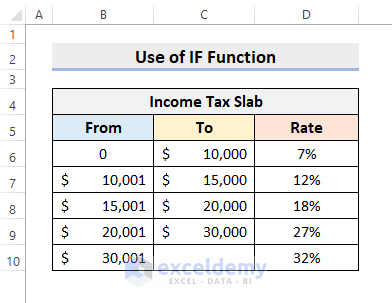

Step 1 – Set up Income Tax Slab

To illustrate how to calculate taxes, we’ll use the following tax rate sample:

- A flat 7% for incomes 0 to $10,000.

- $750 + 12% for income from $10,001 to $15,000.

- $1000 + 18% for income from $15,001 to $20,000.

- $1,350 + 27% for income from $20,001 to $30,000.

- $1,700 + 32% for income from $30,001 and higher.

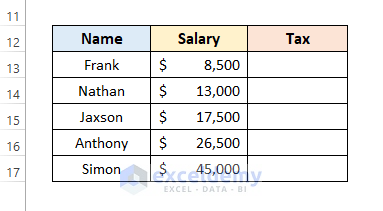

Step 2 – Input Income Data

- Create the required Headers.

- Type the Names.

- Input the precise Salary amounts.

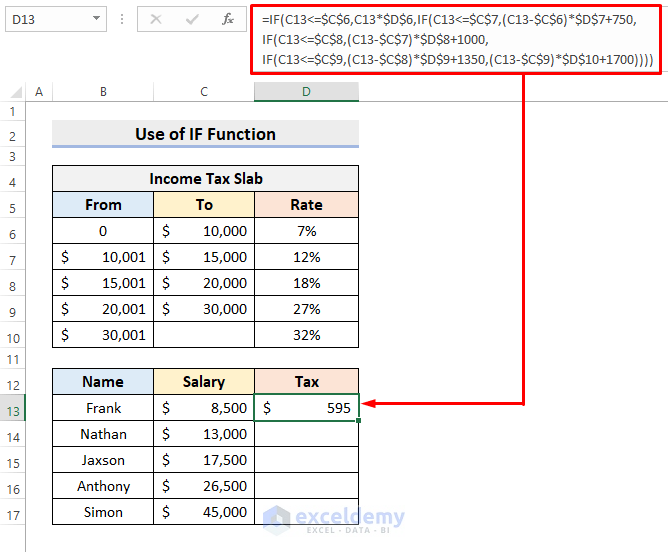

Step 3: Use Excel IF Function

- Select cell D13.

- Type the following formula:

=IF(C13<=$C$6,C13*$D$6,IF(C13<=$C$7,(C13-$C$6)*$D$7+750,IF(C13<=$C$8,(C13-$C$7)*$D$8+1000,IF(C13<=$C$9,(C13-$C$8)*$D$9+1350,(C13-$C$9)*$D$10+1700))))- Press Enter. The function will return the accurate Tax value.

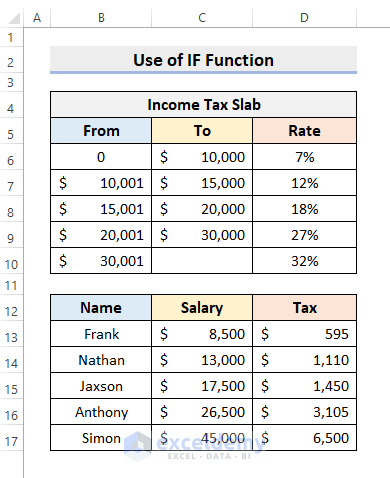

Final Output

- Use the AutoFill tool to return the other income taxes.

How Does the Formula Work?

The IF function tests a logical operation. If it’s True, the formula returns a value. Otherwise, returns another value.

- Here, if C13 is equal to or less than C6, it’ll give C13*$D$6 output.

- If C13 is greater than C6 but equal to or less than C7, it returns (C13-$C$6)*$D$7+750 output.

- However, when C13 is greater than C7 but equal to or less than C8, it returns the output of (C13-$C$7)*$D$8+1000.

- Again, when C13 is greater than C8 but equal to or less than C9, it returns (C13-$C$8)*$D$9+1350 outcome.

- Lastly, If C13 is greater than C9, it returns (C13-$C$9)*$D$10+1700) output.

Some Other Suitable Ways to Calculate Income Tax in Excel

Moreover, we have other methods to calculate income tax in Excel besides the IF function. Here, we’ll show you 2 other functions that you can use for determining the income tax. Here we are going to use the same dataset above.

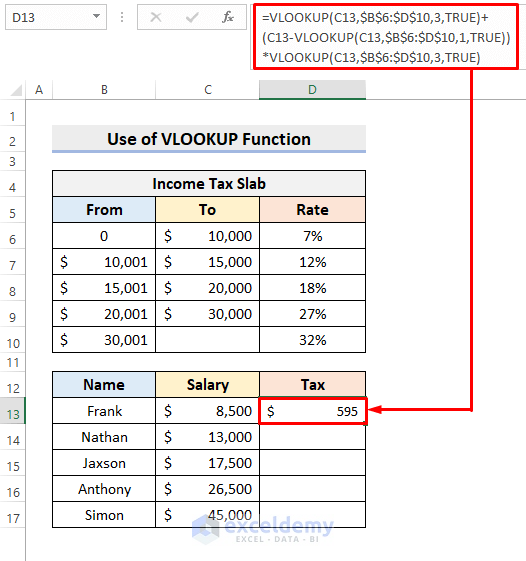

Method 1 – Apply Excel VLOOKUP Function to Calculate Income Tax

In this method, we’ll apply the VLOOKUP function. This function looks for a value in a range and returns a value from the specified column. The tax rate here is not like the earlier sample. So, follow the steps below to perform the task.

