The EIDL loan amortization schedule is a great tool to visualize EIDL loan repayment. EIDL stands for “Economic Injury Disaster Loan”. Some borrowers may fall into sudden economic problems and to get rid of those problems they can get an EIDL loan which gives them several deferment periods during the loan repayment.

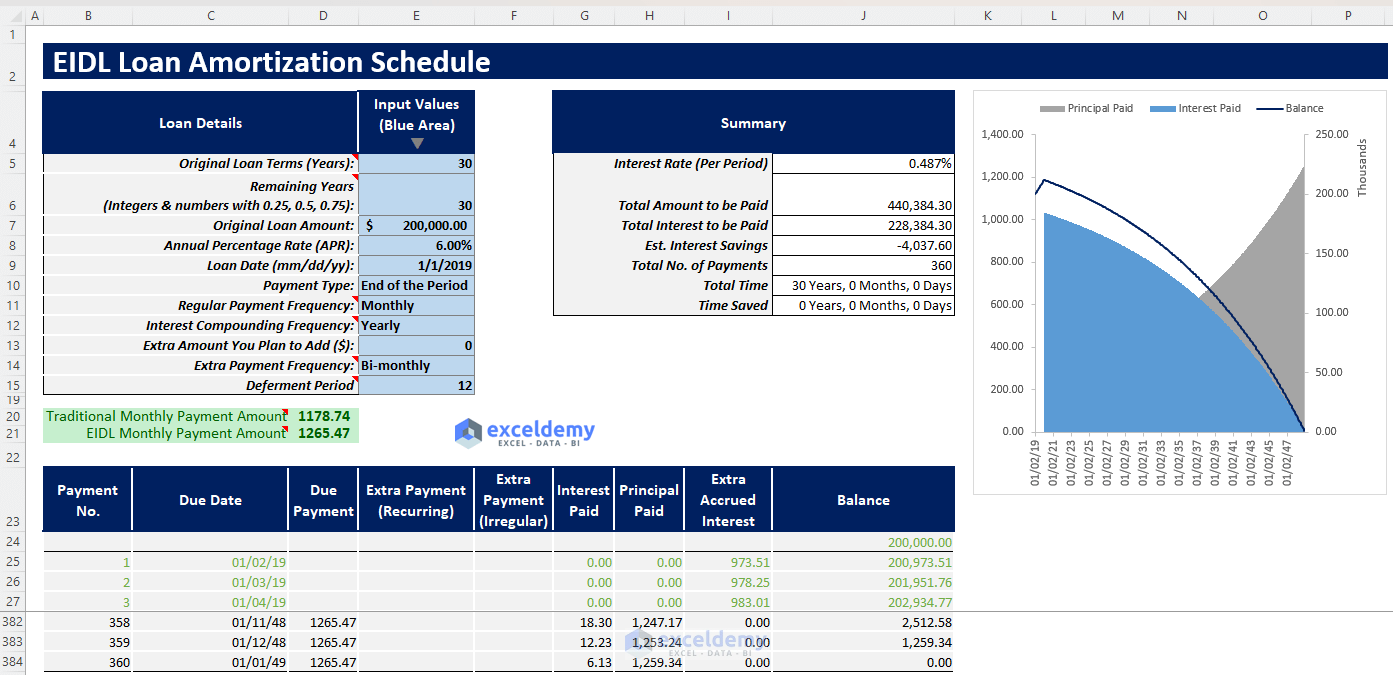

Our free downloadable EIDL loan amortization schedule template will enable you to insert required inputs and will show you all the necessary outputs along with an amortization schedule and a summary chart.

This template would be of great help to students, homeowners, business persons, all kinds of borrowers, and lenders that are looking forward to taking or giving a loan.

Download Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

What Is EIDL Loan?

EIDL stands for “Economic Injury Disaster Loan”. This is a special type of loan that is given to economically distressed persons who need quick money with several approved deferment periods. So, with this loan, the borrowers are relaxed for some specific periods to make no payments for their loan repayment. However, the interest on the remaining balance of the loan continues to be accrued. After the deferment periods end, the borrower starts to pay an increased EMI to repay the loan within the fixed deadline along with the extra accrued interest. Generally, for these kinds of loans, deferment periods start from the first period of the loan.

