Method 1 – Apply Simple Depreciation Formula

Steps:

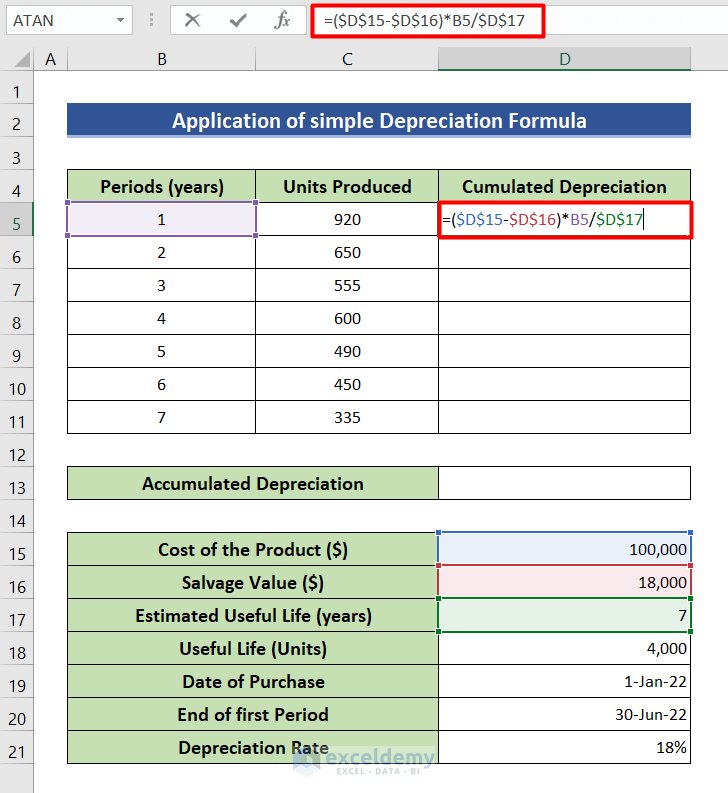

- Click on the left button of the mouse to select empty cell D5.

- Write down the following formula in the formula bar.

=($D$15-$D$16)*B5/$D$17- $D$15 refers to the value of cell D15, $D$16 refers to the value of cell D16 and $D$17 is an absolute reference to cell D17.

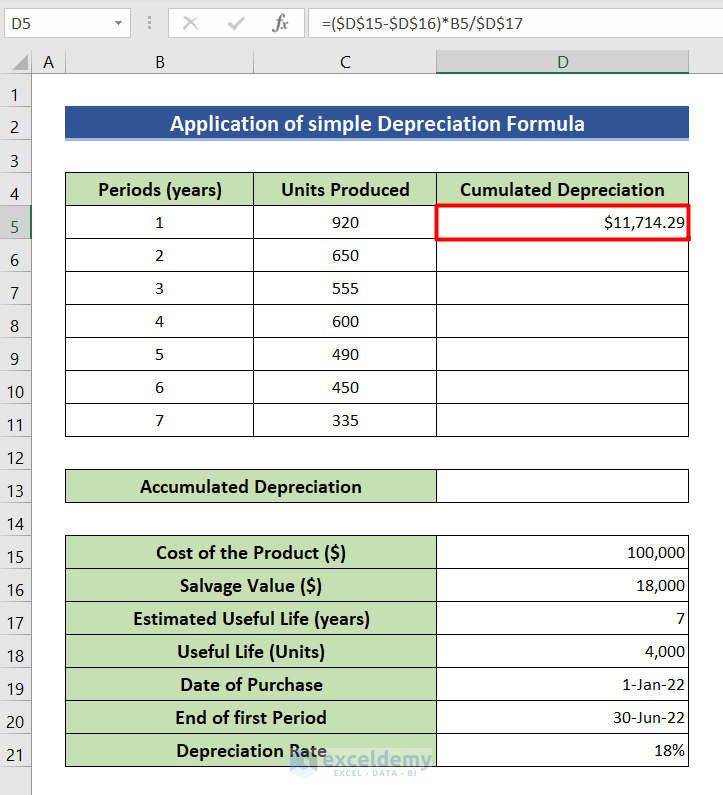

- Press the Enter button to see the cumulative depreciation of the period of year 1.

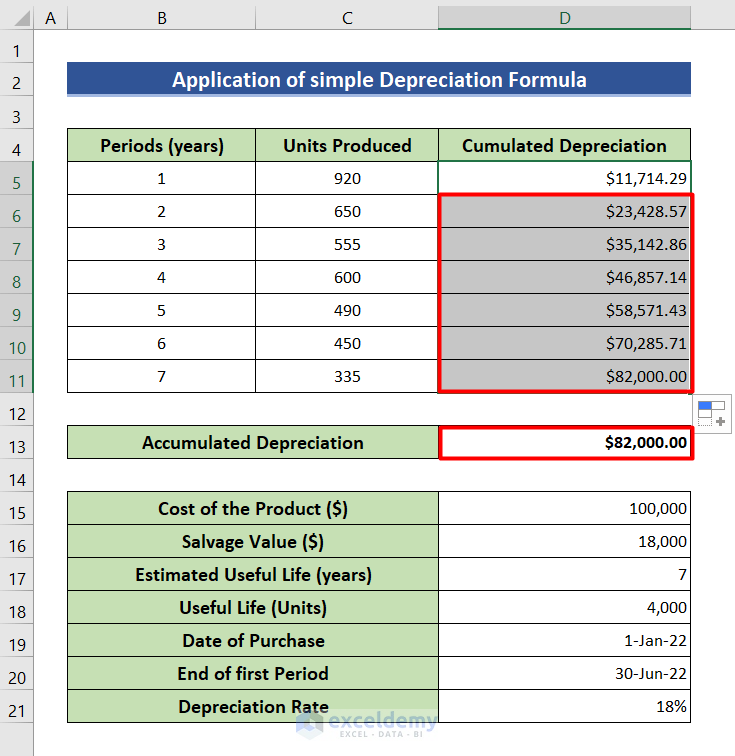

- To get the cumulative depreciation value for periods 2 to 7 years, double-click the bottom right corner of cell D5.

- Cell D11 and D13 will show the cumulative depreciation of the 7-year period which is also the accumulated depreciation.

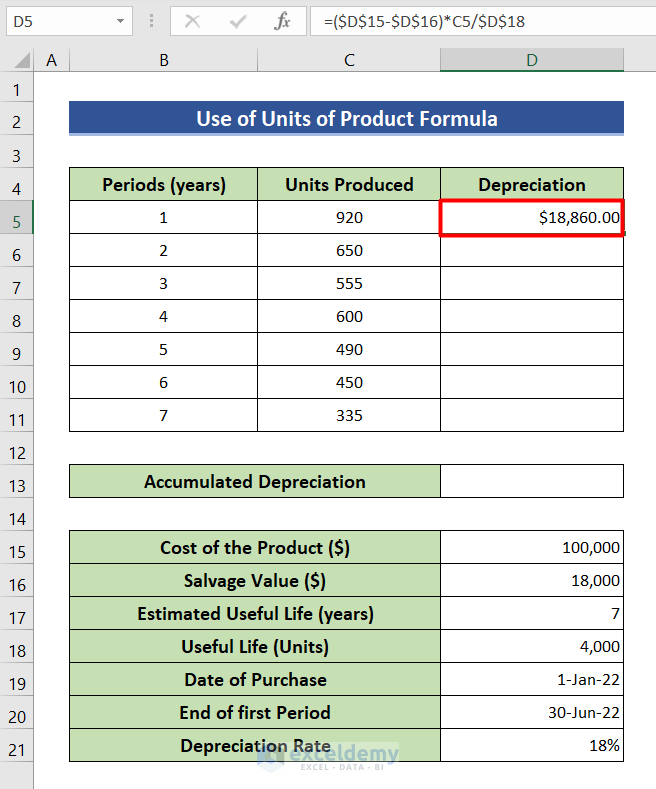

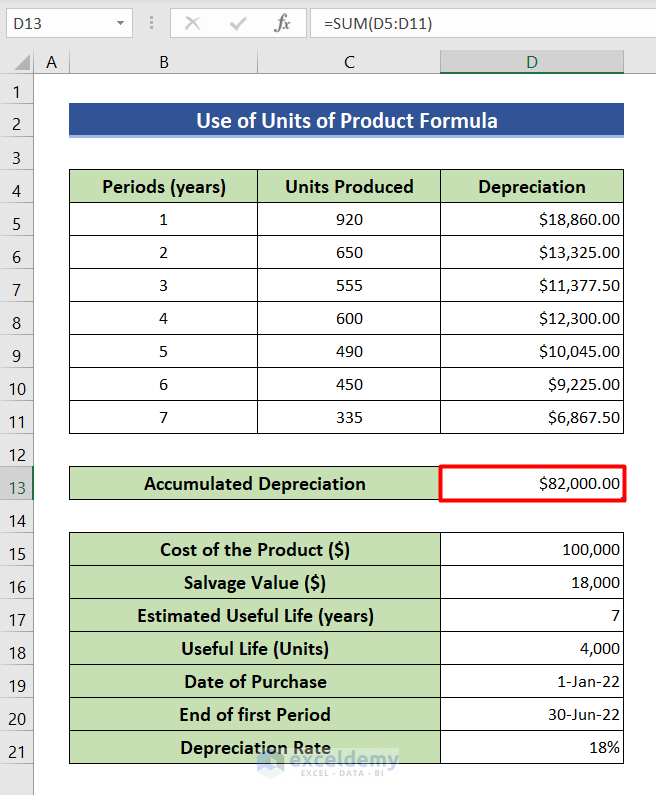

Method 2 – Use the Units of Production Formula

Steps:

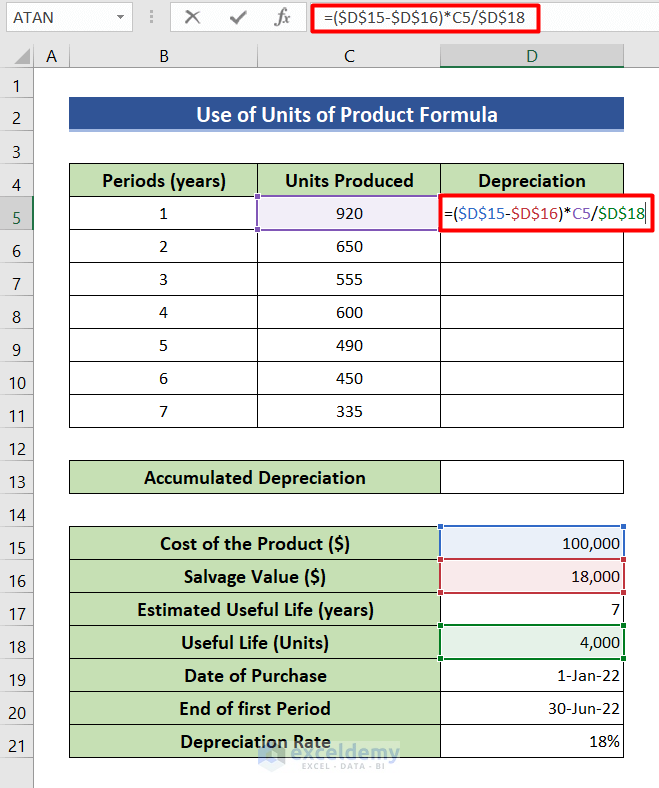

- Bring your cursor to cell D5 and click on it.

