What Is the Sortino Ratio?

The Sortino ratio is a risk-adjustment statistics metric used to calculate the return from a certain investment for a given level of negative risk. It is a refined version of the more widely known Sharpe ratio. The Sharpe ratio considers total price deviation in the calculation, while the Sortino ratio considers a downside deviation while calculating.

The basic formula to calculate the Sortino ratio is:

=(Rp–Rf)/σd- Rp is the portfolio’s Expected Return or Actual Return.

- Rf is the portfolio’s Minimum Acceptable Return (MAR)/Risk-free rate of return.

- σd is the Downside Deviation or Standard Deviation of negative asset return.

How to Calculate the Sortino Ratio in Excel: 2 Methods

Method 1 – Calculate the Sortino Ratio Using Excel Formulas

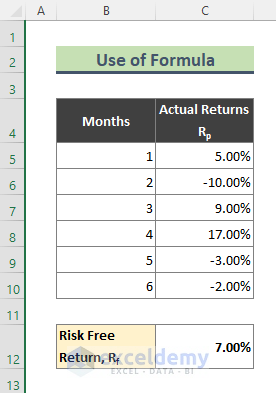

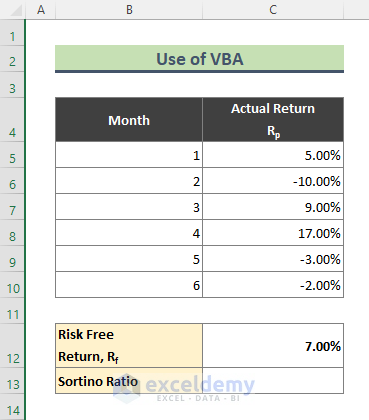

We have the average return percentage of a certain company for 6 months. The risk-free return of the portfolio is 7%.

Steps:

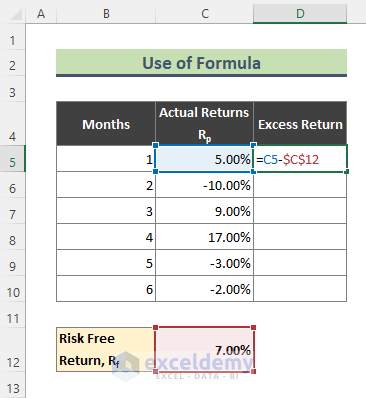

- Calculate the Excess Return with the following formula in Cell D5.

=C5-$C$13- Press Enter.

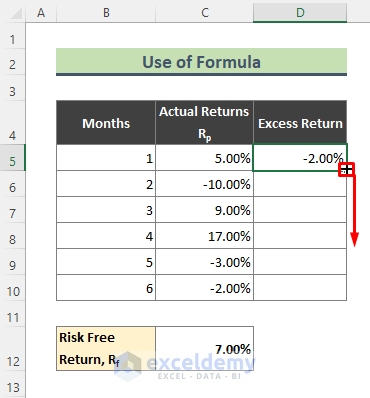

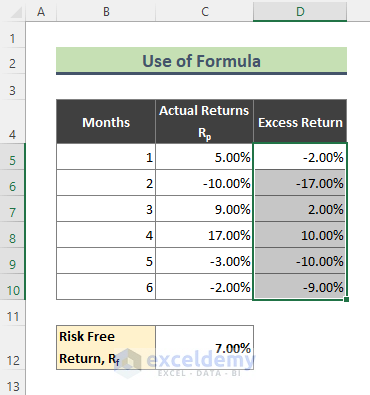

- Use the Fill Handle (+) tool to get the return for the rest of the values.

- Here’s the result.

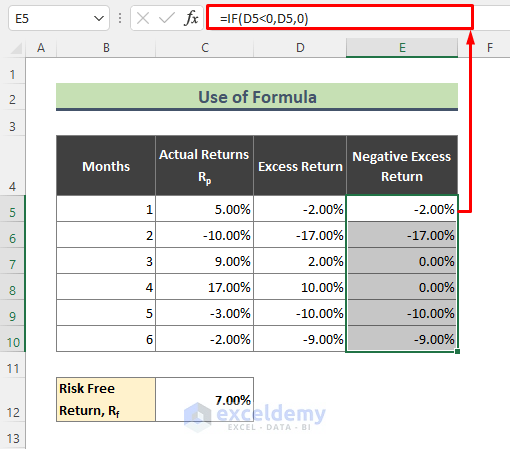

- We will separate only Negative Excess Returns with the following formula in E5, then using AutoFill through the column.

