This article demonstrates a step-by-step guide to making a GST export invoice format in Excel.

GST stands for Goods and Services Tax. Simply put, it is a value-added tax that the government levies on goods and services for domestic consumption.

A GST export invoice contains the following information:

- The supplier’s Name, GSTIN, and Address.

- The Invoice number and Date of its issue.

- The customer’s Name, Delivery Address, and Date.

- The HSN number, item Description, and the applicable tax (GST).

- The item Quantity, and the Total Amount to be paid by the customer.

- A Signature of authorized personnel on behalf of the supplier.

With this in mind, let’s make a GST export invoice template.

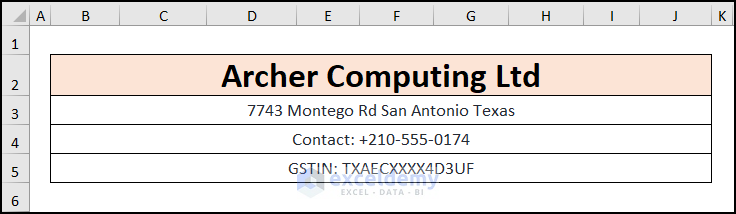

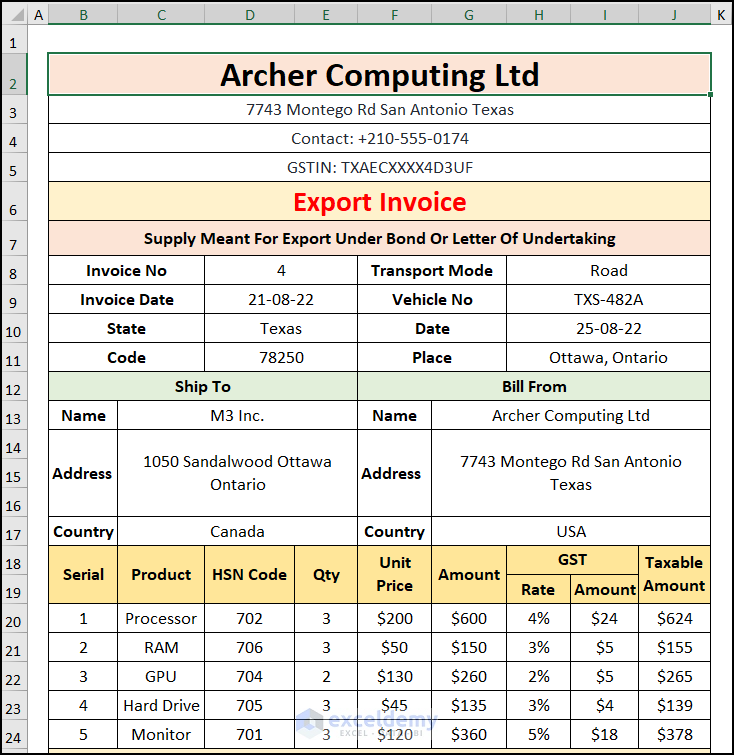

Step 1 – Adding Company Details to the GST Export Invoice

We’ll start by adding the company details at the top of our invoice.

- Enter the company name, here Archer Computing Ltd.

- Include the company Address and the Contact number in cells B3 and B4 respectively.

- Enter the GSTIN number in cell B5.

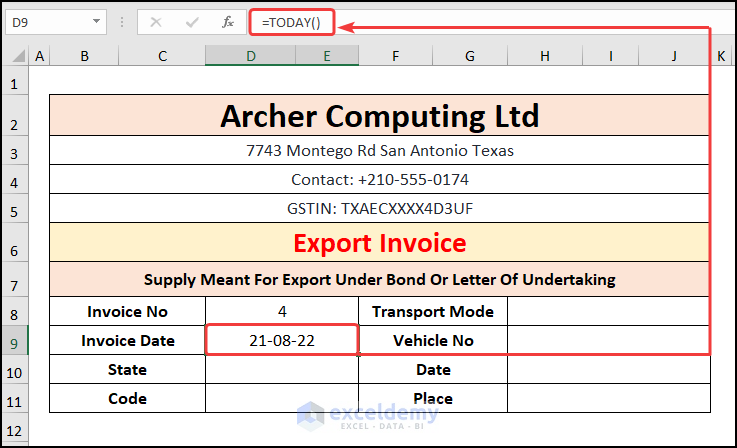

Step 2 – Adding the Invoice Number and Date of Issuance to the GST Export Invoice

Next, we’ll include the Invoice number, the issuing Date, and other information regarding the shipment.

