Download our free 30-Year Amortization Schedule Excel template to generate your own amortization schedule for a 30-year loan. Read the article carefully to learn how to use the template efficiently.

Download the Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

⏷What Is 30-Year Amortization Schedule?

⏷30-Year Amortization Schedule Excel Template

⏵How to Use This Template

⏵30-Year Amortization Schedule with Extra Payments (Regular/Irregular) Excel Template

⏷30-Year Amortization Schedule Excel Template Tips

What Is a 30-Year Amortization Schedule?

30-year amortization schedule is a loan repayment visualization table that shows the due date, due payment, principal paid, interest paid, remaining balance, etc. after each payment of a 30-year loan. From this table, a borrower can easily get a continuous idea of how they’re paying off the loan over the 30-year tenure.

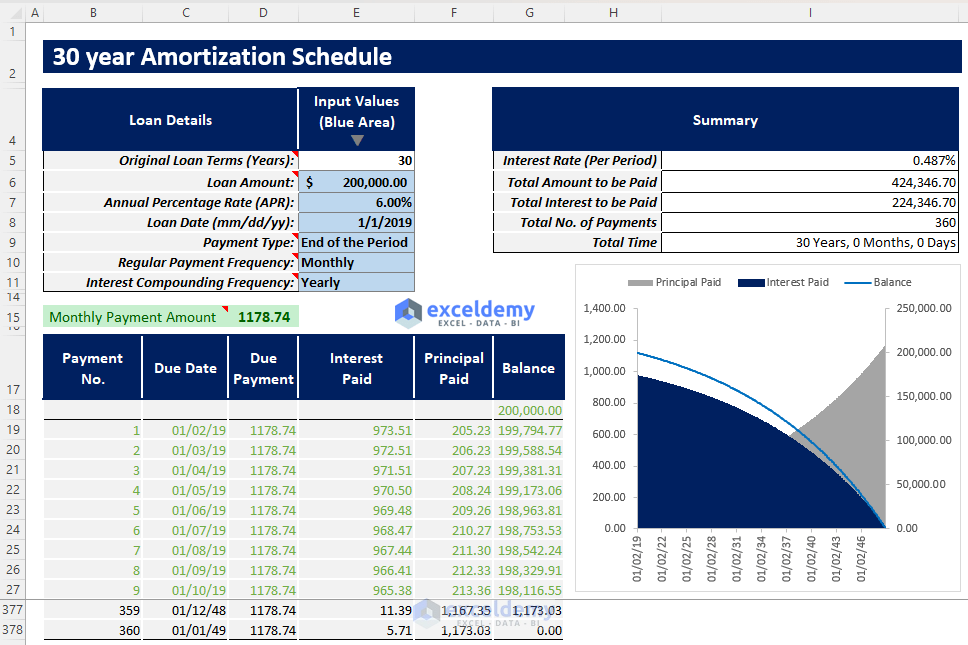

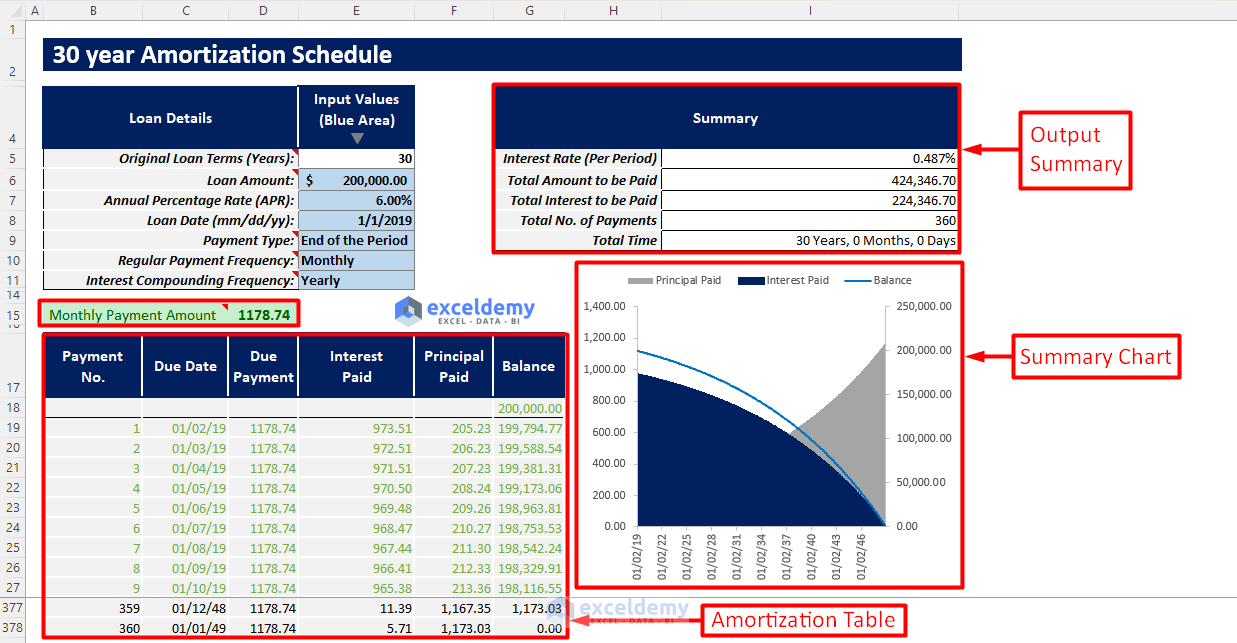

30-Year Amortization Schedule Excel Template

How to Use This Template

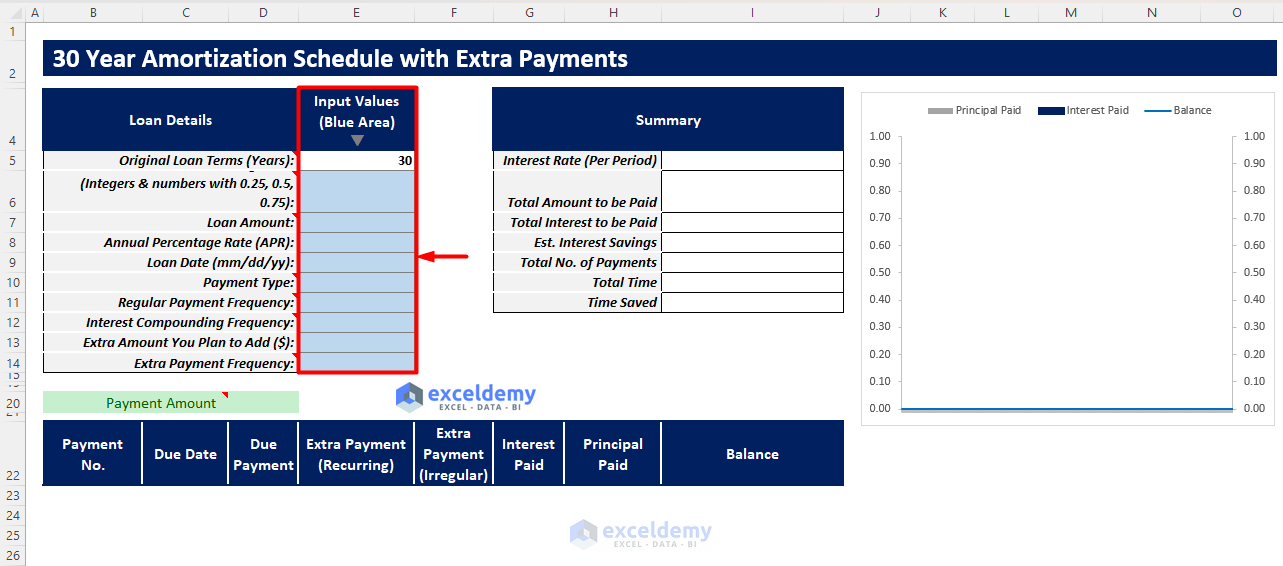

- Open the Payoff Calc. sheet and insert all your inputs in the blue-shaded area of the Input Values column. The Original Loan Terms is fixed as 30 years. The required inputs are:

- Loan Amount

- Annual Percentage Rate

- Loan Date

- Payment Type

- Regular Payment Frequency

- Interest Compounding Frequency

- After inserting all the required inputs, you will get your regular payment amount and an automatically completed amortization schedule.