- Type the following formula in that cell.

=($D$15-$D$16)*C5/$D$18- In this formula, $D$15, $D$16, $D$18 are absolute references to cells D15, D16, and D18, and C5 refers to the value of cell C5.

- Hit Enter. Depreciation of the 1st period will be shown in cell D5.

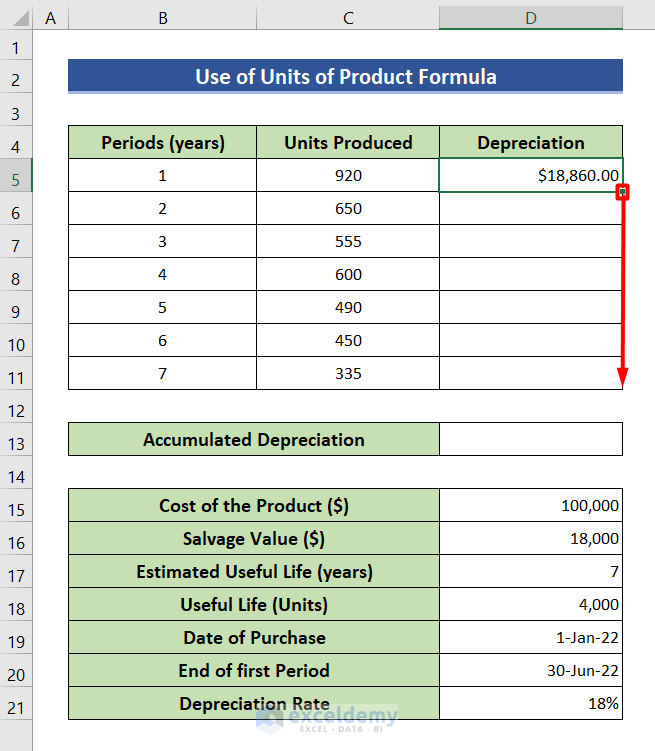

- Drag the bottom right corner of cell D5 to cell D11.

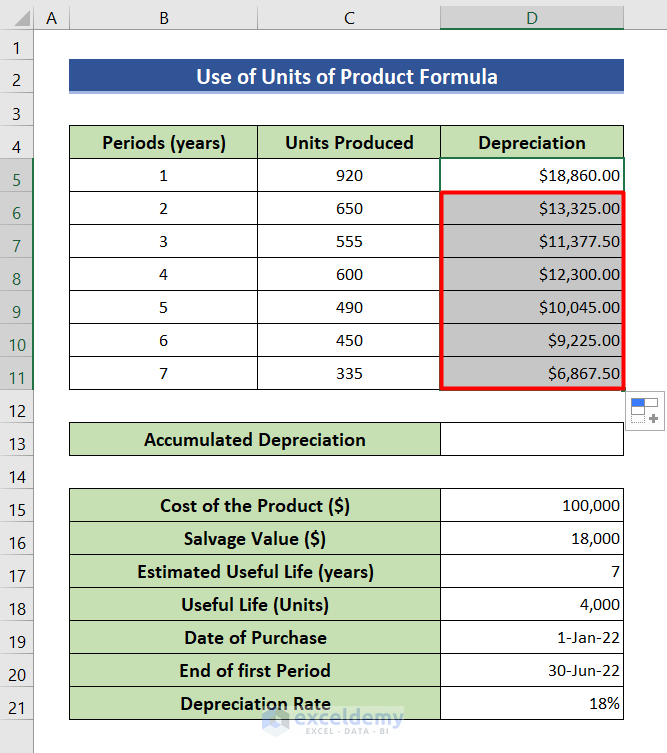

- Get the results for all 7 years.

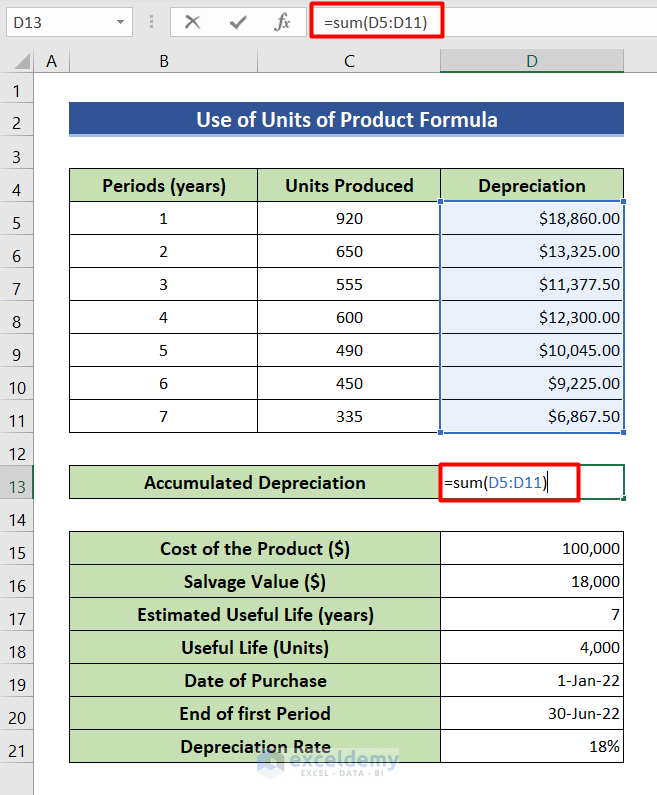

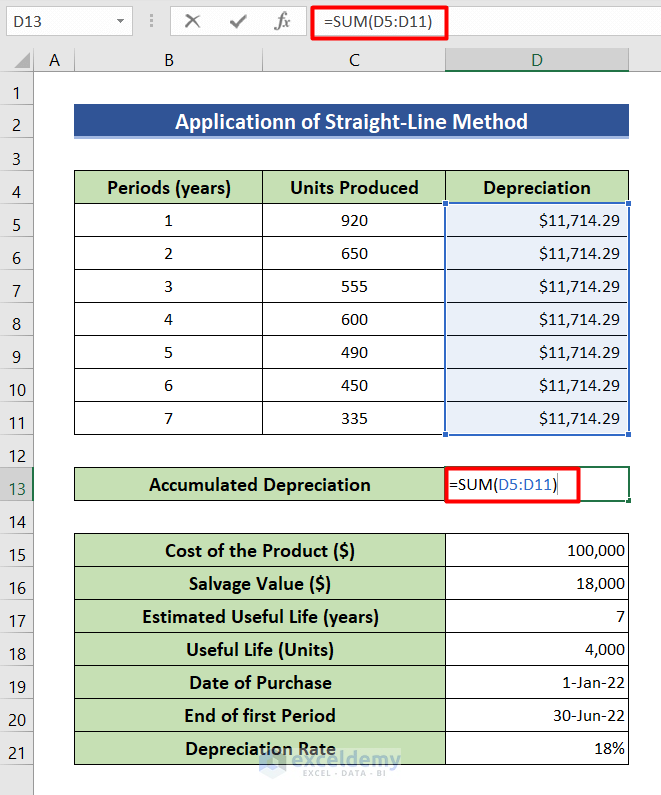

- Find the value of accumulated depreciation, go to cell D13 and write down the following formula.

=SUM(D5:D11)- D5:D11 refers to all cell values from D5 to D11.

- The SUM function will add up all the depreciation of 7 years and give the accumulated depreciation.

