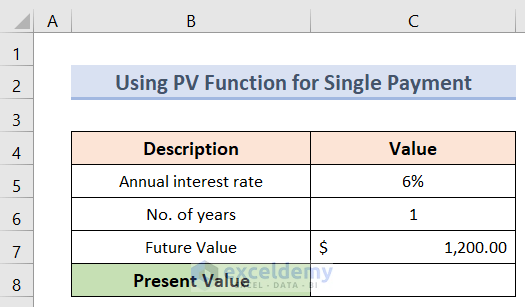

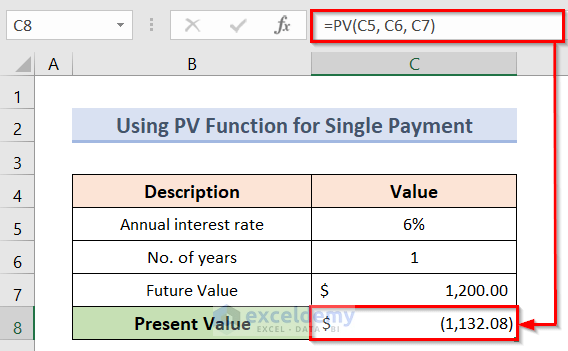

Example 1 – Calculate the Present Value for a Single Payment

The sample dataset (B4:C8) showcases the annual interest rate, No. of years and the future value of a single payment.

Steps:

- Select C8 to keep the present value.

- To calculate the present value enter the formula:

=PV(C5, C6, C7)- Press Enter to see the Present Value of the single payment.

Read More: How to Calculate Present Value of Future Cash Flows in Excel

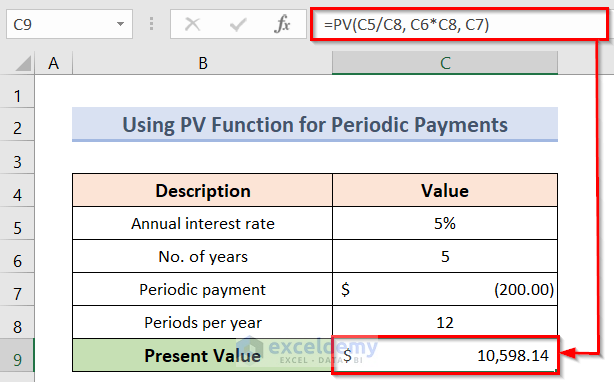

Example 2 – Count the Present Value for a Periodic Payment

In the sample dataset (B4:C9) you can see the investment is $200 per month for 5 years at a 5% annual interest rate.

Steps:

- Select C9 to keep the present value.

- To calculate the future value, enter the formula:

=PV(C5/C8, C6*C8, C7)- Press Enter to see the Present Value.