- Add the Invoice Number, here it is 4.

- For the Invoice Date, use Excel’s TODAY function.

- Fill in the other information like Transport Mode, Vehicle Number, Place, etc.

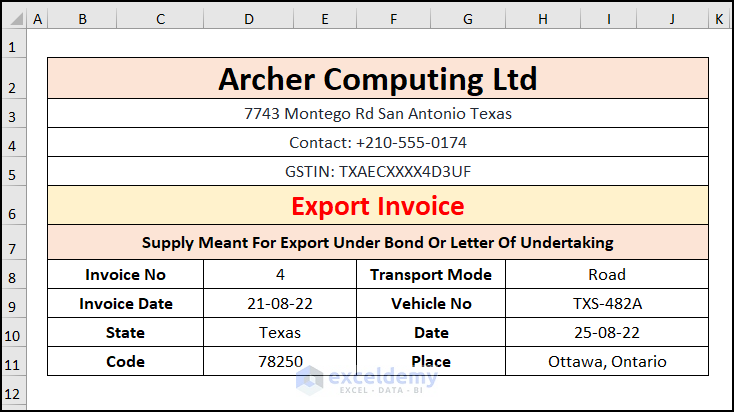

After completing the above steps your invoice should look like the image below.

Read More: How to Create a Tally GST Invoice Format in Excel

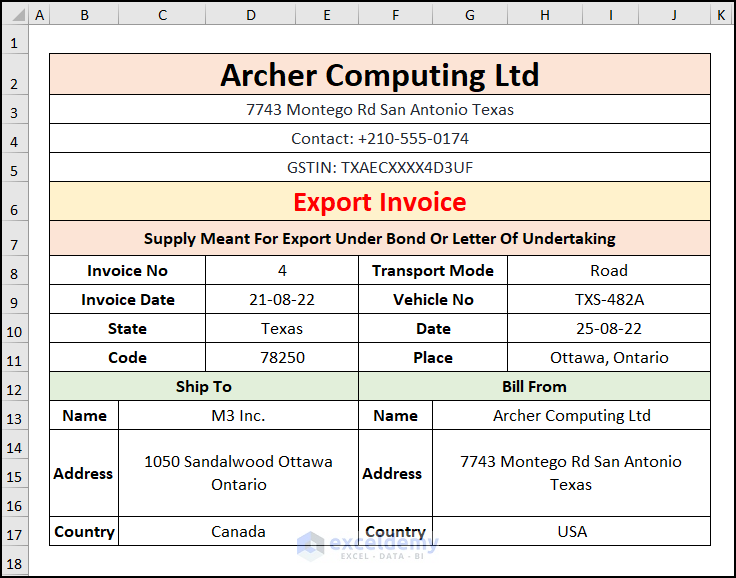

Step 3 – Entering the Supplier and Customer Details into the GST Export Invoice

- Fill in the company Names, Addresses, and Location details of both the supplier and the customer.

The Ship To and Bill From headers refer to the Customer and the Supplier information respectively.

Step 4 – Incorporating the HSN Number, Product, and Tax into the GST Export Invoice

- Enter the Serial Number, Product, and HSN Code.

- List the Quantity and Unit Price for each item.