Steps:

- Select cell D13.

- Type the formula:

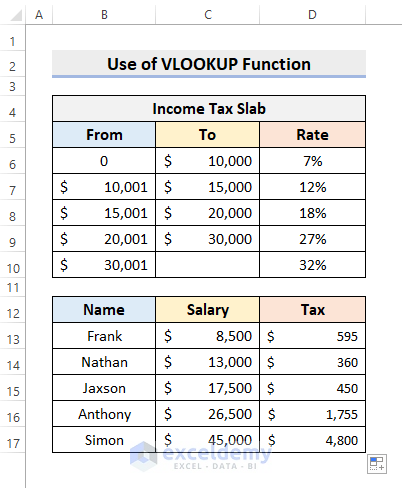

=VLOOKUP(C13,$B$6:$D$10,3,TRUE)+(C13-VLOOKUP(C13,$B$6:$D$10,1,TRUE))*VLOOKUP(C13,$B$6:$D$10,3,TRUE)- Press Enter to return the result.

- Use AutoFill to complete the rest.

How Does the Formula Work?

- VLOOKUP(C13,$B$6:$D$10,3,TRUE)

Firstly, this part of the formula looks for C13 in the range $B$6:$D$10. Then, returns the rate from column 3.

- (C13-VLOOKUP(C13,$B$6:$D$10,1,TRUE))

The VLOOKUP function looks for C13 in the range $B$6:$D$10. Returns the value from the 1st column. Next, deducts the output from C13.

- VLOOKUP(C13,$B$6:$D$10,3,TRUE)+(C13-VLOOKUP(C13,$B$6:$D$10,1,TRUE))*VLOOKUP(C13,$B$6:$D$10,3,TRUE)

At last, it multiplies the outputs of VLOOKUP(C13,$B$6:$D$10,3,TRUE) and (C13-VLOOKUP(C13,$B$6:$D$10,1,TRUE)). After that, add VLOOKUP(C13,$B$6:$D$10,3,TRUE) output to it.

Read More: How to Calculate Social Security Tax in Excel

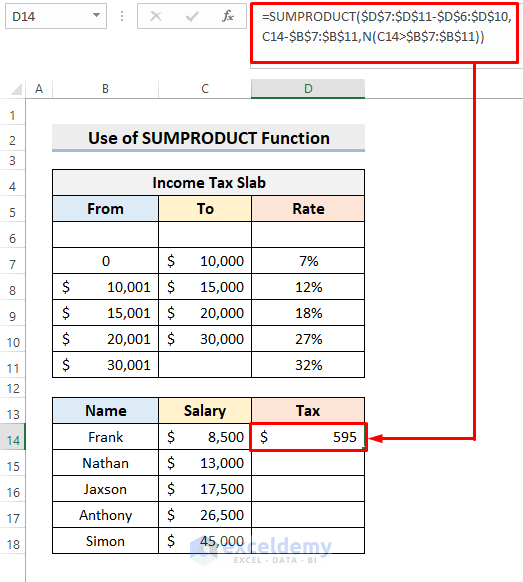

Method 2 – Income Tax Calculation with SUMPRODUCT Function in Excel

Steps:

- Select cell D14.

- Type the formula:

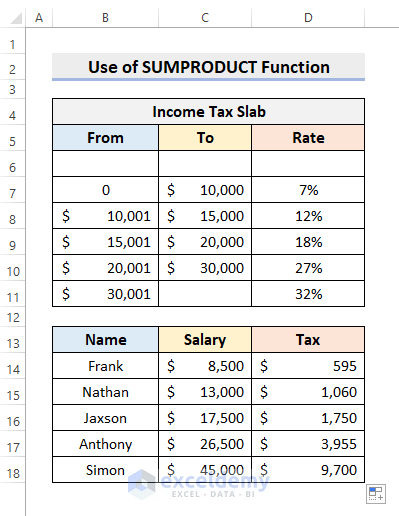

=SUMPRODUCT($D$7:$D$11-$D$6:$D$10,C14-$B$7:$B$11,N(C14>$B$7:$B$11))- Press Enter.

- Use AutoFill to fill the rest of the series.

How Does the Formula Work?

- N(C14>$B$7:$B$11)

Firstly, this formula returns 0. The N function changes texts to number values, dates to serial numbers, and True to 1. Other than that, it returns 0.

- $D$7:$D$11-$D$6:$D$10

In this part, the formula finds out the differential rates.

- C14-$B$7:$B$11

We’ll get the amount to each differential rate here.

- SUMPRODUCT($D$7:$D$11-$D$6:$D$10,C14-$B$7:$B$11,N(C14>$B$7:$B$11))

Eventually, the formula will add all the product outputs.

Read More: Formula for Calculating Withholding Tax in Excel

Download Practice Workbook

Download the following workbook for practice.

Related Articles

- Reverse Tax Calculation Formula in Excel

- How to Calculate Marginal Tax Rate in Excel

- How to Calculate Federal Tax Rate in Excel

- How to Calculate Sales Tax in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

thank you very much.

Hello, Mohan!

Thanks for your appreciation. Stay in touch with ExcelDemy for more helpful content.

Regards

ExcelDemy