Arithmetic Formula to Calculate the Simple Interest Loan

The Simple Interest Loan is the interest calculated by multiplying the initial borrowed amount -the Principal (p), the Rate of Interest (r), and Time (n). The arithmetic formula is:

I = p*n*r

I = Simple Interest (Total interest to be paid)

p= Principal Amount

n = Time elapsed

r = Rate of Interest

Consider a 5-year loan of $5000 with an annual interest of 15% . The calculation will be:

I = $5000 * 5 * 0.15 = $3750

The total amount of interest is $1500 in 5 years.

To calculate the Monthly Payable Interest, use the following formula.

Monthly Payable Interest = (p*r*)/12

In the previous example, the Monthly Payable Interest is:

= (p*r*)/12 = ($5000*0.15)/12 = $62.5

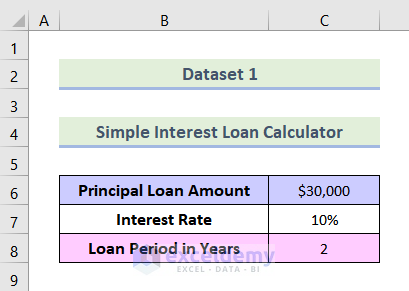

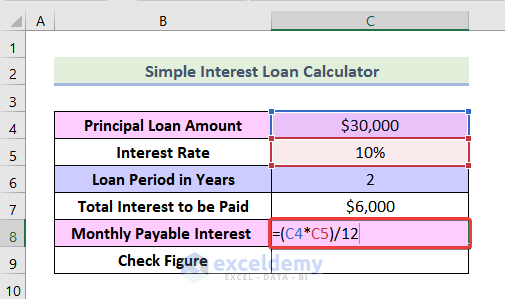

The dataset below showcases a bank loan of $30,000 taken at a 10% annual simple interest rate for 2 years.

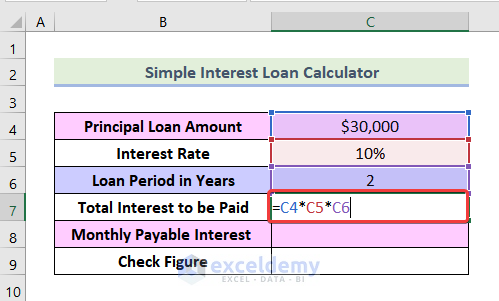

Step 1: Calculating the Total Interest to be Paid

- Enter the following formula in C7.

=C4*C5*C6C4 is the Principal Loan Amount, C5 refers to the Interest Rate, C6 represents the Loan Period in Years, and C7 is the Monthly Payable Interest.

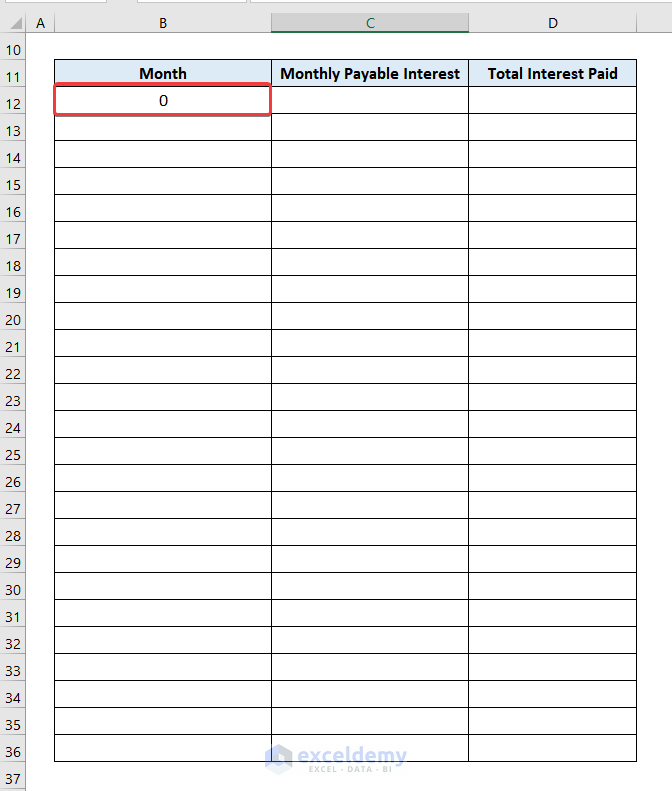

Step 2 – Determining the Number of Months to Repay the Loan

The month when the loan is taken is considered as Month 0.

