Different Types of Costs

1. Fixed Cost

- Fixed costs remain unchanged regardless of the production level within a specific time period.

- Components of fixed costs include:

- Rent: Charges for assets rented or leased by the company.

- Salaries: Regular payments to employees.

- Insurance Fees: Routine charges for insurance services.

- Property Tax: Taxes paid to the government based on asset value.

- Interest Payments: Charges related to loans (become fixed costs if interest rates or payment amounts are fixed).

- Depreciation: Cost to account for the gradual decrease in asset value over time.

- Utilities: Regular payments for services like electricity and gas.

2. Variable Cost

- Variable costs change based on production volume.

- Components of variable costs include:

- Direct Material: Raw materials used in the product.

- Direct Labor: Wages for workers (variable for temporary contracts, fixed for permanent workers).

- Billable Staff Wages: Payments based on billable hours (e.g., overtime work or temporary hiring).

- Commissions: Paid to motivate salespersons based on product sales.

- Production Supplies: Tools and supplies that vary with production levels.

- Shipping Cost: Varies with the number of units shipped.

3. Operating Cost

- Ongoing expenses associated with daily business operations.

4. Total Cost

- The sum of all costs incurred to achieve a specific output level.

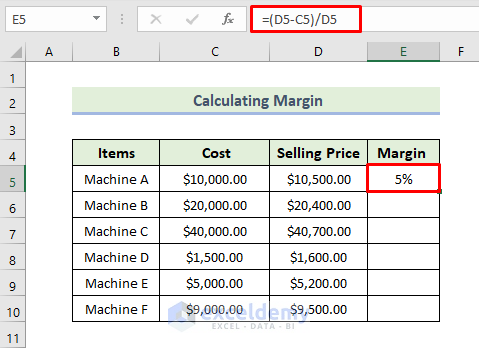

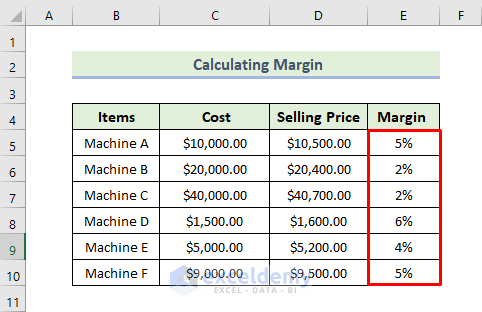

An organization’s profit from the sale of its products and services is known as the sales margin. The equation for calculating the margin is:

Margin (%)= (Selling Price- Cost)/ Selling Price

- To calculate the margin, we will enter the following formula in the cell E5:

=(D5-C5)/D5

This calculates the margin percentage.

- Press Enter.

- Drag the Fill Handle icon to apply the formula to other cells if needed.

General Formula to Add Margin to Cost

The general formula for adding a margin to cost is given below:

Cost After Adding Margin = (Cost)/(1-Margin)

Using the above formula, you will be able to add margin to cost.

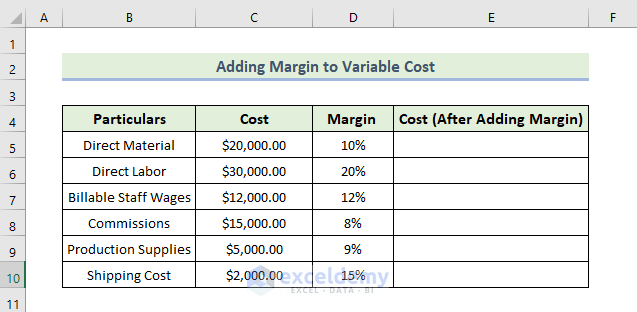

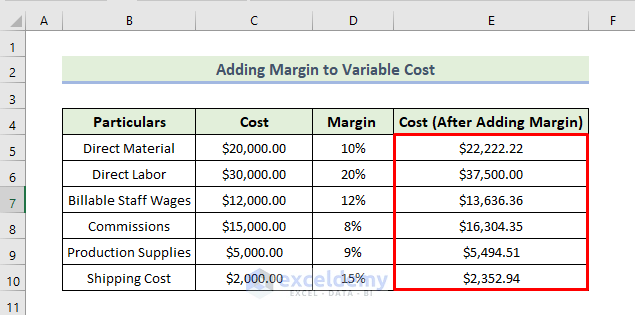

Example 1 – Adding Margin to Variable Cost

- Dataset Introduction:

- Imagine we have an Excel dataset with columns for Particulars, Cost, Margin, and Cost (After Adding Margin).

