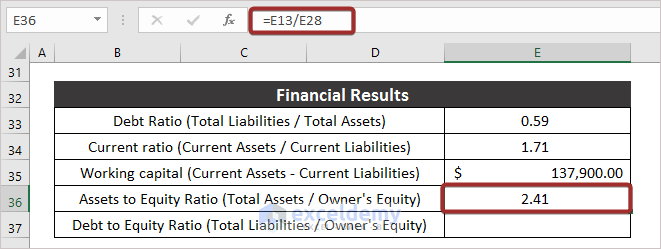

- To calculate Assets to Equity Ratio, in cell E36 enter the following formula:

=E13/E28Here,

E13 = Total Assets

E28 = Owner’s Equity

- In cell E37, apply the following formula to calculate Debt to Equity Ratio:

=E23/E28Here,

E23 = Total Liabilities

E28 = Owner’s Equity

Read More: How to Create Monthly Balance Sheet Format in Excel

Provisional Balance Sheet Format

Here is a template for creating a Provisional balance sheet for a company. Download it below, and just input the necessary amounts to generate a Provisional balance sheet.

Download Practice Workbook

Related Articles

- How to Create Comparative Balance Sheet Format in Excel

- Create Average Daily Balance Calculator in Excel

- Net Worth Formula Balance Sheet in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!