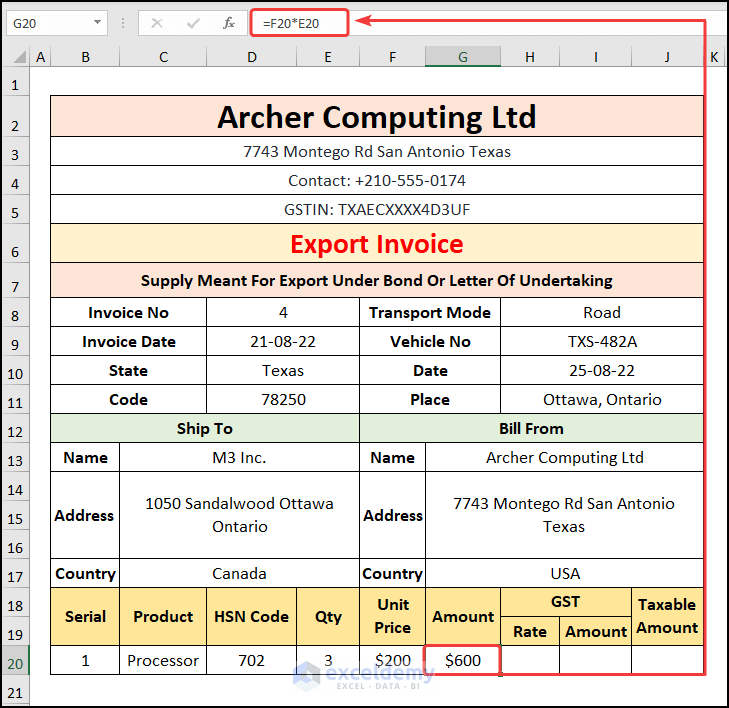

- Go to cell G20 and calculate the Amount by using the formula below:

=F20*E20

In this formula, cell F20 represents the Unit Price of the Processor while cell E20 indicates the Quantity sold.

- Enter the GST Rate for the product. In this case, 4%.

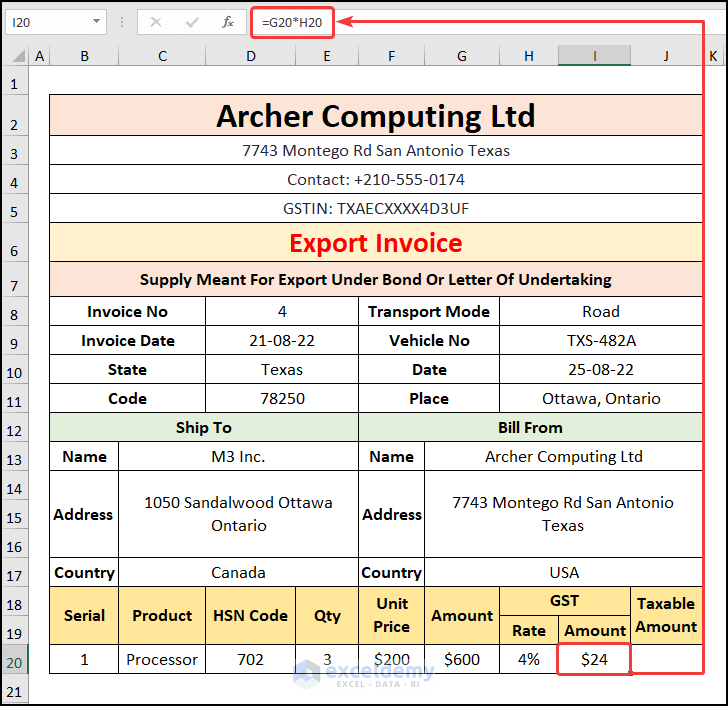

- In cell I20, calculate the GST Amount with the expression below:

=G20*H20

In this formula, cell G20 refers to the Amount $600, and cell H20 points to the Rate of 4%.

