In this article, we’ll demonstrate 6 methods and provide a calculator to calculate continuous compound interest using a formula in Excel.

Basics of Continuous Compound Interest

What is Continuous Compound Interest

Compound interest calculates only the interest on the principal after a certain time. Continuous compound interest means increasing the interest based on the principal or initial amount over multiple time periods. That is to say, it is a measure of the final amount or future value (FV) if the interest is compounding continuously.

The Formula for Continuous Compound Interest

The formula for continuous compound interest is as follows:

A(FV) = Pert

Here,

A is the final amount or continuous compounding amount (FV).

P is the initial amount or principal.

r is the rate of interest expressed in percentage.

t is the number of time units.

How to Use Continuous Compound Interest Formula in Excel : 6 Methods

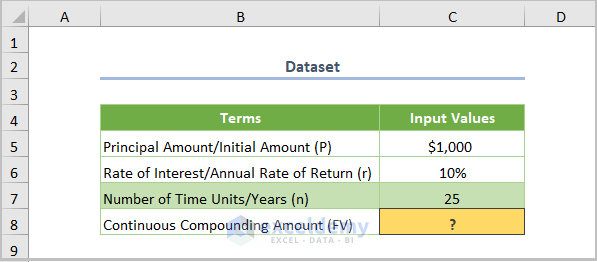

Suppose we want to buy a bond or invest money somewhere that has some properties. Suppose the Principal Amount (P) is $1000, the Rate of Interest (r) is 10% and the Number of Time Units (n) is 25 years. The investment period will end after that period. More importantly, the interest is compounding continuously. Let’s compute the Continuous Compounding Amount or Future Value (FV).

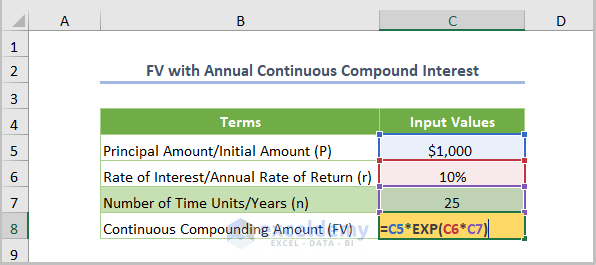

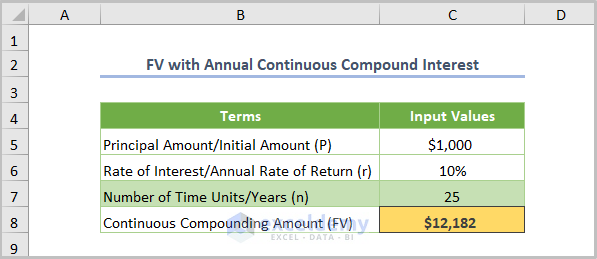

Method 1 – Future Value with Annual Continuous Compound Interest

The investment will end after 25 years. To measure the continuous compounding amount at the end of the period, use the following formula:

=C5*EXP(C6*C7)

Here, C5 is the initial amount (P), C6 is the rate of interest (r), and C7 is the number of time units/years (n).

The EXP function returns the value of the constant e raised to the power of a given number.

After inserting the formula, press Enter and the output will look like the following.

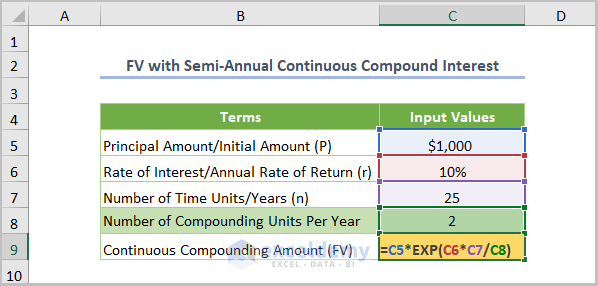

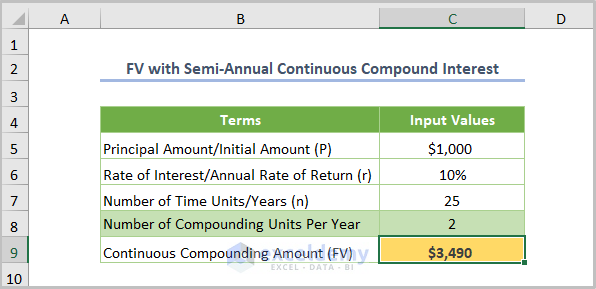

Method 2 – Future Value with Semi-Annual Continuous Compounding

Now suppose the interest is compounding continuously with a semi-annual interest rate. So if the investment yields 10% semi-annually, the annual compounding interest will be 20%. For convenience, add an individual term namely Number of Compounding Units Per Year. In the case of semi-annual compounding, the value of the term will be 2.

