In this article, we will explain how to create a balance sheet format for a trading company in Excel.

Introduction to Balance Sheet

Projected balance sheets, also known as pro forma balance sheets, show estimated changes in a company’s financial status, such as investments, other assets, liabilities, and equity financing.

In general, a balance sheet contains 3 portions: Assets, Liabilities, and Owners’ Equity, which are organized according to the equation:

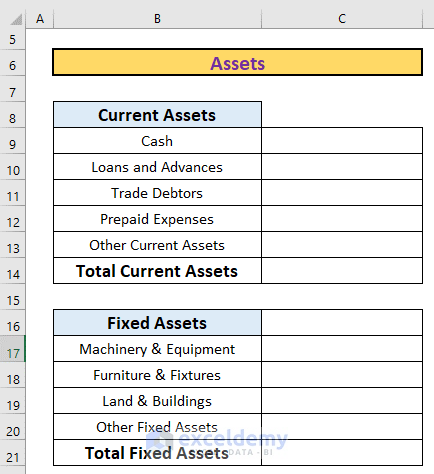

Assets: The main resources owned by the organization. They can be classified into categories like Current and Fixed Assets, Tangible, and Intangible assets, etc.

Liabilities: Amounts that the organization owes, like cash, loans, etc.

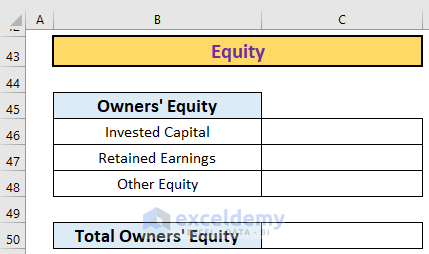

Equity: The portion of a business owned by the shareholders. The equity is the difference between assets and liabilities.

Read More: How to Create Daily Bank Balance Report Format in Excel

3 Steps to Create a Balance Sheet Format for a Trading Company in Excel

In this article, we have divided the process of creating a balance sheet into 3 easy steps. However, there is no fixed rule for this.

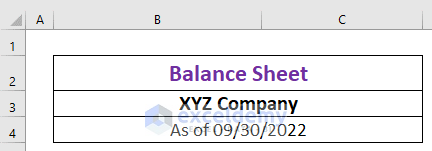

Step 1 – Create a Format Outline

The first step is to create an outline. The balance sheet should start with a heading followed by the company’s name and the date the balance sheet is being created.

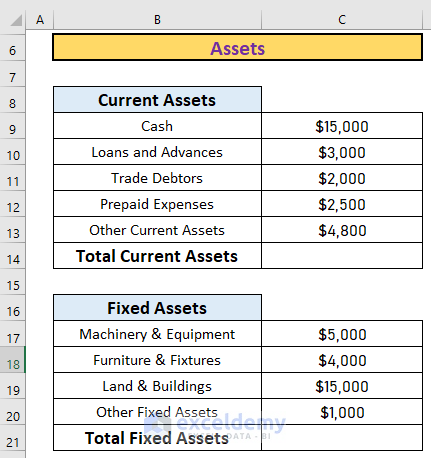

Assets

The balance sheet includes assets in the following way:

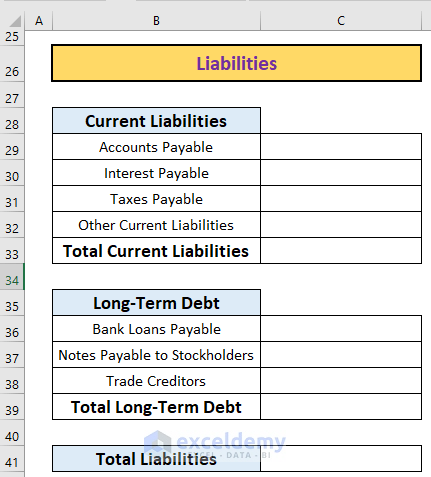

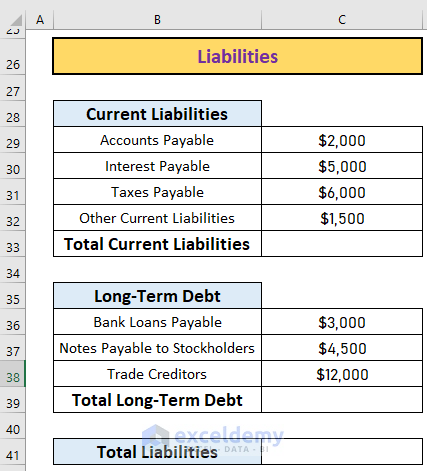

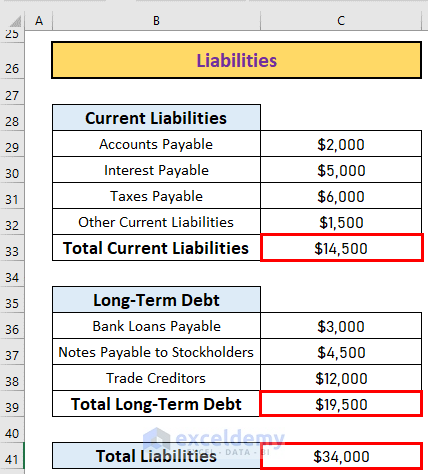

Liabilities

Liabilities are mainly of two types: Long-term liabilities and Current liabilities. Current liabilities are those payable within 12 months, with Long-term liabilities being those payable thereafter.

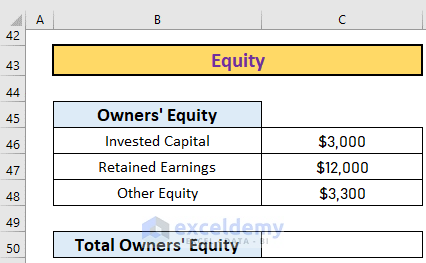

Owner’s Equity

Next comes the Owner’s Equity. The outline for this might look like this.

Read More: Income and Expenditure Account and Balance Sheet Format in Excel

Step 2 – Enter the Information

Now, enter the inputs carefully, with the relevant values in the correct places.

Assets

First add the assets. Here is a sample of all the asset accounts with their values.

Liabilities

Next do the liabilities. The accounts are always categorized into long-term and current liabilities.

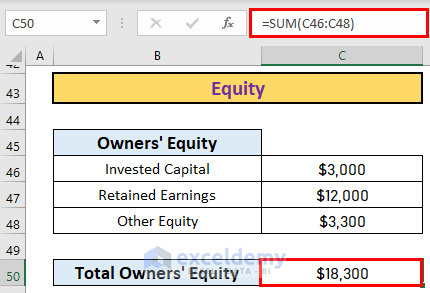

Owner’s Equity

Finally, enter the information for the Owner’s Equity accounts.

Read More: Balance Sheet Format of a Company in Excel

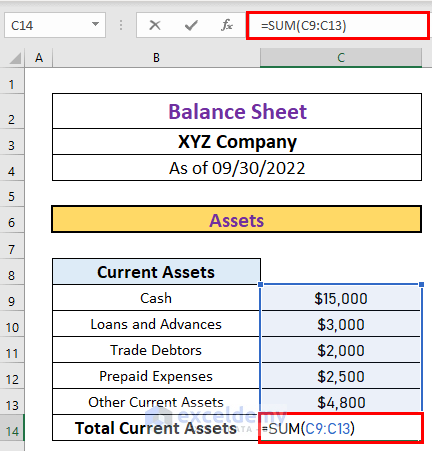

Step 3 – Calculate Totals for the Assets, Liabilities, and Owner’s Equity

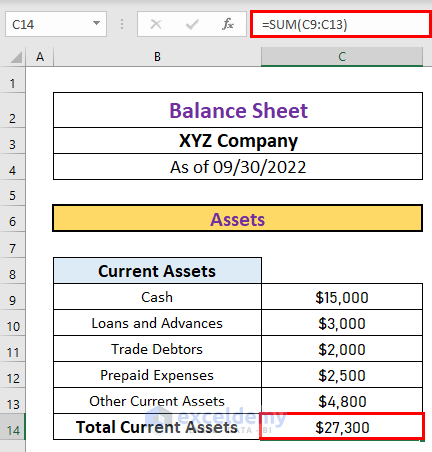

Next, we calculate total assets, liabilities, and owner’s equity using the SUM function.