- Enter 0 in B12.

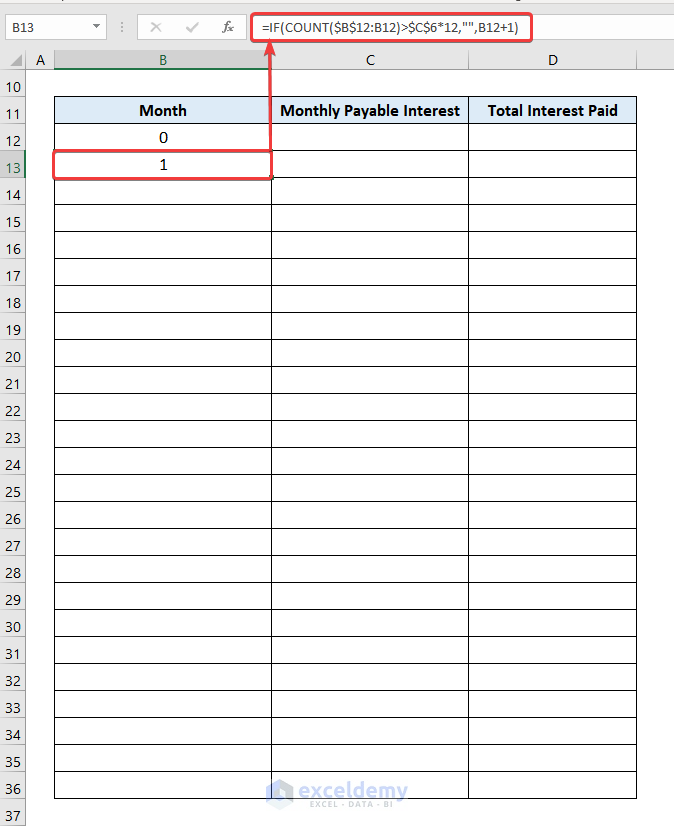

=IF(COUNT($B$12:B12)>$C$6*12,"",B12+1)B12 refers to Month 0.

Formula Breakdown

- COUNT($B$12:B12) counts cells containing the value in B12 in column B.

- Checks the value is greater than the Loan Period*12 (Number of months) using the argument COUNT($B$12:B12)>$C$6*12 with a preceding IF function.

- If the above condition is true, the Loan Period has passed and a blank is returned. If the condition is false you are within the Loan Period and the cell value is increased by 1, using the following argument:

=IF(COUNT($B$12:B12)>$C$6*12,"",B12+1)

- Drag down the Fill Handle to see the result in the rest of the cells. The formula automatically stops at the end of the Loan Period.

Step 3 – Computing the Monthly Payable Interest

- Enter the formula in C8 to see the Monthly Payable Interest.

