What Is a Projected Balance Sheet?

A projected balance sheet, also called a pro forma balance sheet, contains all the financial information (such as assets, liabilities and owner’s equity) of an organization. A projected balance sheet always satisfies the following equation:

Total Assets = Total Liabilities + Total EquityIn the equation,

Total Assets: refers to the sum of the resources that a company or organization owns, such as cash, inventories, prepaid expenses, accounts receivable, licenses, etc.

Total Liabilities: is the sum of all the organization’s debt, such as accounts payable, unearned revenue, mortgage payable, etc.

Total Equity: is the net worth of an owner’s investment in a company after deducting all liabilities.

Method 1 – Manually Creating Projected Balance Sheet Format for 3 Years

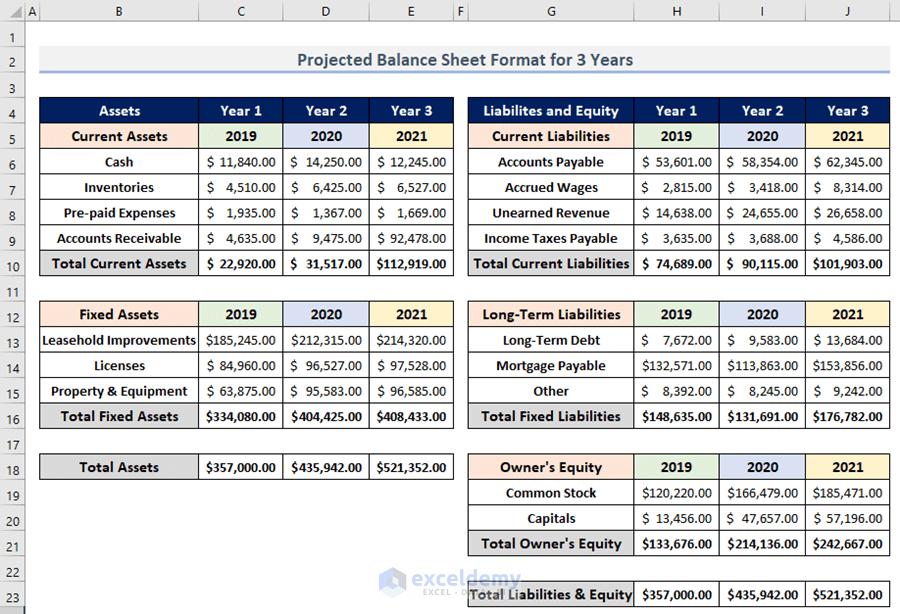

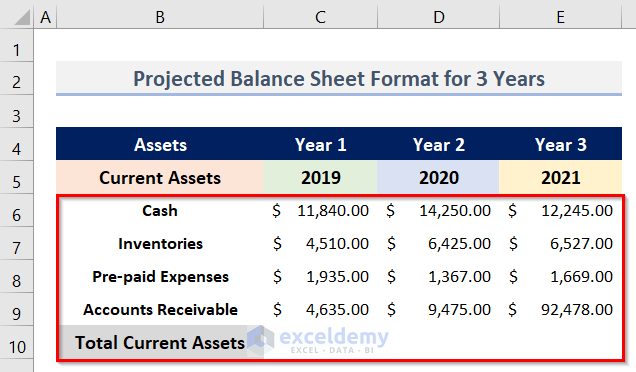

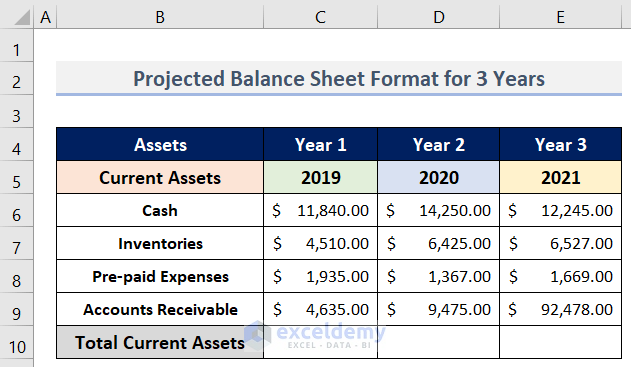

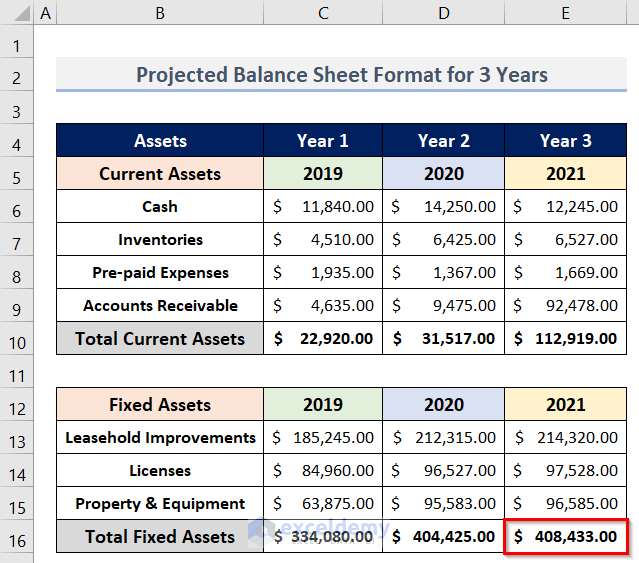

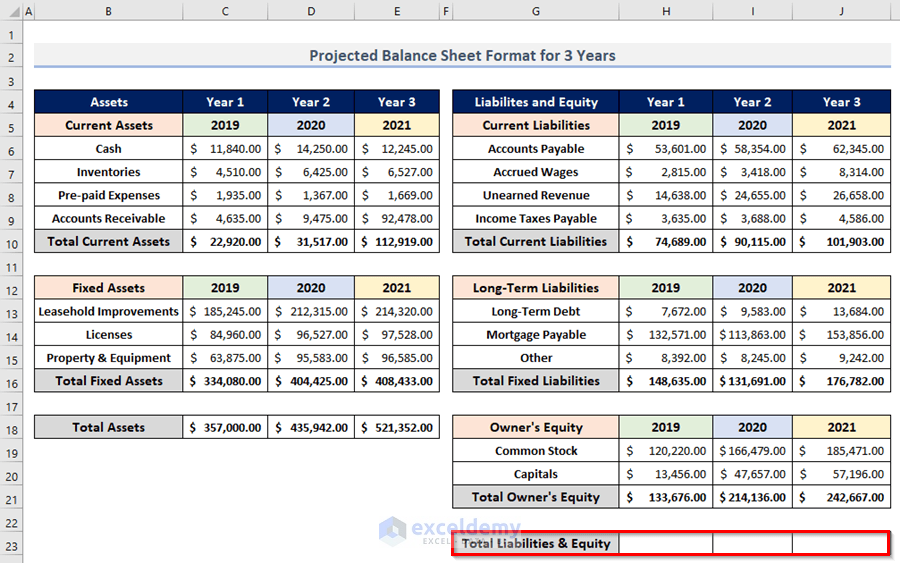

Here, Year 1 is 2019, Year 2 is 2020, and Year 3 denotes 2021. We will create a projected balance sheet like the following picture.

