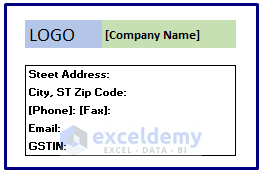

Method 1 – Create a Bill Header with Company Details

Enter company details such as Company Logo, Name, Address, Contact Details, GSTIN No. etc.

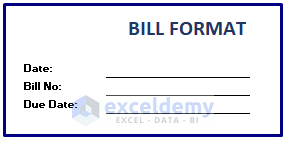

Method 2 – Add Bill/Invoice Details to Tally Bill Format

Each company follows a specific type of bill/invoice No. Usually, Bill No. is a unique number. In this section of the format, you have to enter the Date of Issuance of the bill, the Due Date of the payment, etc.

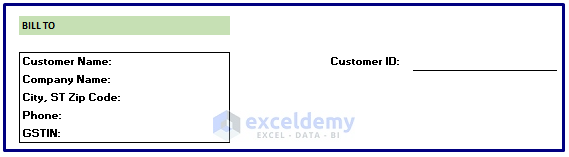

Method 3 – Add Customer’s Details to Tally Bill Format

Input the details of the customer. For example, Customer Name, Contact details, GSTIN No. Besides you have to add a unique customer ID in this section.

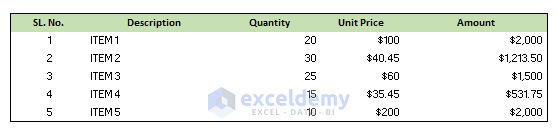

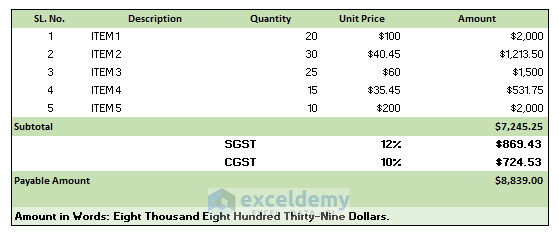

Method 4 – Description of the Items Provided to the Customer

In this section, companies describe the services and goods they are providing to the customer. All the names, prices, quantities of the provided services are provided in this section.

Method 5 – Add the Subtotal and Total Amount

We can add a subtotal of the goods/services in this section. Besides, if any taxes are applied to the provided goods/services, then we have to list that amount too.

In this section, we can use Excel formulas and functions to calculate the payable amount. Even simple multiplication formulas in Excel make the calculation process of bills easier. For example, in my bill format, we used the SUM function along with the ROUND function to calculate the total payable amount.

We entered the formula below:

=ROUND(SUM(F25:F27),0)

The above formula returns the total payable amount in Excel.

How Does the Formula Work?

➤ SUM(F25:F27)

The SUM function adds all the amounts in the range F25:F27.

➤ ROUND(SUM(F25:F27),0)

The ROUND function rounds the total amount to zero decimal places.

Method 6 – Include Comments/Notes/Payment Terms in the Tally Bill Format

If you want to add any payment terms or any instructions about the payment, then you can add those in this section. For example, you may have a late fee policy or conditions for the provided service warranty. In that case, add those things here.

Method 7 – Additional Features

- Most of the time companies add the signature of the authorized person in bills.

- Companies include concluding messages and brief contact details of the company. You can add that, too, in your tally bill format.

Download Practice Workbook

You can download the practice workbook that we have used to prepare this article.

Related Articles

- Tax Invoice Format in Excel (Download the Free Template)

- Create GST Invoice Format in Excel (Step-by-Step Guideline)

- Excel Invoice Tracker (Format and Usage)

- Create Tally Debit Note Format in Excel (With Easy Steps)

- How to Create a Tally Button in Excel (2 Suitable Examples)