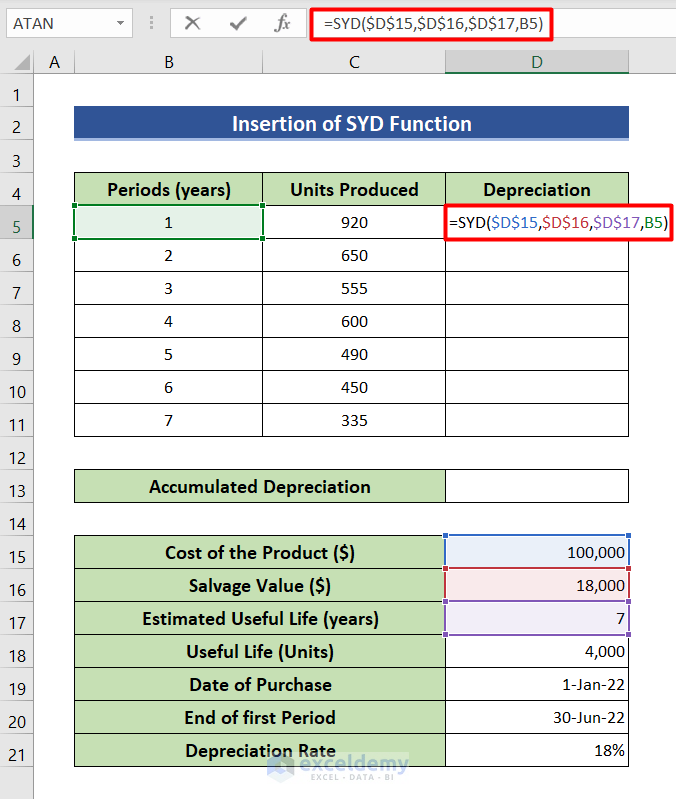

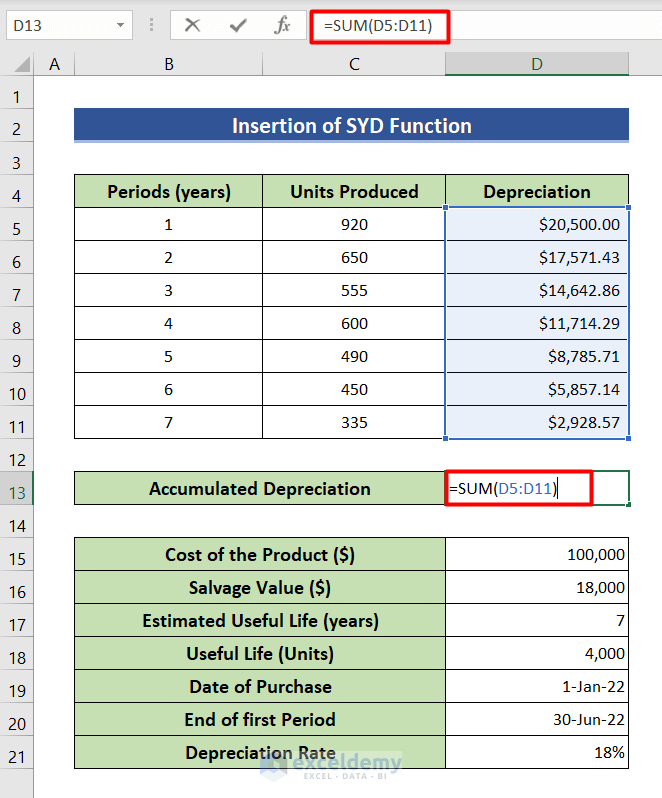

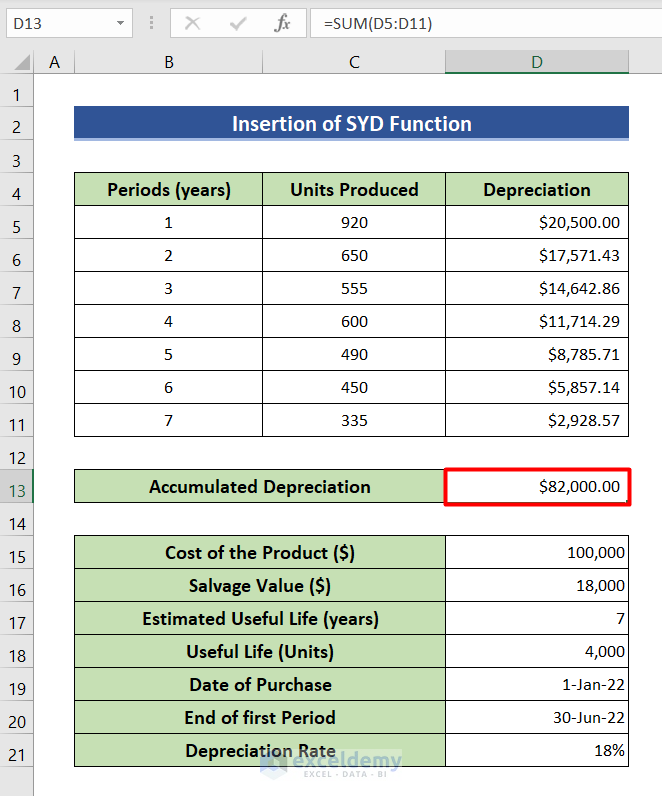

Method 3 – Insert SYD Function

Steps:

- Select cell D5 and write down the formula given below.

=SYD($D$15,$D$16,$D$17,B5)- $D$15, $D$16, $D$17 are absolute references to cells D15, D16 and D18 respectively and B5 refers to cell B5.

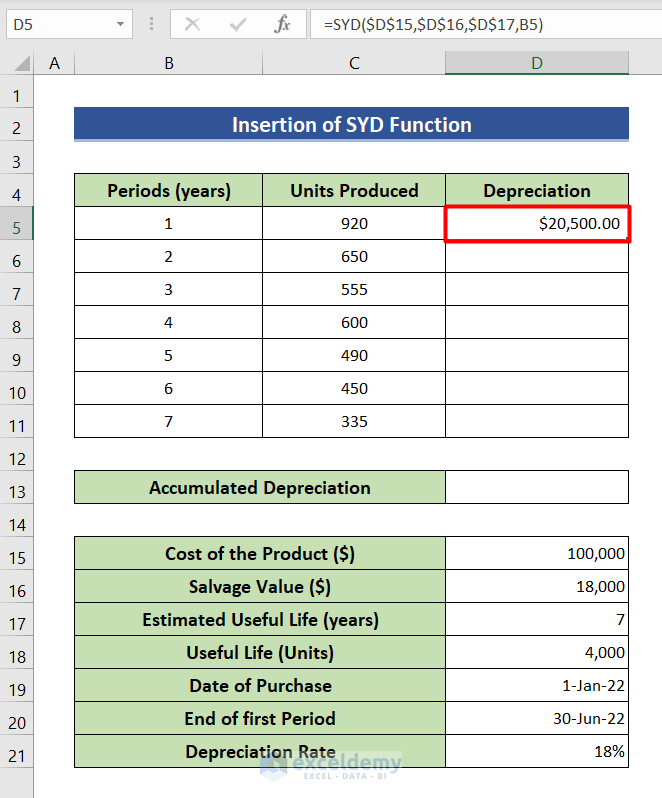

- Hit the Enter button to see the depreciation in cell D5.

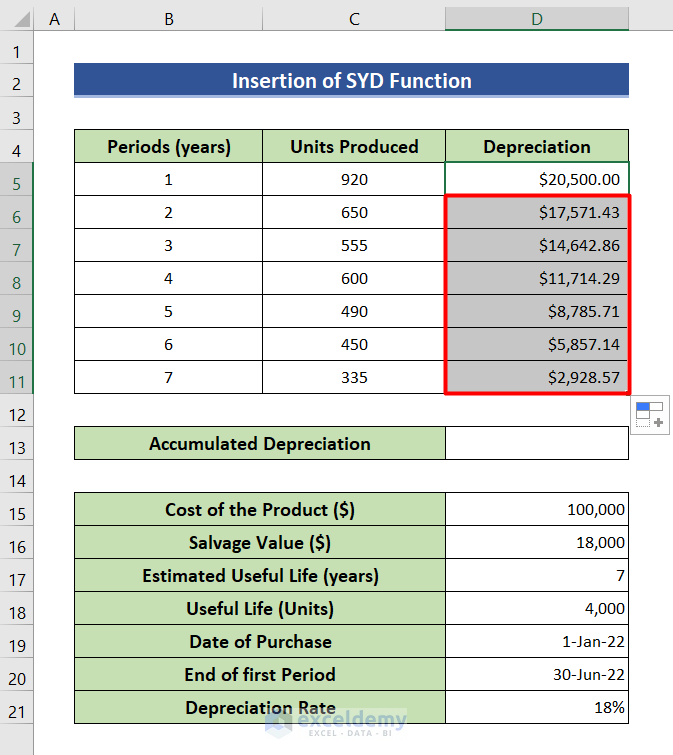

- Double-click on the bottom right corner of cell D5 to get the depreciation value for all data.

- See how to determine the accumulated depreciation from all the depreciation values. Type the sum formula in cell D13.

=SUM(D5:D11)- D5:D11 refers to cells D5 through D11.

- If you press Enter, you will get the accumulated depreciation in cell D13.