- We’ll use the SUM function to calculate total costs.

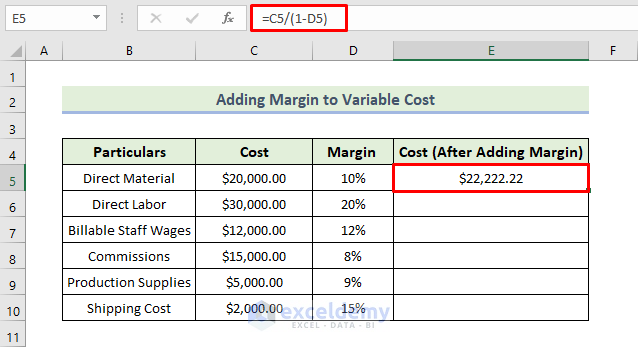

- Calculating Cost After Adding Margin:

- In cell E5, enter the formula:

=C5/(1-D5)

This calculates the cost after adding the margin.

-

- Press Enter.

-

- Drag down the Fill Handle icon to apply the formula to other cells (if needed).

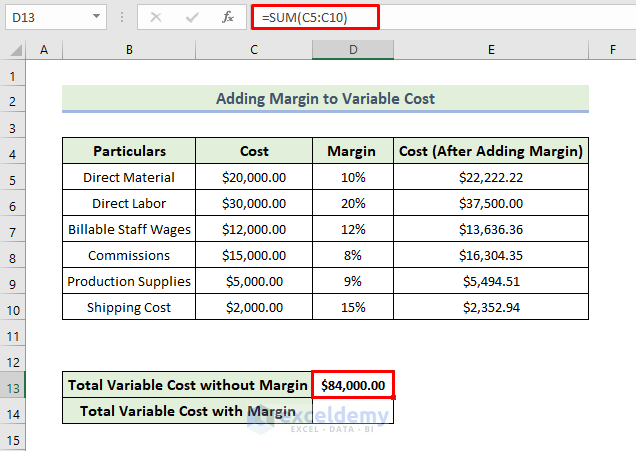

- Total Variable Cost Without Margin:

- In cell D13, enter the formula:

=SUM(C5:C10)

This gives the total variable cost without adding a margin.

-

- Press Enter.

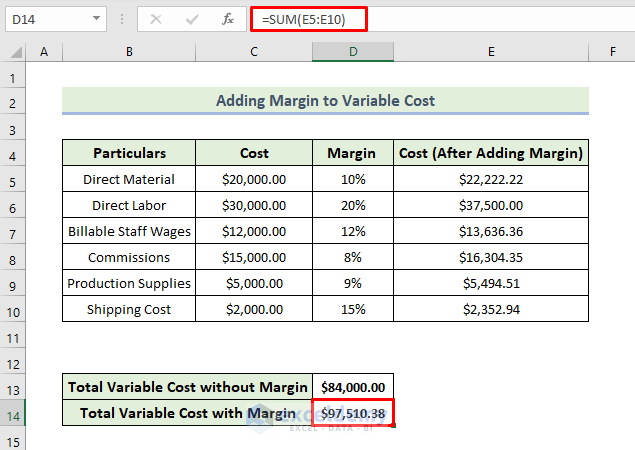

- Total Variable Cost After Adding Margin:

- In cell D14, enter the formula:

=SUM(E5:E10)

This provides the total variable cost after adding a margin.

-

- Press Enter.

