Dataset Overview

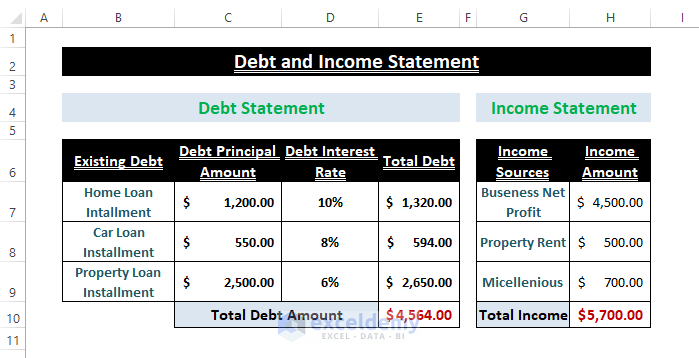

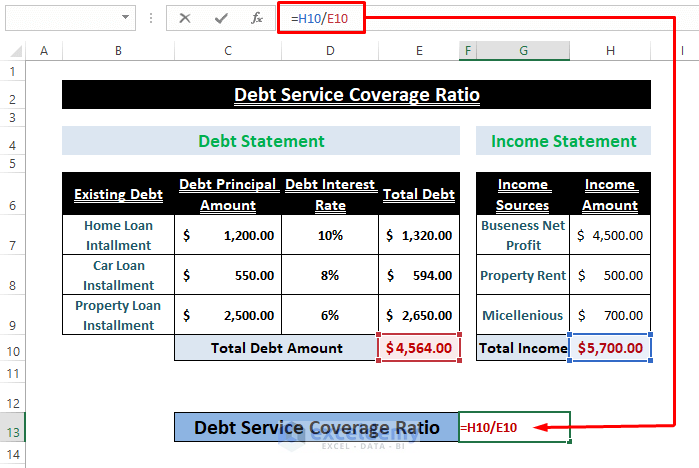

Let’s say we have a user’s Debt and Income Statement, or Balance Sheet as shown in the image below. And we want to find the Debt Service Coverage Ratio (DSCR) from it.

Debt and Income Statement

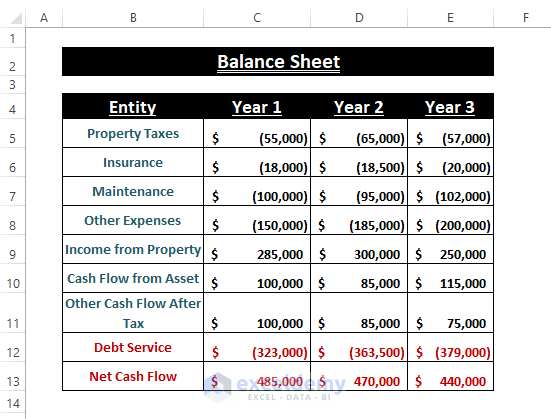

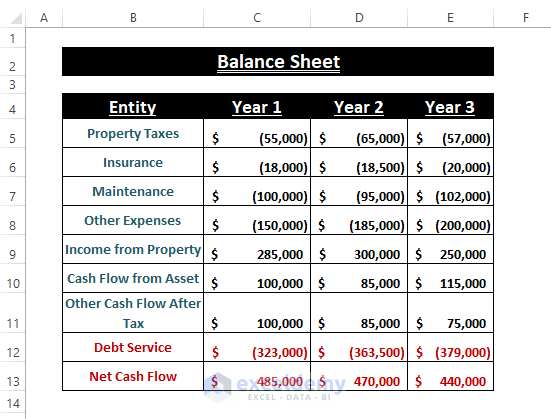

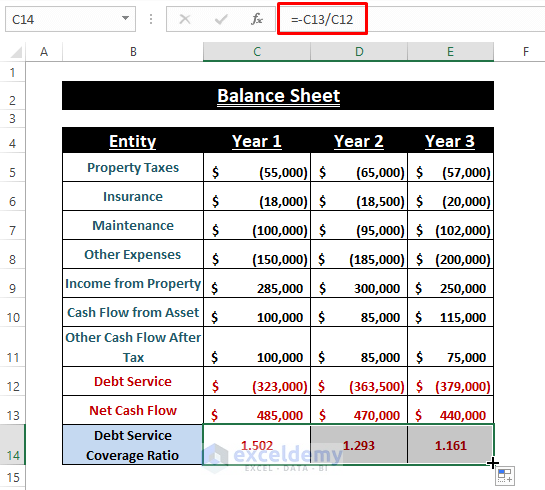

Balance Sheet

What Is Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial metric that helps companies, organizations, or individuals assess their ability to meet debt obligations. It compares the Net Operating Income (or Cash Flow) to the Debt Service. A DSCR greater than 1 indicates a safer financial position. Here’s the formula:

Debt Service Coverage Ratio (DSCR)=Net Operating Income/Debt Service

Net Operating Income = Represents the cash flow after deducting all expenses.