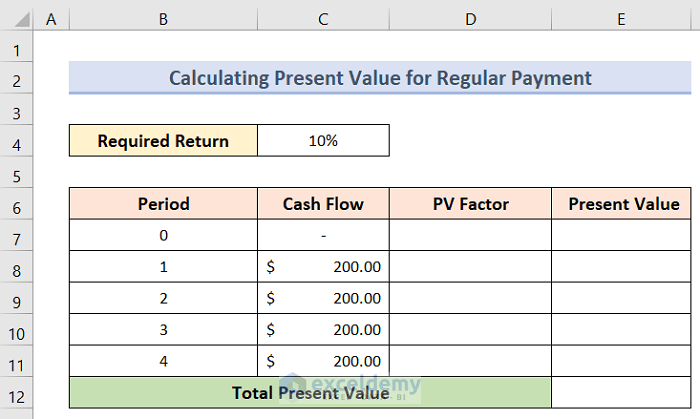

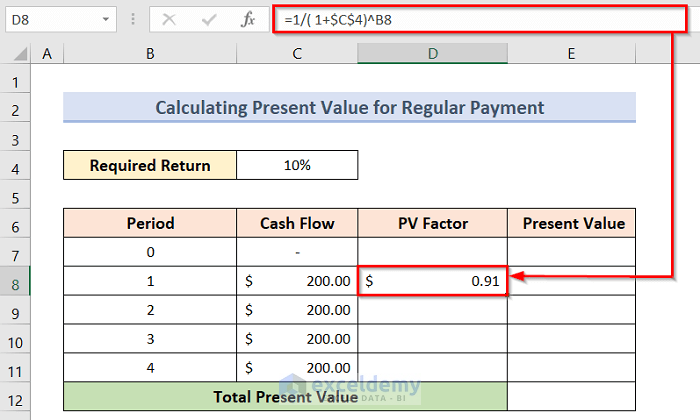

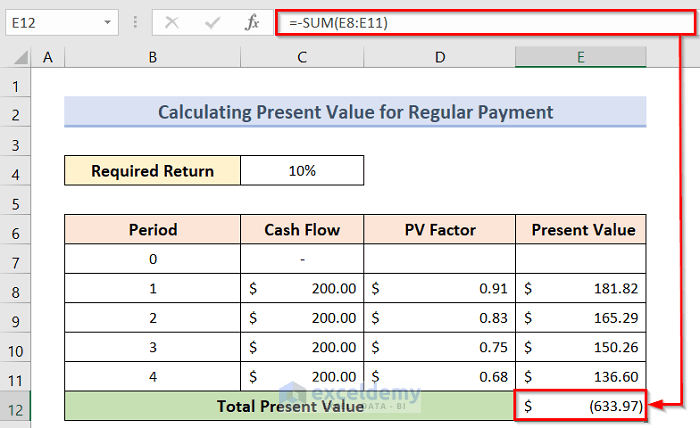

Example 3 – Present Value Calculation with Regular Cash Flow

In the dataset (B4:E12) you can can see 4 periods, a required return, and regular cash flows of $200.

Steps:

- Select D8 and enter the following formula:

=1/(1+$C$4)^B8- Press Enter to see the Present Value (PV) factor for period 1.

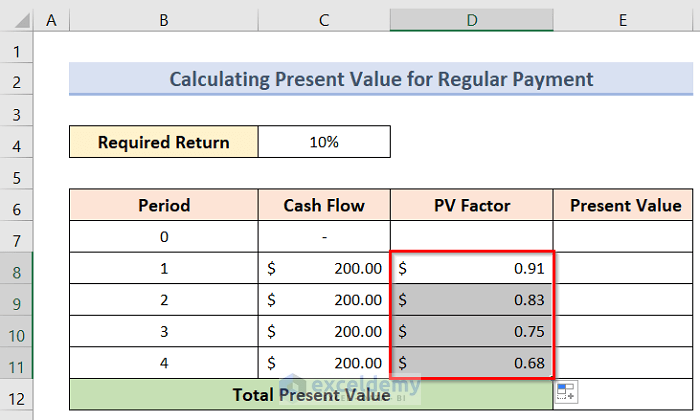

- Select D8 and drag the Fill Handle to D11 to see the PV factors for all the periods.

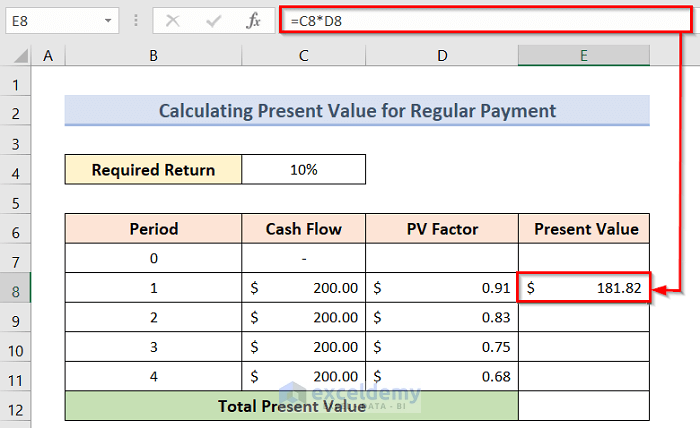

- To calculate the present value for an individual period, select E8 and enter the following formula:

=C8*D8- Press Enter to see the present value for period 1.

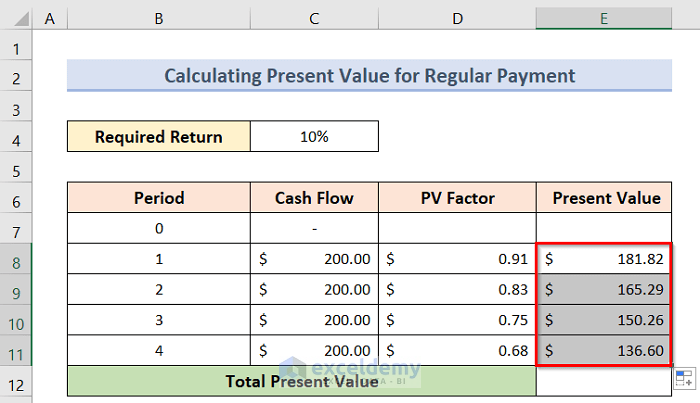

- Select E8 and drag the fill handle to E11 to see the present values for all the periods.