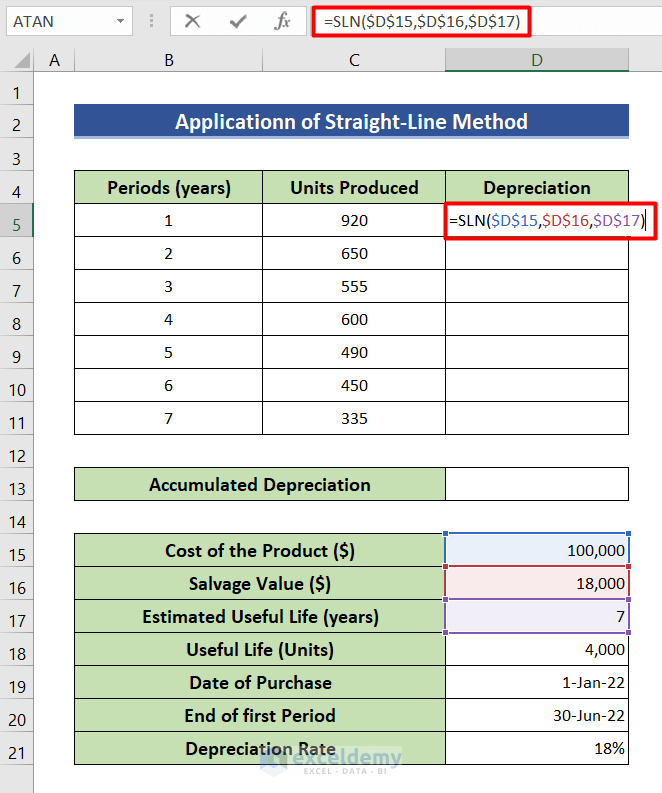

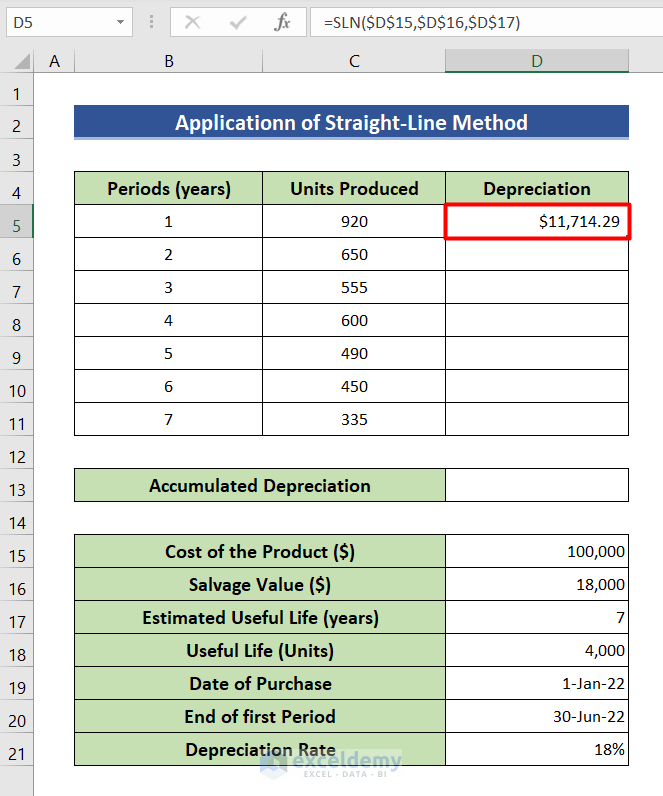

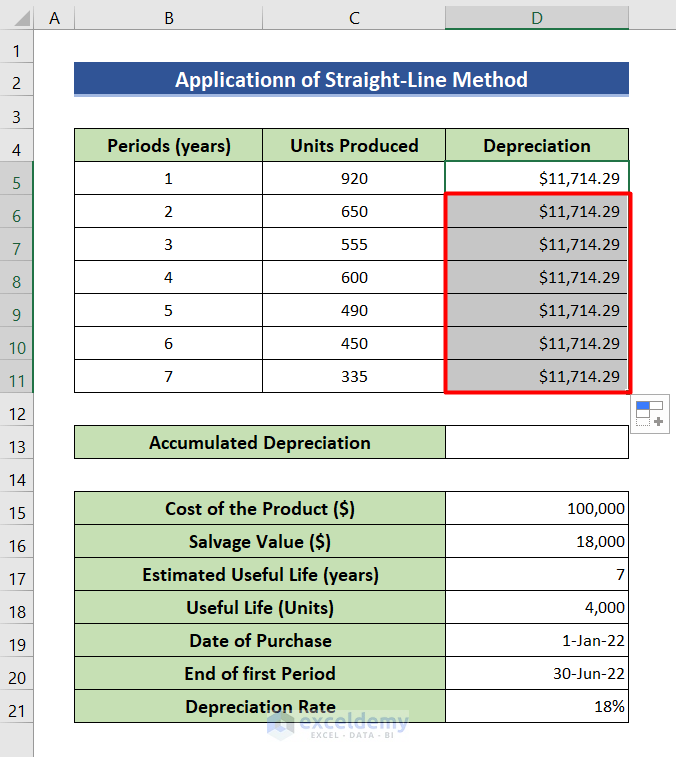

Method 4 – Apply Straight-Line Method

Steps:

- Uuse your mouse to select D5.

- Now you need to type the SLN formula in that cell.

=SLN($D$15,$D$16,$D$17)- $D$15 refers to the value of cell D15, $D$16 refers to the value of cell D16 and $D$17 is an absolute reference to cell D17.

- To get the result in cell D5, press Enter.

- Bring your cursor to the bottom right corner of cell D5 and click the left button of the mouse two times.

- This will give you depreciation value for periods 2 through 7.

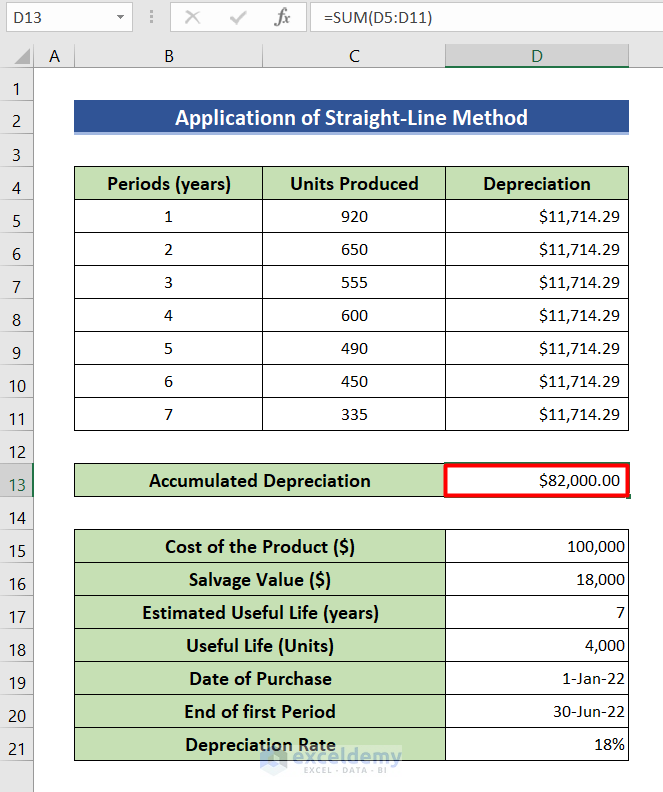

- Use the SUM function to determine the accumulated depreciation. Use the following formula, where D5:D11 refers to the depreciation of cells D5 to D11.

- Hit Enter and see the desired accumulated depreciation value.