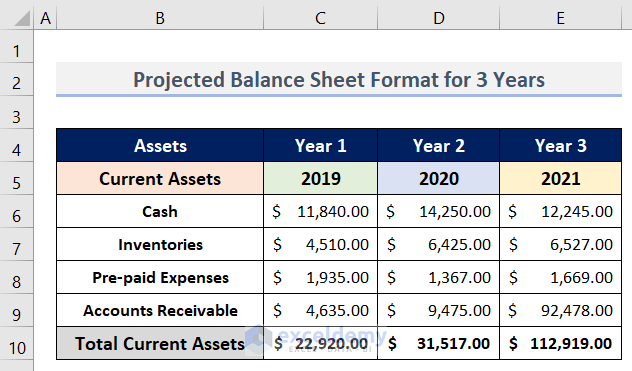

Step 1 – Creating Dataset of Current Assets

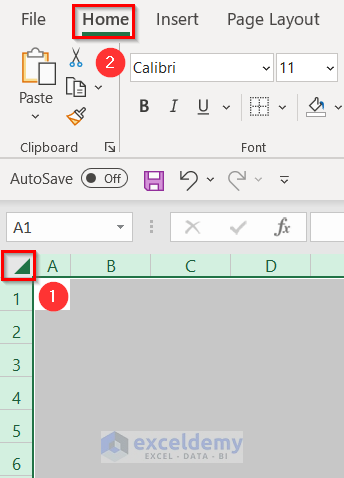

- Open a worksheet in Excel.

- Select the entire worksheet with a left-click on the triangle located at the top-left corner of the worksheet.

- Go to the Home tab.

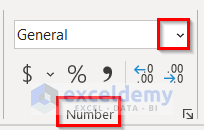

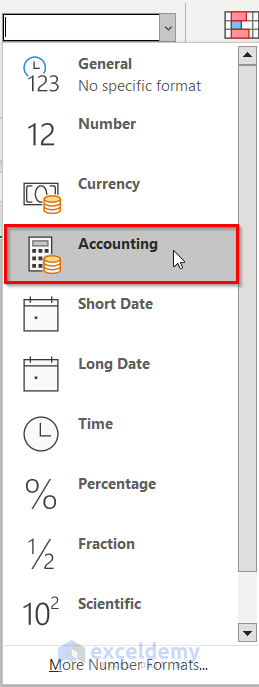

- Click on the Number Format drop-down in the Number group.

- Select Accounting from the dropdown menu.

A dollar sign ($) will now be appended to any value in the worksheet.

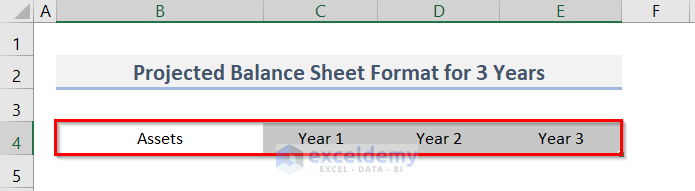

- Enter Assets, Year 1, Year 2 & Year 3 in the range B4:E4.

- Select range B4:E4.

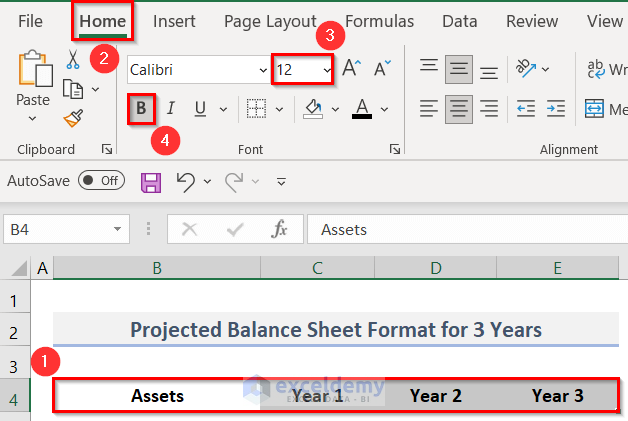

- Go to the Home tab.

- Change the Font Size to 12.

- Click on B (for Bold).

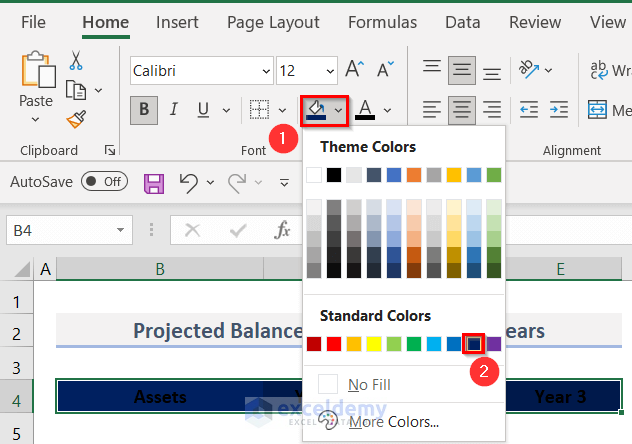

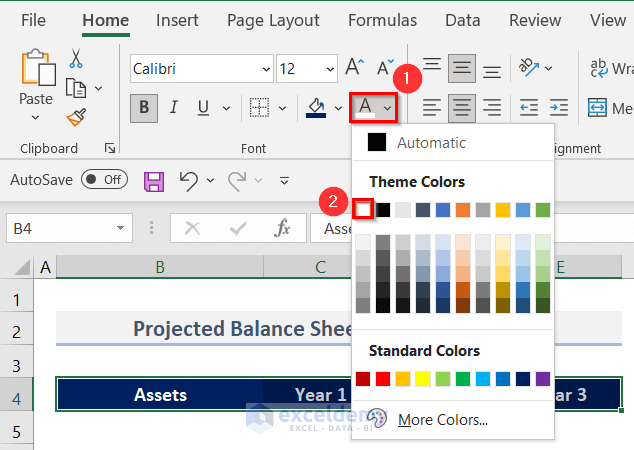

- Change the Fill Color (to Dark Blue).

- Select the font color (White) by clicking on the Font Color dropdown.

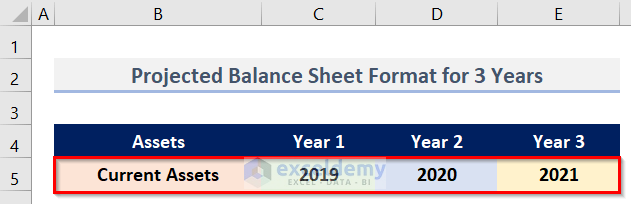

- Create headings (B5:E5) for the Current Assets table as in the image below.

- Enter the names of the Current Assets and Total Current Assets in the B6:B10 range.

- Enter the asset values for the 3 years in the C6:E9 range.

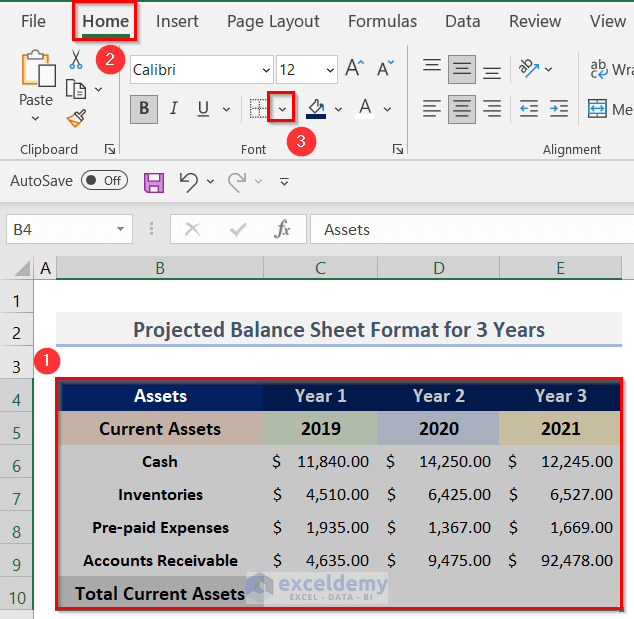

- Select the B4:E10 range.

- Go to the Home tab.