We\ll start with the total current assets.

- In cell C14, enter the following formula:

=SUM(C9:C13)

- Press ENTER to get the output.

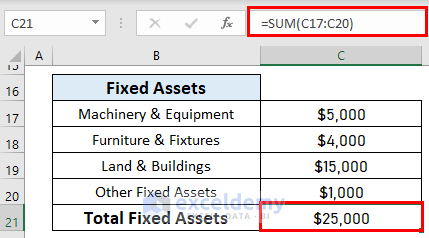

Similarly, calculate the total fixed assets.

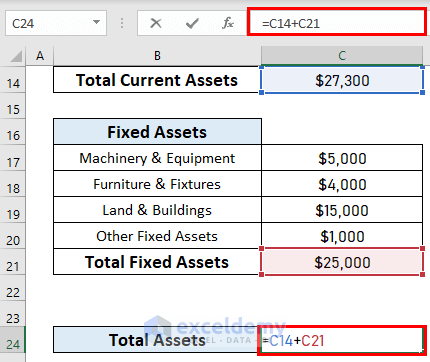

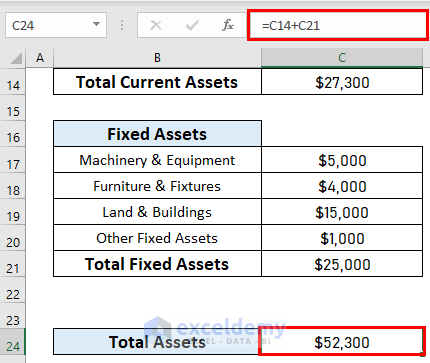

We’ll add the two values to get the total assets for the current period.

- In cell C24, enter the following formula:

=C14+C21

- Press ENTER to get the output.

- Calculate the liabilities in the same way.

- Same again for Equity.

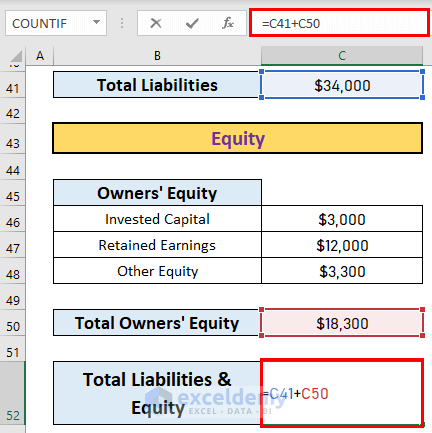

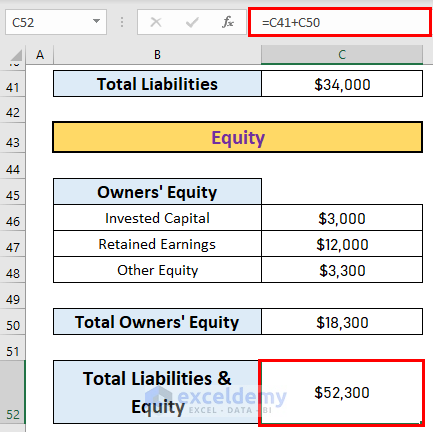

The balance sheet includes total liabilities and owner’s equity. So, we will now calculate those.

- In cell C52, enter the following formula:

=C41+C50

- Press ENTER to get the output.

Our balance sheet format is complete.

Read More: Balance Sheet Format for Construction Company in Excel

Things to Remember

- Total assets must equal the sum of total liabilities and equity.

Download Practice Workbook

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- Create a Format of Balance Sheet of Partnership Firm in Excel

- How to Create Projected Balance Sheet Format for 3 Years in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!