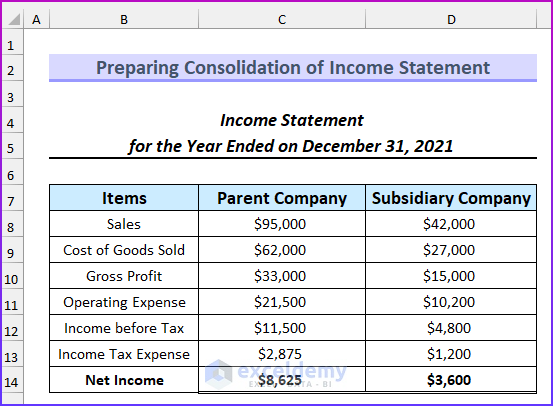

Method 1 – Preparing the Consolidation of Income Statement

Steps:

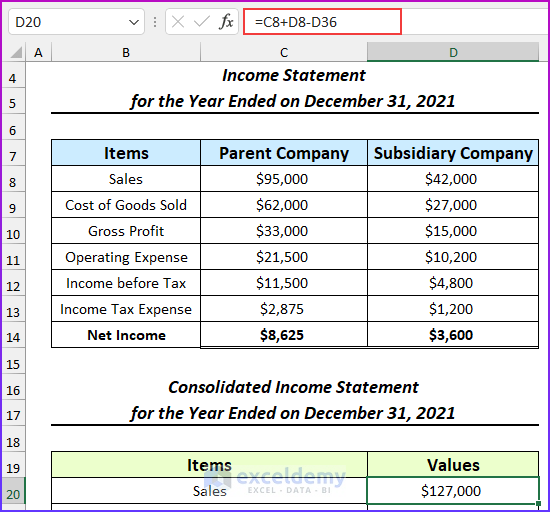

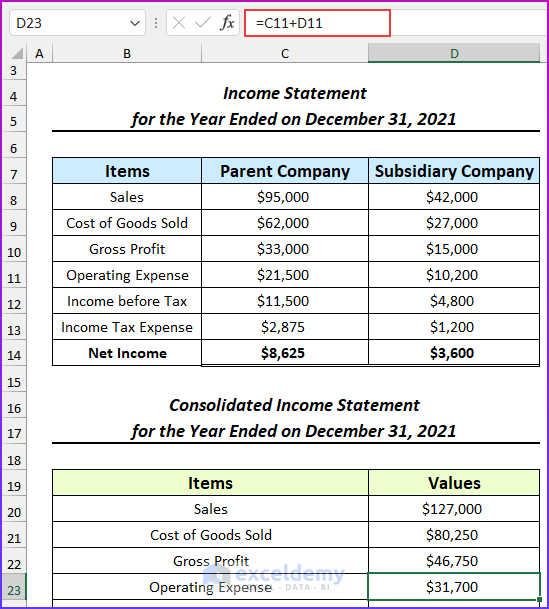

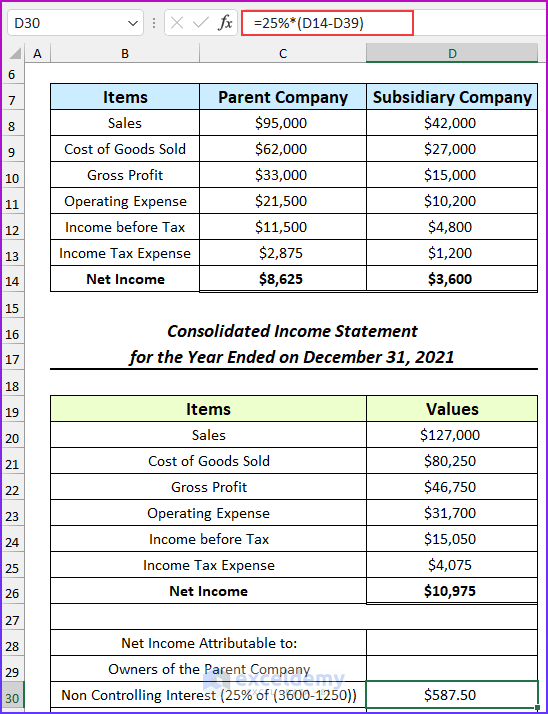

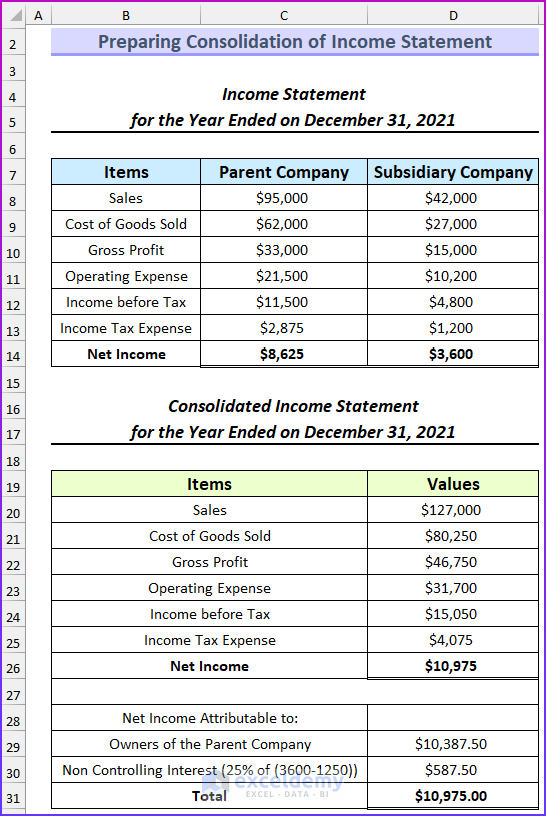

- The income statements for the two companies are given to us.

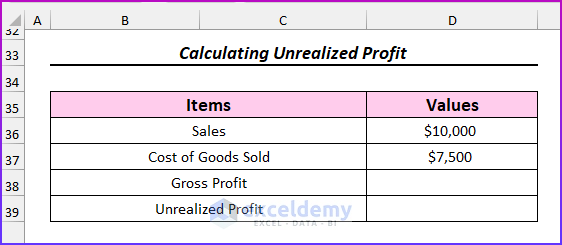

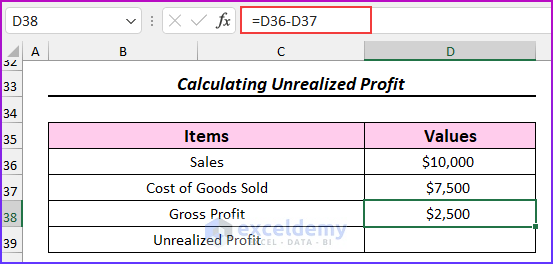

