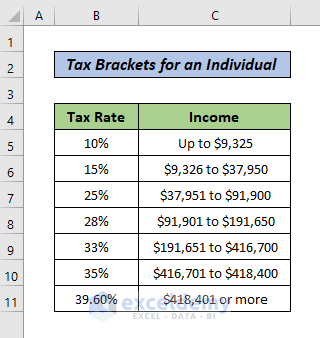

There are various tax brackets in most countries, and each bracket has a different rate of tax. For example, let’s look at the sample tax calculation for individuals in the U.S.

As an example, Robert works in finance. He earns $100,000 a year and invests some of it in tax-saving financial instruments. Let’s say that amount is $20,000. As a result, he has a taxable income of $80,000.

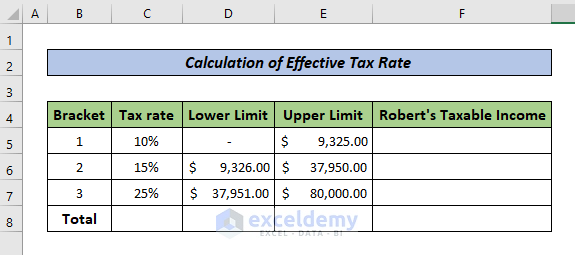

Step 1 – Collect Data

- Create a dataset as shown in the following image. Our first goal is to calculate Robert’s taxable income.

Read More: Formula for Calculating Withholding Tax in Excel

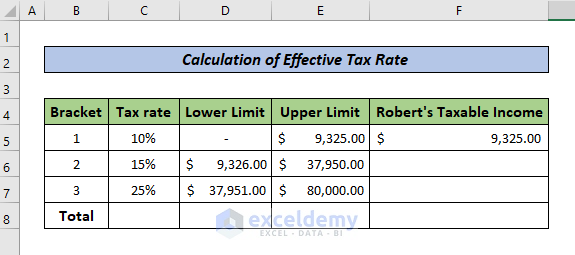

Step 2 – Calculate Taxable Income

- For the first bracket, due to the zero lower limit, the maximum Taxable Income will be 9,315.

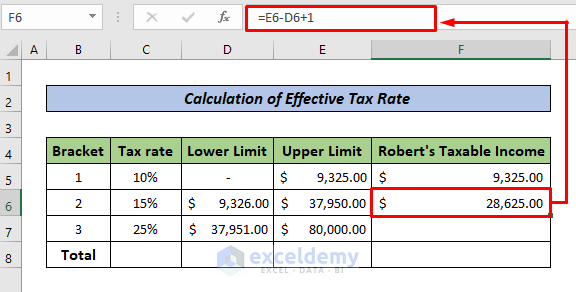

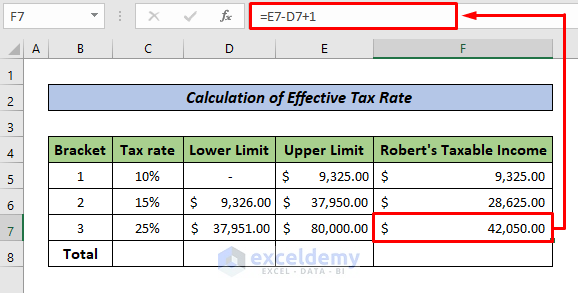

- To calculate the taxable income for the second Bracket, we need to subtract the lower limit (Cell D6) from the upper limit (Cell E6) and then add the result with 1.

- Determine the taxable income for the third bracket in the same way.

- If the income goes into the next bracket, continue until it’s under the upper limit for the bracket.

Read More: How to Calculate Social Security Tax in Excel

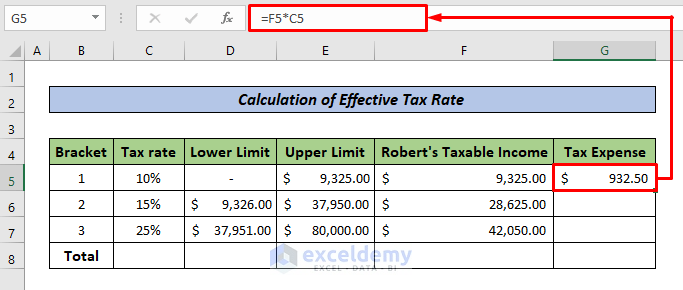

Step 3 – Find the Tax Expense

- Multiply the taxable income (Cell F5) with the tax rate for that bracket (Cell C5).

