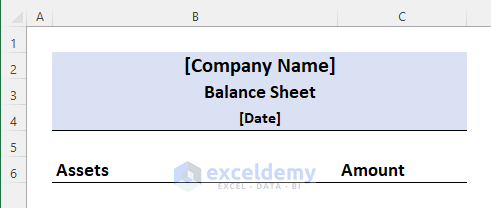

Step 1 – Create a Proper Heading for the Balance Sheet

- In cell B2, type the name of your company.

- In cell B3, write Balance Sheet.

- Enter the date in cell B4.

- Merge cells B and C for rows 2 to 4.

- Apply the Bottom Border from the Home tab.

- Your balance sheet heading will now look as follows.

Step 2 – Insert Balance Sheet Components

- In Column B, enter the components: Assets, Liabilities, and Shareholder’s Equity.

- Corresponding amounts will be entered in Column C.

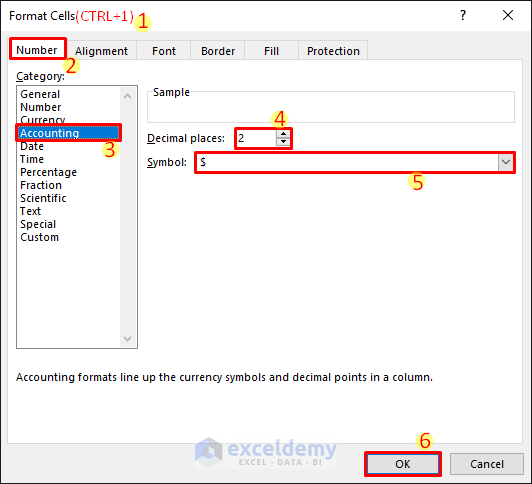

Step 3 – Format the Amount Column

- Before entering data, format the Amount column.

- Select Column C by clicking on the column number.

- Press CTRL+1 to open the Format Cells dialog box.

- Choose the Accounting number format with 2 decimal places.

- Ensure the $ sign is visible.

- Click OK.

Read More: How to Create Tally Debit Note Format in Excel

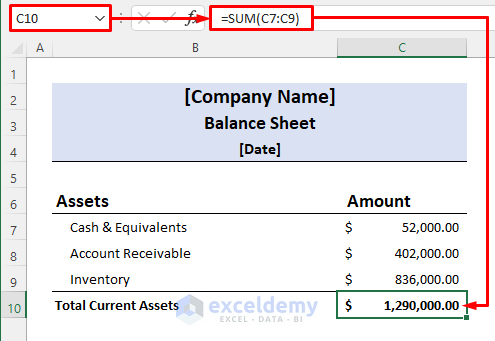

Step 4 – Insert Current Assets

- Enter the current assets into your balance sheet. These are typically assets with a period of less than one year. Examples include Cash and Equivalents, Accounts Receivable, and Inventory.

- In cells B7 to B9, enter the names of these components.

- Corresponding amounts should be entered in cells C7 to C9.

- To calculate the total current assets, enter the formula in cell C10:

=SUM(C7:C9)

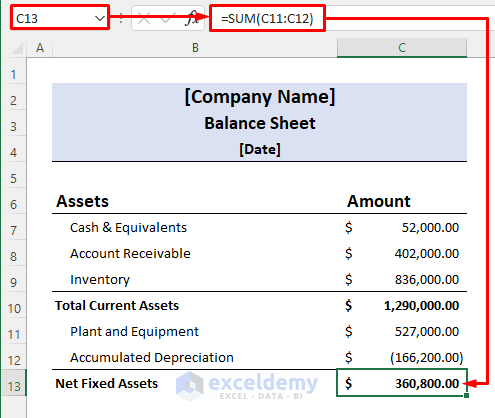

Step 5 – Input Fixed Assets

- Enter the fixed assets (such as Plant & Equipment) in cell B11.

- The corresponding amount should be entered in cell C11.

- Depreciation amounts must be entered as negative values (inside brackets).

- Calculate the Net Fixed Assets using the formula in cell C13:

=SUM(C11:C12)

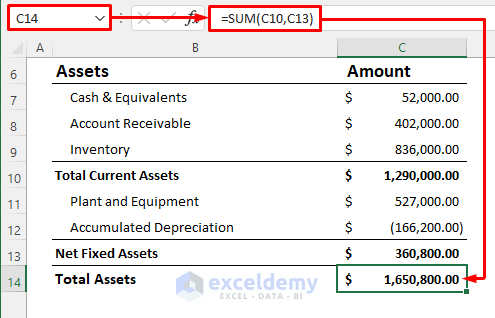

Step 6 – Calculate Total Assets

- In cell C14, calculate the Total Assets by adding the Total Current Assets and Net Fixed Assets:

=SUM(C10,C13)

Read More: Revised Schedule 3 Balance Sheet Format in Excel with Formula

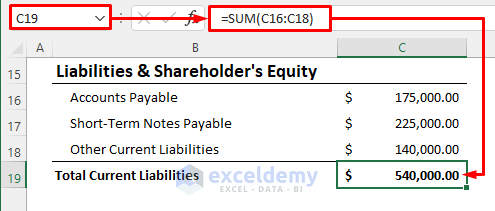

Step 7 – Input Current Liabilities

- Enter the current liabilities (such as Accounts Payable, Short-Term Notes Payable, etc.) in cells B16 to B18.

