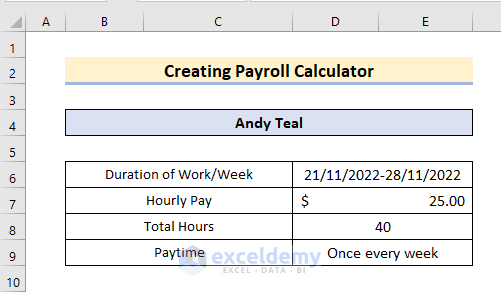

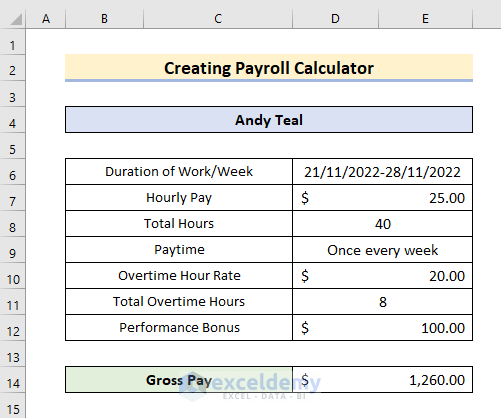

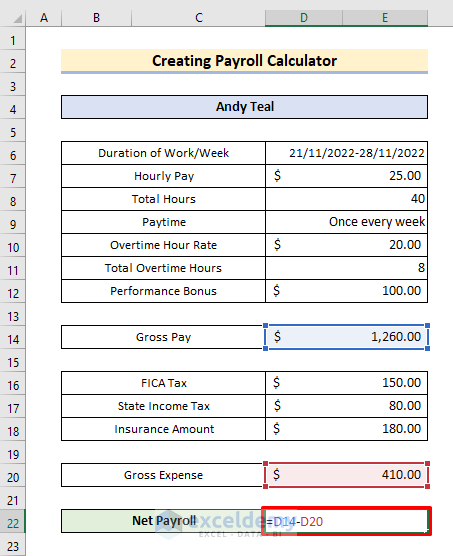

Step 1- Set up Employer Data

- Create a header.

- Create 2 columns and enter the sub-header.

- Enter the Duration of Work/Week, Hourly Pay, Total Hours & Paytime.

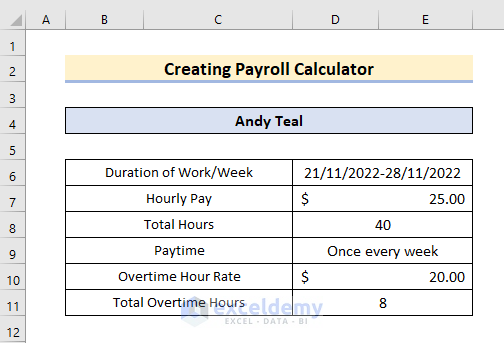

Step 2 – Enter Overtime Working Hours

- Enter the subheader of overtime hourly rate and total overtime hours.

- Enter the overtime hourly rate and total overtime hours.

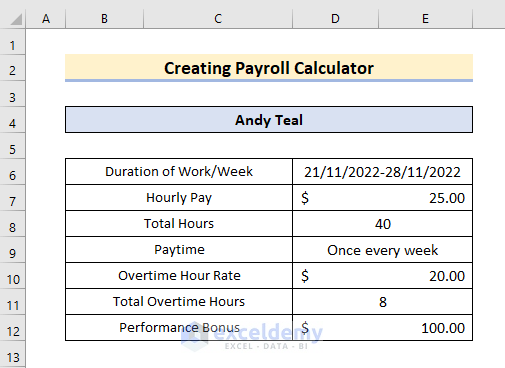

Step 3 – Include Employee Compensation

- In row 12, add the performance bonus header and the amount.

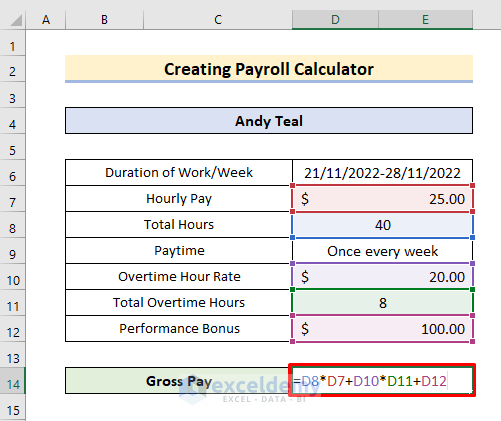

Step 4 – Calculate the Gross Pay

- In D14, enter the formula,

=D8*D7+D10*D11+D12

- Press Enter to see the result.