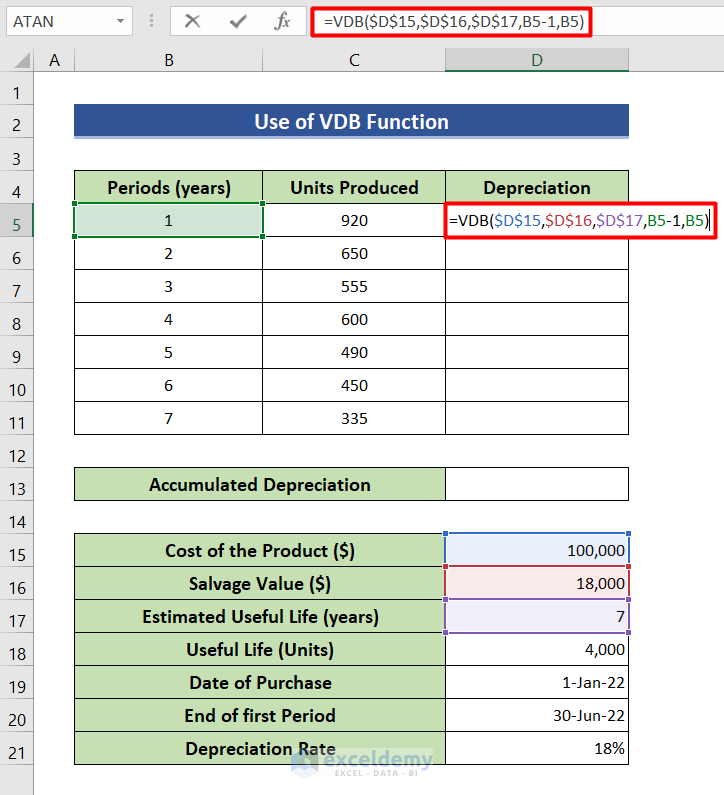

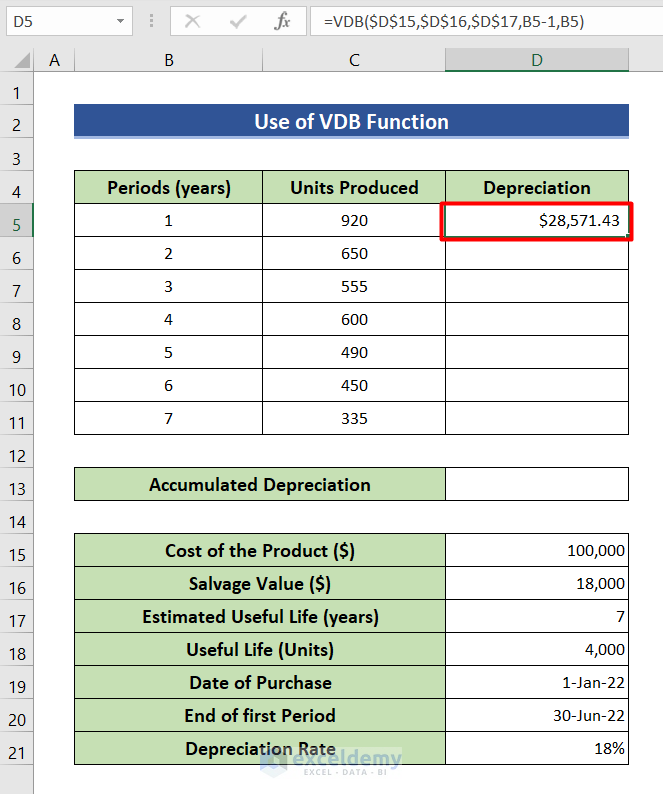

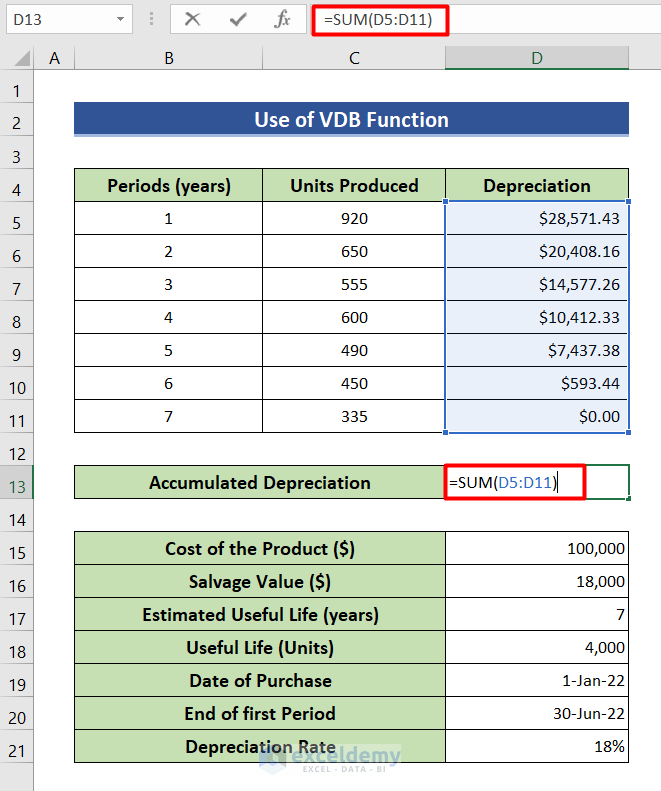

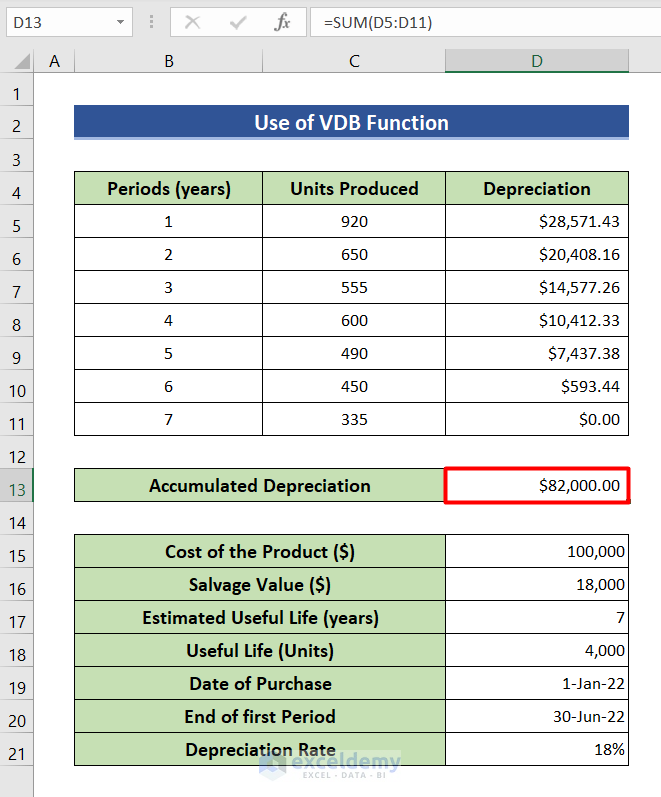

Method 5 – Utilize VDB Function

Steps:

- Go to cell D5 and click on it.

- Write down the following formula in the formula bar.

- Hit Enter on the keyboard to find out the depreciation of 1st year.

- Double-click the bottom right corner of cell D5. This will give you depreciation for the whole period.

- Use the following sum formula to calculate accumulated depreciation.

=SUM(D5:D11)- D5:D11 refers to all the values of D5 to D11.

- Press Enter and get the accumulated depreciation.

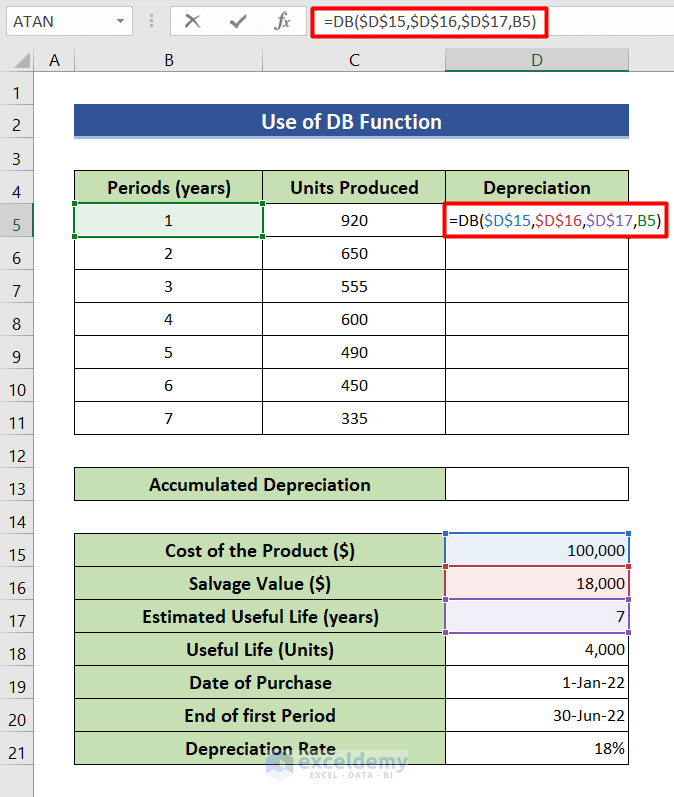

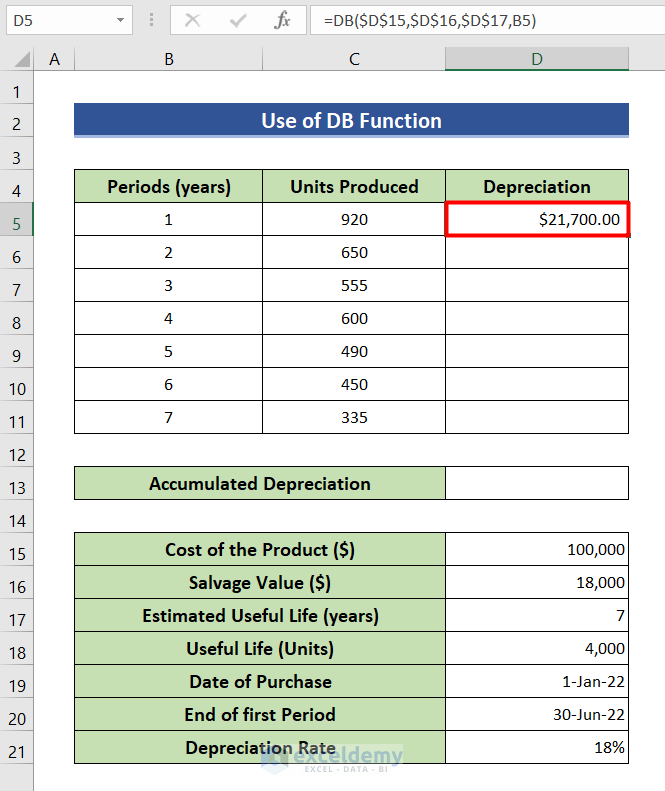

Method 6 – Use DB Function

Steps:

- Select cell D5 and type the below formula.

=DB($D$15,$D$16,$D$17,B5)- $D$15, $D$16, $D$17 are absolute references to cells D15, D16 and D17 respectively and B5 refers to the value of cell B5.

- Hit Enter and get the result in cell D5.

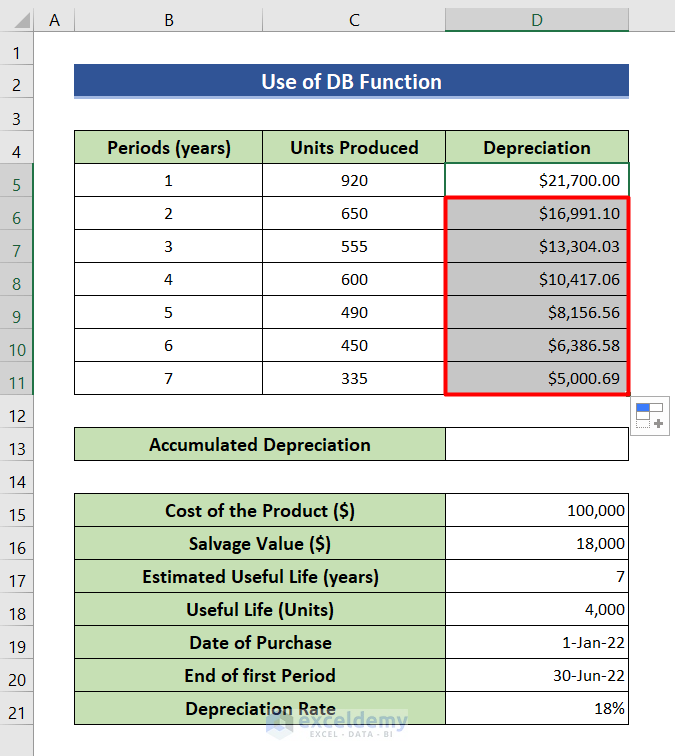

- Move your cursor to the bottom right corner of cell D5 and double-click on it.

- This will show the results for all 7 years.

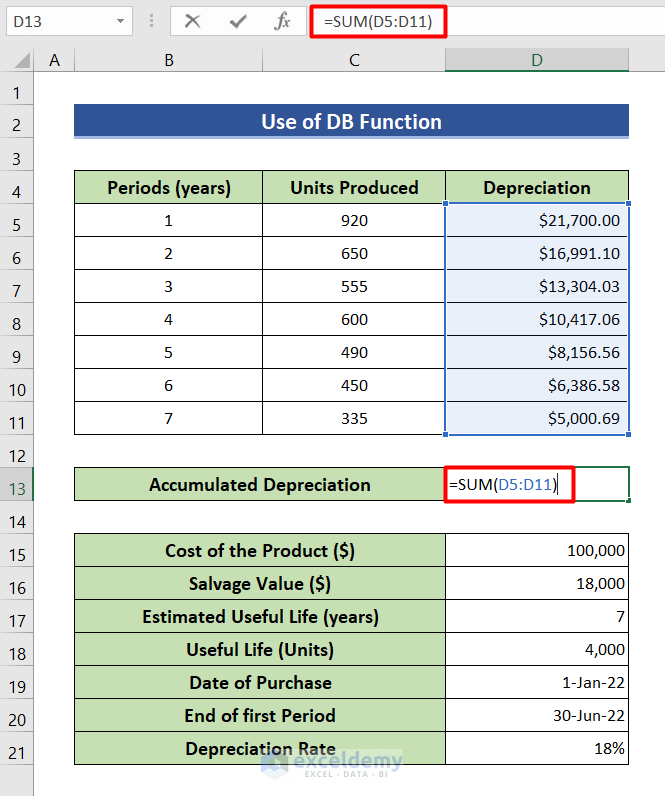

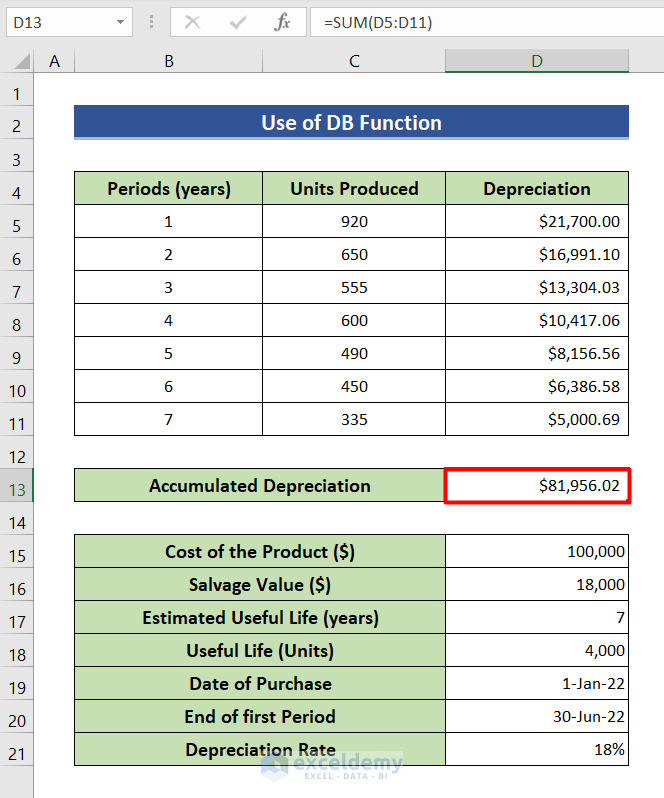

- Use the following formula to get the accumulated depreciation.