- We need the unrealized profit. The first two values are given to us.

- Use this formula to get the value of gross profit.

=D36-D37

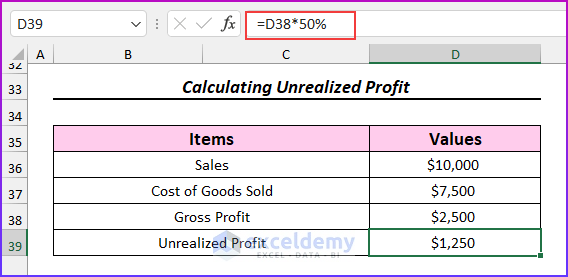

- Use another formula to return the value of the unrealized profit.

=D38*50%

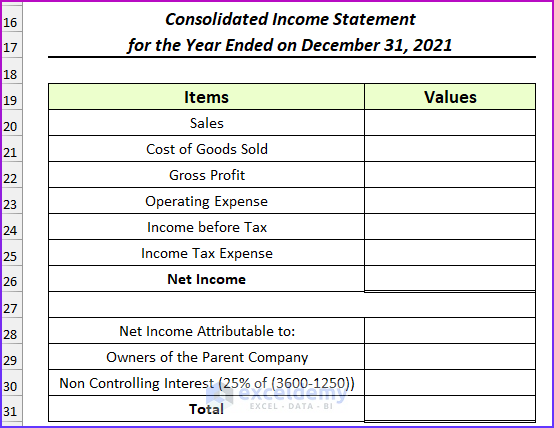

- Create this format for the consolidated income statement.

- Use this formula in cell D20 to get the consolidated value of sales.