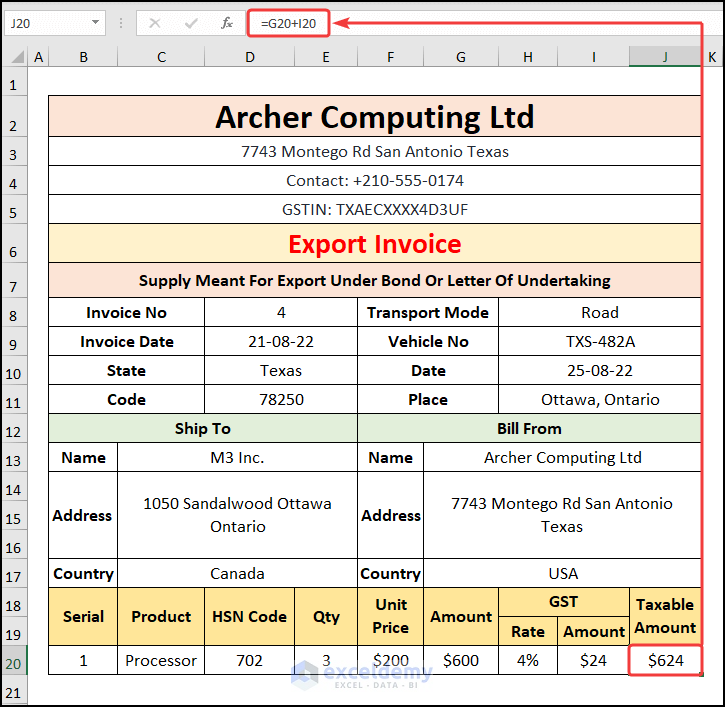

- Calculate the Taxable Amount by adding the values in cells G20 and I20.

Here, the G20 and I20 cells represent the sales Amount and the GST Amount respectively.

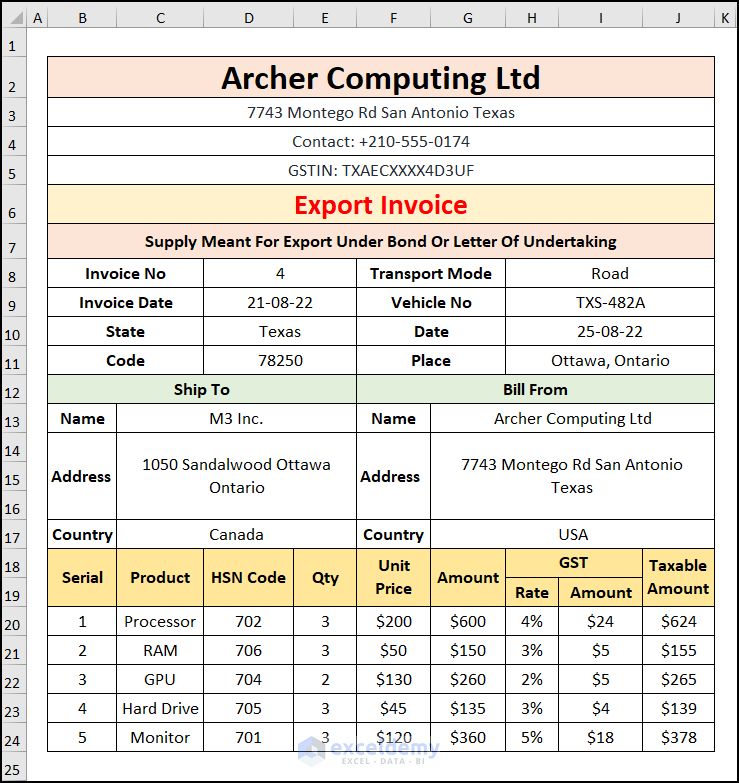

- In a similar fashion, enter the details for the other products.

The output should look like the picture below.