- To get the total present value, use the SUM function. Enter the formula in E12:

=SUM(E8:E11)- Press Enter to see the total present value.

Read More: How to Calculate Present Value of Lump Sum in Excel

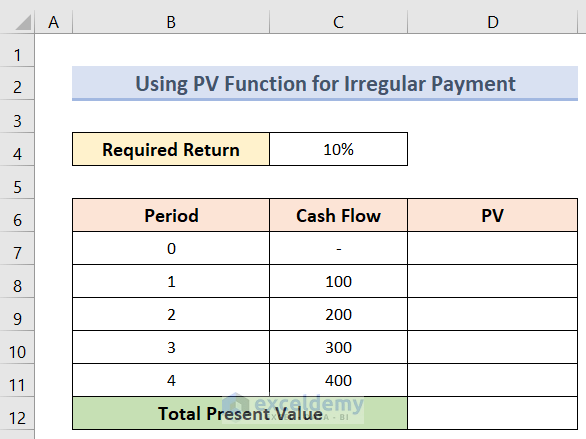

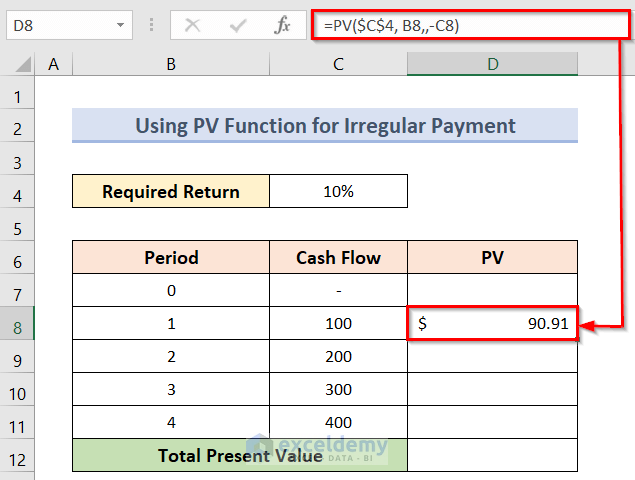

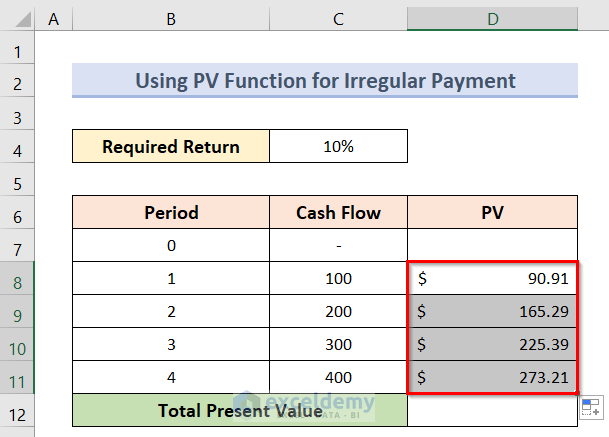

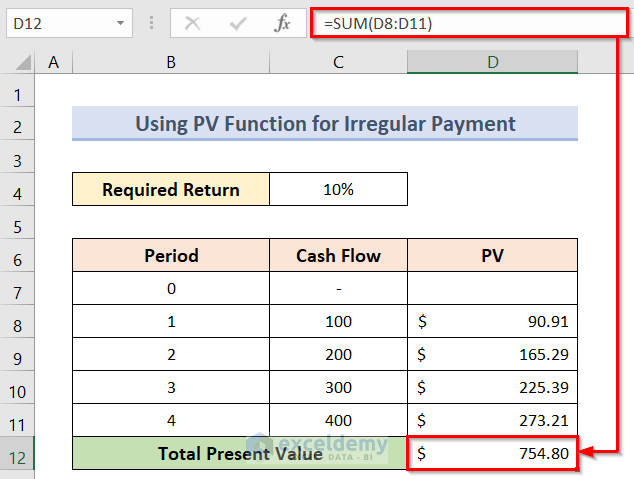

Example 4 – Present Value Calculation with Irregular Cash Flow

The dataset (B4:D12) showcases 4 periods, a required return, and irregular cash flows.

Steps:

- Select D8.

- Enter the formula in C8:

=PV($C$4, B8,,-C8)- Press Enter to see the present value of the corresponding cash flow.

- To get all the present values of the cash flows, drag the Fill Handle to the final cash flow.

- All present values of the individual cash flows will be displayed.

- To get the total present value, use the SUM function. Enter the formula in D12:

=SUM(D8:D11)- Press Enter to see the total present value.

