India introduced the GST system to replace some of its messy indirect tax systems. This article will discuss the components of the GST system and provide a list of GST state codes in Excel.

Download the List

You can download the Excel sheet from here.

What Is GST?

Goods and Services Tax (GST) is an indirect tax on the provision of goods and services. It is a thorough, multistage, destination-based tax. It is thorough because it has replaced nearly all indirect taxes, with the exception of a few state taxes. Due to its multi-staged nature, the GST is levied at each stage of production. However, because it is a destination-based tax, rather than an origin-based tax like earlier ones, the government collects from the point of consumption rather than the place of origin.

What Is GST State Code?

The first two digits of the state code where the business entity is registered make up the GST number given to the taxpayer. The location of the company entity and where manufacturing is done is also indicated by the state code. As a result, it is the special code given by the GST law to each state in India. The government can categorize the registered taxpayers in each state using this code.

Why Do We Need GST State Code?

Short, numerical codes are advantageous since they help to avoid the confusion that results from writing an alphabetic GST state code in GST invoices and GST return data. Processing invoices, identifying the relevant GST liabilities, and submitting GST returns would all experience issues as a result. Similar to this, once taxpayers are aware of their jurisdiction, they can benefit much from transparency. They would be able to communicate their complaints to this jurisdictional officer, who would also be able to resolve any disputes regarding jurisdiction between the center and the state.

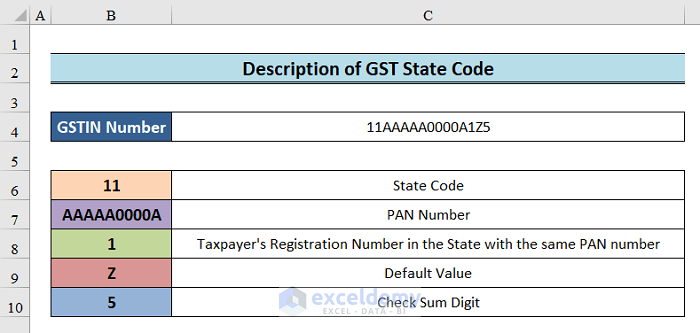

Description of GST State Code

According to the GST law, every state has a unique numeric code. It will be incorporated with the Goods and Service Tax Identification Number(GSTIN). This is a 15-digit code unique to every taxpayer. A sample GSTIN code is as follows,

11AAAAA0000A1Z5

We will break it down part by part in the following sections.

State Code

According to the Indian Census 2011, the first two digits stand for the state code. Each state has its own code. For example, the state code of Delhi is 07, whereas that of Punjab is 03.

PAN Number

The next ten digits (AAAAA0000A) will be the Permanent Account Number (PAN) of a taxpayer. A 10-digit unique identity alphanumeric number called a “Pan Card” is given to Indians, typically to those who pay taxes.

Taxpayer’s Registration Number

The 13th digit (in this case 1) denotes the taxpayer’s registration in the same state under the same PAN.

Default Value

“Z” is a default value.

Check Code

5 is the check code. The check code will be the last digit. It could be a letter or a number.

Here, we have applied cell formatting to highlight the cells to make the code break down discernible.

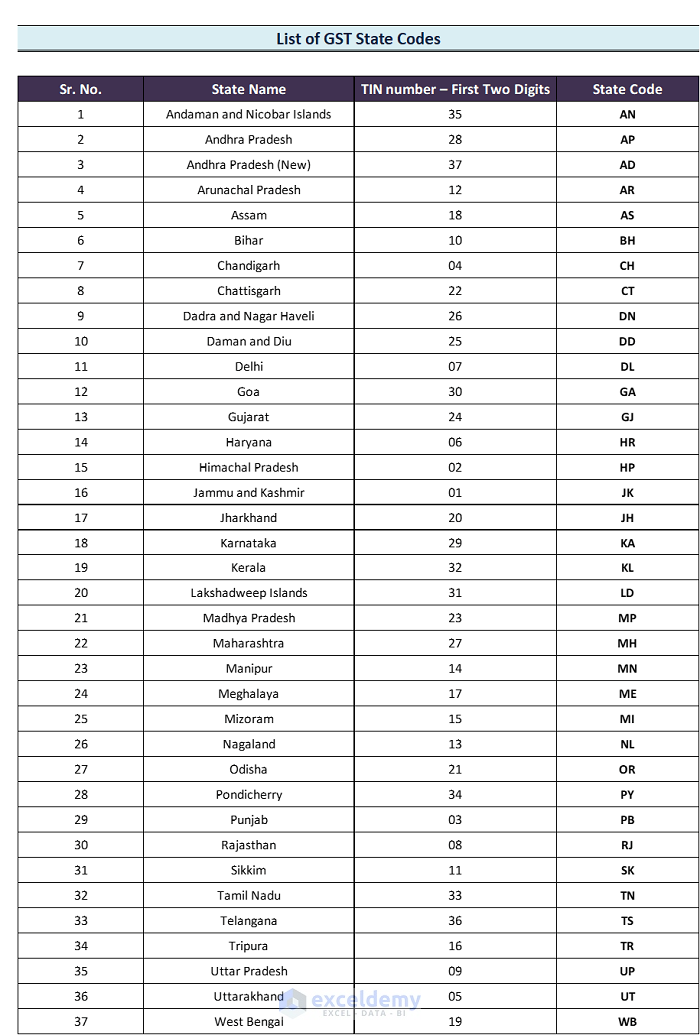

List of GST State Codes in Excel

According to the GST law, every state has a unique numeric two-digit code. Here is a list of all the states with their GST codes. We have used cell formatting to highlight the state codes.

We used the Copy as Picture command to take this Excel snap of the GST state codes.

<< Go Back to Excel Sample Data | Excel Data for Analysis | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!