=(C4*C5)/12

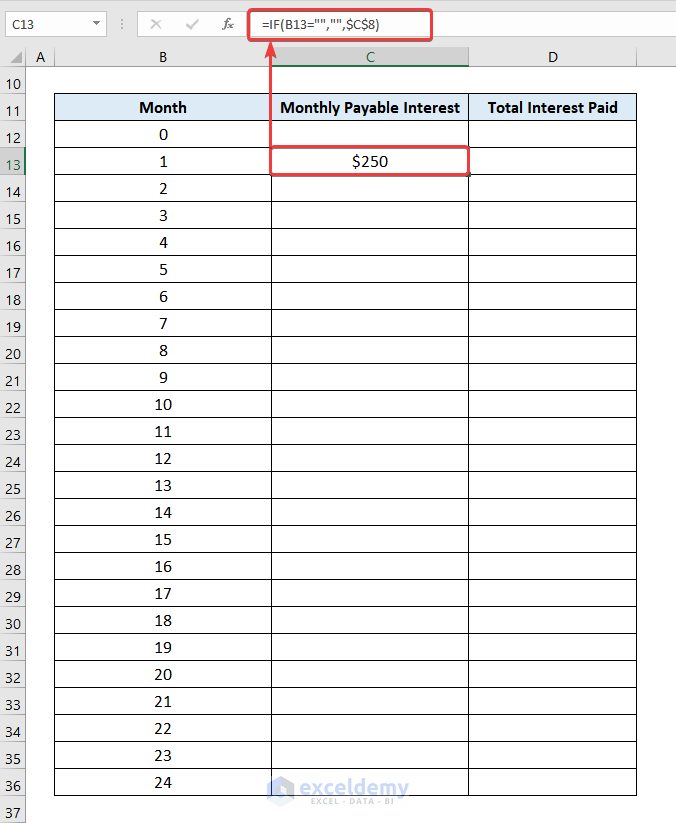

To add this value to the last month of the Loan Period:

- Use the following formula in C13.

=IF(B13="","",$C$8)C13 refers to the Monthly Payable Interest for the 1st month.

Formula Breakdown

- =IF(B13=””,””,$C$8) checks if the adjacent cell in column B is blank. If this condition is true, the Loan Period has passed and a blank is returned. If the condition is false, you are within the Loan Period and the Monthly Payable Interest ($C$8) is displayed.

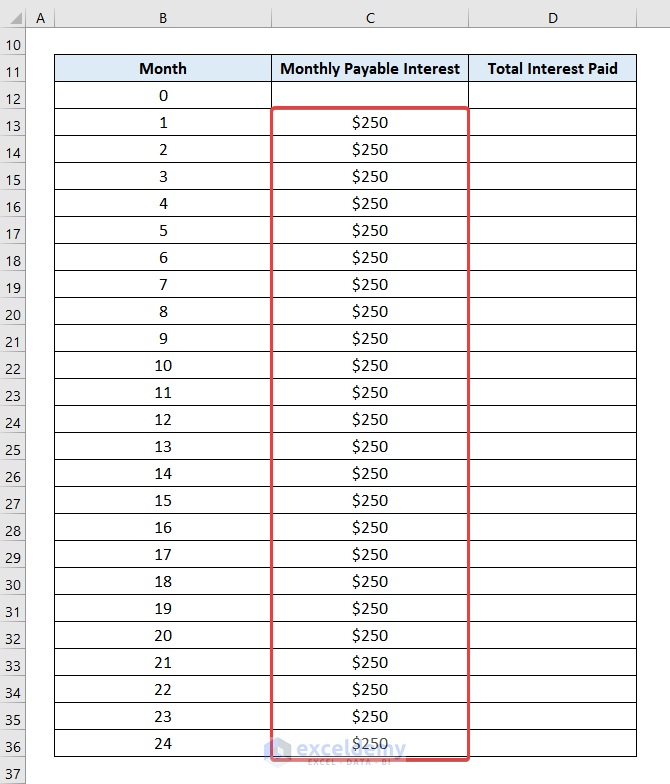

- Drag down the Fill Handle to see the result in the rest of the cells.

