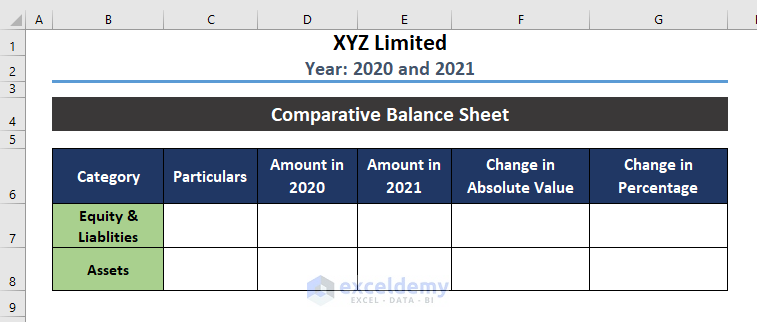

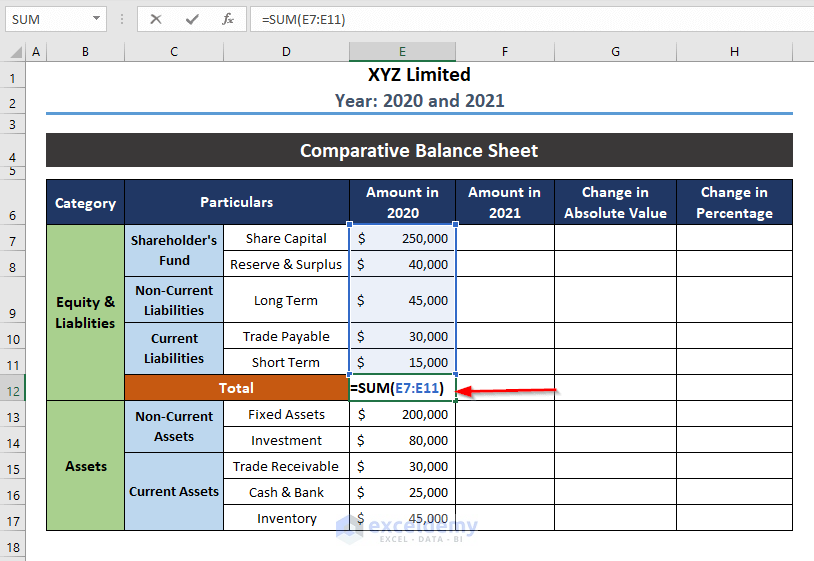

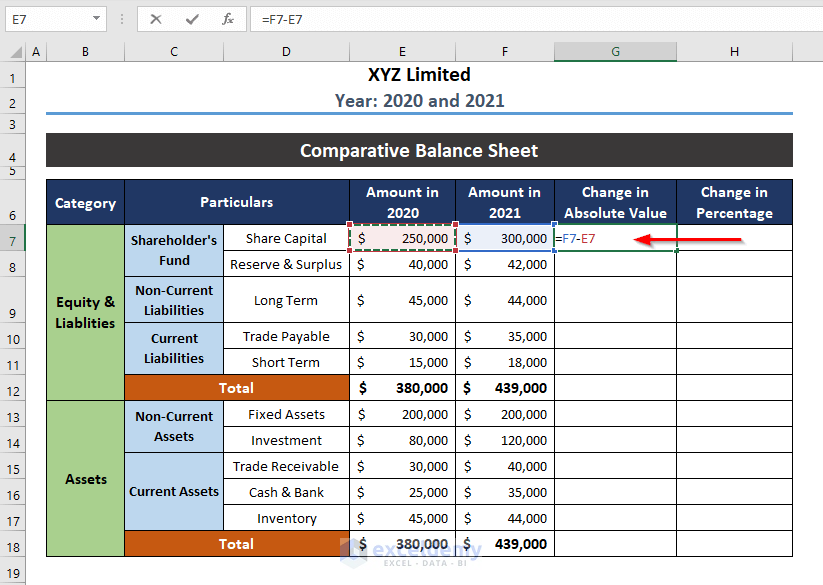

Step 1 – Assign Particulars for the Balance Sheet

- Create a table like the one stated in the image below. Usually, a balance sheet consists of two main categories of particulars.