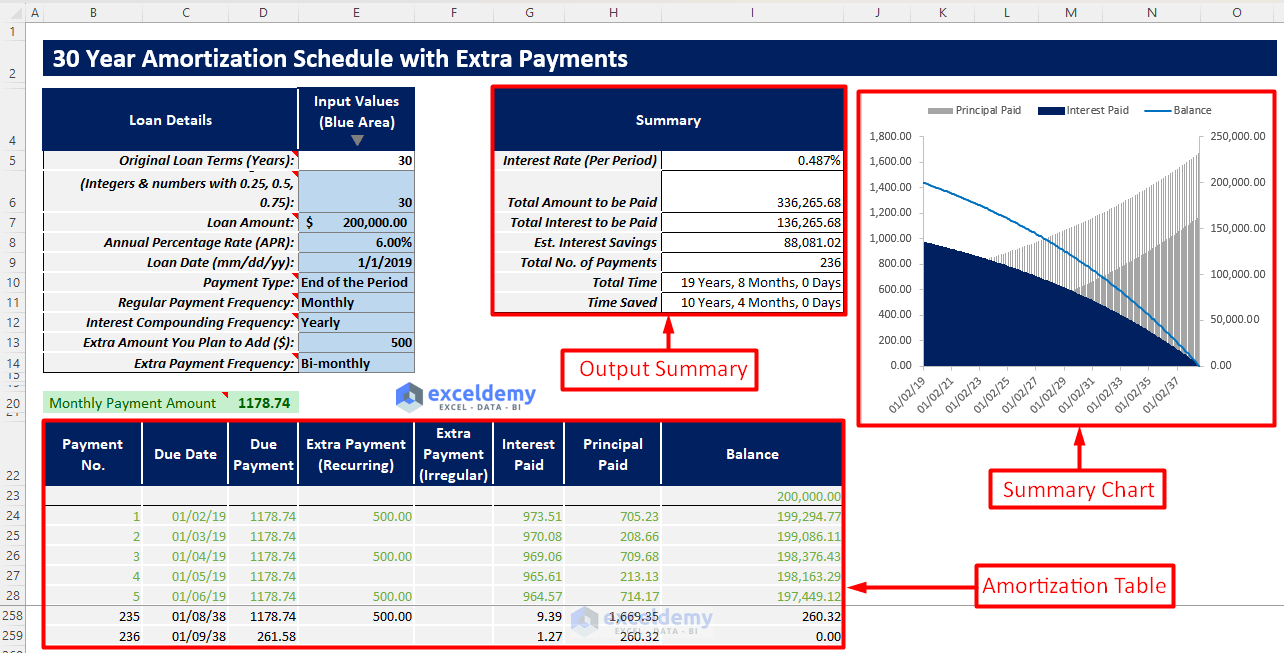

- You will find an output summary containing:

- Interest Rate (Per Period)

- Total Amount to be Paid

- Total Interest to be Paid

- Total No. of Payments

- Total Time

- You will find a summary chart showing the Principal Paid, Interest Paid, and Balance over the loan tenure.

Read More: Loan Amortization Schedule with Variable Interest Rate in Excel

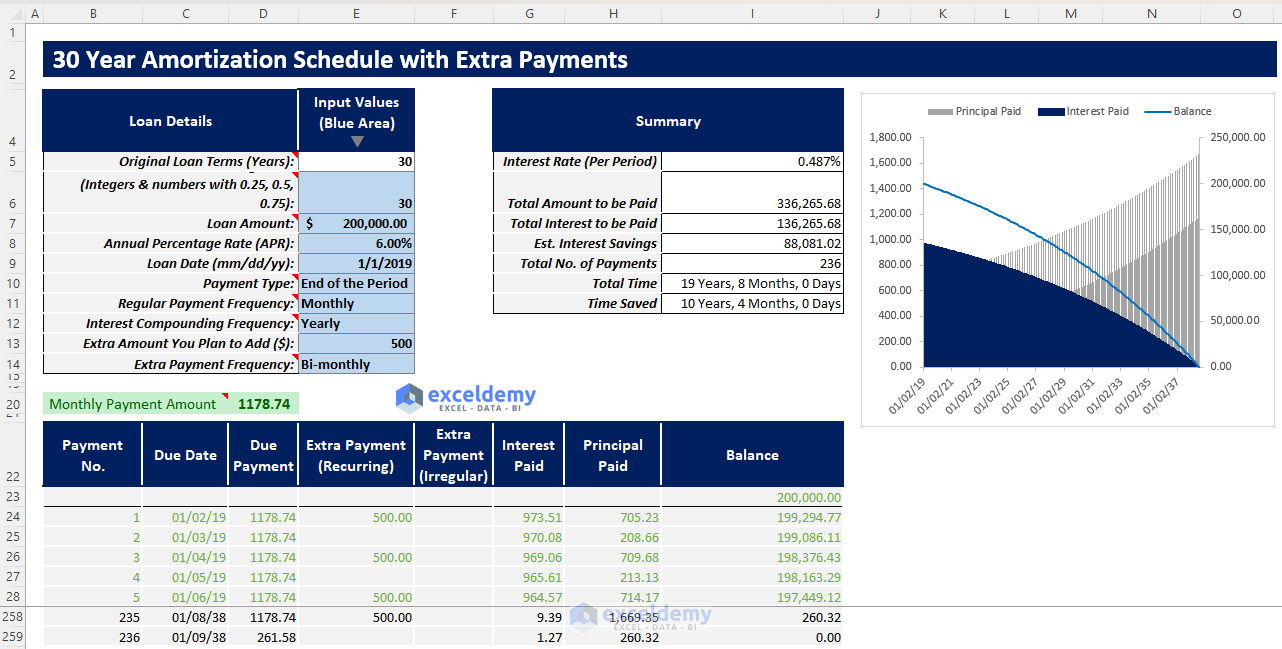

30-Year Amortization Schedule with Extra Payments (Regular/Irregular) Excel Template

This template is quite similar to the previous one. The only difference is you can add any regular or irregular extra payments in this template.