Formula Breakdown

- D8*D7 multiplies Hourly Pay and Total Hours to get the total payment.

- D10*D11 multiplies Overtime Hour Rate & Total Overtime Hours to see the total overtime amount.

- D8*D7+D10*D11+D12 adds the Performance Bonus to the obtained amounts to get the Gross Pay.

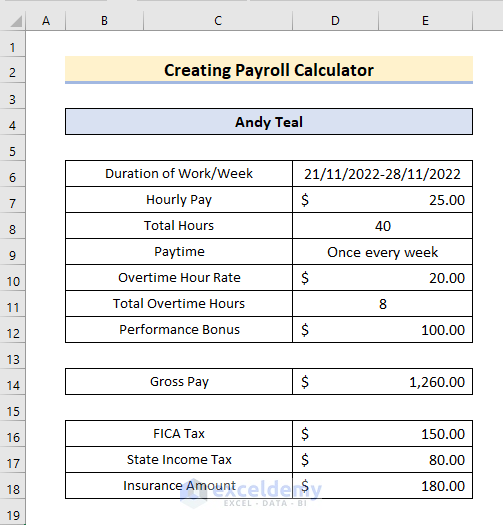

Step 5 – Insert Tax Information

- Add FICA Tax, State Income Tax, and Insurance Amount as sub-headers.

- Enter the tax amount in the right-side columns.

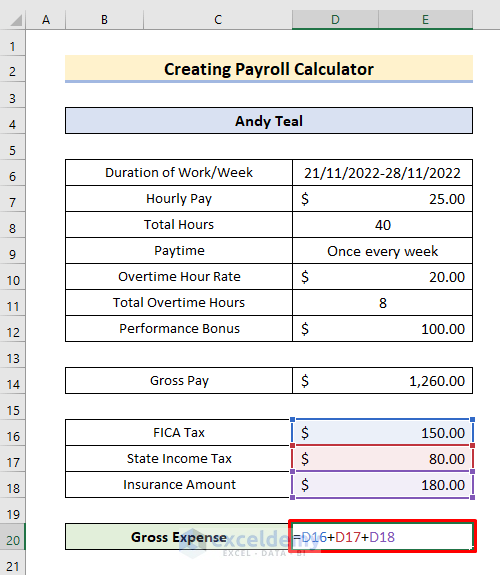

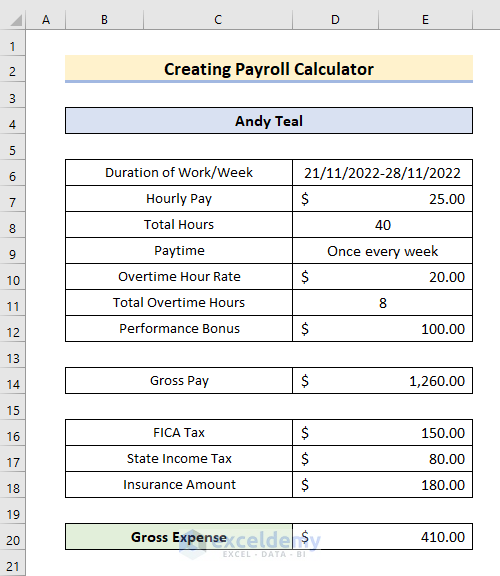

Step 6 – Sum Gross Expenses

- Enter Gross Expense as the sub-header.

- In D20, enter the following formula

=D16+D17+D18- Press Enter.

This is the gross expense.

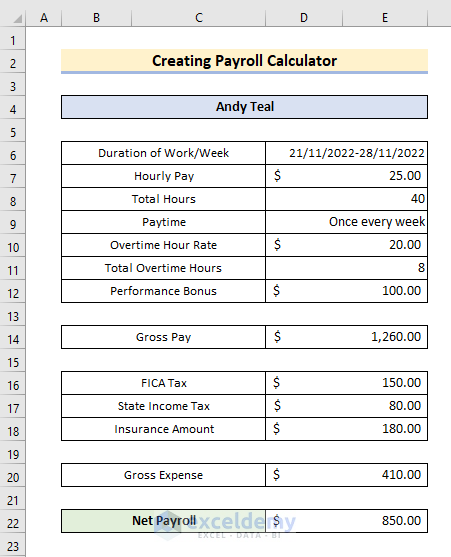

Step 7 – Calculate the Net Payroll

- In D22, enter the formula,

=D20-D14- It subtracts Gross Expense from Gross Pay.

- Press Enter.

The net pay is displayed.

Download Practice Workbook

Download the workbook.

Related Articles

<< Go Back to Excel Payroll Templates | Excel HR Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!