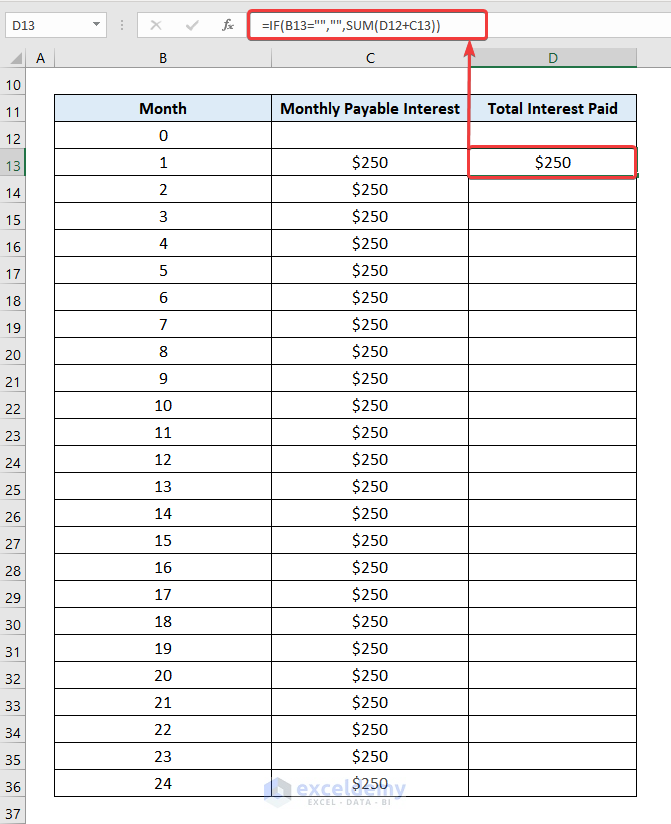

Step 4 – Calculating the Cumulative Total Interest Paid

- Use the following formula in C13.

=IF(B13="","",SUM(D12+C13))D12 and D13 represent the Total Interest Paid in months 0 and 1.

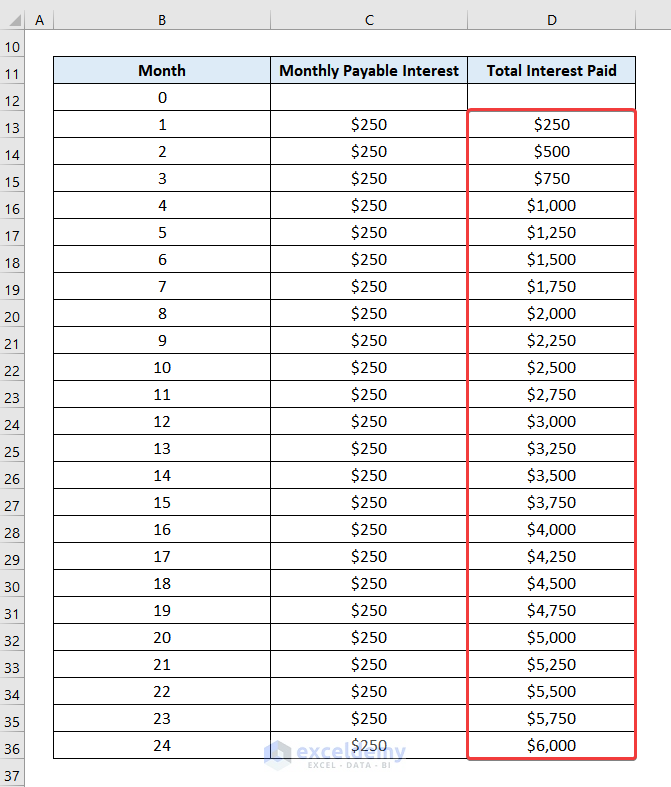

- Drag down the Fill Handle to see the result in the rest of the cells.

The simple interest loan calculator payment schedule is created.

