This is an overview:

Method 1 – Using the Goal Seek Feature to Create a Reverse EMI Calculator in Excel

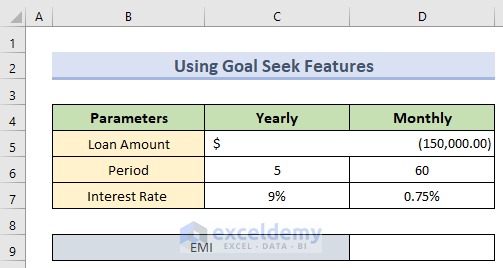

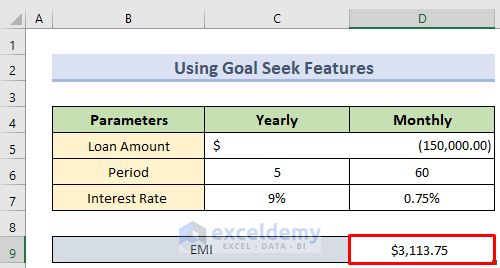

Step 1: Establishing the Relationship

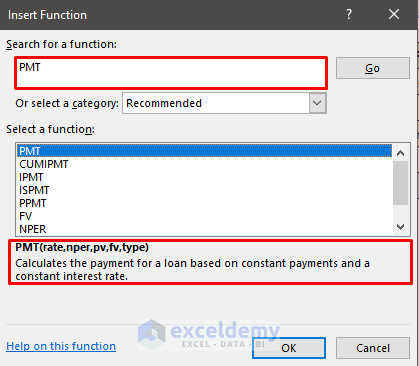

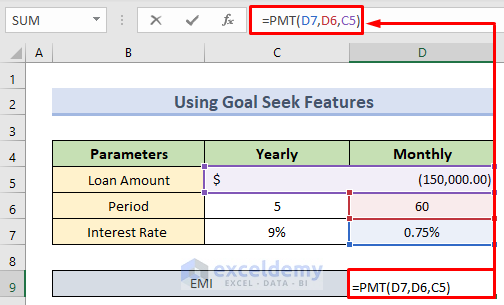

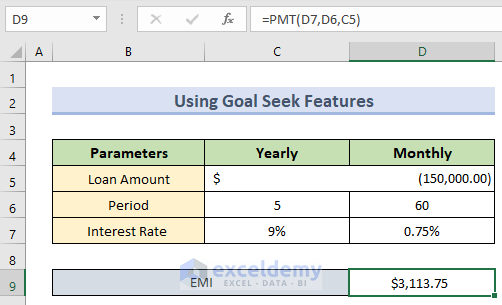

To establish the relationship between the EMI and the Total Loan based on the Interest Rate and Time, use the PMT function. Its syntax is:

- Enter the total time (nper) and interest rate (rate).

- Use the following formula:

- Press Enter to see the result.

The EMI is calculated.

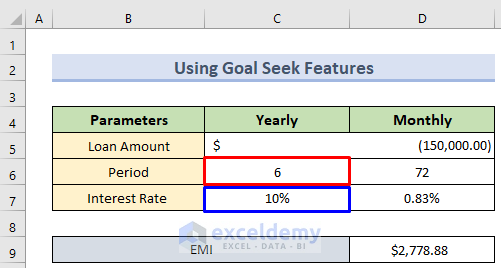

Step 2: Setting up the Parameters

Change the npr and the rate. Here, a time period of 6 years at a rate of 10%.

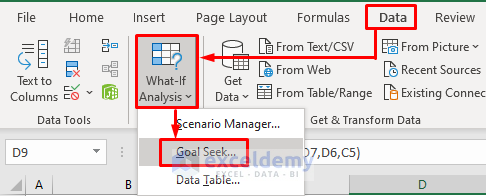

Step 3: Using the Goal Seek Feature to Calculated the Reverse EMI

- Go to the Data tab and select What If Analysis in Forecast.

- Select Goal Seek.

- In the Set cell, enter the EMI amount.

- In By changing cell, select the cell containing the total Loan Amount.

- Press Enter.

The EMI was set to 3000$ to see the total amount or present value.

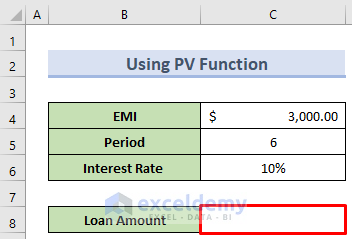

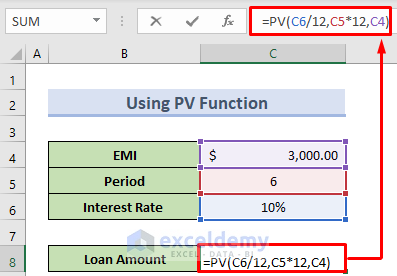

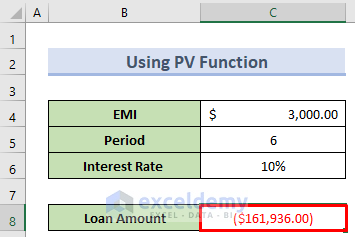

2. Using the PV Function to Create a Reverse EMI Calculator in Excel

Steps:

- To find the Loan Amount in the dataset below:

- Select a cell to see the output and enter the following formula in the formula bar:

- Press Enter to see the result.

Read More: Reducing Balance EMI Calculator in Excel Sheet

Things to Remember

- The Goal Seek feature requires an existing relationship.

Download Practice Workbook

Download the following workbook.

Related Articles

- Personal Loan EMI Calculator Excel Format

- Home Loan EMI Calculator with Reducing Balance in Excel

- Create Home Loan EMI Calculator in Excel Sheet with Prepayment Option

- SBI Home Loan EMI Calculator in Excel Sheet with Prepayment Option

- EMI Calculator with Prepayment Option in Excel Sheet

<< Go Back to EMI Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!