Download Practice Workbook

You can download the Excel file here.

Problem Overview

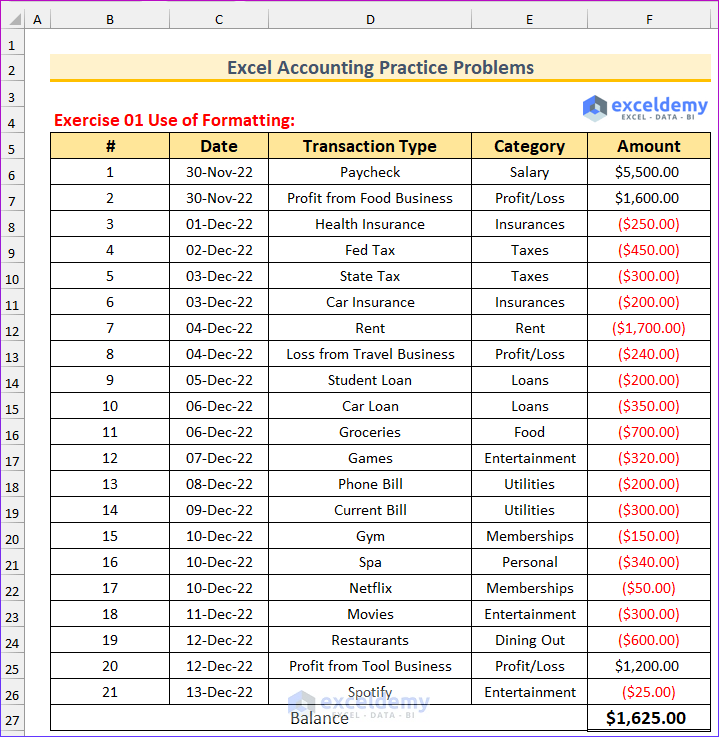

There will be eight exercises related to Excel accounting practice problems. Each problem has a distinct dataset. The “Problem” sheet shows the exercises, and the “Solution” sheet the solved problems. The following image showcases the first problem.

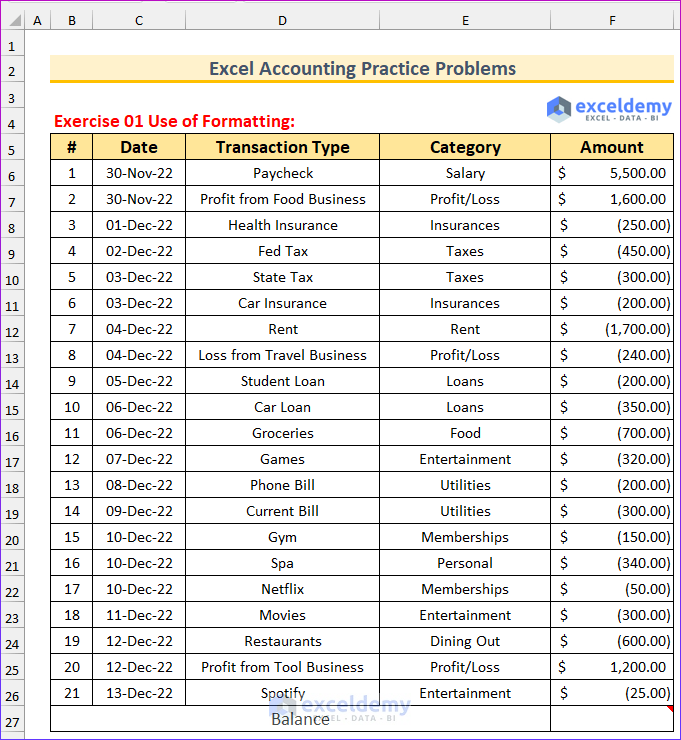

- Exercise 1 – Formatting: Twenty one cash transactions are given in this first exercise. Your task is to change the formatting of the expenses to red and find the total value, double underlining it.

- Exercise 2 – Transaction Analysis: Ten transactions are given. You will use them to create a summary (distribute them into Assets, Liability and Owner’s Equity account) and solve the accounting equation.

- The Owner invests $13,000 cash on a business.

- Purchases equipment: $5,000 cash.

- Buys supplies: $1,400 credit.

- Service provided: $1,000 cash.

- Purchase of marketing advertisement: $200 credit.

- Service provided: $1,200 cash and $1,800 credit.

- Cash payment of office rent: $500, salaries and wages $800, utilities bill $100.

- Payment of accounts payable for the marketing advertisement: $200

- From the sixth transaction, the owner received $400.

- Owner’s withdrawal:$1,100.

- Exercise 3 – Complete Financial Statements: Information is provided for four financial statements. Calculate the missing information.

- The following GIF shows a partial solution to this exercise.

- Exercise 4 – Examine the Impact of the Transactions: There are seventeen statements. Your task is to determine if those increase or decrease the three accounts (assets, liabilities, and owner’s equity).

- Exercise 5 – Prepare Financial Statements from Transactions: Ross Geller opens his own firm on December 1,2022. During the first month of the operation, the following transactions took place.

- Ross invested $13,000 cash on the firm.

- Paid $1,000 for the office’s December rent.

- $5,000 worth of equipment was purchased with credit.

- Performed services for a customer: cash $1,700.

- On a note payable, borrowed $900 from a bank.

- Performed a second service for a fee of $4,000 on account.

- Paid the following monthly expenses: $700 for salaries and wages, $500 for utilities, and $300 for advertising.

- For personal use, Ross withdrew $3,000 from the account.

- Create an income statement, an owner’s equity statement, and a balance sheet.

- Exercise 6 – Debit Credit Rules & Use of Data Validation: There is a list of ten accounts. You will return whether it will be Debit or Credit when those accounts increase. Use data validation and a conditional formula in the Decrease column to return the opposite.

- Exercise 7 – Create a Journal and a Ledger: Your goal is to create a journal and a ledger using the following transaction data for a shop:

- December 1 – Owner invested $10,000 on the business. The owner purchased office equipment: $5,000 for a 3-month, 13%, $5,000 payable note.

- December 2 – Receives $1,200 cash in advance for a service that is expected to be completed within the month.

- December 3 – Paid rent expense: $900 cash.

- December 20 – The owner withdraws $4,000 for personal use.

- Exercise 8 – Prepare Income Statement from a Trial Balance: An adjusted trial balance is given. Your task is to create an income statement using those values.

The following image shows the solution to the first problem.