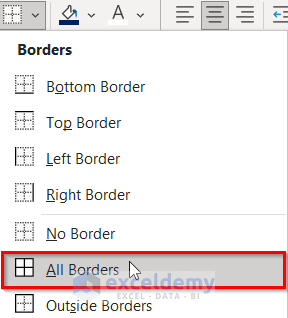

- Click on the Border dropdown from the Font group.

- Select All Borders from the dropdown menu.

The table (B4:E10) will look like the following image.

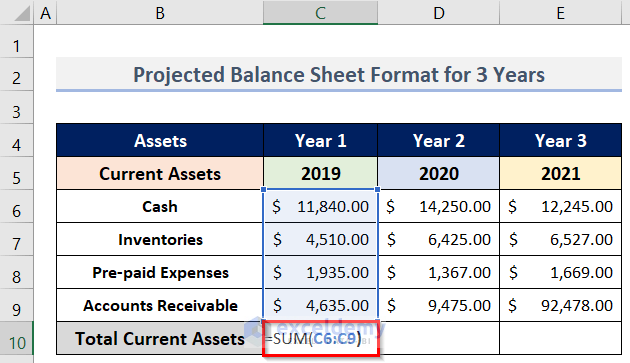

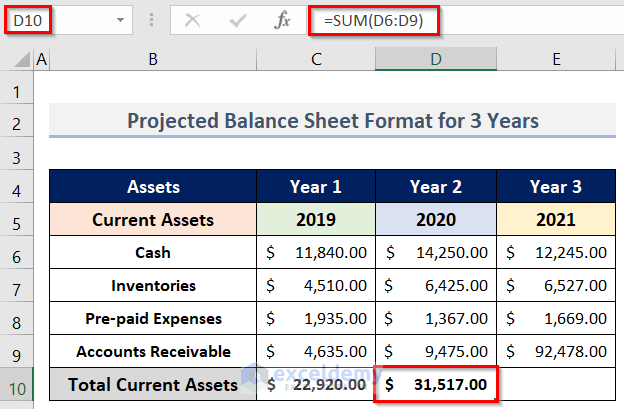

- To calculate the Total Current Assets of Year 1, enter the formula below in cell C10:

=SUM(C6:C9)

- Press Enter.

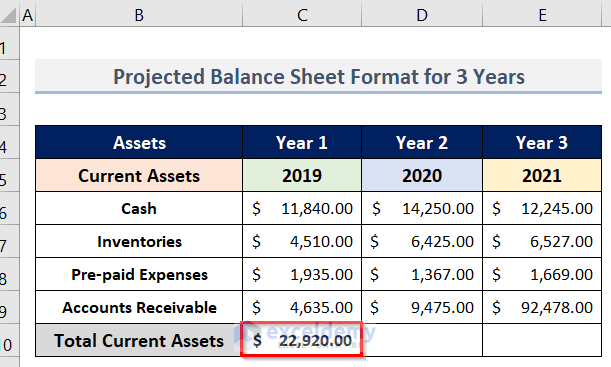

The Total Current Assets for Year 1 are returned.

- In the same way, add the Currents Assets of Year 2 by entering the following formula in cell D10:

=SUM(D6:D9)- Press the Enter key to get the result in cell D10.

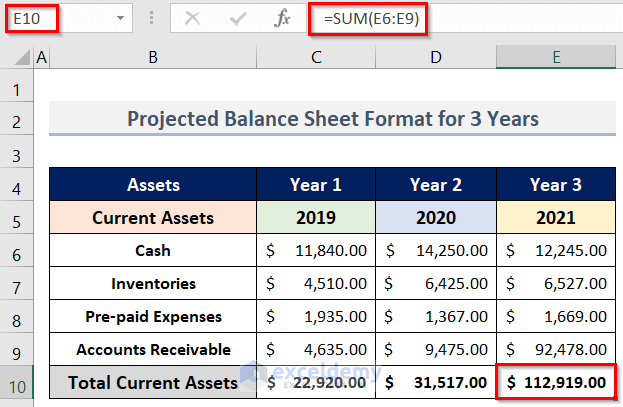

- Add the Total Current Assets for Year 3 by entering the following formula in cell E10:

=SUM(E6:E9)- Press Enter to return the result.

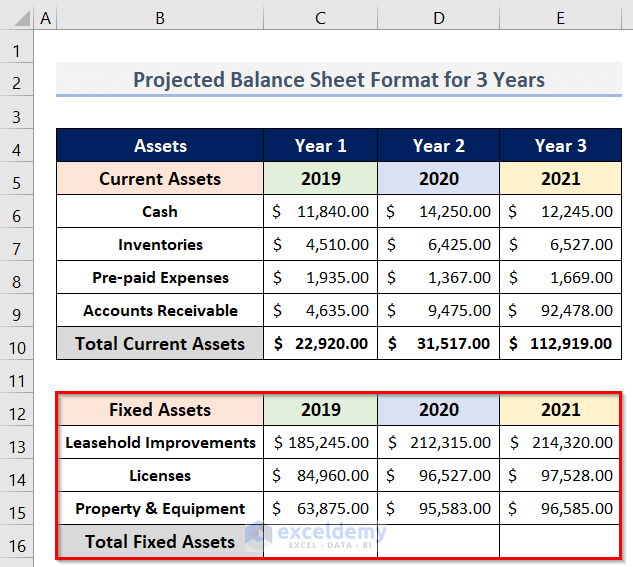

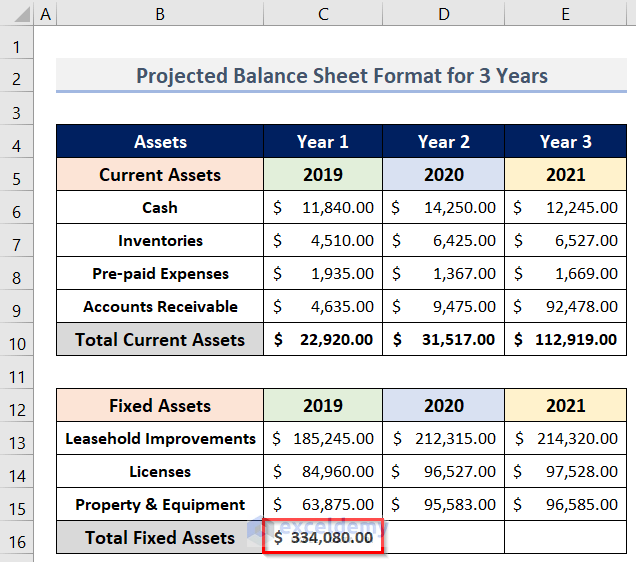

Step 2 – Estimating Total Fixed Assets

- Create a dataset (B12:E16) of Fixed Assets for the 3 years by following the process shown in the previous step.

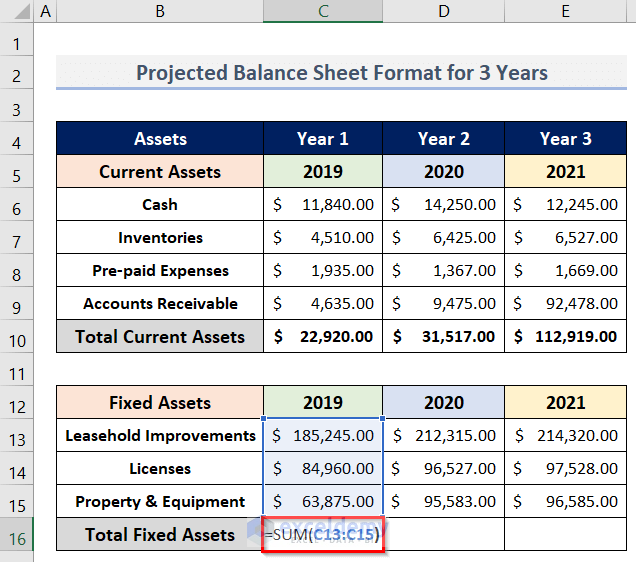

- To sum the values of Fixed Assets in Year 1, enter the formula below in cell C16:

=SUM(C13:C15)

- Press Enter to return the result.