- Equity & Liabilities

- Assets

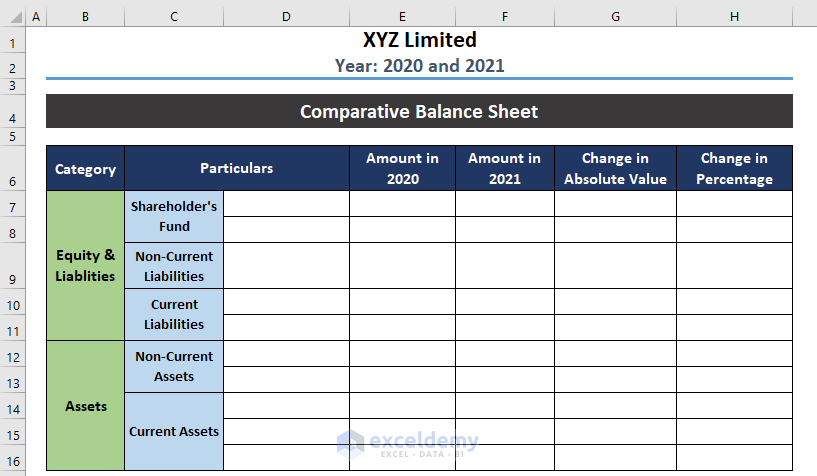

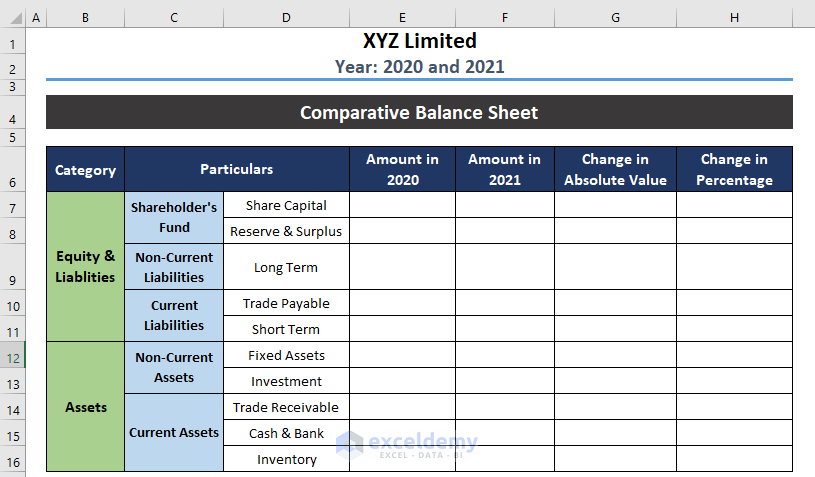

- Assign particulars for these two main categories. For Equity & Liabilities, we have assigned:

- Shareholder’s Fund

- Non-Current Liabilities

- Current Liabilities

For Assets, the particulars considered are:

- Non-Current Assets

- Current Assets

- Assign some components as per your business strategy.