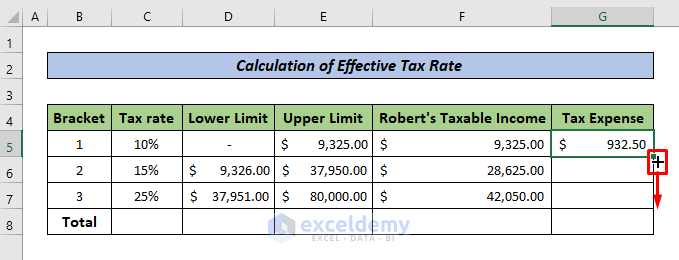

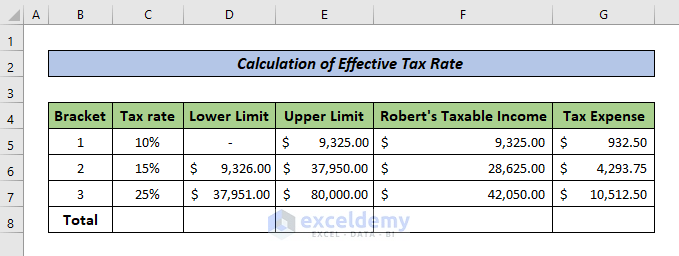

- Calculate the Tax Expenses for other brackets by dragging the Fill Handle to the remaining cells.

- Here are the tax expenses for Robert for all brackets.

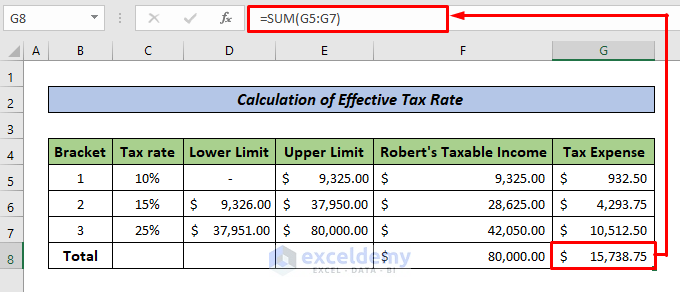

Step 4 – Calculate the Total Taxable Income and Total Tax Expense

- Use the SUM function in the bottom-right cell to sum cells above it.

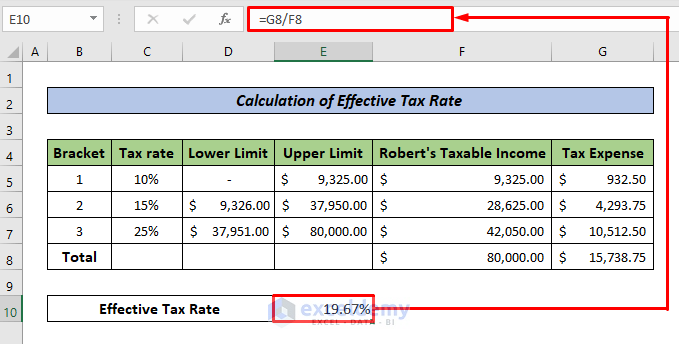

Step 5 – Calculate Federal Tax Rate

We will compute the Effective Tax Rate by applying the following formula:

Effective Federal Tax Rate = Total Tax Expenses / Total Taxable Income

The total tax expense is $15,738.75 (Cell G8), and the total taxable income is $80,000 (Cell F8).

Download the Practice Workbook

Related Articles

- How to Calculate Income Tax in Excel Using IF Function

- Reverse Tax Calculation Formula in Excel

- How to Calculate Income Tax on Salary with Example in Excel

- How to Calculate Sales Tax in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Hafizul,

Thank you so much for making calculating the Federal Tax Rate easy.

Myron

Hello Myron,

You are most welcome.

Regards

ExcelDemy