=C8+D8-D36

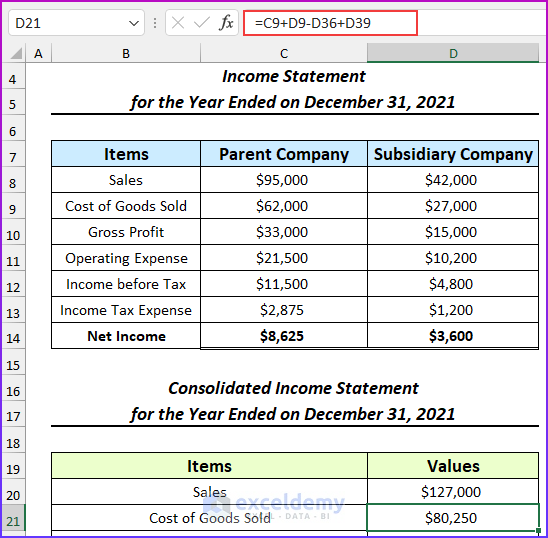

- Use this formula to get the consolidated value of the cost of goods sold.

=C9+D9-D36+D39

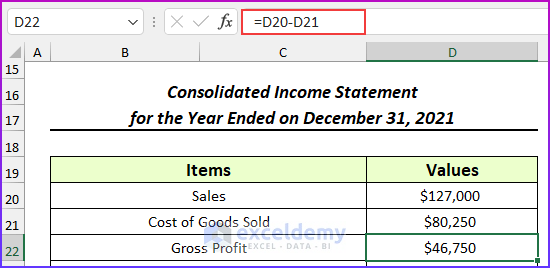

- Use this formula to get the gross profit.

=D20-D21

- Use this formula to find the consolidated operating expense.

=C11+D11

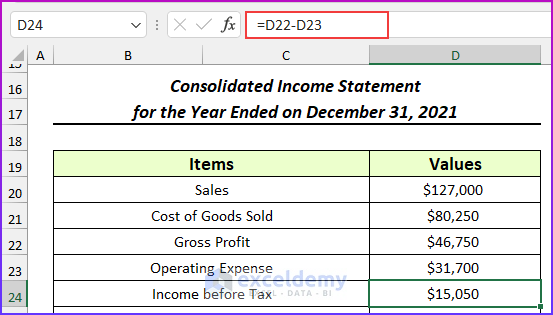

- Insert this formula to calculate the income before tax.

=D22-D23

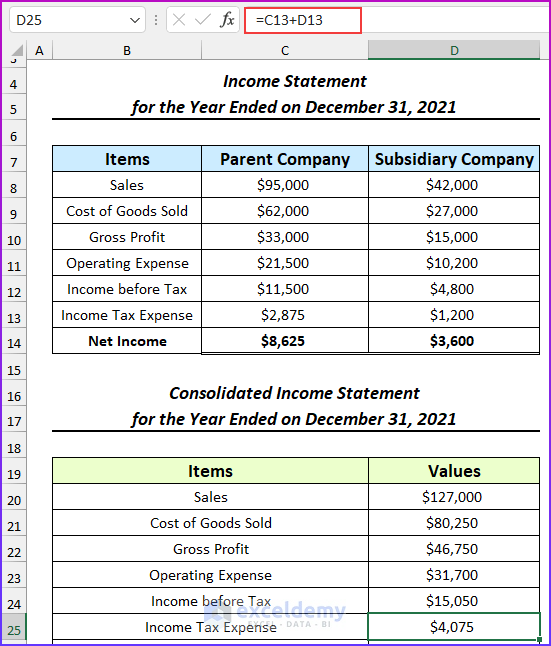

- Apply this formula to calculate the income tax expense.

=C13+D13

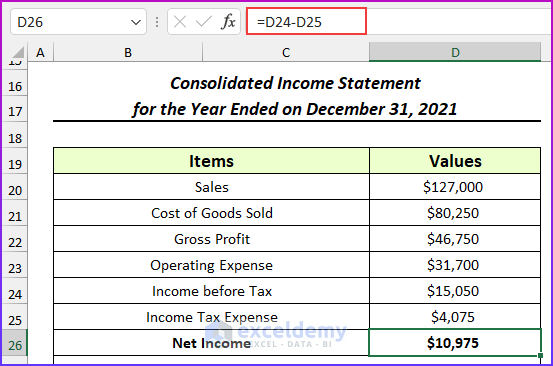

- Apply this formula to get the consolidated net income.