=SUM(D5:D11)

- Press Enter on the keyboard. It will sum up all the depreciation and give the accumulated depreciation.

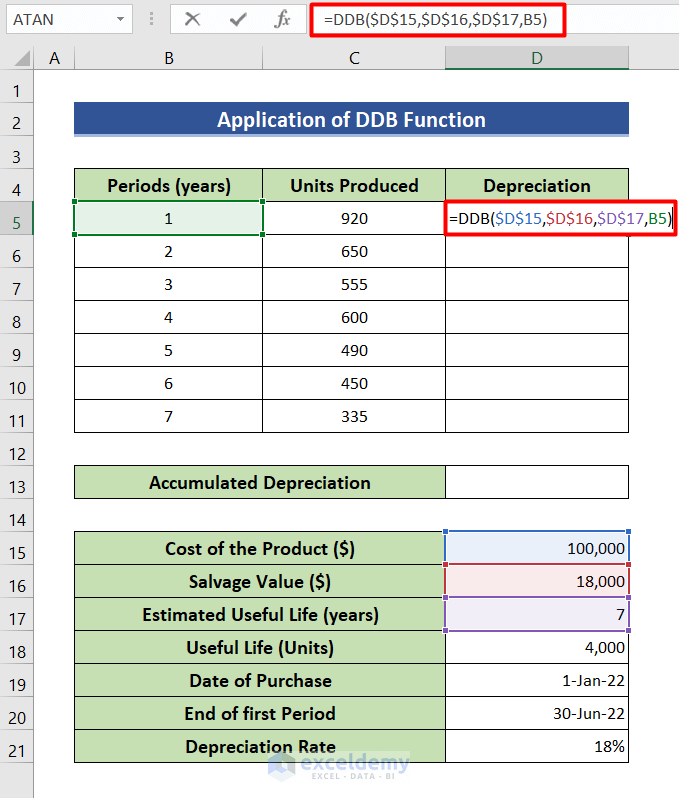

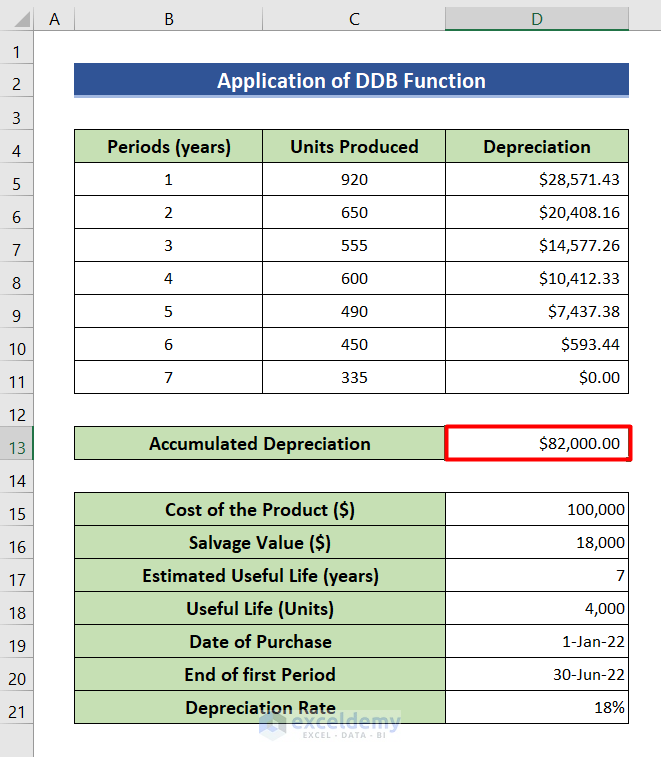

Method 7 – Apply DDB Function

Steps:

- Click on cell D5 and write down the following formula.

=DDB($D$15,$D$16,$D$17,B5)- $D$15, $D$16, $D$17 are absolute references to cells D15, D16, D17 and B5 refers to the value of cell CB5.

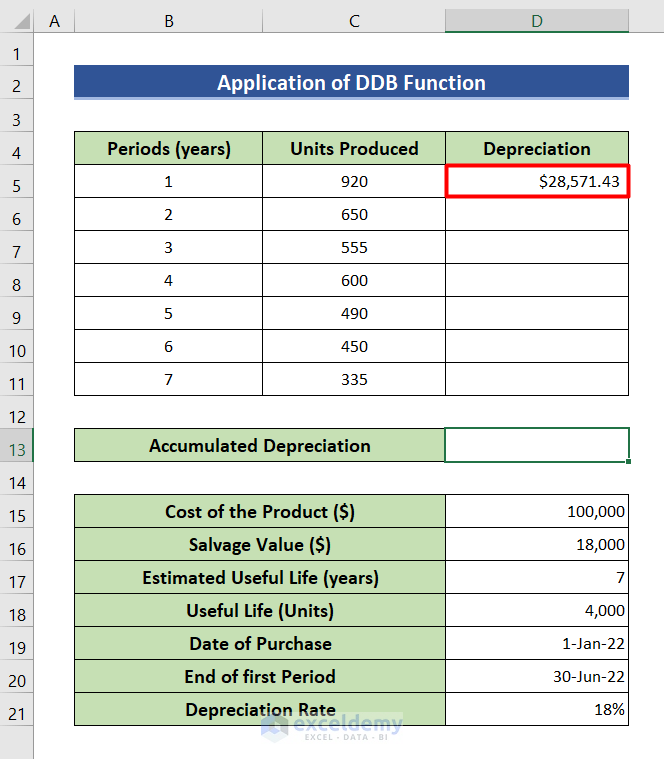

- Hit Enter.

- It will give you the result of the 1st period.

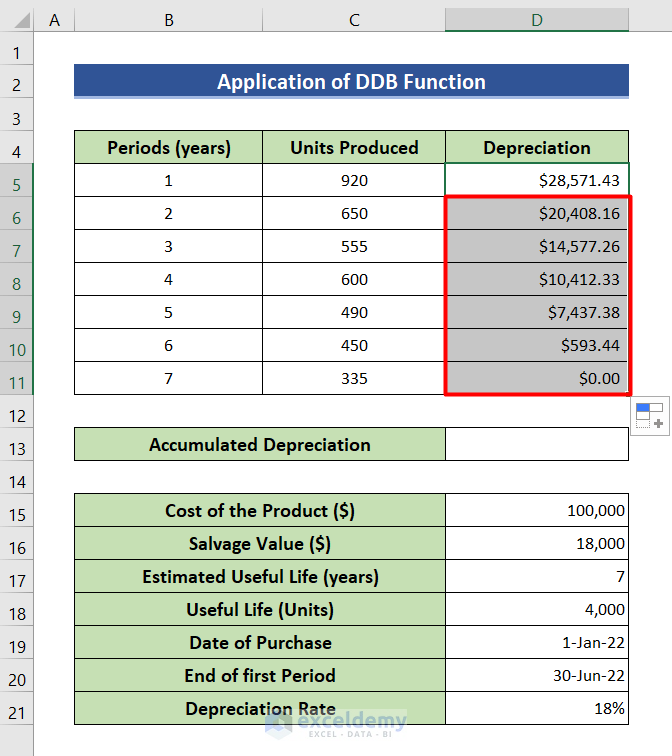

- To find out the depreciation over the full 7 years, double-click the bottom right corner of cell D5.

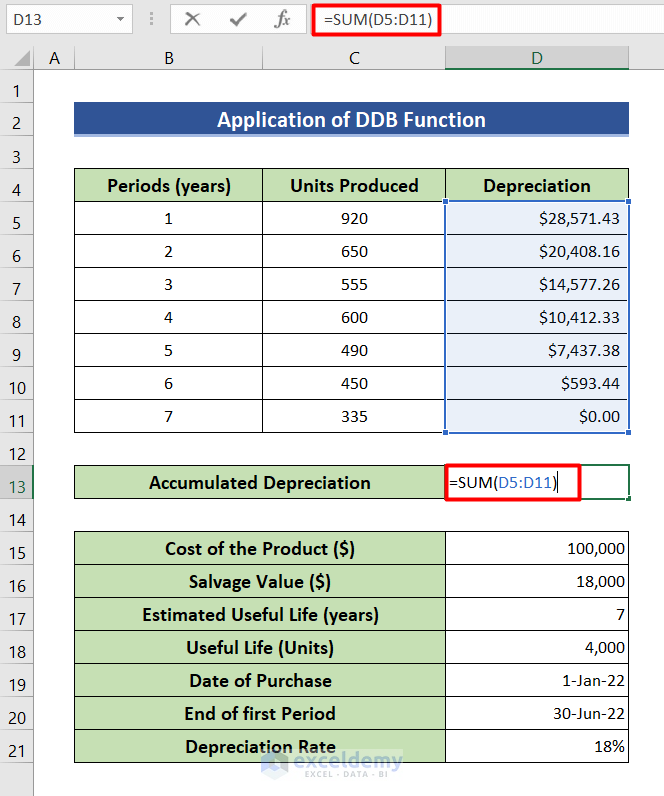

- Write the following sum formula to get the accumulated depreciation.

=SUM(D5:D11)

- It will add up all the values from D5 to D11 and give the desired result.