Debt Service = Refers to the total obligations that need to be met.

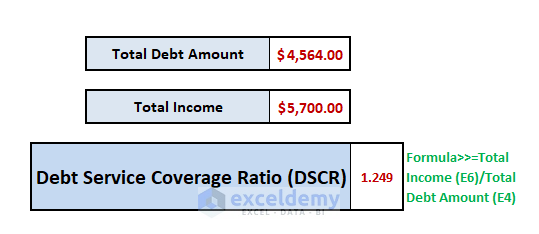

Basic Debt Service Coverage Ratio (DSCR) Calculation

To calculate the DSCR, you’ll need two fundamental entities:

- Net Income or Cash Flow (after deducting expenses)

- Total Debt or Debt Service

Simply find the ratio between Net Income (or Cash Flow) and Debt Service to determine the DSCR.

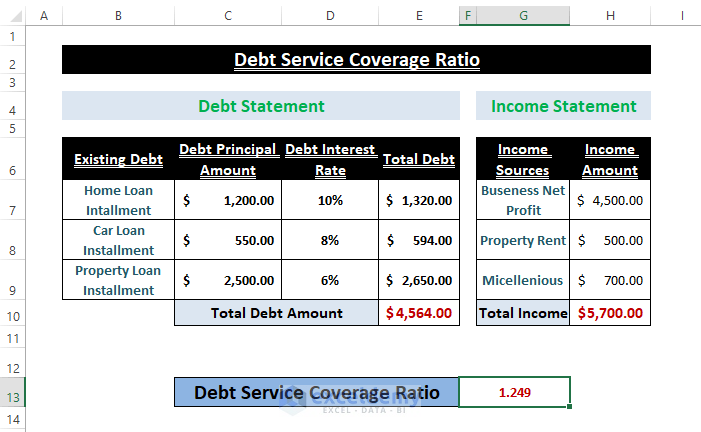

Example 1 – Calculating DSCR from Income and Debt Statement

Suppose you have an Income and Debt Statement like the one shown below. You can obtain this statement from your accountant or financial logs.

Follow these steps:

- Insert the following formula (Net Income / Total Debt Service) into any blank cell:

=H10/E10

- Press ENTER, and you’ll instantly get the DSCR.

You can use your financial statement or the attached dataset as a template.

Read More: How to Do Ratio Analysis in Excel Sheet Format

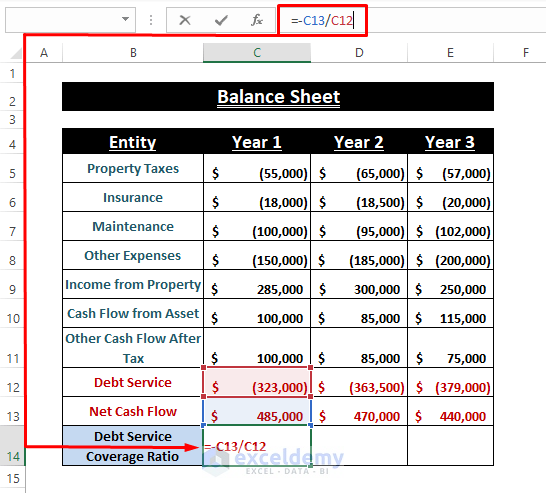

Example 2 – Determining DSCR from Balance Sheet

Companies or institutions often maintain Balance Sheets that depict their Incomes and Expenses. Using the relevant entries, you can find the DSCR.

Suppose your Balance Sheet looks like the following screenshot:

Follow these steps:

- Enter the following formula in any cell:

=-C13/C12In the formula, C13 refers to the Net Cash Flow or Income, and C12, Debt Service.

- Press ENTER, and then drag the Fill Handle to the right to calculate DSCRs for each column.

Remember that the specific fields in Financial Balance Statements may vary from company to company, but essential entries like Net Income (or Cash Flow) and Debt (or Liability) are always present.

Read More: How to Graph Ratios in Excel

Download Excel Workbook

You can download the practice workbook from here:

Related Articles

- How to Calculate Ratio Percentage in Excel

- How to Use Interest Coverage Ratio Formula in Excel

- How to Convert Percentage to Ratio in Excel

- How to Convert Ratio to Decimal in Excel

<< Go Back to Ratio in Excel | Calculate in Excel | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!