=D24-D25

- We will also find the non-controlling interest. The parent company owns 75% of the subsidiary. So, the remaining 25% is non-controlling.

- Use this formula to calculate the non-controlling interest.

=25%*(D14-D39)

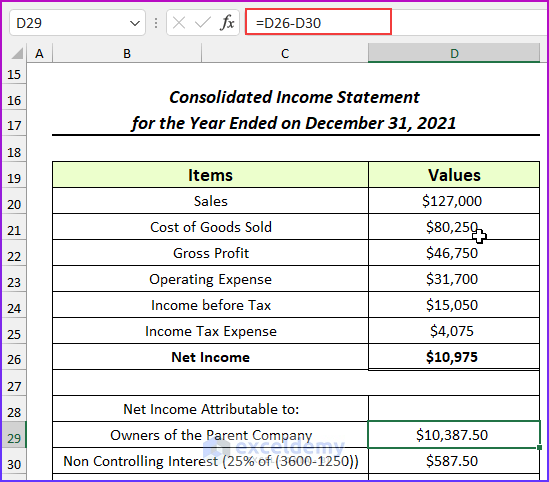

- Insert this formula to find the net income attributable to the owners of the parent company.

=D26-D30

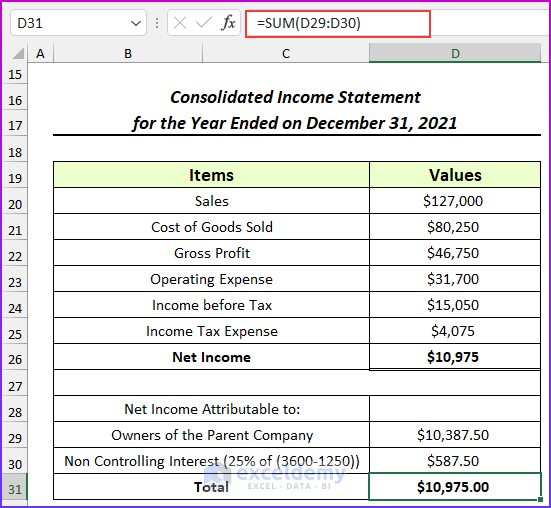

- Add these two values to get the net income value, which should match the previously calculated value.

=SUM(D29:D30)

- The overall consolidation of the income statement should look like this. We concluded by showing the steps for the first example of consolidating financial statements in Excel.