So the adjusted formula will be:

=C5*EXP(C6*C7/C8)

Here, C8 is the number of compounding units per year.

Press Enter to return the following output:

Read More: Formula for Monthly Compound Interest in Excel

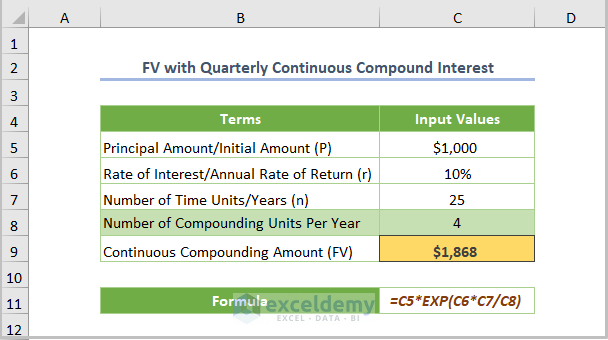

Method 3 – Future Value with Quarterly Continuous Compound Interest

Here, the investment yields 10% quarterly, meaning the annual compound interest will be 40%. We adapt our formula as follows:

=C5*EXP(C6*C7/C8)

Here, C8 is the cell representing the number of compounding units per year.

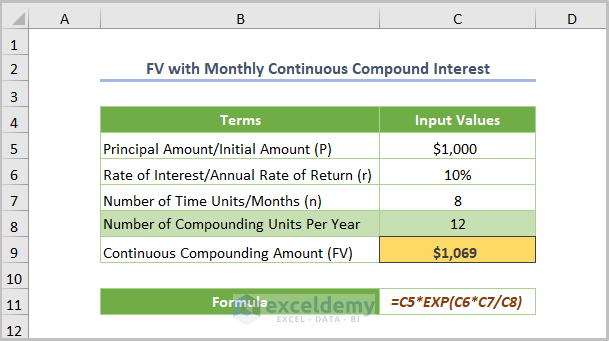

Method 4 – Future Value with Monthly Continuous Compound Interest

To measure the future value (FV) after 8 months with a monthly compounding interest of 10%, use the following formula:

=C5*EXP(C6*C7/C8)

Here the number of compounding units (C8 cell) is 12.

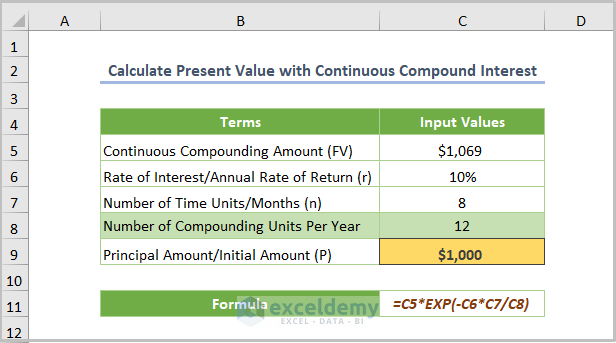

Method 5 – Calculate Present Value with Continuous Compound Interest

Suppose the future value in 8 months time is known, and we need to find out the present value to invest in order to achieve that future value at the given interest rate.

To do this, put a minus sign (-) after the EXP function and before the rate of interest:

=C5*EXP(-C6*C7/C8)

The principal or present value is calculated based on the future value.

Read More: How to Calculate Compound Interest for Recurring Deposit in Excel

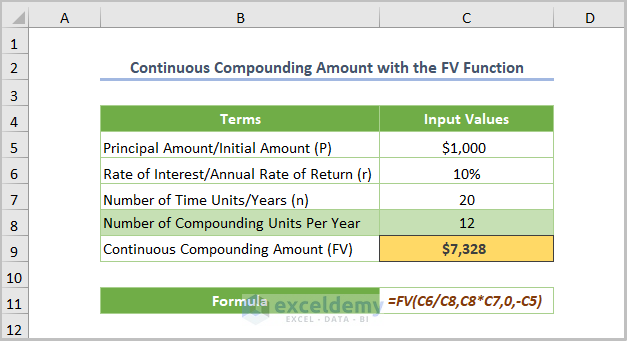

Method 6 – Continuous Compound Interest with the FV Function

Last but not least, we can use the FV function to calculate the continuous compounding amount. The function mainly calculates the future value of an investment based on compounded interest.