=IF(D5<0,D5,0)

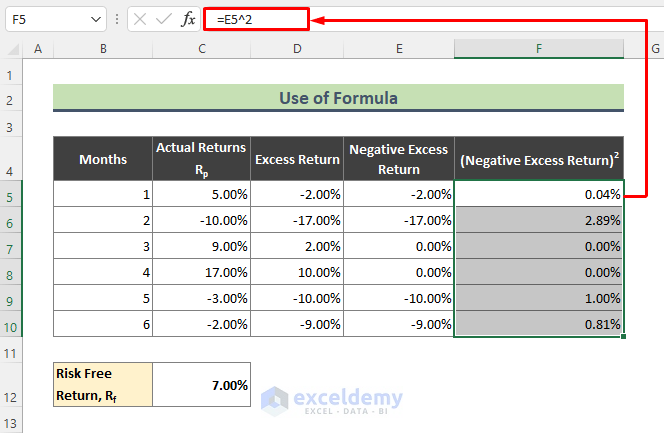

- Use the following formula to calculate the square of Negative Excess Returns.

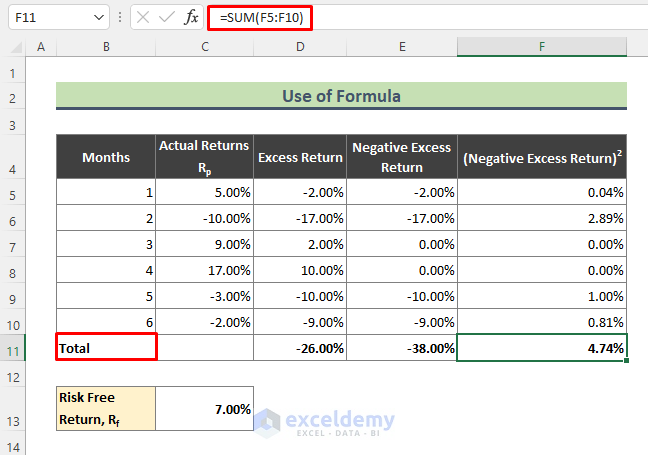

- Use the SUM function for the total of Excess Returns.

- We also calculated the total of the square of Negative Excess Return values using the SUM formula.

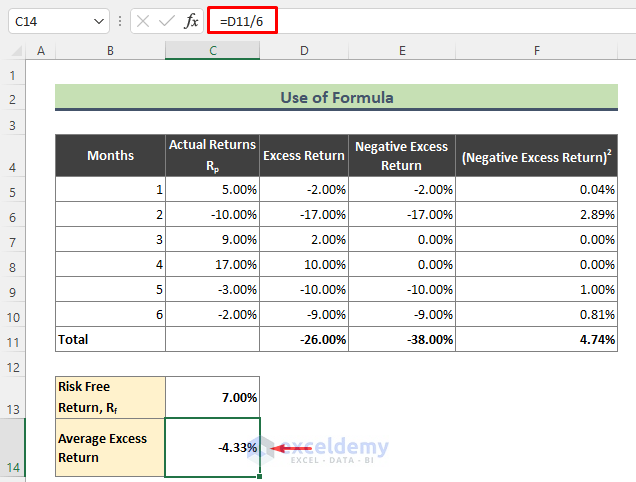

- Calculate the average of the Excess Return using the following formula:

=D11/6

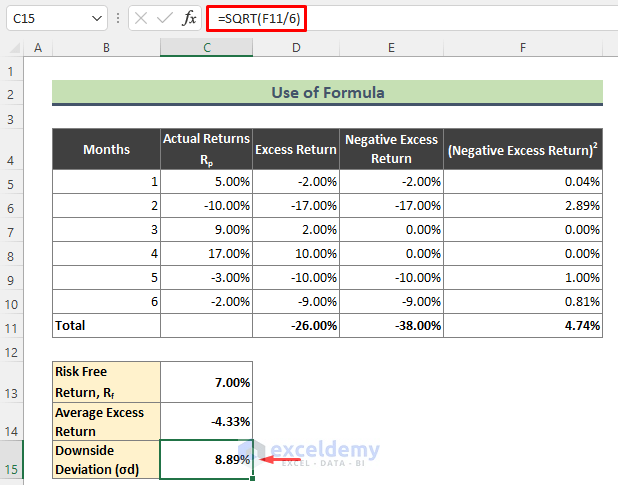

The formula to calculate the Downside Risk is:

=√(∑(Square of Negative Excess Returns)/No. of months)- Use this formula to calculate Downward Risk:

=SQRT(F11/6)

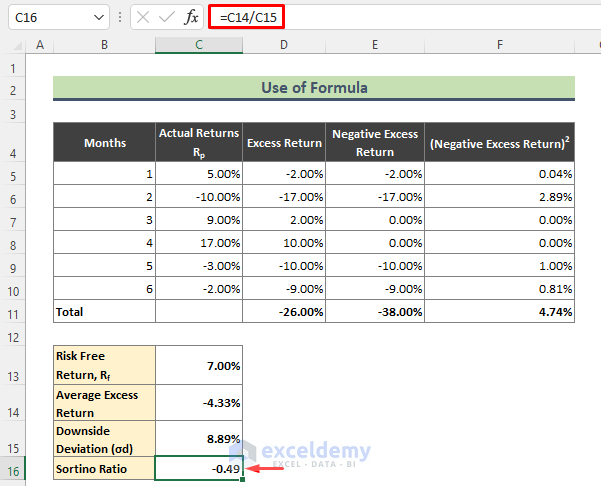

- To calculate the Sortino ratio, divide Average Excess Return by Downside Risk.

=C14/C15

Note:

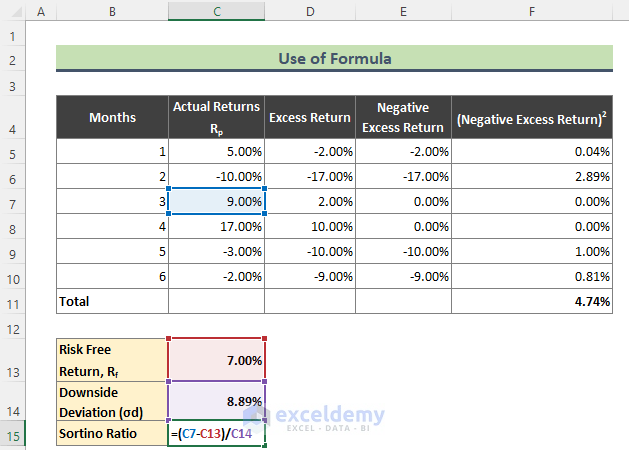

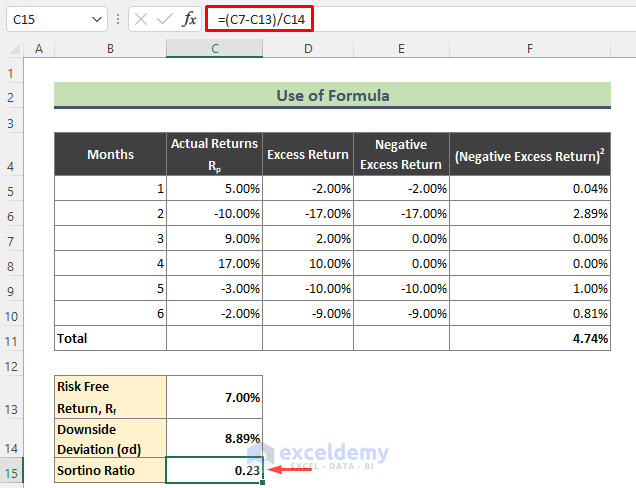

If you want to calculate the Sortino ratio against the Actual Return of a random month, follow these steps:

- After calculating the Downside Risk following the steps above, subtract the Risk-Free Return from the specific Actual Return.

- To calculate the Sortino ratio for the Average Return of Cell C7, use the below formula:

=(C7-C13)/C14

- You can calculate the Sortino ratio for any other Actual Return and thus compare which investment is safe.

