Carried Interest Basics

Private equity, venture capital, and hedge fund general partners receive carried interest as a portion of their income. General partners are entitled to the carried interest based on their participation rather than on an initial investment in the fund. Carry interest synchronizes the general partner’s income with the fund’s returns as a performance fee. The hurdle rate is the minimum return that the fund must meet in order to receive carried interest. Carried interest is usually treated as a long-term capital gain and is taxed at a lower rate than regular income.

Carried Interest in Private Equity

A private equity fund or fund manager’s portion of the profit earned on the sale of an investment is known as carried interest, sometimes known as “carry.”

A distribution waterfall is a method for dividing investment profits or capital gains among a pool of investment participants. The distribution waterfall, which is frequently related to private equity firms, establishes the hierarchy by which payouts are given to limited and general partners.

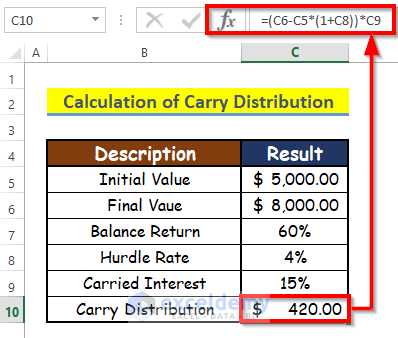

The general formula to carry out distribution in Private Equity is,

Carry Distribution = (X - Y*(1 + H))*IX = Initial Balance

Y = Final Balance

H = Hurdle Rate

I = Carried Interest

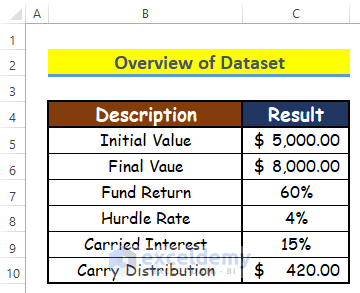

The sample dataset is an overview.

Step 1 – Create a Dataset

Create the heading of carried interest: initial balance, final balance, percentage of fund transfer.

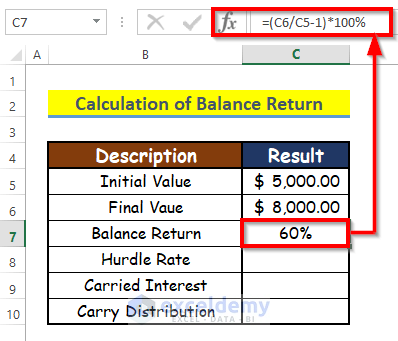

Step 2 – Calculate the Fund Return in Percentage

Use a mathematical formula. The performance of the investment fund is measured by either the fund or balance return.

Consider the XYZ group invested $5000.00 as the initial balance and over time, the final balance became $8000.00. To calculate the fund or balance transfer:

- Select C7 and enter the formula:

=(C6/C5-1)*100%C5 is the initial balance, and C6 is the final balance.

- Press Enter.

The return is 60%.

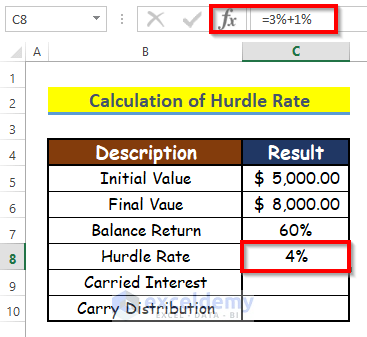

Step 3 – Evaluate the Hurdle Rate

The lowest rate of return necessary for a project or investment is known as a “hurdle rate.” Higher hurdle rates are typically associated with riskier ventures, whereas lower rates are associated with reduced risk. The formula for the Hurdle rate is:

Hurdle Rate = Cost of Capital + Risk PremiumIf the cost of capital of the XYZ group is 3% and the risk of premium is 1%, the hurdle rate becomes 4%.

Step 4 – Determine the Carried Interest and Carry Distribution

The amount of the overall fund return that the investment fund claims as its performance fee is called “carried interest.” The carried interest for the XYZ group is 15%. To calculate the carry distribution:

- Select C7 and enter the formula:

=(C6-C5*(1+C8))*C9C5 is the initial balance, C6 is the final balance, C8 is the hurdle rate, and C9 is the carried interest.

- Press Enter.

The carry distribution is $420.00.

- Portfolio managers won’t receive a carry distribution if it is negative, because the investment fund performance is below the hurdle rate.

Read More: How to Calculate Daily Interest in Excel

Download Practice Workbook

Download the practice workbook.

Related Articles

- How to Calculate Interest Between Two Dates in Excel

- How to Calculate GPF Interest in Excel

- Calculation of Interest During Construction in Excel

- How to Perform Actual 360 Interest Calculation in Excel

- How to Split Principal and Interest in EMI in Excel

- How to Use Cumulative Interest Formula in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!