Read More: How to Create GST Rental Invoice Format in Excel

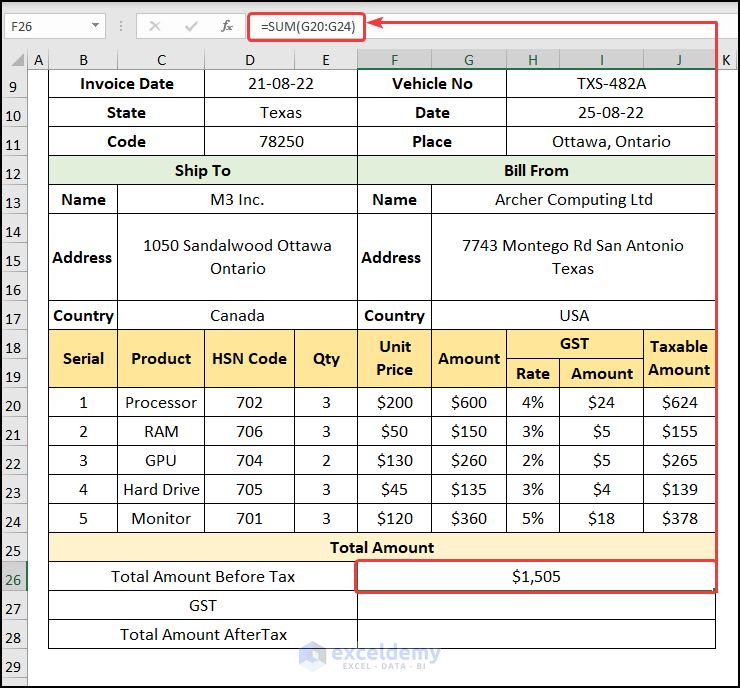

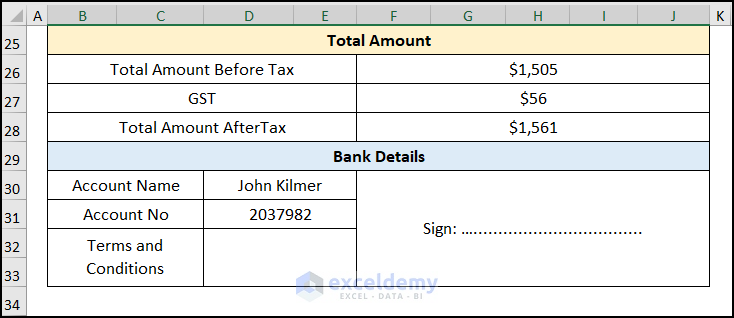

Step 5 – Calculating the Total Amount Including Tax in the GST Export Invoice

- In cell F26, compute the Total Amount Before Tax using the SUM function:

=SUM(G20:G24)

Here, the G20:G24 range of cells represents the sales Amount of each item.

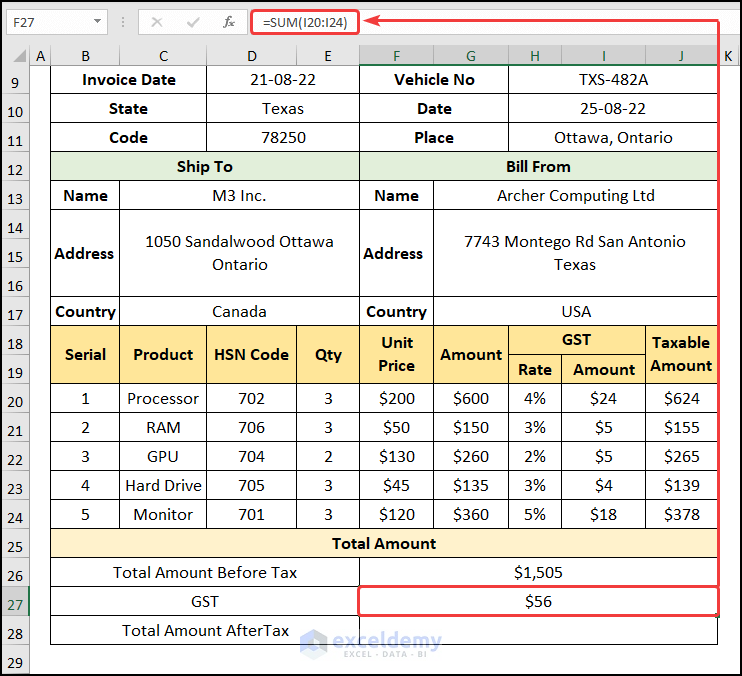

- In cell F27, calculate the GST utilizing this SUM function:

=SUM(I20:I24)

Here, the I20:I24 range of cells points to the GST Amount.