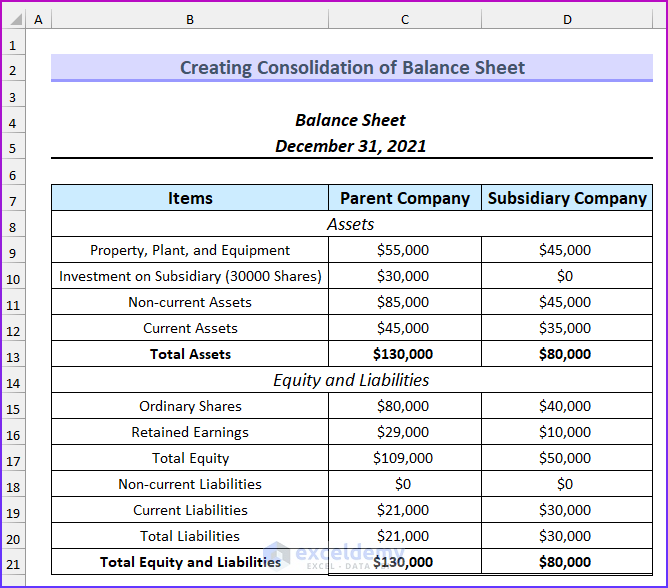

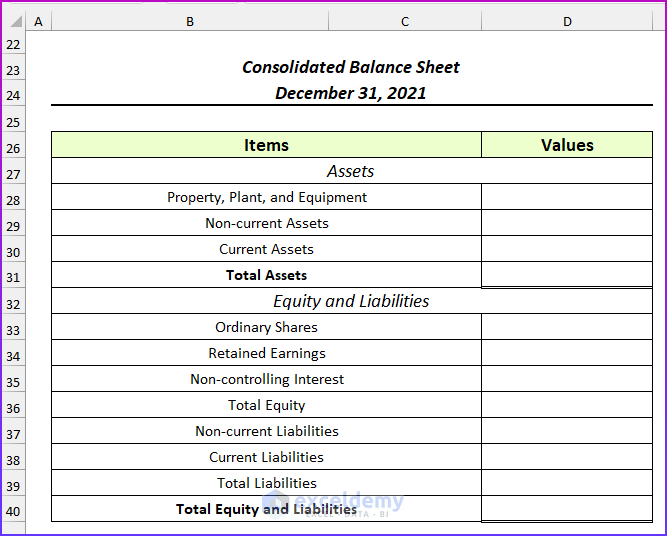

Method 2 – Creating a Consolidation of Balance Sheet

Steps:

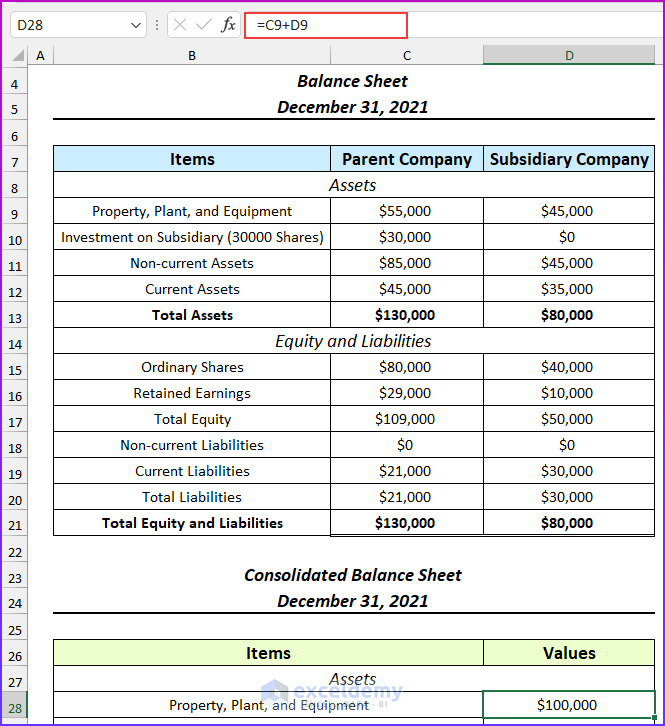

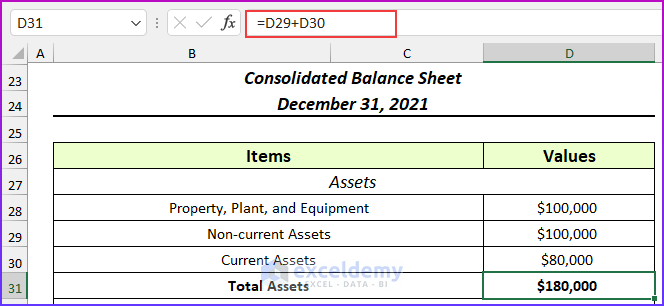

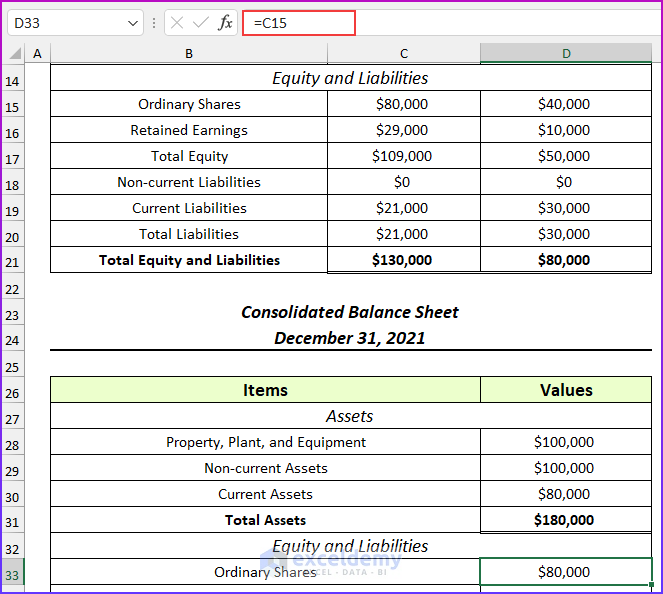

- We have given the balance sheets for the two companies. Using these values, we will create the consolidated balance sheet.