- Corresponding amounts should be entered in cells C16 to C18.

- Calculate the total current liabilities using the formula in cell C19:

=SUM(C16:C18)

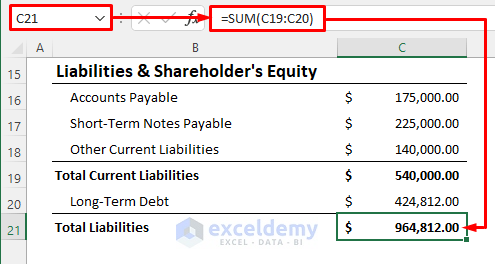

Step 8 – Estimate Total Liabilities

- Enter the long-term liabilities (such as Long-Term Debt) and their corresponding values.

- Calculate the total liabilities using the formula in cell C21:

=SUM(C19:C20)

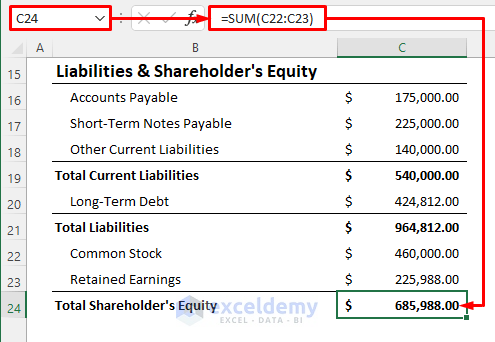

Step 9 – Calculate Total Shareholder’s Equity

- Enter the Shareholder’s Equity components (Common Stock, Treasury Stock, Retained Earnings, etc.), also known as Owner’s Equity.

- In cell C24, calculate the total shareholder’s equity:

=SUM(C22:C23)

Read More: Schedule 6 Balance Sheet Format in Excel

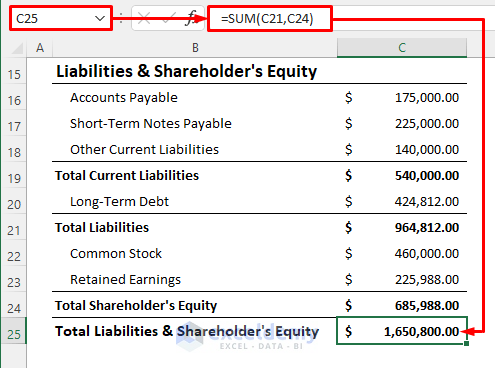

Step 10 – Estimate Total Liabilities & Shareholder’s Equity

- In cell C25, enter the following formula to find the Total Liabilities & Shareholder’s Equity. Ensure that this value matches the total assets obtained earlier:

=SUM(C21,C24)

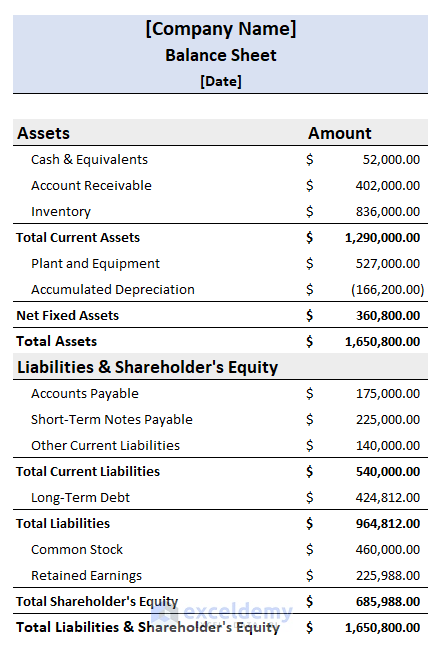

Step 11 – Prepare Final Balance Sheet

- Apply any necessary fill color or other formatting as required.

- After completing these steps, your balance sheet will appear as follows:

Things to Remember

- Always use a negative (-) sign before any depreciation amount.

- Ensure that the total assets, total liabilities, and shareholder’s equity in your balance sheet match.

Download the Free Templates

You can download the practice workbook from here:

Related Articles

- How to Make Hotel Balance Sheet Format in Excel

- Create Horizontal Balance Sheet Format in Excel

- How to Perform Balance Sheet Ratio Analysis in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!