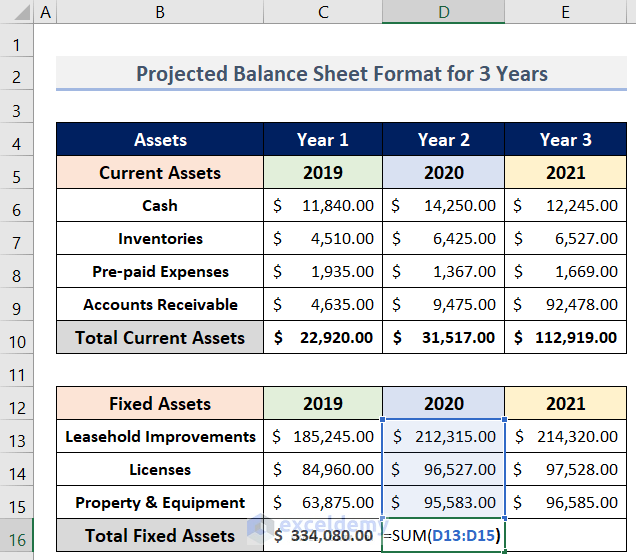

- To add the Fixed Assets in Year 2, enter the following formula in cell D16:

=SUM(D13:D15)

- Press Enter to return the result.

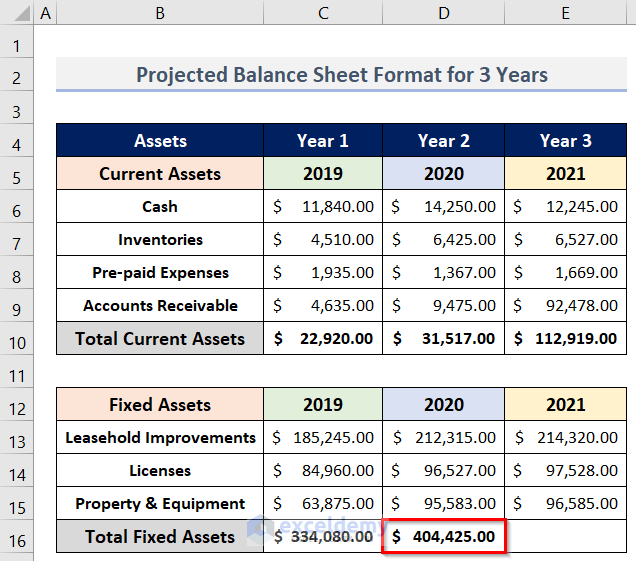

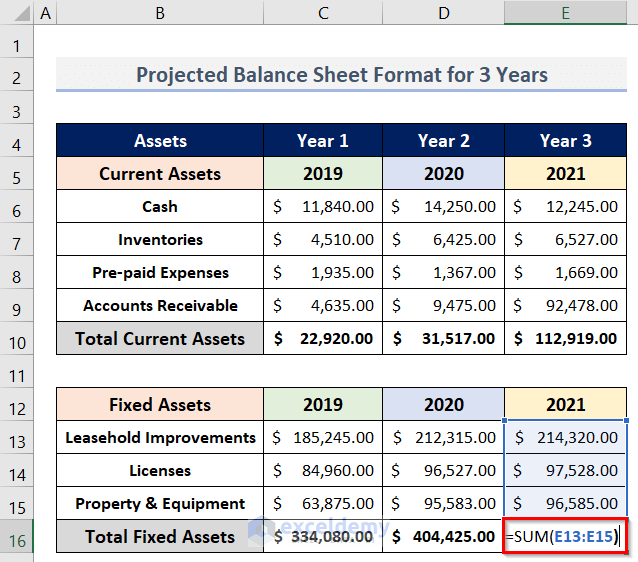

- To find the Total Fixed Assets in Year 3, enter the formula below in cell E16:

=SUM(E13:E15)

- Press Enter to return the result.