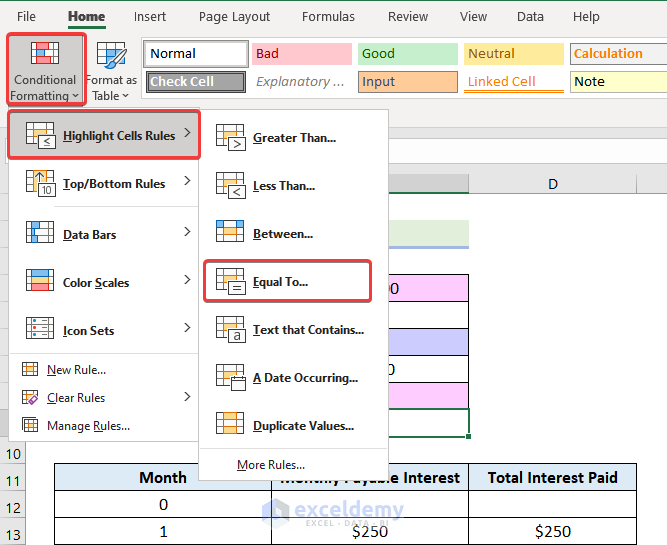

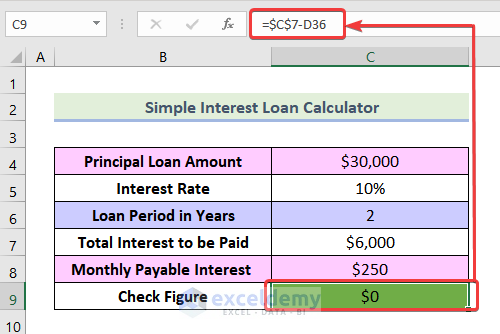

Step 5 – Checking the Figures in the Simple Interest Loan Calculator in Excel

Check whether the Total Interest Paid in the Payment Schedule matches the value in Step 1.

- Select C9 and click Conditional Formatting in the Home tab.

- Select Highlight Cell Rules.

- Choose Equal To.

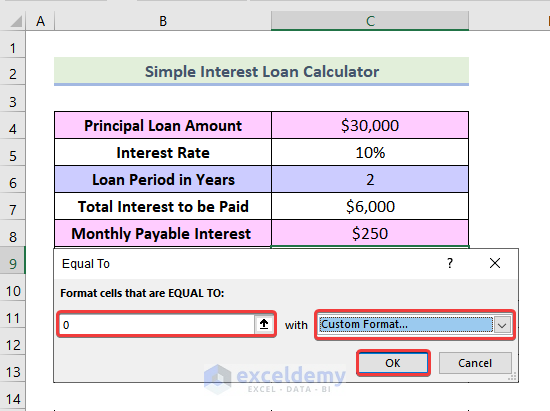

- In the Equal To dialog box, enter 0 as shown below.

- Select a formatting option.

- Click OK.

- In C9 use the following formula.

=$C$7-D36The cell is Green, which means the calculation in the Payment Schedule is correct.

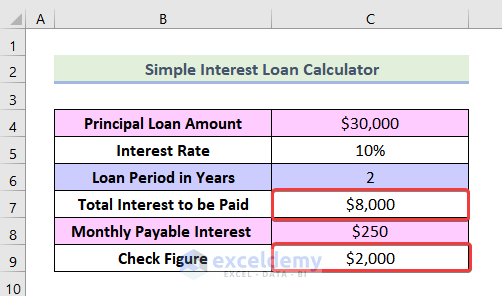

If the calculation was wrong (Total Interest to be Paid ≠ Total Paid Interest), C9 wouldn’t be highlighted in green:

Below the Total Interest to be paid is $8000. Total Interest to be Paid – Total Paid Interest = $2000. C9 is not highlighted in green, which indicates an error.

Things to Remember

- In Step 2, you need to use an Absolute Cell Reference in the starting point of the COUNT function ($B$12:B12) and in $C$6.

- In Step 3, you need to use an Absolute Cell Reference in $C$8.

Download Practice Workbook

Related Articles

- Car Loan Calculator in Excel Sheet

- Create Home Loan Calculator in Excel Sheet with Prepayment Option

- How to Create Loan Calculator with Extra Payments in Excel

<< Go Back to Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!