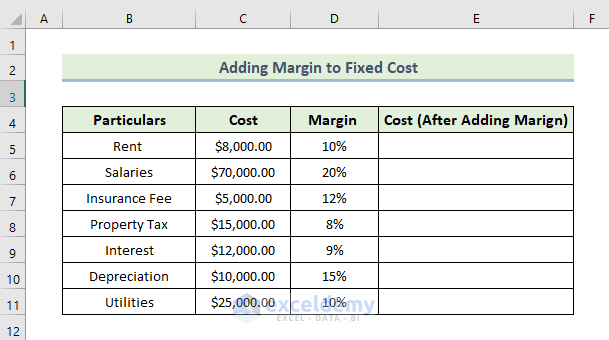

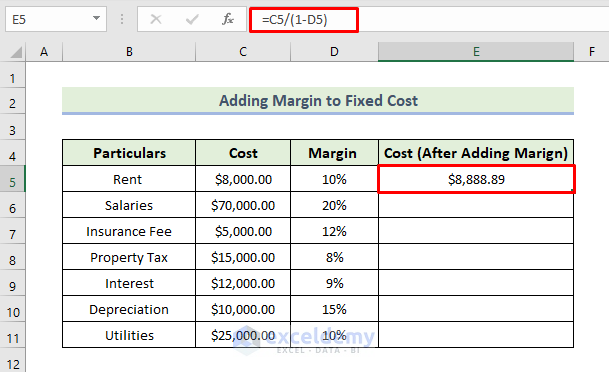

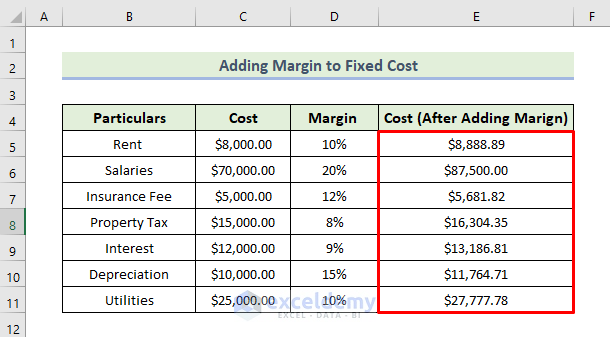

Example 2 – Adding Margin to Fixed Cost

- Calculating Cost After Adding Margin:

- Similar to the variable cost, enter the formula in cell E5:

=C5/(1-D5)

-

- Press Enter.

- Press Enter.

-

- Drag down the Fill Handle icon.

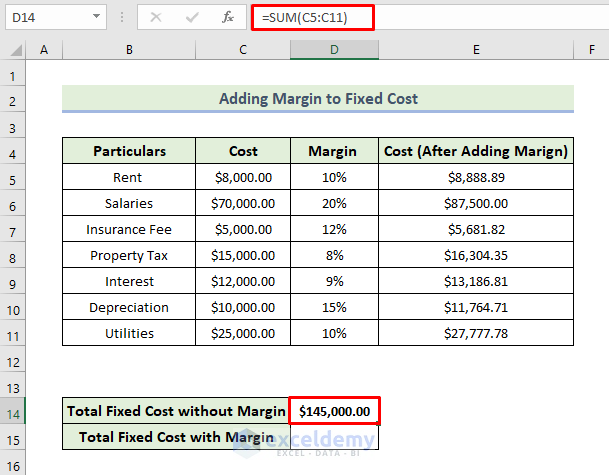

- Total Fixed Cost Without Margin:

- In cell D14, enter the formula:

=SUM(C5:C11)

This gives the total fixed cost without adding a margin.

-

- Press Enter.

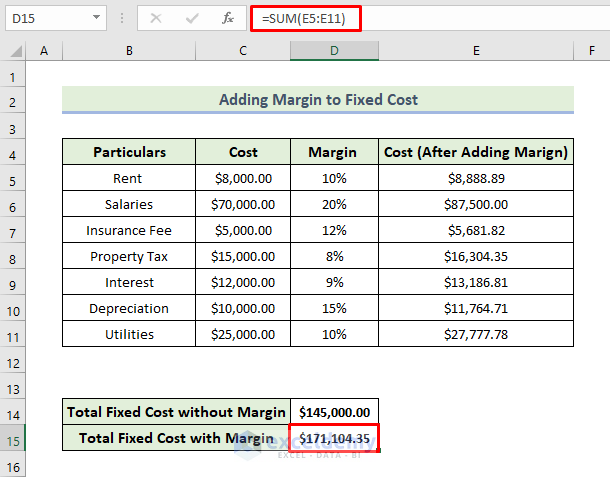

- Total Fixed Cost After Adding Margin:

- In cell D15, enter the formula:

=SUM(E5:E11)

This provides the total fixed cost after adding a margin.

-

- Press Enter.

