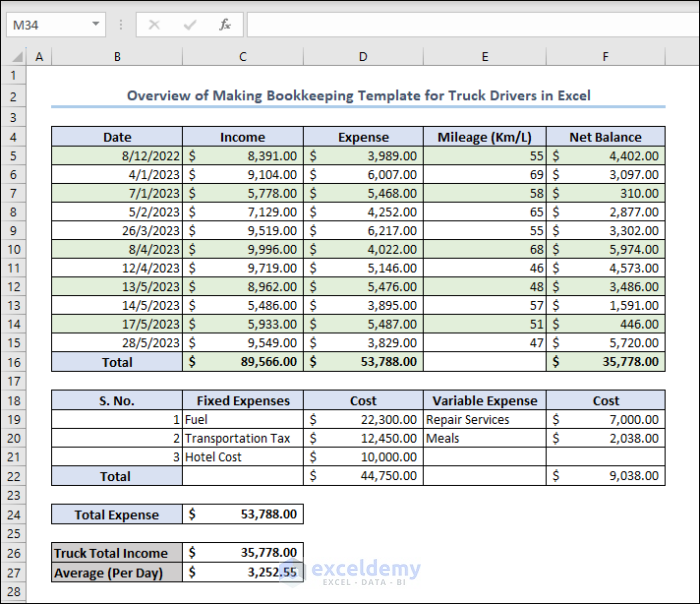

Here’s an overview of the template we’ll make in the article.

Bookkeeping for Truck Drivers in Excel: Step-by-Step Procedure

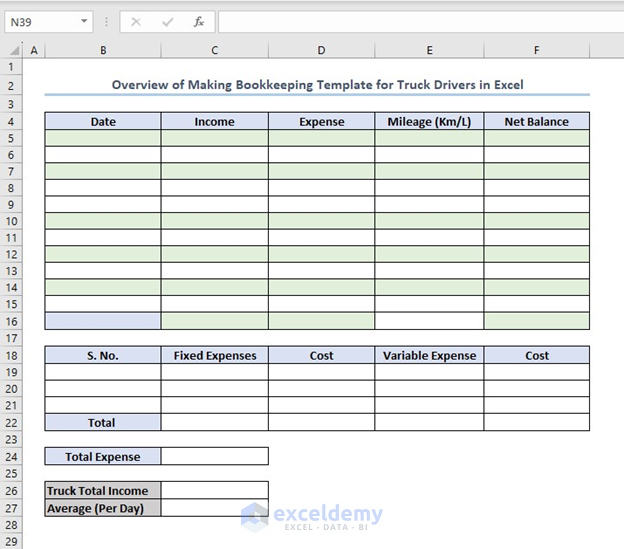

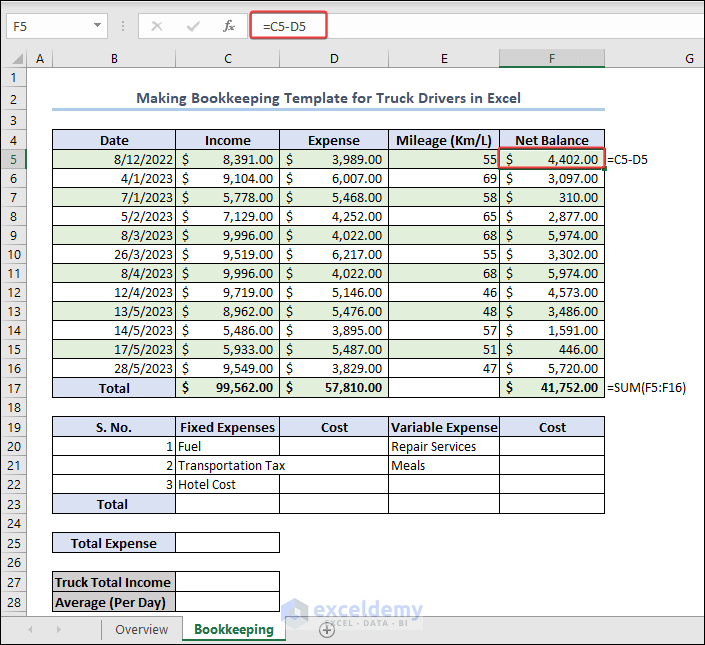

Step 1 – Creating a Primary Dataset for Bookkeeping

- Create an empty dataset for entering the data for our bookkeeping.

- You can use our template for the bookkeeping. We have used the columns Date, Income, Expense, Mileage, Net Balance.

- We made a separate table for Expenses (Fixed Expense and Variable Expense).

- We will calculate Total Income, Total Expense, and Average Income.