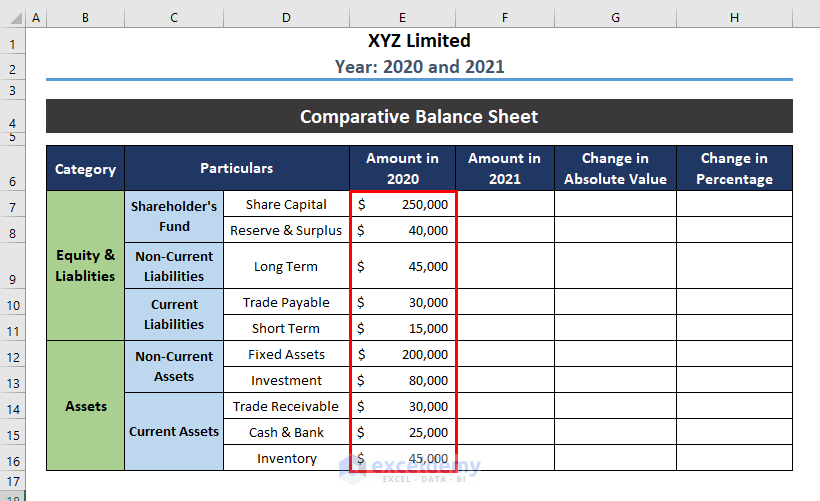

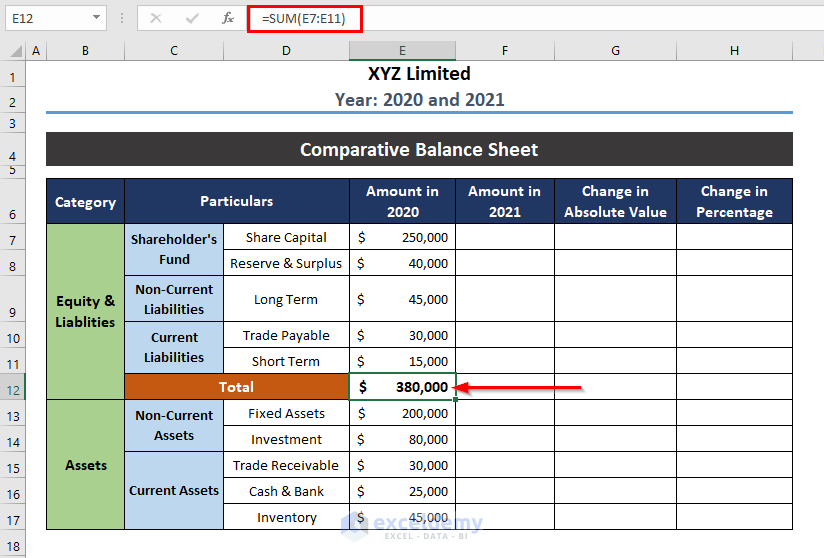

Step 2 – Input Values for the Time Period

- Insert the values for the first financial year (i.e. 2020).

- Select a cell where you want to show the total amount of Liabilities and use the following formula:

=SUM(E7:E11)

E7 = First cell of Equity & Liabilities to calculate the sum

E11 = Last cell of Equity & Liabilities to calculate the sum

- Press ENTER to get the total amount of Equity & Liabilities.

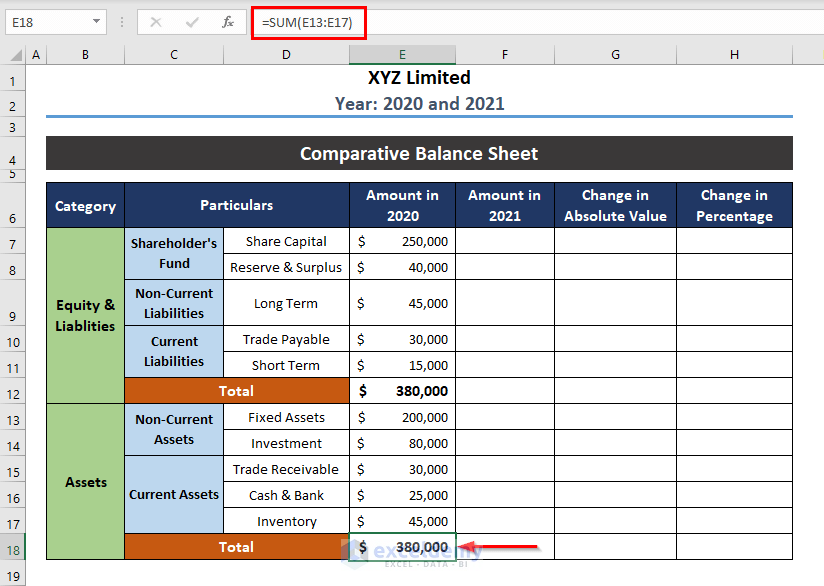

- Calculate the total amount of Assets available in that financial year.