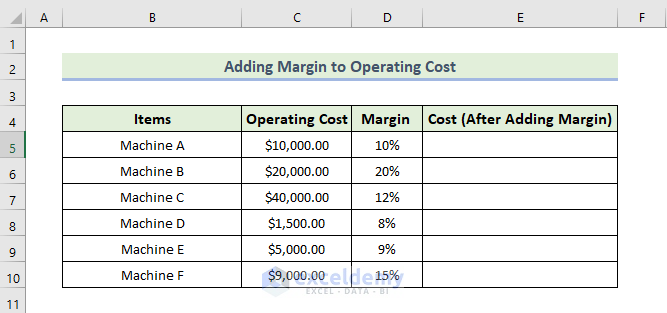

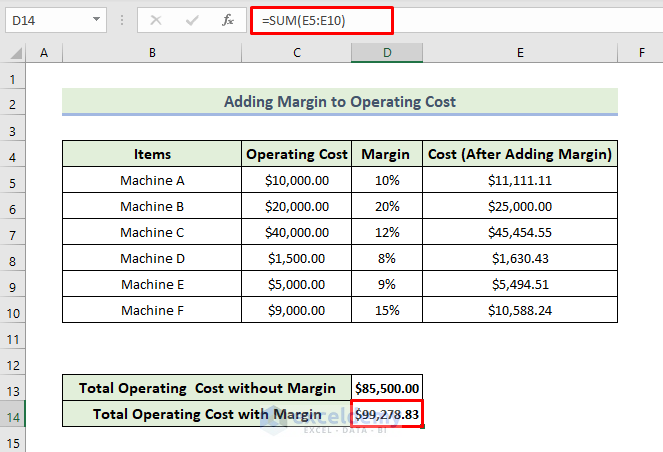

Example 3 – Adding Margin to Operating Cost

- Dataset Introduction:

- Imagine we have an Excel dataset with columns for Items, Operating Cost, Margin, and Cost (After Adding Margin).

- We’ll use the SUM function to calculate total costs.

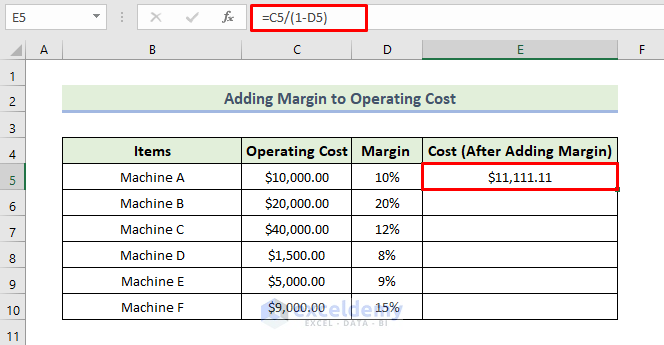

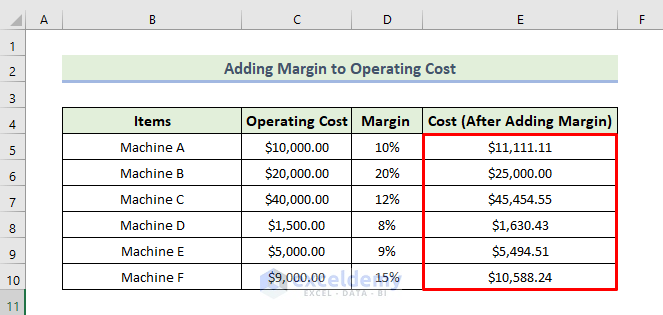

- Calculating Cost After Adding Margin:

- In cell E5, enter the formula:

=C5/(1-D5)

This calculates the cost after adding the margin.

-

- Press Enter.

-

- Drag down the Fill Handle icon to apply the formula to other cells (if needed).

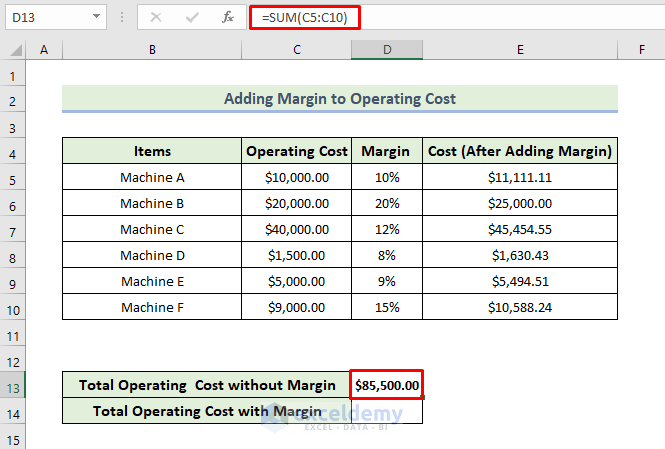

- Total Operating Cost Without Margin:

- In cell D13, enter the formula:

=SUM(C5:C10)

This gives the total operating cost without adding a margin.