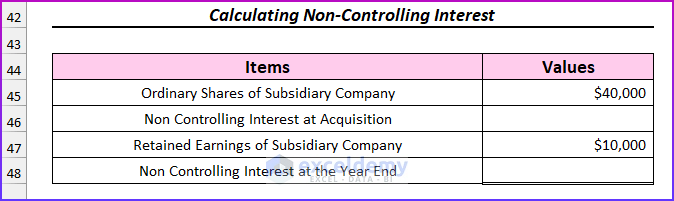

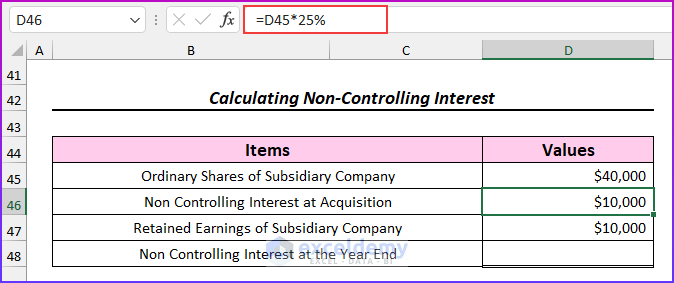

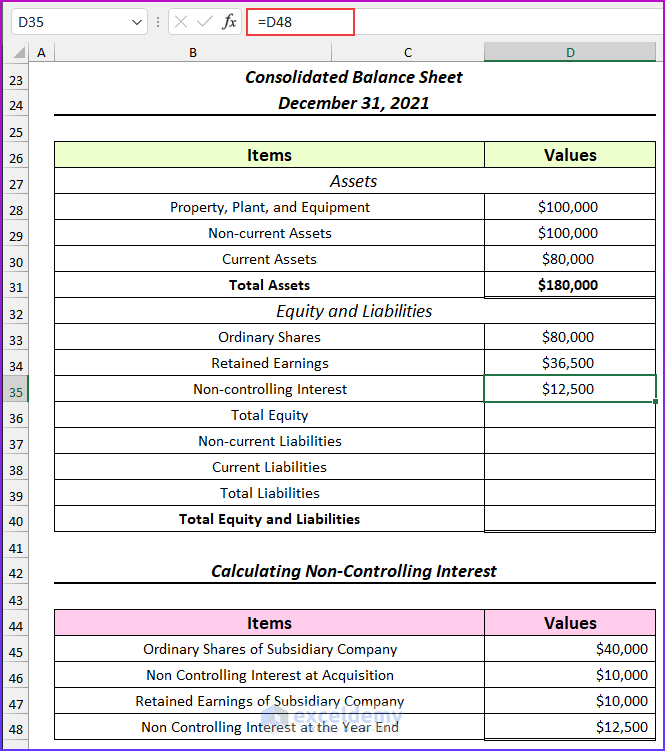

- We need to find the non-controlling interest.

- Use this formula.

=D45*25%

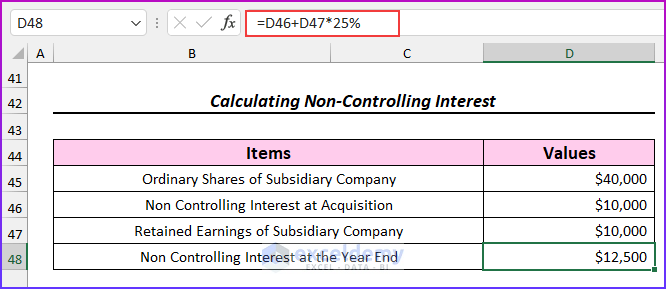

- Apply another formula.

=D46+D47*25%

- Insert the values in the consolidated balance sheet format.

- Enter this formula.

=C9+D9

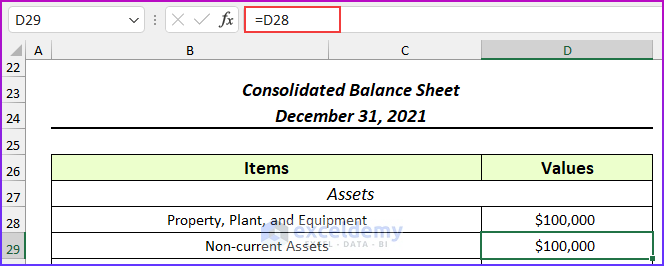

- Insert this formula.