Read More: Balance Sheet Format for Construction Company in Excel

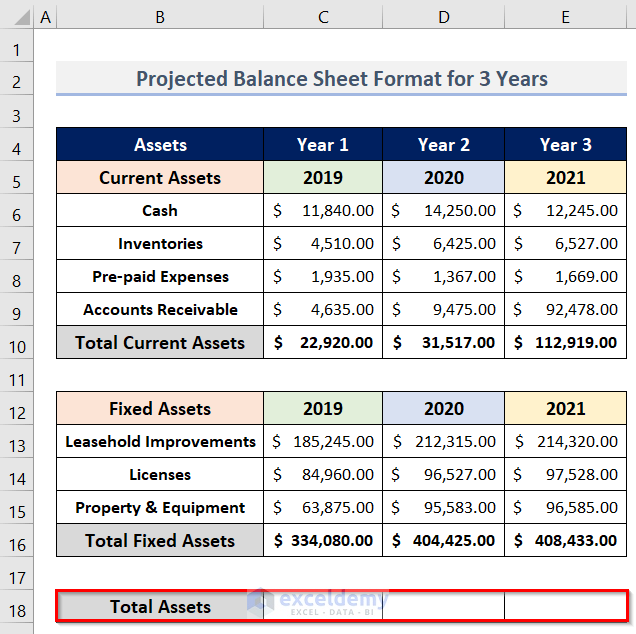

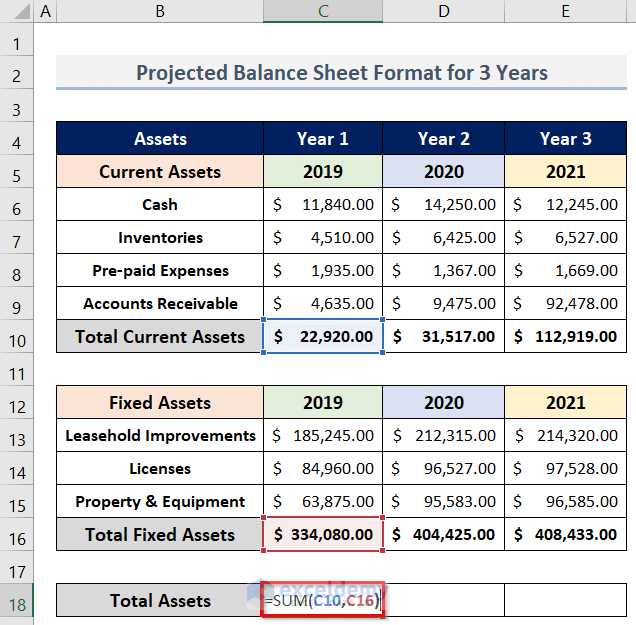

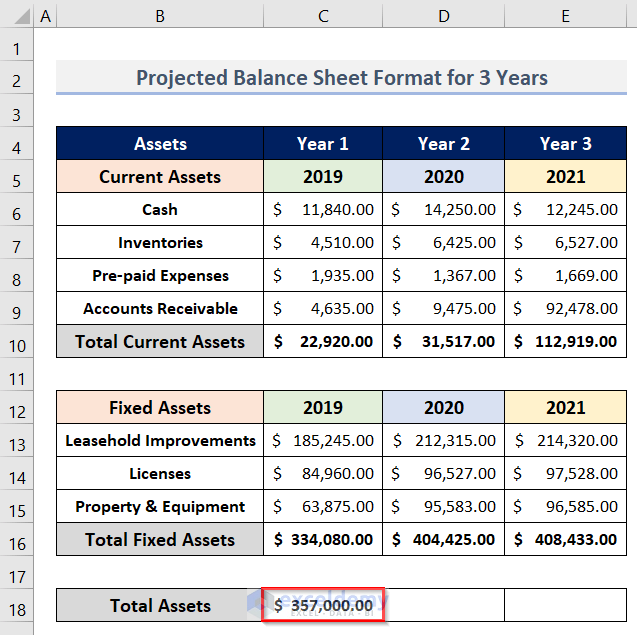

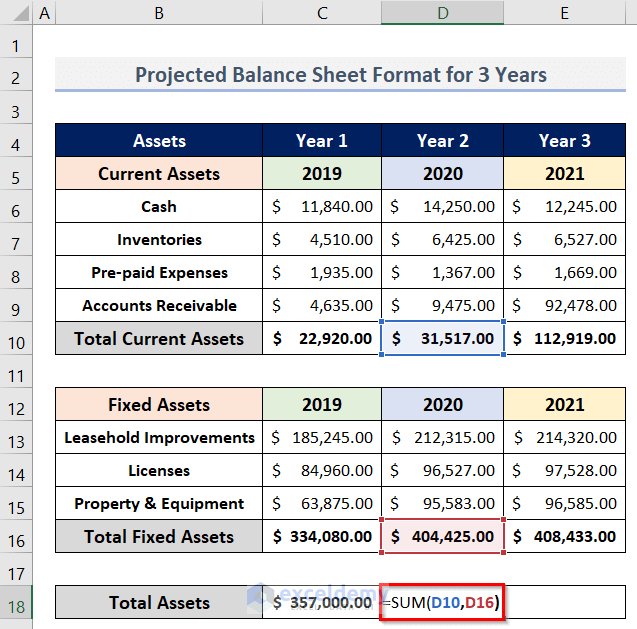

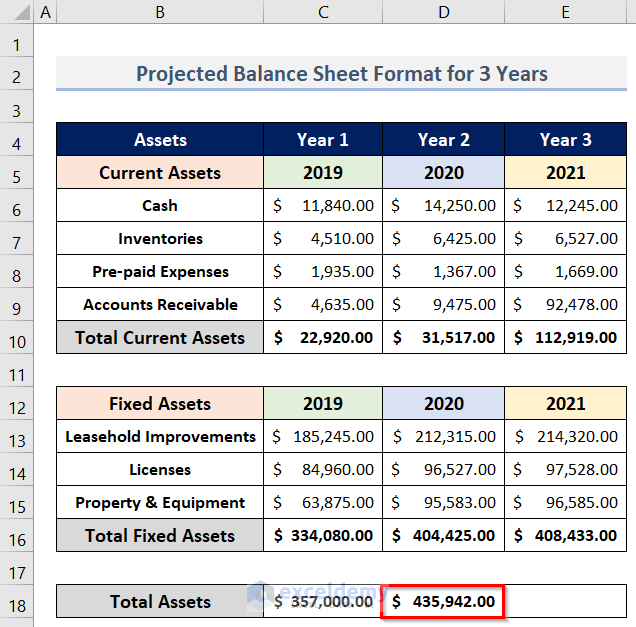

Step 3 – Finding Total Assets

To determine the Total Assets, simply add the Total Current & Fixed Assets.

- Create a row (B18:E18) for storing the Total Assets values for the 3 years.

- In cell C18, enter the following formula:

=SUM(C10,C16)

- Press Enter to return the result.

- In cell D18, to calculate the Total Assets in Year 2, enter the following formula:

=SUM(D10,D16)

- Press Enter to return the result.

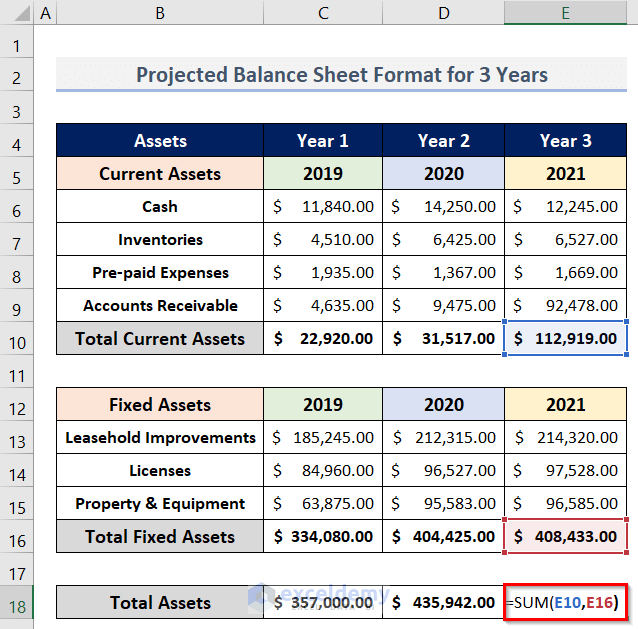

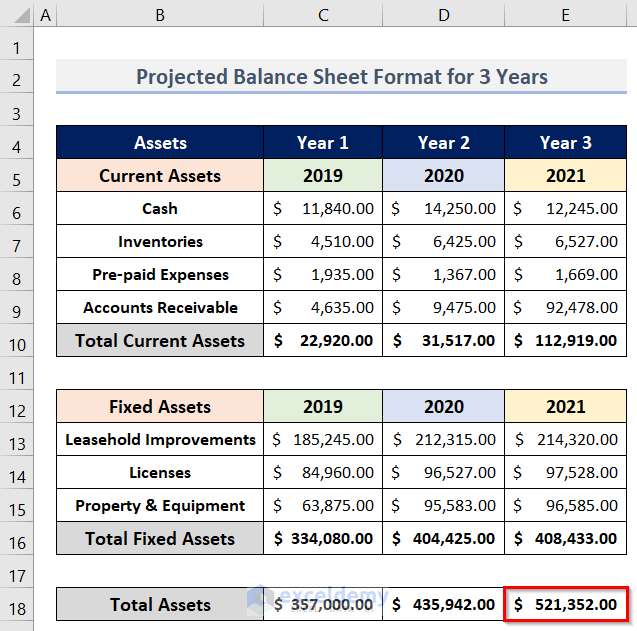

- To determine the Total Assets in Year 3, enter the following formula in cell E18:

=SUM(E10,E16)

- Press Enter to return the result.

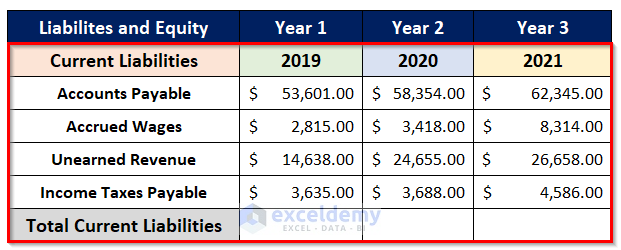

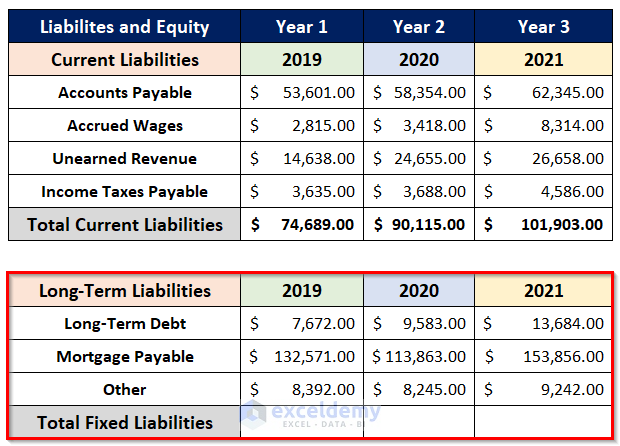

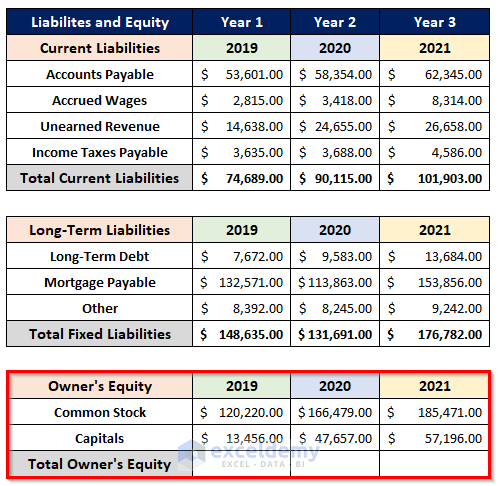

Step 4 – Making Dataset of Current Liabilities

- Insert headings (G4:J4) for Liabilities and Equity of Year 1, Year 2, and Year 3 by following the process in Step 1.