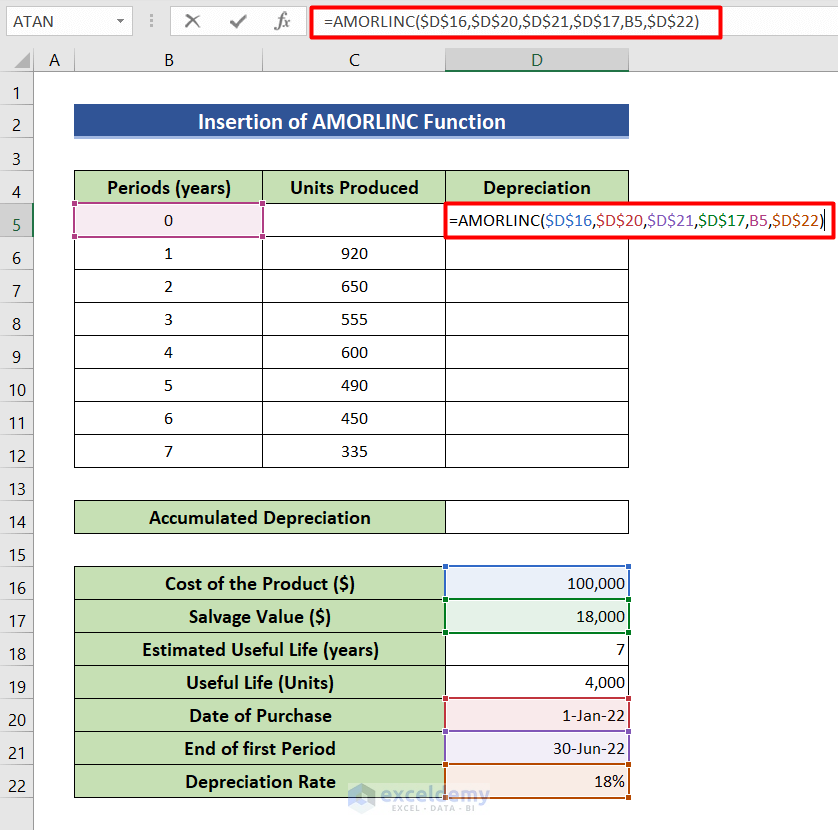

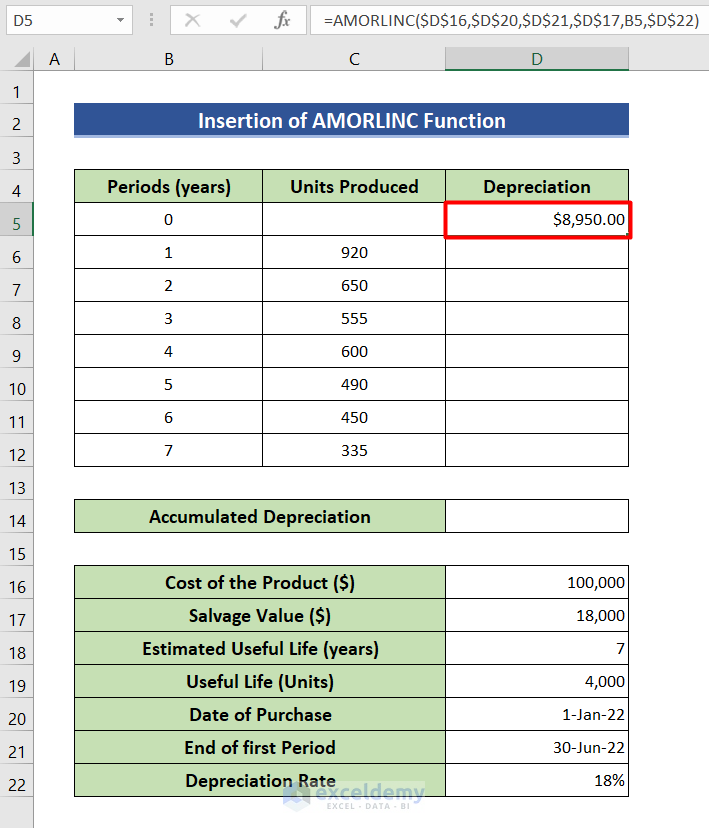

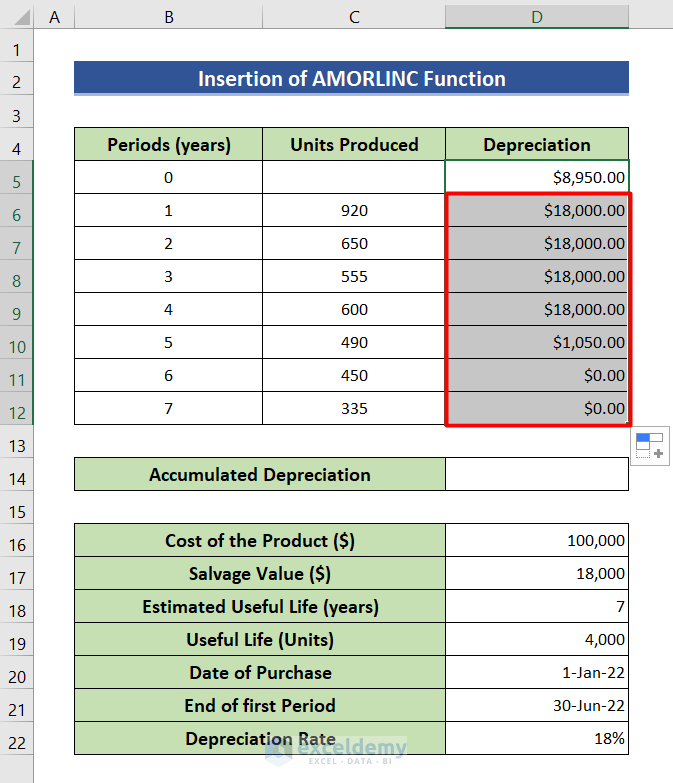

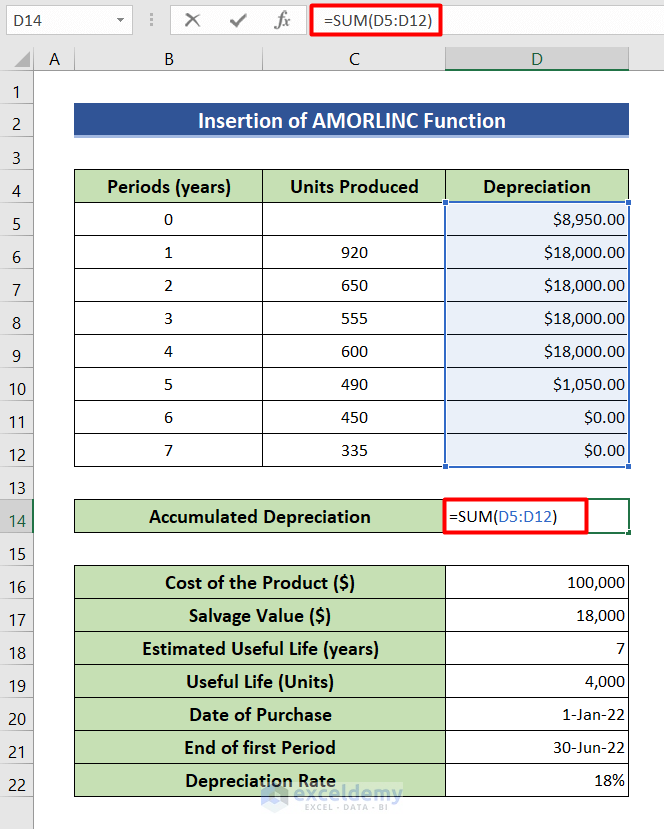

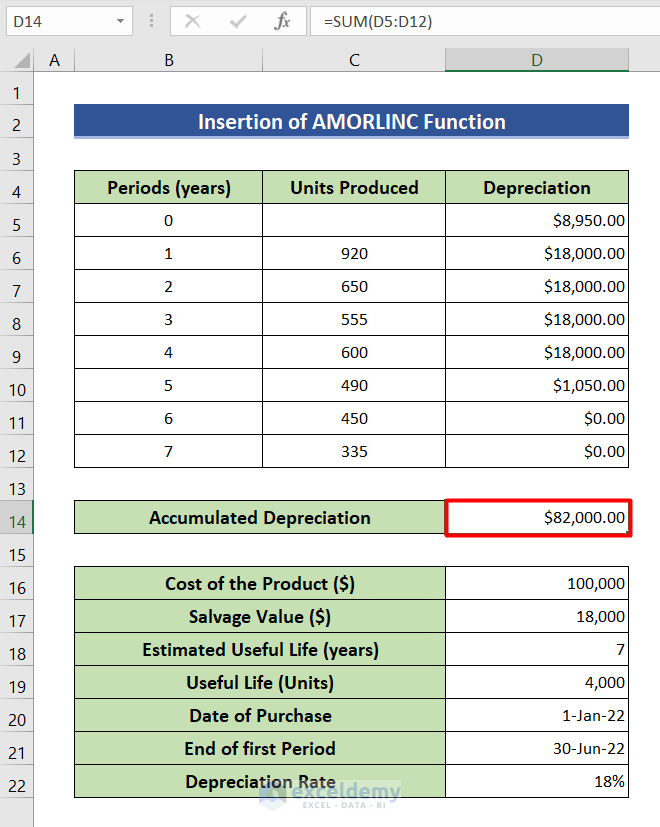

Method 8 – Insert AMORLINC Function

Steps:

- Type the following formula in cell D5.

=AMORLINC($D$16,$D$20,$D$21,$D$17,B5,$D$22)- In this formula, $D$16,$D$20,$D$21,$D$17 refers to cells D16, D20, D21 and D17 B5 refers to the value of cell B5 and $D$22 is absolute reference to cell D22.

- Press the Enter button and find the result in cell D5.

- Double-click the bottom right corner of cell D5 to get results for the whole period.

- Find out the accumulated depreciation, use the sum formula, where D5:D12 refers to cells D5 through D12.

=SUM(D5:D12)

- Hit Enter and see the desired accumulated depreciation.