EIDL Loan Amortization Schedule Excel Template

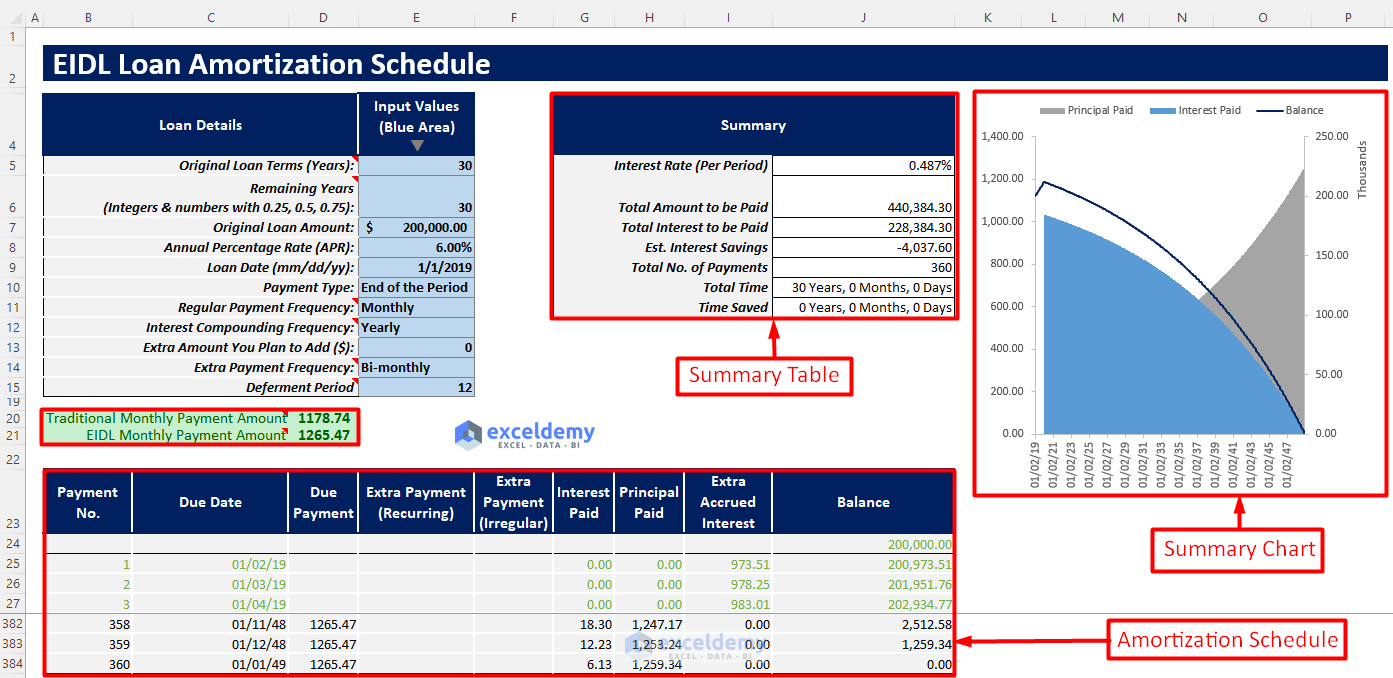

In our template, you will be able to insert all required inputs such as loan term, loan amount, annual percentage interest, regular payment frequency, deferment periods, etc. You will find an output summary table containing all the necessary outputs and an amortization schedule along with a summary chart to visualize your loan repayment process.

How to Use This Template

Follow the instructions below to use this template most efficiently.

Instructions:

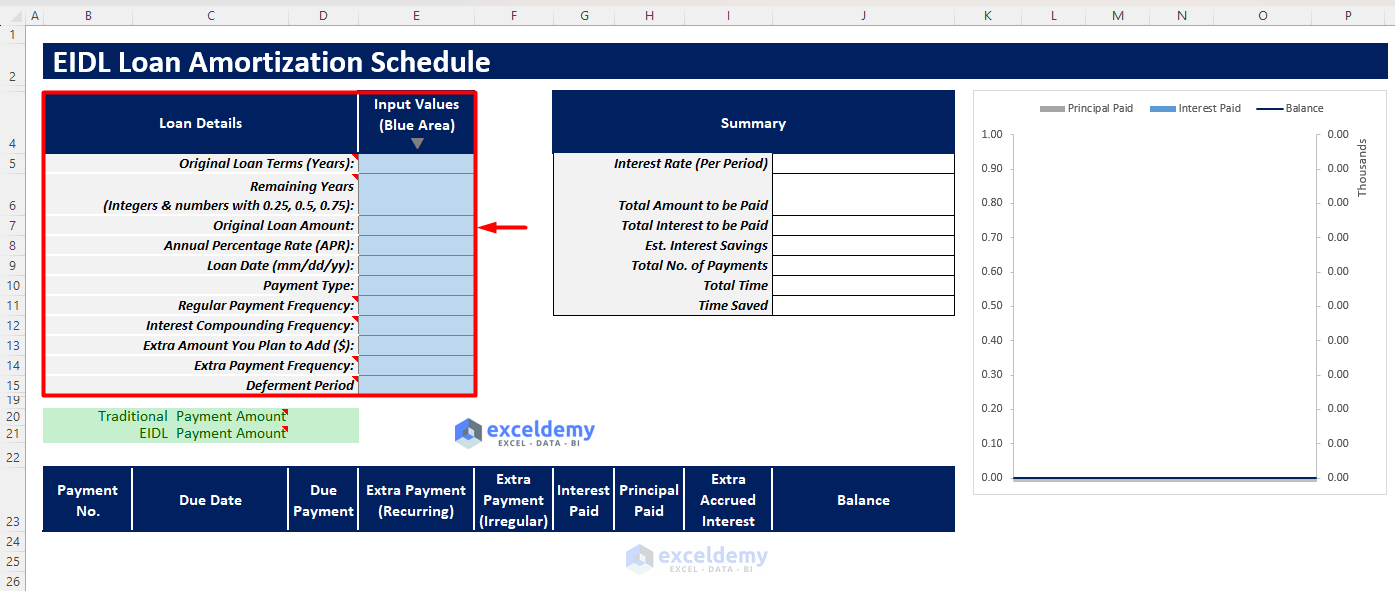

- Open the template and insert all your input values in the blue shaded section according to the Loan Details column.