Read More: How to Calculate Sharpe Ratio in Excel

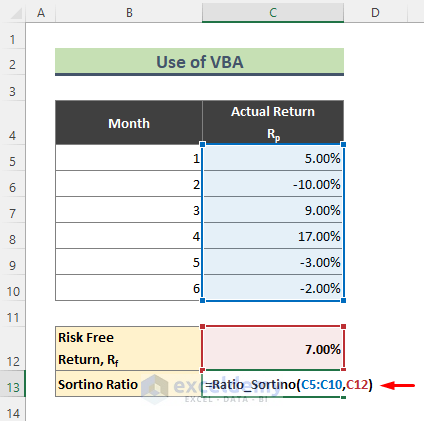

Method 2 – Excel VBA to Calculate the Sortino Ratio

We will use the same dataset that was used in Method 1.

Steps:

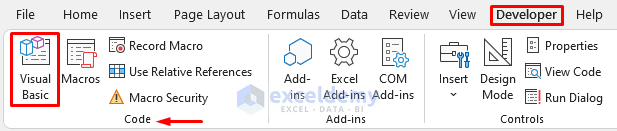

- From the Ribbon, go to the Developer tab.

- Select Visual Basic.

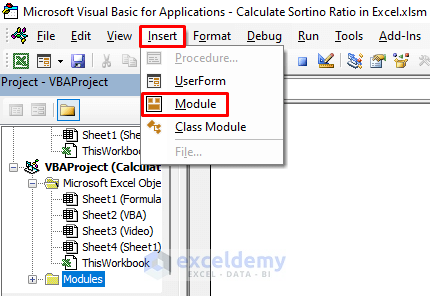

- The VBA window will appear.

- Go to the Insert option.

- Select a new Module.

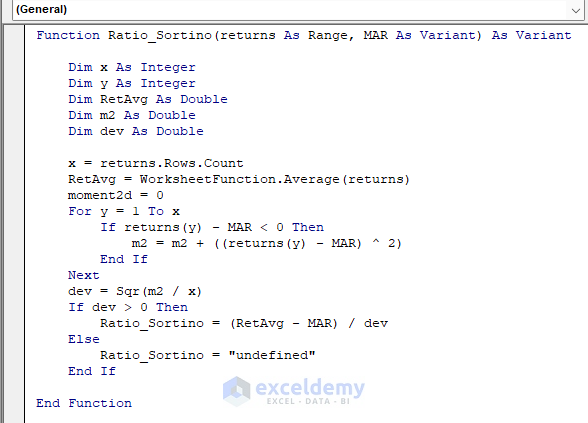

- Use the following code in the newly inserted Module.

Function Ratio_Sortino(returns As Range, MAR As Variant) As Variant

Dim x As Integer

Dim y As Integer

Dim RetAvg As Double

Dim m2 As Double

Dim dev As Double

x = returns.Rows.Count

RetAvg = WorksheetFunction.Average(returns)

moment2d = 0

For y = 1 To x

If returns(y) - MAR < 0 Then

m2 = m2 + ((returns(y) - MAR) ^ 2)

End If

Next

dev = Sqr(m2 / x)

If dev > 0 Then

Ratio_Sortino = (RetAvg - MAR) / dev

Else

Ratio_Sortino = "undefined"

End If

End Function

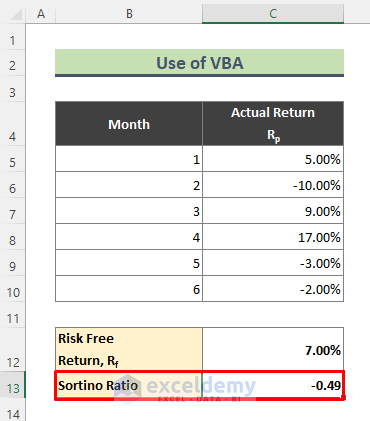

- Use this formula in Cell C13 and hit Enter.

- We will get the Sortino ratio for the above data.

Read More: How to Calculate Ratio of 3 Numbers in Excel

Observations from Calculating the Sortino Ratio

- By calculating the Sortino ratio for a specific portfolio’s Actual Return, you can check the return on investment.

- By comparing the Sortino ratio of certain actual returns, you can check which investment is safer to pursue.

- The Sortino ratio is really helpful to retail investors as it helps them to make the right decision about any investment.

Download the Practice Workbook

Related Articles

- How to Calculate Average Ratio in Excel

- How to Calculate Male Female Ratio in Excel

- How to Calculate Odds Ratio in Excel

- How to Calculate Compa Ratio in Excel

<< Go Back to Ratio in Excel | Calculate in Excel | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!