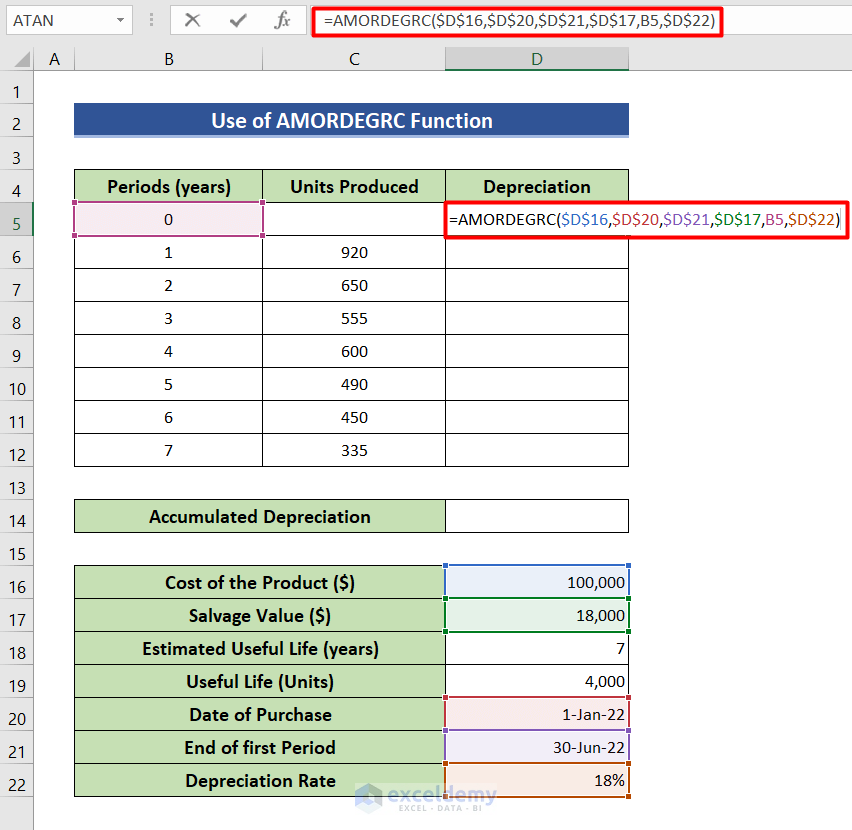

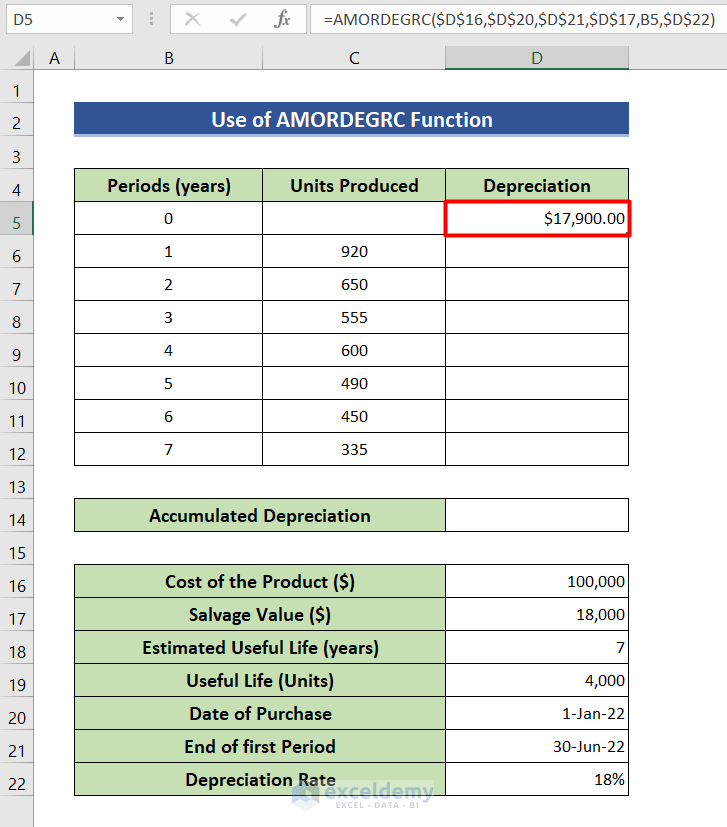

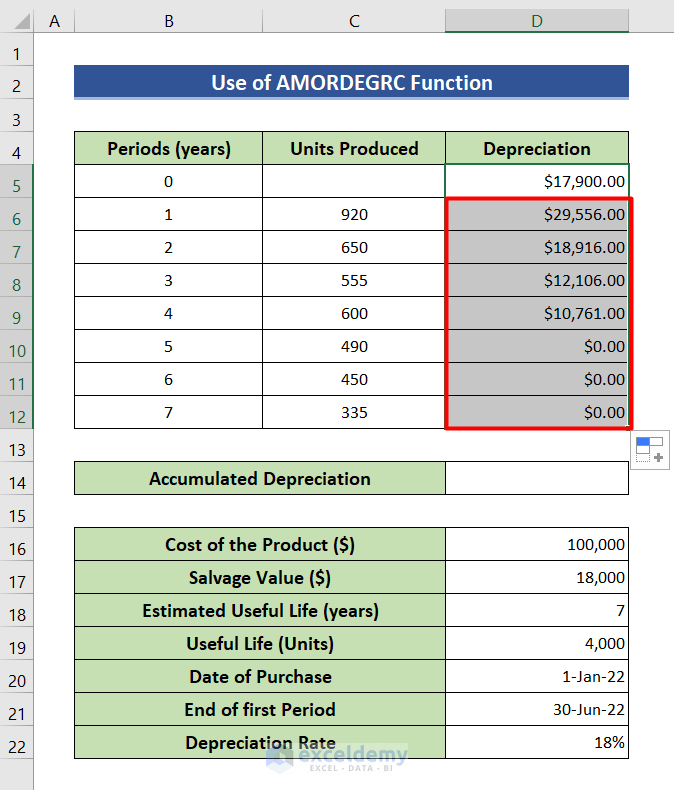

Method 9 – Use AMORDEGRC Function

Steps:

- Select empty cell D5.

- Write down the AMORDEGRC formula.

=AMORDEGRC($D$16,$D$20,$D$21,$D$17,B5,$D$22)

- To get the result for the 1st year, hit Enter.

- Double-click the bottom right corner of cell D5.

- This gives you all the depreciation value.

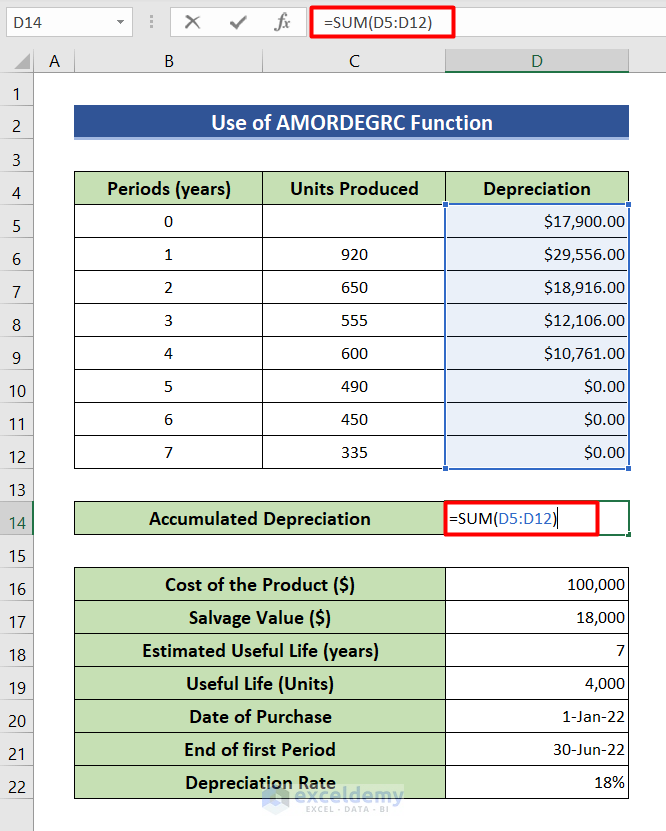

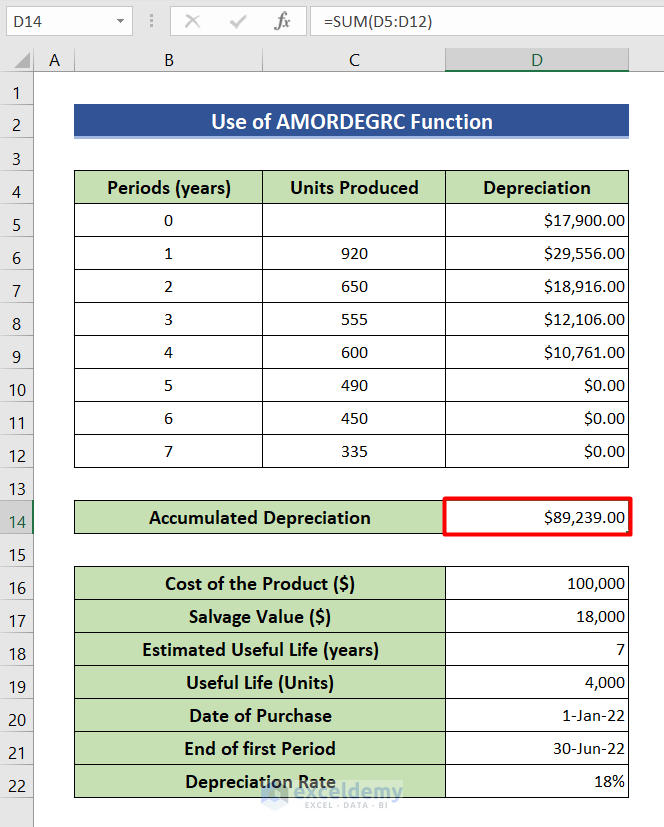

- Find the accumulated depreciation. Use the SUM function, where D5:D12 refers to cells D5 to D12.

=SUM(D5:D12)

- Press Enter and get the accumulated depreciation.

Things to Remember

- While using a formula, don’t forget to give proper cell references or you won’t get the desired results.

- Use the absolute reference sign ($) for the formulas otherwise, you can get erroneous results.

Download Practice Workbook

Download this practice workbook for practice while you are reading this article.

Related Articles

- How to Use WDV Method of Depreciation Formula in Excel

- How to Use MACRS Depreciation Formula in Excel

- How to Use Formula to Calculate Car Depreciation in Excel

- How to Calculate Double Declining Depreciation in Excel

<< Go Back to Depreciation Formula In Excel|Excel Formulas for Finance|Excel for Finance|Learn Excel

Get FREE Advanced Excel Exercises with Solutions!