- Create a table for the Current Liabilities for the three years (as in Step 1).

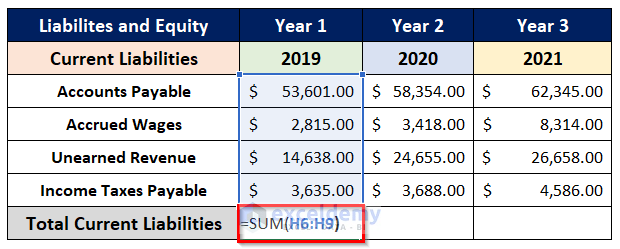

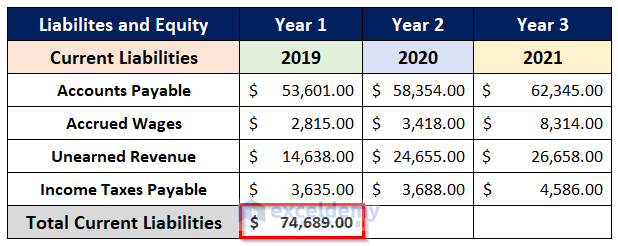

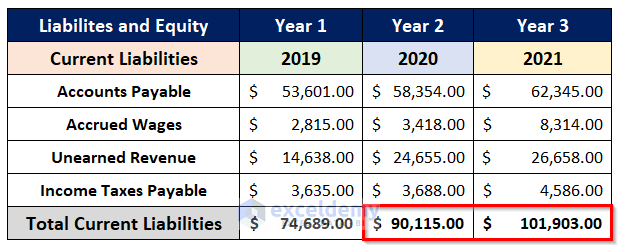

- To find the Total Current Liabilities of Year 1, enter the following formula in cell H10:

=SUM(H6:H9)

- Press Enter to return the result.

- To find the Total Current Liabilities in Year 2, enter the formula below in cell I10:

=SUM(I6:I9)- And for Year 3, enter the following formula in cell J10:

=SUM(J6:J9)

Read More: Create a Balance Sheet Format for Trading Company in Excel

Step 5 – Determining Total Long-Term Liabilities

- Create a dataset (G12:J16) for the Long-Term Liabilities.

The dataset will look like the following image.

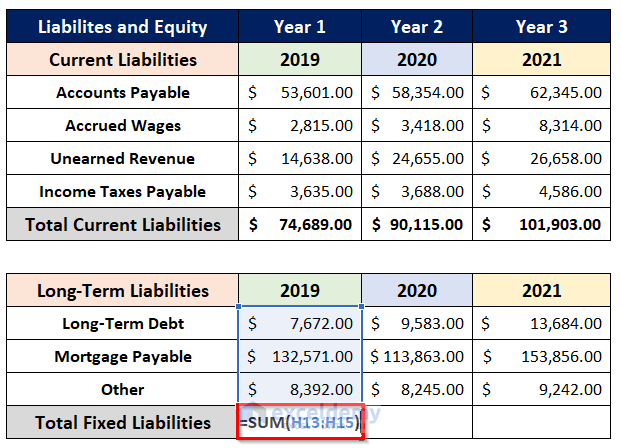

- In cell H16, to add the Fixed or Long-Term Liabilities for 2019, enter the following formula:

=SUM(H13:H15)

- Press Enter to return the result.

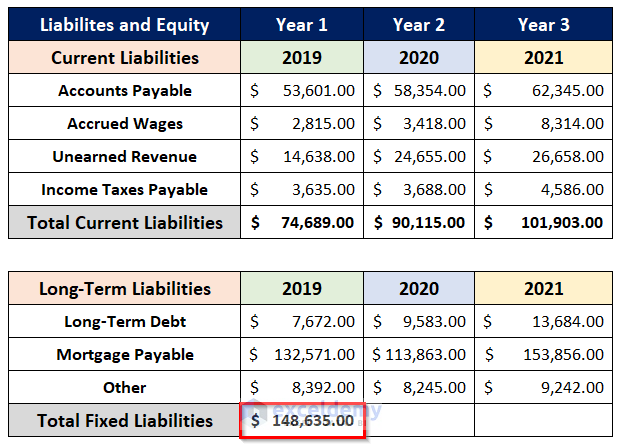

The output is returned ($ 148,635.00).

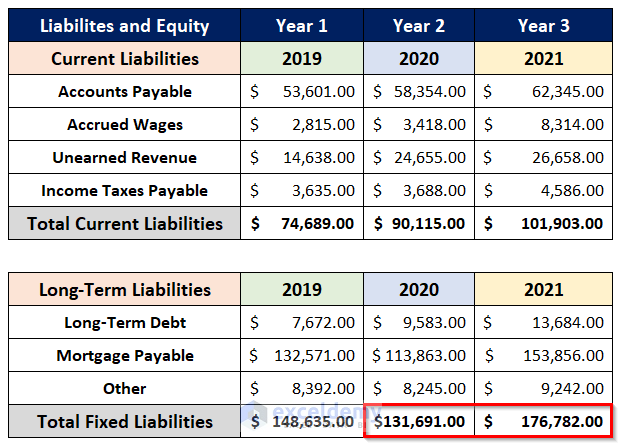

In the same way, estimate Total Fixed Liabilities for 2020 and 2021 respectively.

- For the year 2020, use the formula below in cell I16:

=SUM(I13:I15)- Similarly, for 2021, use the following formula in cell J16:

=SUM(J13:J15)

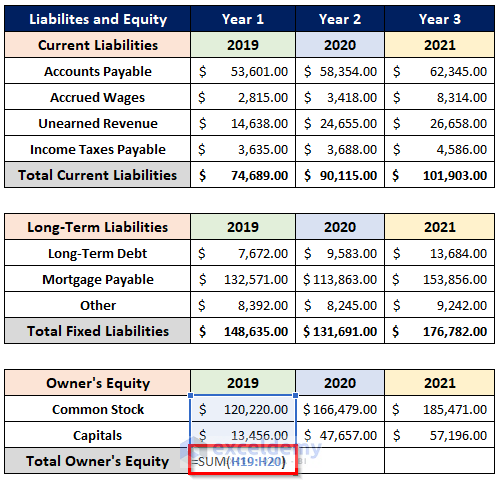

Step 6 – Calculating Total Owner’s Equity

- Prepare a table (G18:J21) by entering the names and values of the Owner’s Equity.