-

- Press Enter.

- Total Operating Cost After Adding Margin:

- In cell D14, enter the formula:

=SUM(E5:E10)

This provides the total operating cost after adding a margin.

-

- Press Enter.

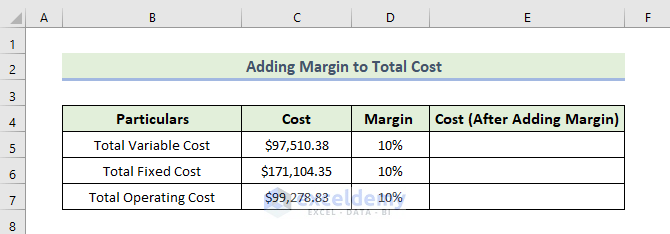

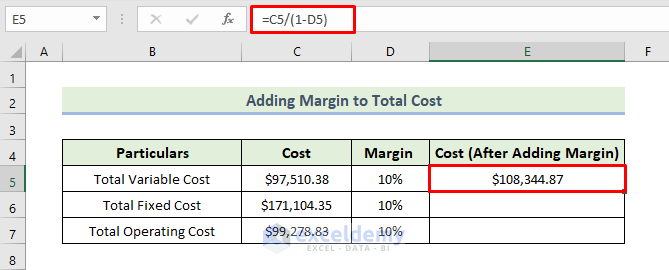

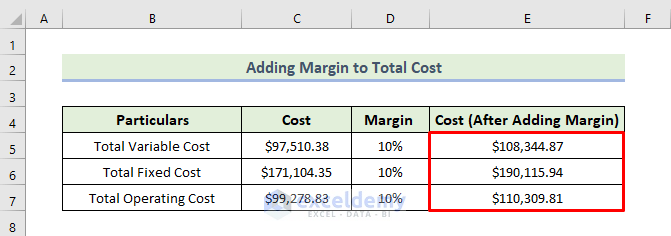

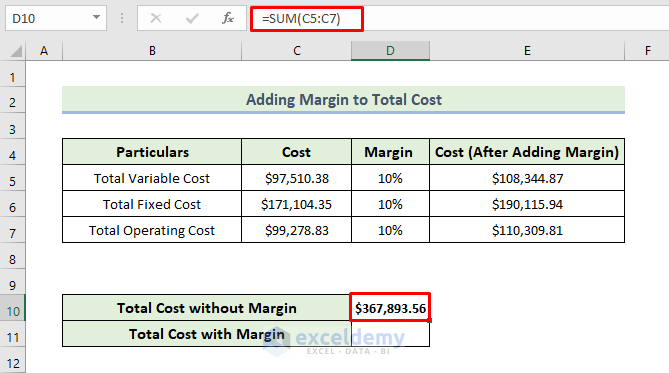

Example 4 – Adding Margin to Total Cost

- Calculating Cost After Adding Margin:

- Similar to the operating cost, enter the formula in cell

=C5/(1-D5)

-

- Press Enter.

-

- Drag down the Fill Handle icon.

- Total Cost Without Margin:

- In cell D13, enter the formula:

=SUM(C5:C7)

This gives the total cost without adding a margin.

-

- Press Enter.

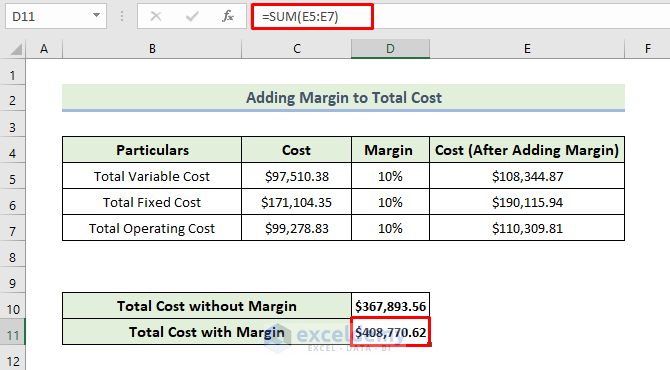

- Total Cost After Adding Margin:

- In cell D14, enter the formula:

=SUM(E5:E7)

This provides the total cost after adding a margin.

-

- Press Enter.

Download Practice Workbook

You can download the practice workbook from here:

<< Go Back to Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!