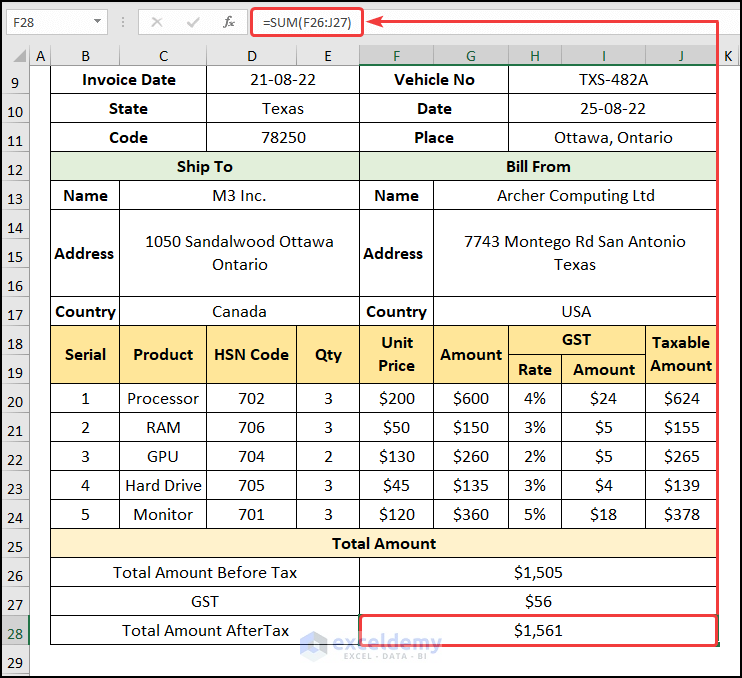

- In cell F28, obtain the Total Amount After Tax as follows:

=SUM(F26:J27)

In this expression, the F26:J27 range of cells represents the Total Amount Before Tax and the GST.

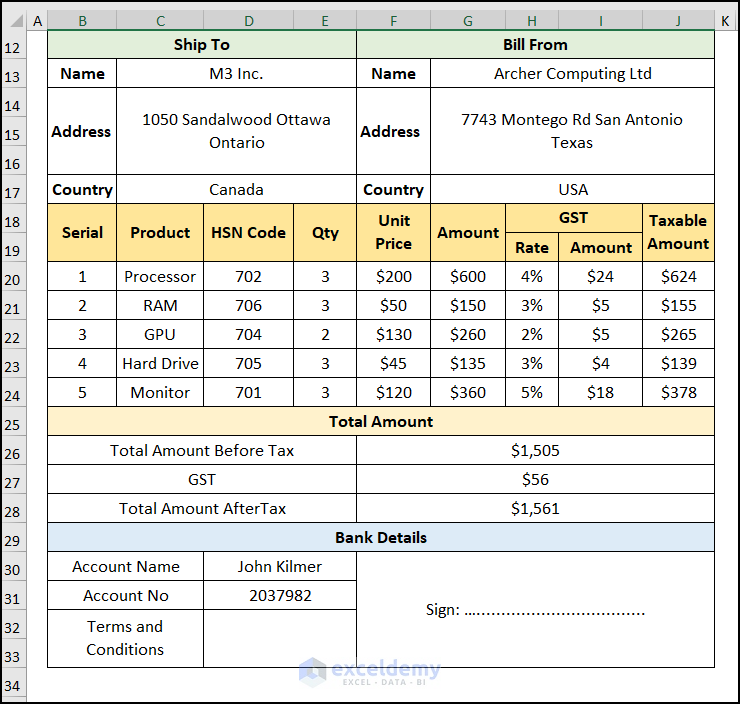

- Add Bank Details and keep space for Signing the document at the bottom of the invoice.

That’s it, our GST export invoice is complete and ready for use.

Read More: How to Create Proforma Invoice for Advance Payment in Excel

Download Practice Workbook

Related Articles

- Tally Sales Invoice Format in Excel

- Proforma Invoice Format in Excel with GST

- Create Non GST Invoice Format in Excel

- How to Create GST Bill Format in Excel with Formula

<< Go Back to Excel Invoice Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!