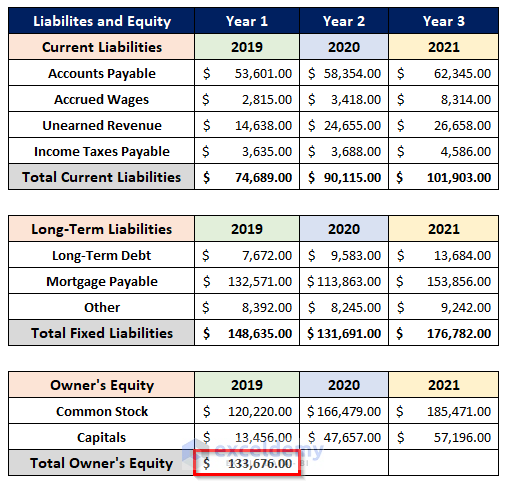

- To calculate the Total Owner’s Equity for Year 1, enter the formula below in cell H21:

=SUM(H19:H20)

- Press Enter.

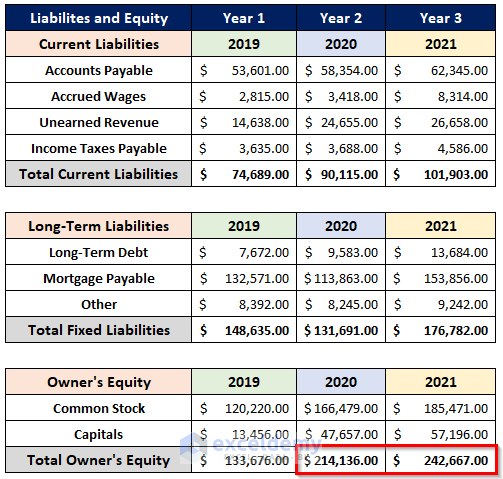

The result ($133,676.00) is returned in cell H21.

- For Year 2, enter the formula below in cell I21:

=SUM(I19:I20)- And for Year 3, enter the following formula in cell J21:

=SUM(J19:J20)

Read More: Balance Sheet Format of a Company in Excel

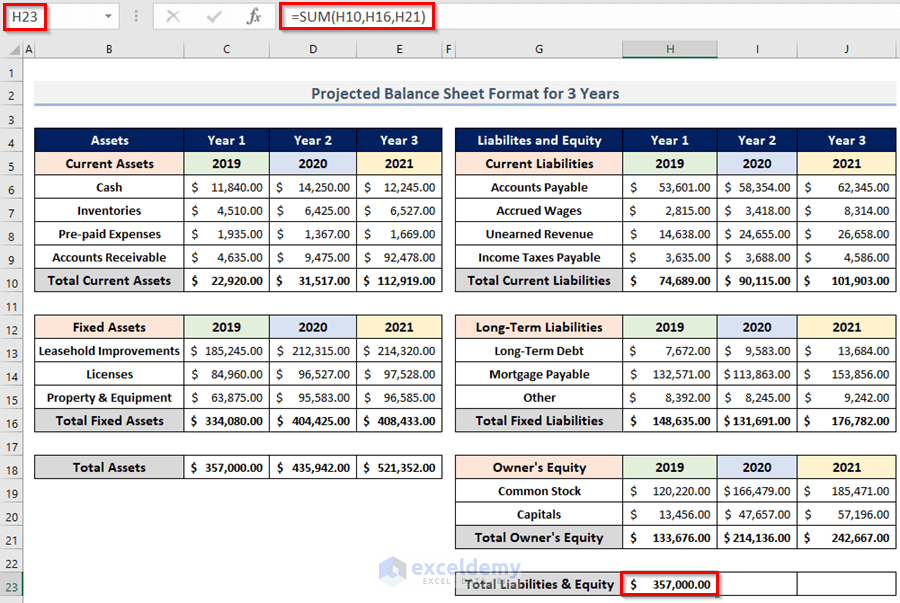

Step 7 – Adding Total Current & Fixed Liabilities with Total Equity

We will perform this calculation in the H23:J23 range.

- To calculate Total Liabilities & Equity in 2019, enter the following formula in cell H23:

=SUM(H10,H16,H21)

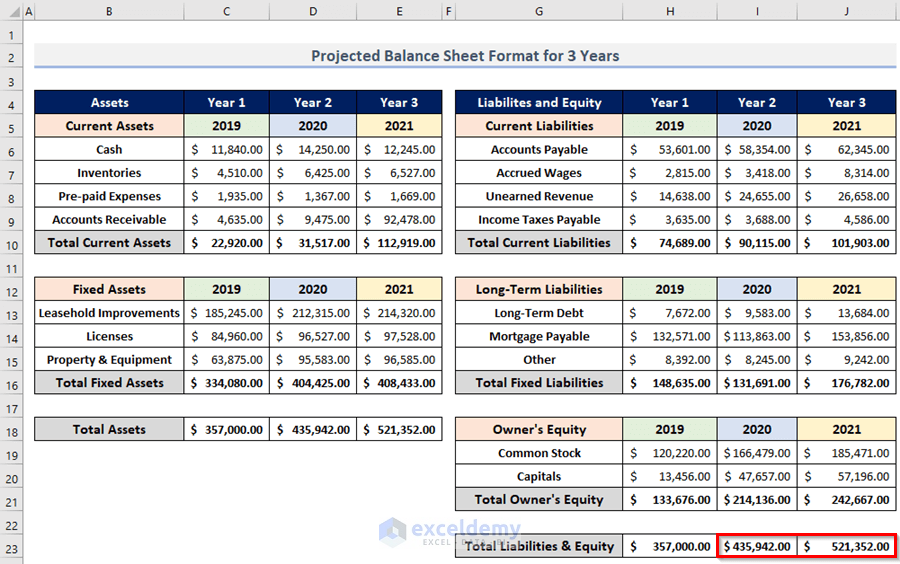

- For 2020, enter the formula below in cell I23:

=SUM(I10,I16,I21)- And for 2021, enter the following formula in cell J23:

=SUM(J10,J16,J21)

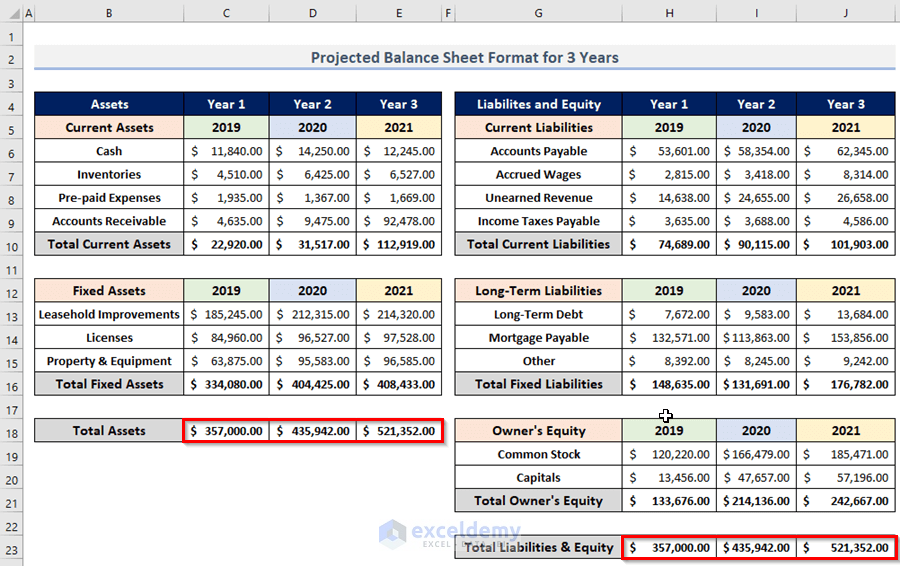

Final Output

We have a complete projected balance sheet format in Excel for 3 years.

In this balance sheet, the Total Assets (C18:E18) and Total Liabilities & Equity (H23:J23) are equal in each of the 3 years.