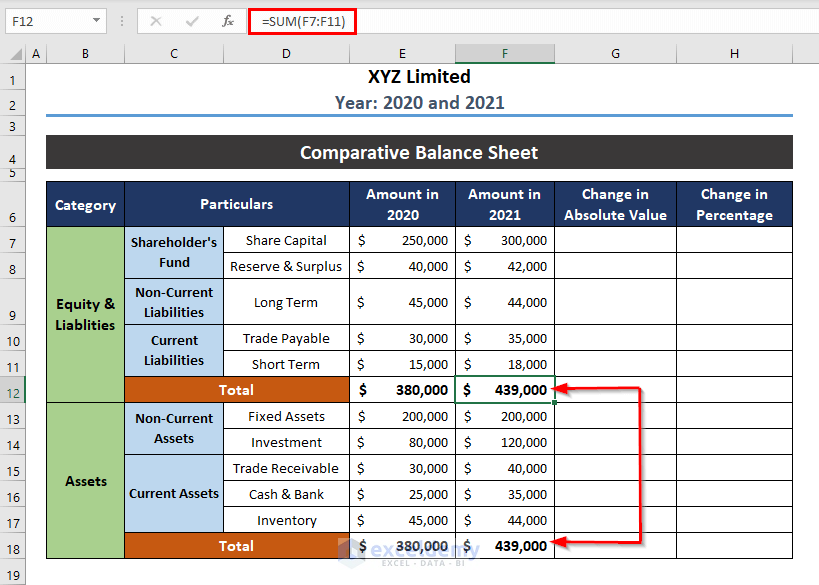

- Repeat the same process for the following financial year (i.e. 2021) and find out the total amount of Assets and Liabilities for this year.

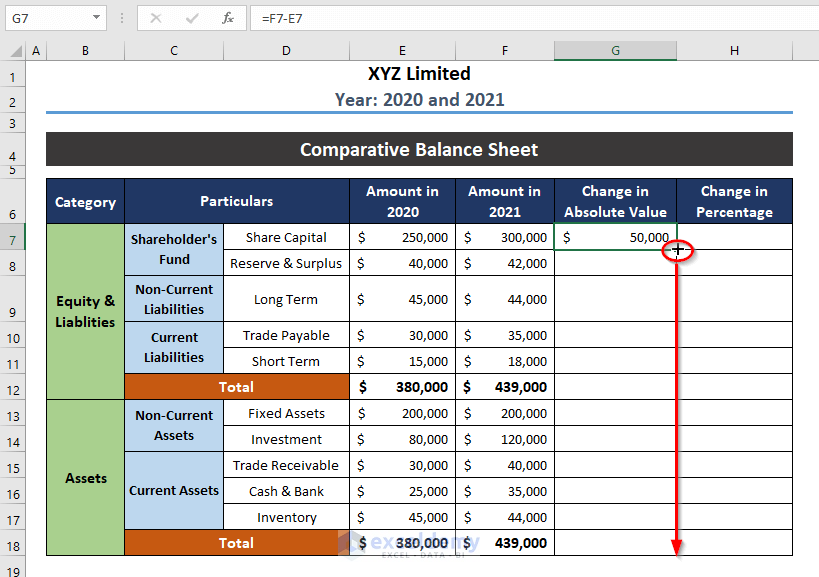

Step 3 – Finding the Absolute Change Between Financial Years

- Use the following formula in the column named “Change in Absolute Value”.

=F7-E7

- E7 = Amount of Share Capital in 2020

- F7 = Amount of Share Capital in 2021

- Press ENTER, and the cell will show you the change in the absolute amount between the financial years.

- Drag the Fill Handle tool down to Autofill the formula.