Use the formula below.

=FV(C6/C8,C8*C7,0,-C5)

Here,

Rate = C6/C8. We divide the rate of interest by the number of compounding units per year to get a monthly interest rate.

Nper = C8*C7. We multiply the number of years by the number of compounding units to get the total number of payment periods.

Pmt = 0. We don’t have any additional payments in each period.

Pv = –C5. This is the present value i.e. the initial amount.

Things to Remember

- Keep in mind the number of compounding units per year, which can be found in the following table.

| Intra-year Compounding Interest Rate | Number of Compounding Units Per Year |

|---|---|

| Semi-Annual | 2 |

| Quarterly | 4 |

| Monthly | 12 |

| Weekly | 52 |

| Daily | 365 (actual) |

- Theoretically, the number of time units in the case of continuous compound interest is infinite, however this is not practical in the real world. So, we need to assume the number of periods for calculation purposes.

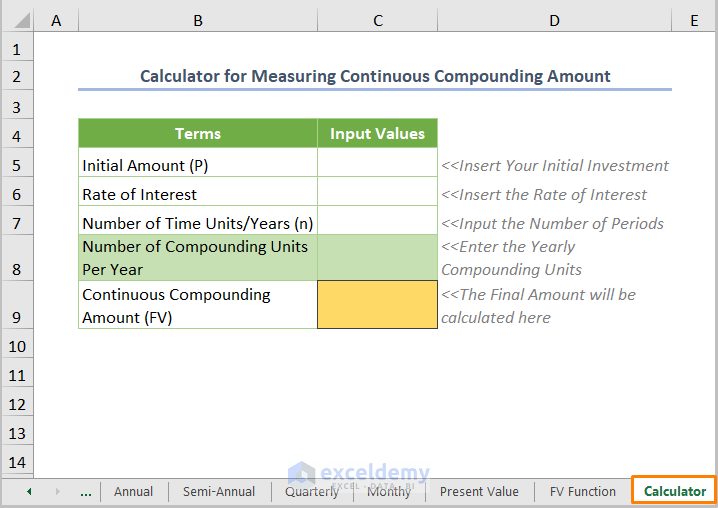

Calculator for Measuring Continuous Compound Interest

If you download the practice workbook below, you’ll find a sheet namely Calculator. If you wish, insert your investment values to calculate the Future Value.

Note: Also, you may save the sheet as an Excel template for using the calculator frequently.

Download Practice Workbook

Related Article

<< Go Back to Compound Interest in Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Good day

Thank you for the great insights and calculation.

I wonder if you can provide further insights guidance on the following requirement / scenario

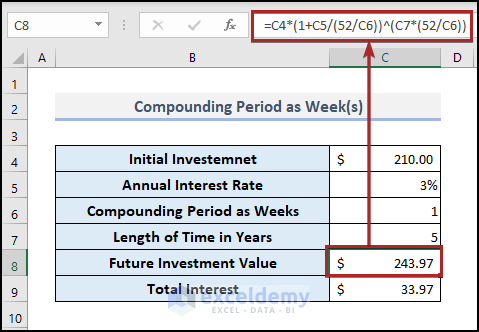

Investment / principal amount is $210

Compounded growth is weekly at 3% (yes,3% every week) for 5 years (60 months)

I used the formula as follows

“FV = (0,03/52; 52*5; 0; -210)” and the result I get is $237,95

the manual process comes to the value of $236,36 on the 4th line as follows

210

216.30

222.79

229.47

236.36

243.45…. etc

Appreciate your guidance and assistance

Many thanks

A

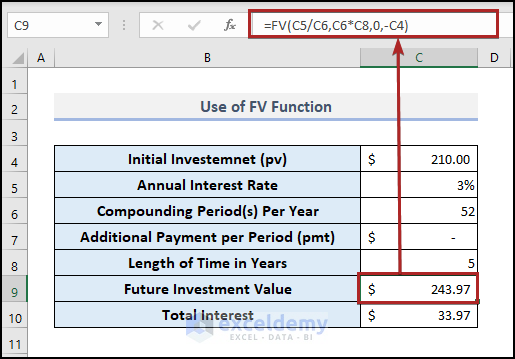

Hello AHMED

I think you made an unintentional mistake during the calculation.

After 5 years, the future value would be $243.97. The result would come the same whether you calculate manually or use any function.

Calculating manually, you’ll get the result below.

And, using the FV function the result would come like in the one below.