Read More: How to Apply Present Value of Annuity Formula in Excel

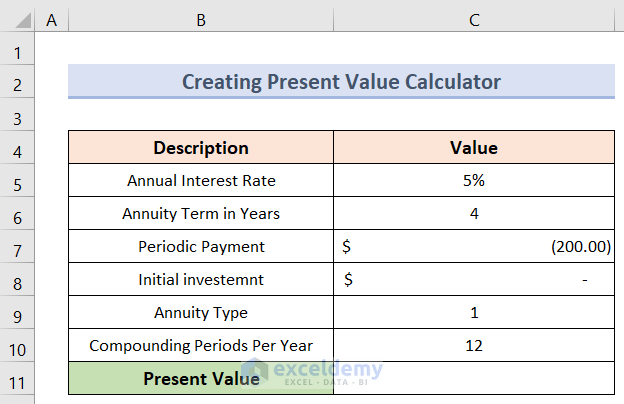

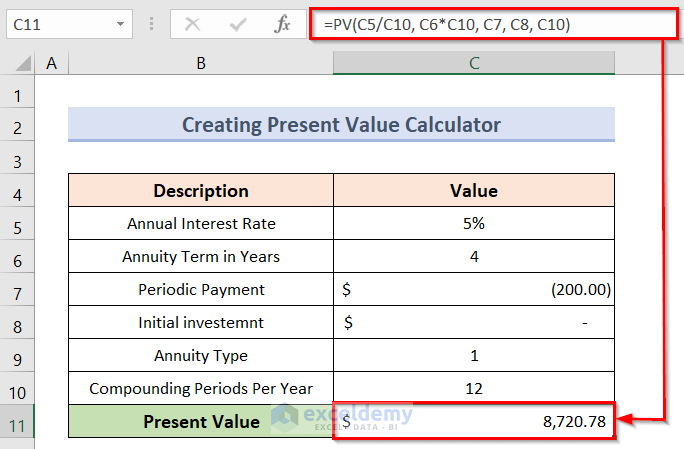

Example 5 – Creating a Present Value Calculator

- Define the arguments:

rate (periodic interest rate): C5/C10 (annual interest rate / periods per year)

nper (total number of payment periods): C6*C10 (number of years * periods per year)

pmt (periodic payment amount): C7

pv (initial investment): C8

type (when payments are due): C9

compounding periods per year: C10

Steps:

- Select C11 and enter the formula:

=PV(C5/C10, C6*C10, C7, C8, C10)- Press Enter to see the present value.

Read More: How to Calculate Present Value of Uneven Cash Flows in Excel

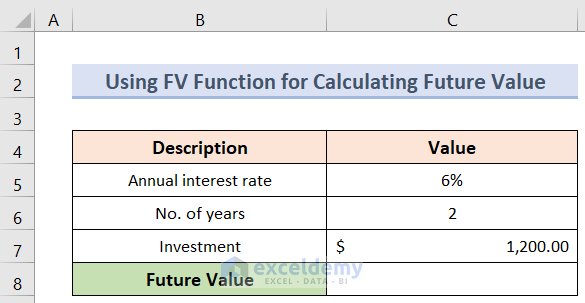

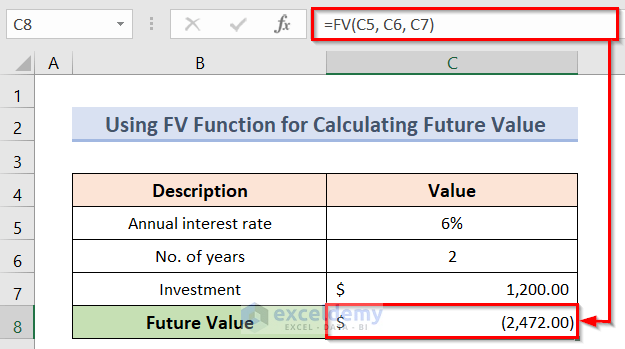

How to Calculate the Future Value with Different Payments in Excel

Steps:

- Select C8 to keep the future value.

- Enter the formula:

=FV(C5, C6, C7)- Press Enter to see the Future Value of the single payment.

Read More: How to Calculate Future Value in Excel with Different Payments

Download Practice Workbook

Download the Excel workbook here.

Related Articles

- How to Apply Future Value of an Annuity Formula in Excel

- How to Calculate Future Value with Inflation in Excel

- Calculate NPV for Monthly Cash Flows with Formula in Excel

- How to Calculate Future Value of Uneven Cash Flows in Excel

- How to Calculate Future Value of Growing Annuity in Excel

<< Go Back to Time Value Of Money In Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!