Introduction to the 360 Interest Calculation System

Actual/360, also known as the 365/360 rule, is the most frequently used method by banks to calculate interest accrual. In this method, you need to divide the annual interest rate by 360 to get the daily interest rate. Then, you multiply the daily interest rate by the number of days in the month. You will get the interest rate for that month. After that, multiplying the loan amount by the monthly interest rate calculates the interest amount.

The actual/360 method is used by most banks because it helps to standardize daily interest rates across the year. Another advantage of the 360-day calculations over 365-day calculations is that the daily interest rate is slightly higher.

2 Steps to Perform Actual 360 Interest Calculation in Excel

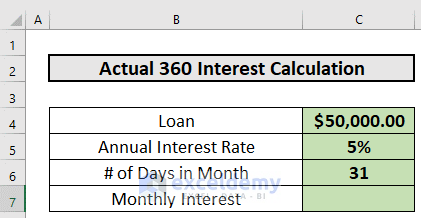

Step 1 – Write Down the Required Information

In our example, the loan amount is $50,000, the annual interest rate is 5%, and the number of days in the month is 31.

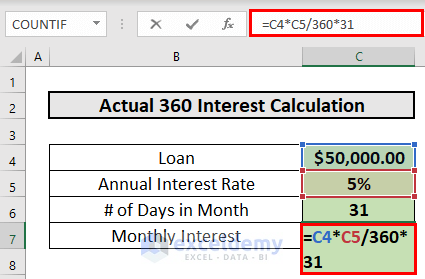

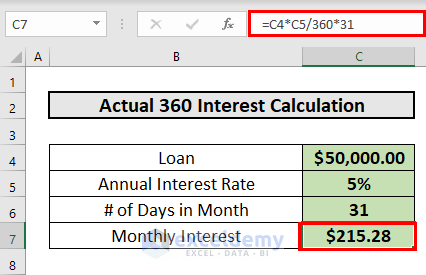

Step 2 – Calculate the Interest Amount in Actual/360 Method

- Go to C7 and insert the following formula:

=C4*C5/360*31

Formula Explanation:

- The Annual Interest Rate is 5%.

- We have divided 5% by 360 to get the daily interest rate of 014%.

- We multiplied 014% by 31 and got the monthly interest rate of 0.43%.

- We multiplied $50,000 by 43% to get the monthly interest.

- Hit Enter.

Download the Practice Workbook

Related Articles

- How to Calculate GPF Interest in Excel

- How to Use Cumulative Interest Formula in Excel

- How to Split Principal and Interest in EMI in Excel

- Perform Carried Interest Calculation in Excel

- How to Calculate Interest Between Two Dates in Excel

- Calculation of Interest During Construction in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!