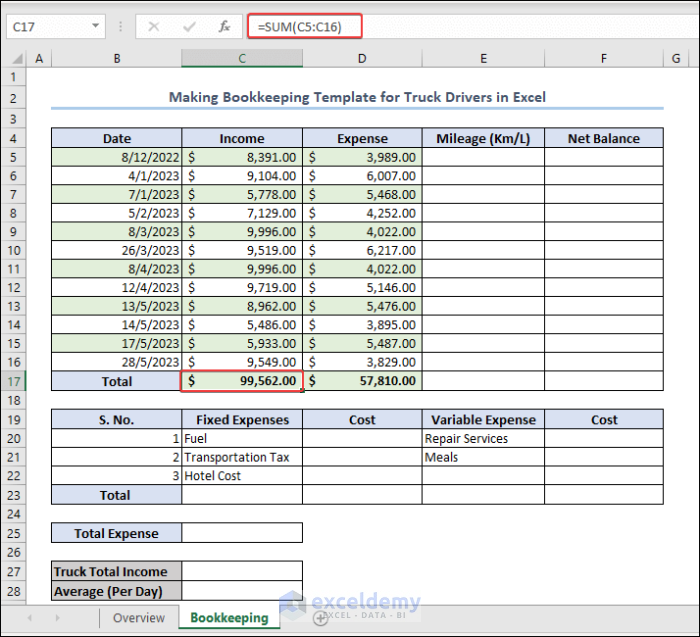

Step 2 – Calculating the Total Income and Expenditure

- Insert the data in the Date, Income, and Expense columns.

- Apply the following formula in to calculate the Total Income:

=SUM(C5:C16)

The formula assumes your dataset ends with row 15. If you have more rows, you’ll need to change the argument accordingly.

- Apply a similar formula for the Total Expense:

=SUM(D5:D16)

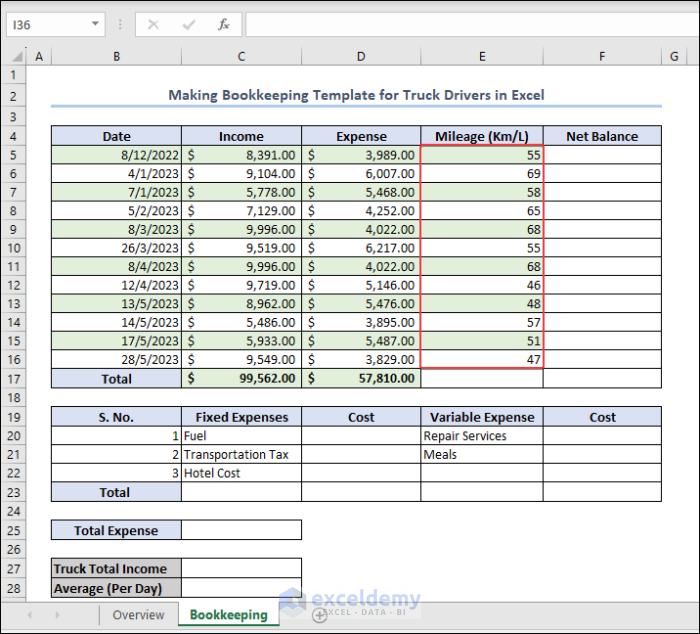

Step 3 – Inserting the Mileages

- Enter the mileage of the truck in the Mileage column.

Step 4 – Evaluating the Net Balance

- Subtract the expenses from the income to get the Net Income.

=C5-D5

- Apply the Fill Handle to copy the formula.

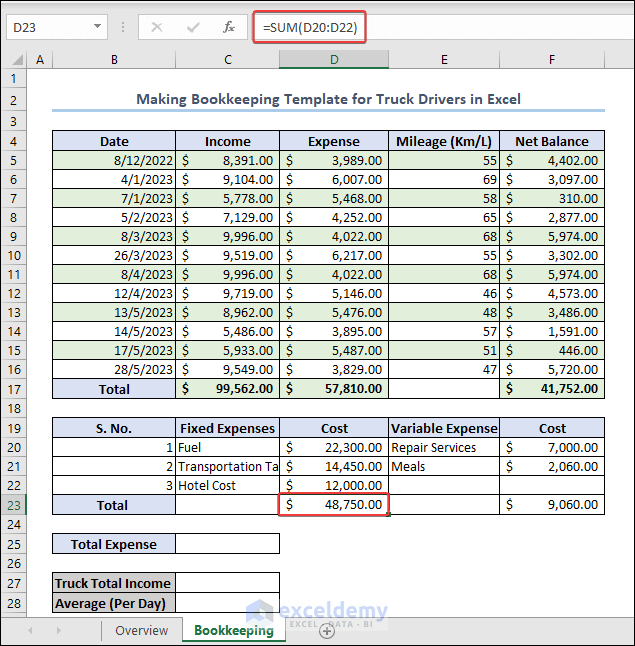

Step 5 – Preparing Separate Account Data

- Add a separate table for the Expenses (Both Fixed and Variable types)

- Get the Total Fixed and Total Variable Expense with the typical SUM formula.