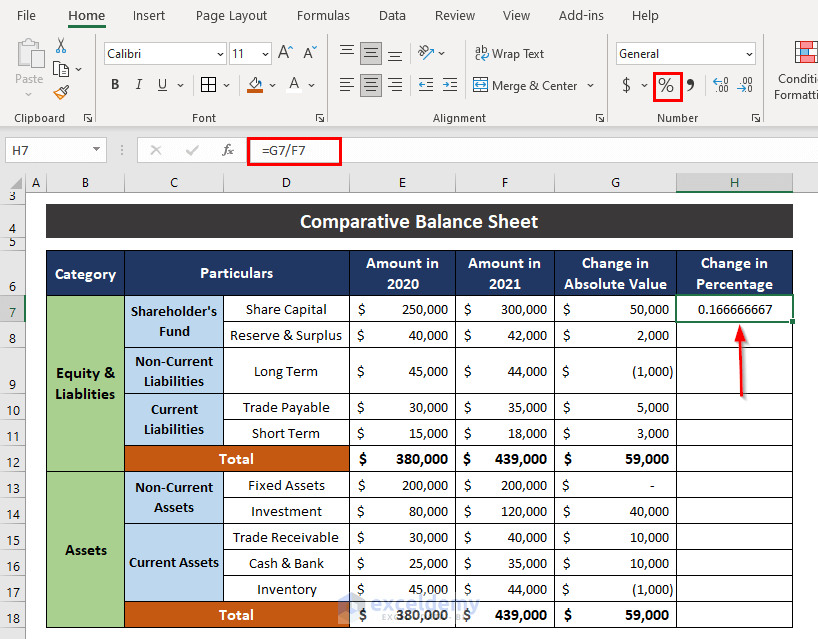

Step 4 – Determine the Change in Percentage

- Apply the formula below.

=G7/F7

G7 = Change in Absolute Value of Share Capital

F7 = Amount of Share Capital in 2021

- Go to the Home tab and click Percentile Style on the Number group to change the format to percentage.

- Drag the formula down and the changes will be found in percentages for every value.

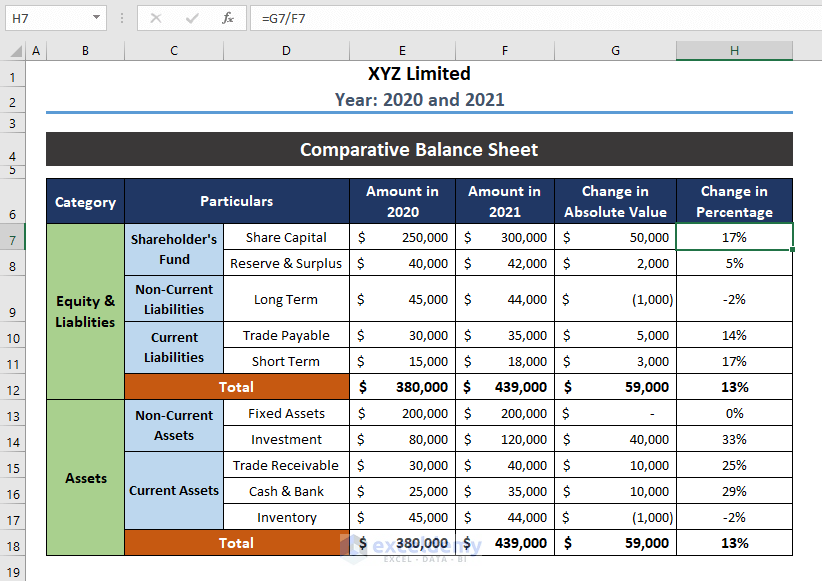

Advantages of a Comparative Balance Sheet

- Analyzing the comparative balance sheet ascertains the condition of company financials. For the balance sheet we are dealing with, Reserve & Surplus has increased by 5% in a financial year. On the other hand, Long Term Liabilities have decreased by 2%.

- A comparative balance sheet projects the trend of the company for several years and shows the fluctuation in the amount of Assets & Liabilities.

- Observing the balance sheet by making a financial comparison between 4-5 consecutive periods helps predict the financial condition of the company.

- Comparing different companies in the same industry helps to make decisions in which sector more priority should be given for ultimate profit.

Download the Practice Workbook

Related Articles

- How to Create Monthly Balance Sheet Format in Excel

- How to Create Provision Balance Sheet Format in Excel

- Create Average Daily Balance Calculator in Excel

- Net Worth Formula Balance Sheet in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!