Read More: Income and Expenditure Account and Balance Sheet Format in Excel

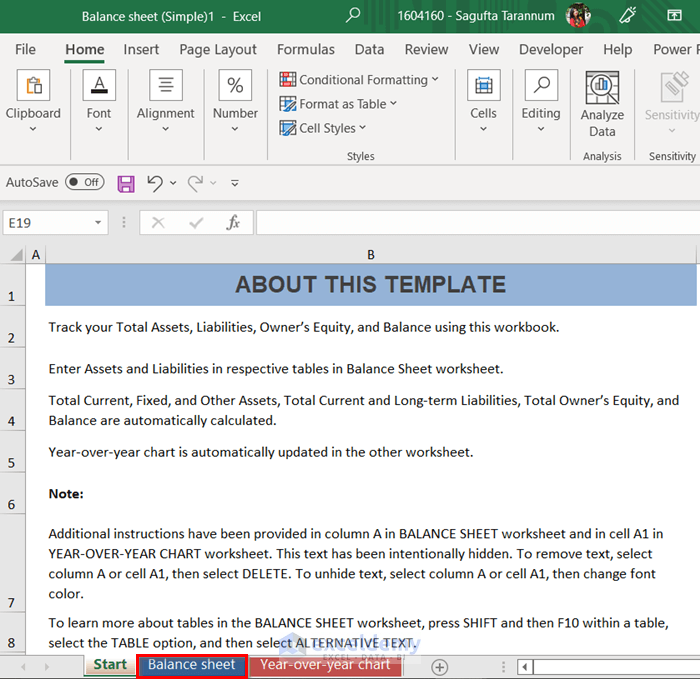

Method 2 – Using Excel Templates to Make a Projected Balance Sheet Format for 3 Years

Microsoft Excel contains some built-in balance sheet templates that we can easily modify as per our requirements.

Steps:

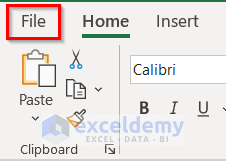

- Go to the File tab.

- Select the New option.

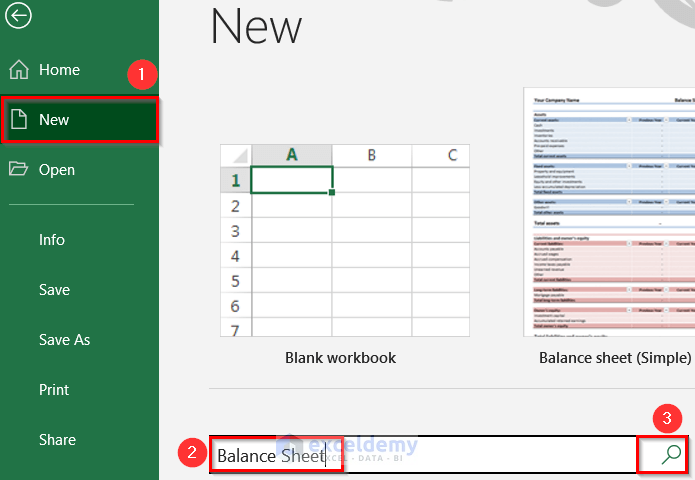

- Type ‘Balance Sheet’ in the search box.

- Click on the search icon.

Some Balance Sheet templates will appear.

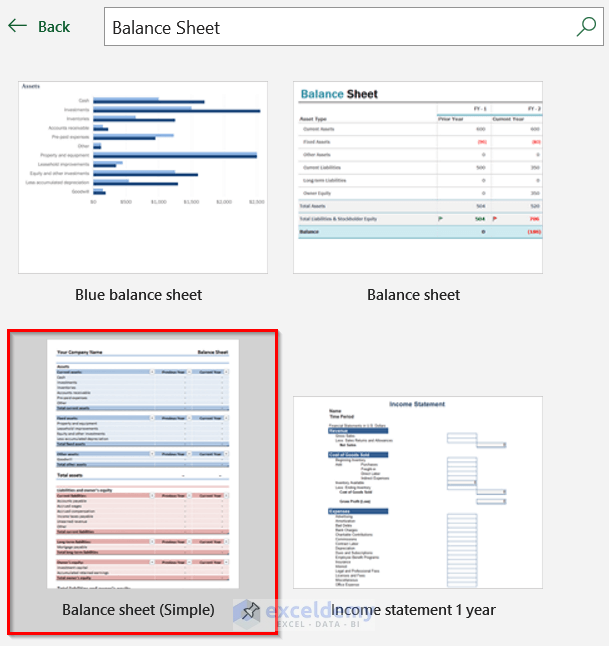

- Select an option. In our case, we selected the Balance Sheet (Simple) as it looks close to the one we require.

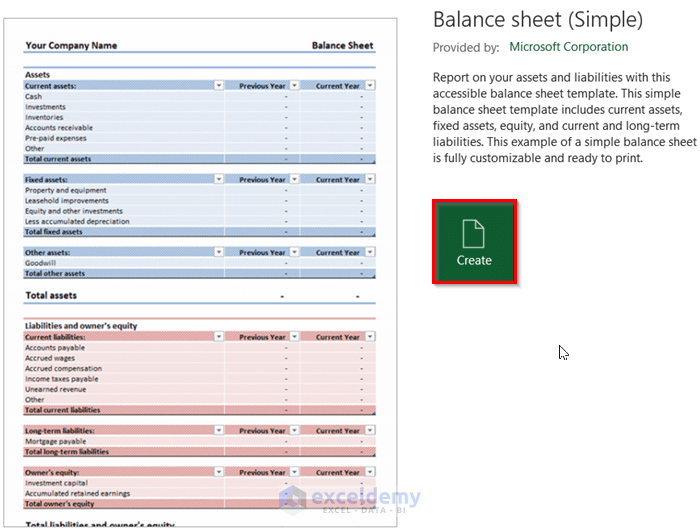

- Click on the Create button.

A new Excel workbook will open containing 3 worksheets.

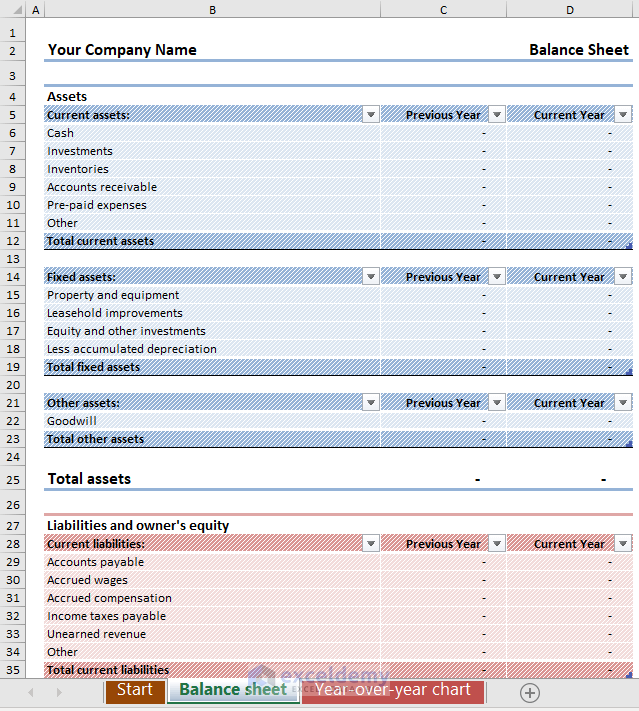

- Select Balance Sheet from the sheet tab section.

The Balance Sheet will appear.

- Modify this Balance Sheet as desired.

In our case, we need a balance sheet for three years, but this balance sheet is only for two years.

- Add another column.

Read More: How to Create Daily Bank Balance Report Format in Excel

Things to Keep in Mind

- In the balance sheet, the Total Assets, Total Liabilities, and Equity have to be equal in all years.

- Before any depreciation value, always use a minus (–) symbol.

Download Practice Workbook

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- Create a Format of Balance Sheet of Partnership Firm in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!