=SUM(D19:D21)

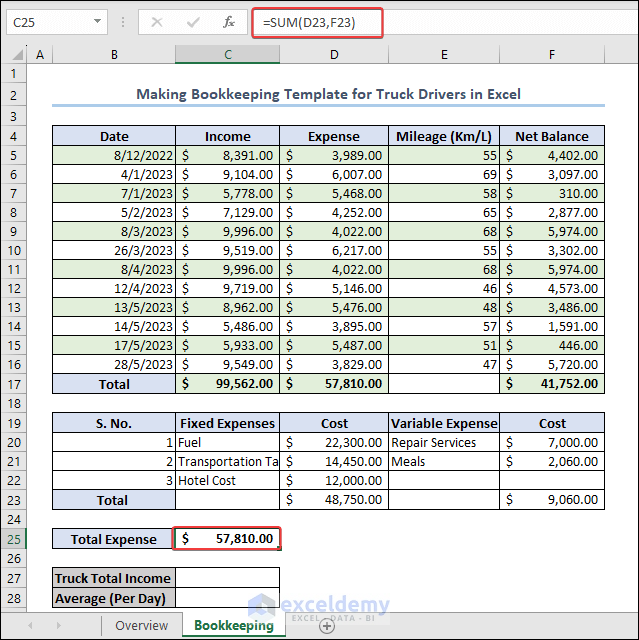

- Calculate the Total Expense by adding the Fixed and Total Variable Expenses.

=SUM(D22,F22)

Read More: How to Create Double Entry Bookkeeping in Excel

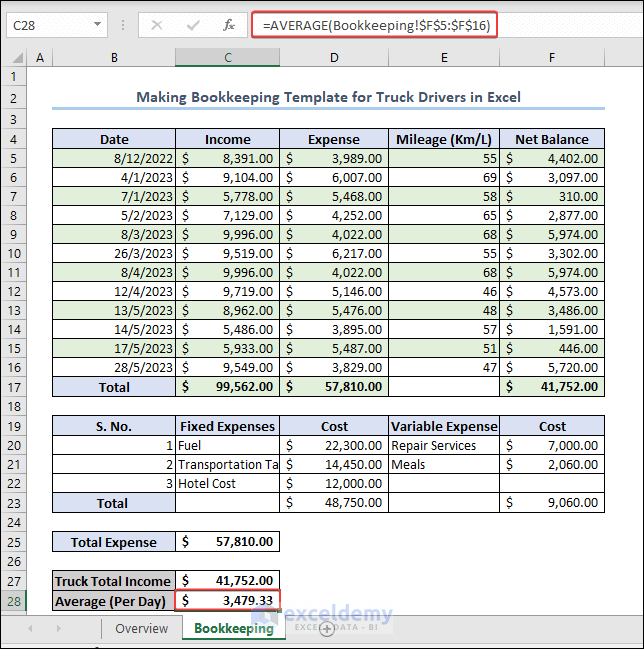

Step 6 – Calculating the Total Income and Average Income

- Calculate the Total Net Income.

=SUM(F5:F15)

- Apply the following the AVERAGE function to get the average income from a truck.

=AVERAGE(Overview!$F$5:$F$15)

Things to Remember

- Please cross-check every piece of data before entering it into the dataset. Any wrong input will create an anomaly in our ledger.

- Deal with the Fixed and Variable Expenses as they may seem confusing sometimes. And without a good understanding, you can introduce inaccuracies in bookkeeping for truck drivers in Excel.

- To copy the formula without adapting cell references, use the absolute cell references with a “$” sign.

- Before entering the date, select the cells and change the format to Date Format.

Frequently Asked Questions

Why is bookkeeping important for truck drivers?

Bookkeeping is essential for truck drivers because it helps them keep track of their income and expenses accurately. It allows them to monitor their financial health, determine profitability, and make informed decisions regarding their business operations. Additionally, accurate bookkeeping is crucial for tax compliance, as it provides documentation for income and conclusive expenses.

Can Excel generate reports and summaries based on the data entered?

Yes, Excel has powerful reporting capabilities that can generate reports and summaries based on the data entered in the spreadsheet. You can use functions like SUM, AVERAGE, and various other formulas to calculate Total, Average, and other metrics. Additionally, Excel allows you to create charts, graphs, and Pivot Table to visualize and analyze the data in a more interactive and meaningful way.

What are Invoices in Trucking?

Invoices in trucking refer to the documents that truck drivers or trucking companies send to their clients or customers to request payment for the services rendered. An invoice serves as a formal request for price and includes details about the services provided, such as transportation of goods or materials, along with the associated charges.

Key information typically included in a trucking invoice includes Sender and recipient details, Invoice number, Invoice date, etc.

Download the Practice Workbook

<< Go Back to Excel Bookkeeping Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!