- After inserting all the inputs and choosing dropdowns properly, you will find your traditional regular payment amount and EIDL regular payment amount (after deferment periods) to repay your loan within the initial deadline.

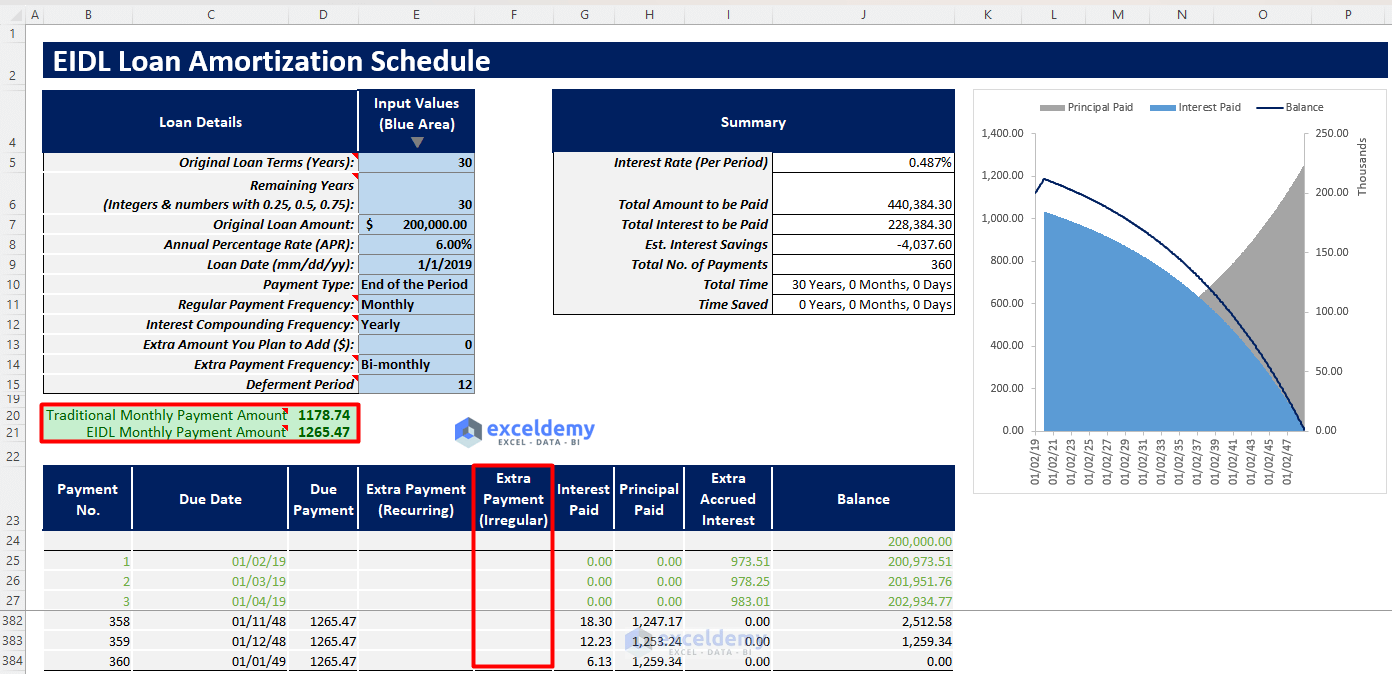

- If you want to add some irregular extra payments, insert the payment amount directly according to the respective payment dates in the amortization table.

- After inserting all your required and desired input values, you will find an amortization table that will show due payments, principal paid, interest paid, and remaining balance after each payment.

- You will also find an output summary table containing the most important output values and a summary chart to show the interest paid, principal paid, and balance trends.

Read More: Loan Amortization Schedule with Variable Interest Rate in Excel

EIDL Loan Amortization Schedule Excel Tips

- Insert all your inputs properly according to the loan parameters.

- When inputting and selecting dropdowns, follow the added notes to avoid complicated mistakes.

- When choosing interest compounding frequency, choose it as larger or equal frequency to the regular payment frequency. And, when choosing extra payment frequency, choose it as multiple frequency of regular payment frequency.

Related Articles

- Loan Amortization Schedule in Excel with Moratorium Period

- Excel Actual/360 Amortization Calculator Template

- Excel 30 Year Amortization Schedule Template

- Excel Weekly Amortization Schedule

- Excel Bi-Weekly Amortization Schedule

- Excel Monthly Amortization Schedule

- Excel Quarterly Amortization Schedule

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!