=D28

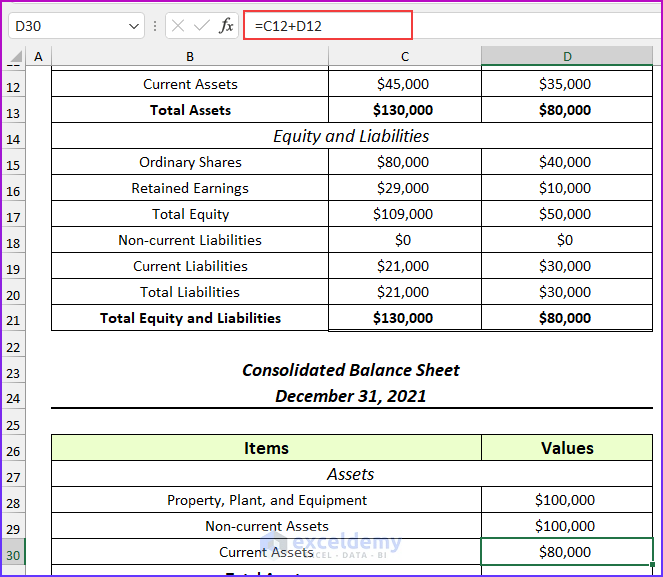

- Insert this formula in cell D30 to find the consolidated current assets.

=C12+D12

- Use this formula.

=D29+D30

- Insert this formula.

=C15

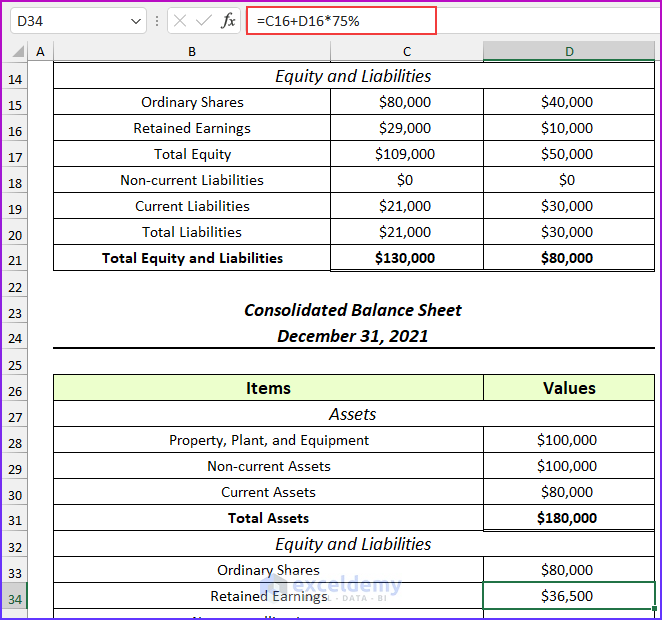

- Apply this formula to find the consolidated retained earnings.

=C16+D16*75%

- Insert this formula.

=D48

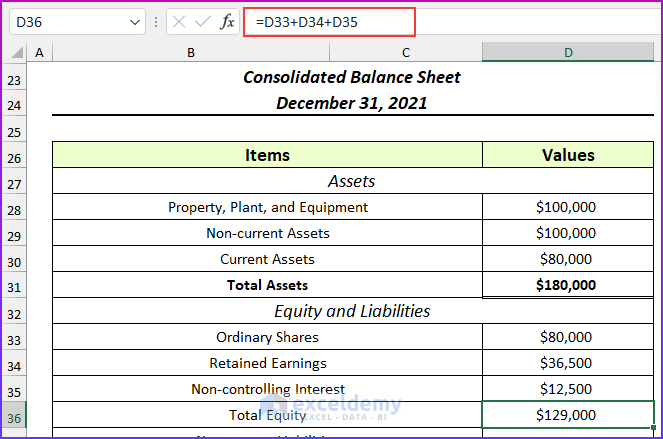

- Use this formula to calculate the consolidated equity.