Suppose a borrower has taken a loan for 30 years. After some time, their income increases, and they want to pay off the loan quicker by making some extra payments. This will result in lesser interest to be paid over the loan term and repaying the loan quicker.

How to Use This Template

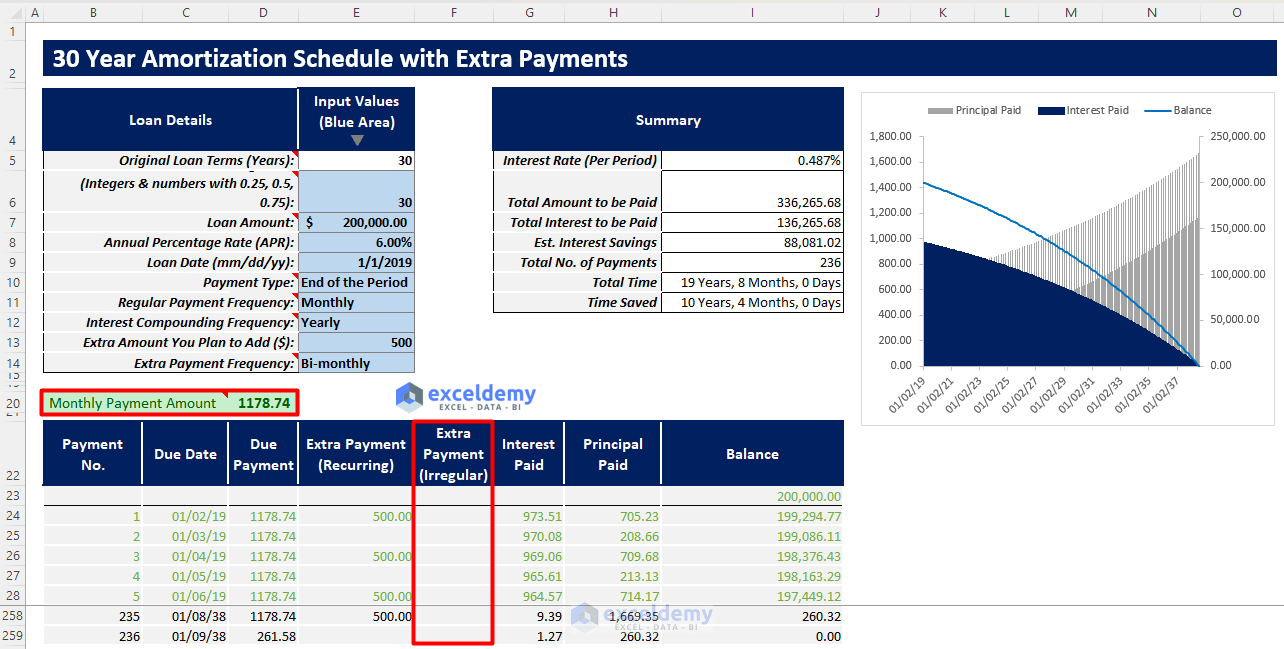

- Open the Payoff Calc. (Extra Payments) template and insert all the required inputs in the blue shaded area of the Input Values column.

- You will find your regular payment amount and amortization table based on your input values and chosen dropdowns.

- You have to insert your additional irregular extra payments in the Extra Payment (Irregular) column of the amortization table.

- You will get your final amortization table and an output summary containing the important outputs like estimated interest savings and time saved.

- You will also see a summary chart showing interest paid, principal paid, and remaining balance over the loan tenure.

Read More: Excel Actual/360 Amortization Calculator Template

30-Year Amortization Schedule Excel Template Tips

- When working with the templates, insert all the required inputs correctly and choose all the required dropdowns properly.

- When inserting values, you can follow the given notes in the loan parameters to insert values properly.

- When choosing interest compounding frequency, remember to choose it as equal to or greater frequency than the regular payment frequency. That is, if you choose regular payment frequency as monthly, then choose the interest compounding frequency as monthly, bi-monthly, semi-annually, or yearly. Do not choose weekly, bi-weekly, or semi-monthly.

- When choosing extra regular payment frequency, choose it as multiple frequency of regular payment frequency. That is, if you choose regular payment as weekly, then choose extra payment frequency as weekly or bi-weekly. Do not choose semi-monthly, monthly, bi-monthly, or yearly.

Related Articles

- EIDL Loan Amortization Schedule Excel

- Excel Weekly Amortization Schedule

- Excel Quarterly Amortization Schedule

- Excel Monthly Amortization Schedule

- Loan Amortization Schedule in Excel with Moratorium Period

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!