=D33+D34+D35

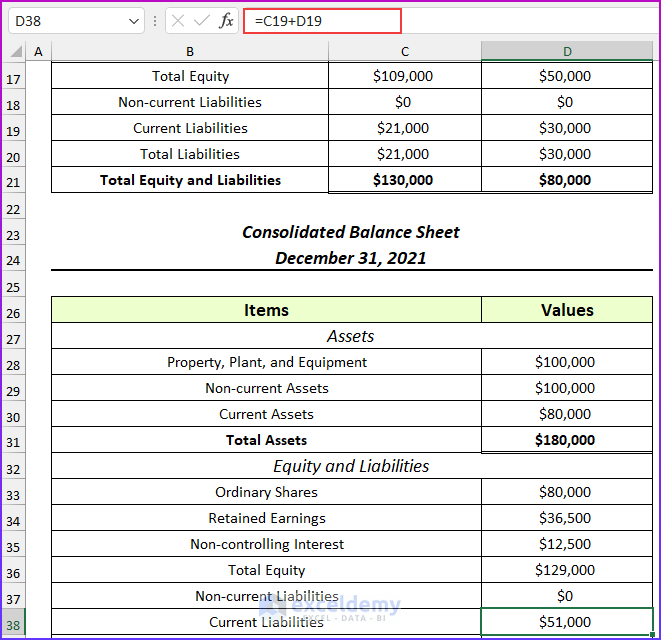

- Enter another formula.

=C19+D19

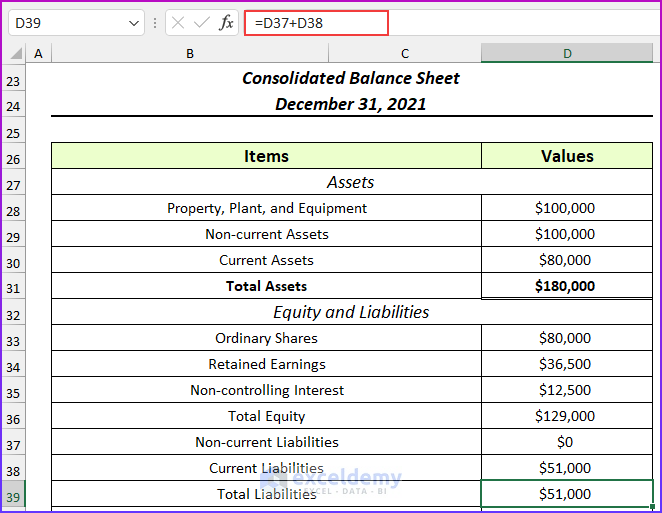

- Use this formula.

=D37+D38

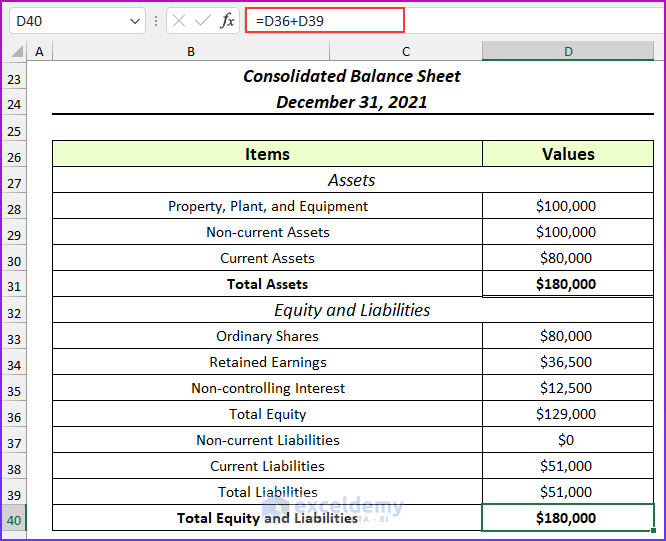

- Use this formula to find the total equity and liabilities. We will complete the second example of the consolidation of financial statements in Excel.

=D36+D39

Download the Practice Workbook

Related Articles

- How to Automate Financial Statements in Excel

- How to Link 3 Financial Statements in Excel

- How to Create Pro Forma Financial Statements in Excel

<< Go Back to How to Create Financial Statements in Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!