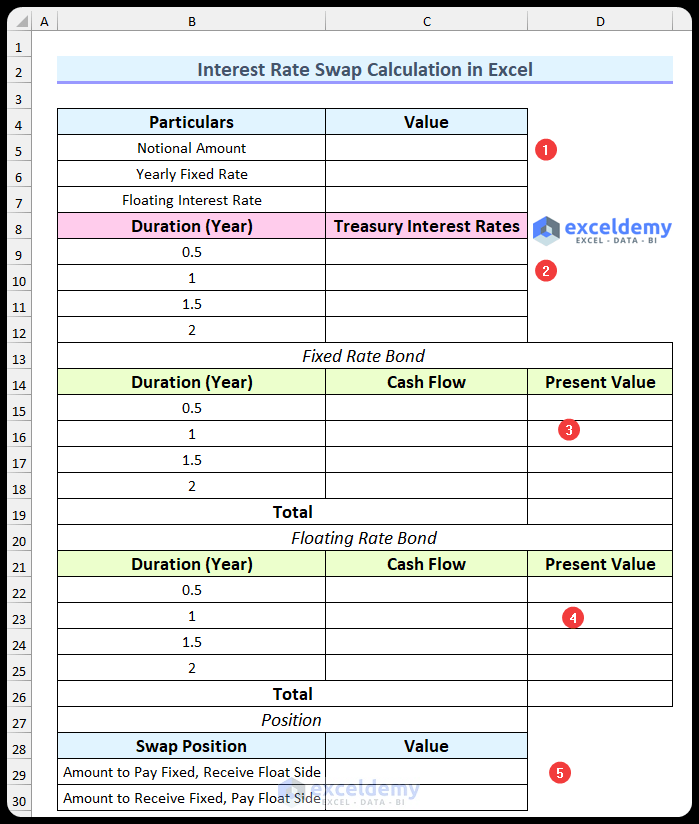

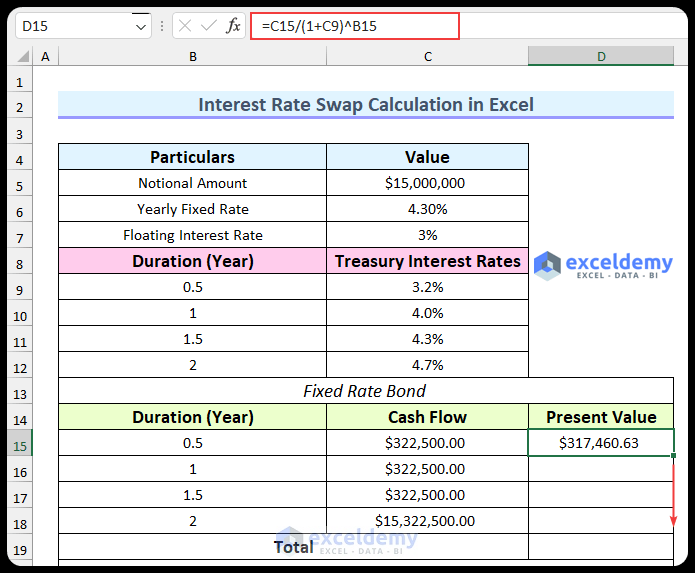

Step 1 – Set Up the Format

- We’ll use the following information:

-

- Notional Amount – This is the original swap amount for both parties.

- Yearly Fixed Rate – In this field, we will input the annual fixed interest rate.

- Floating Interest Rate – We will need to assume this rate, and we will assume the six-month Treasury rate is equal to this rate.

- The Treasury interest rates with a six-month gap are included in the next section of this format.

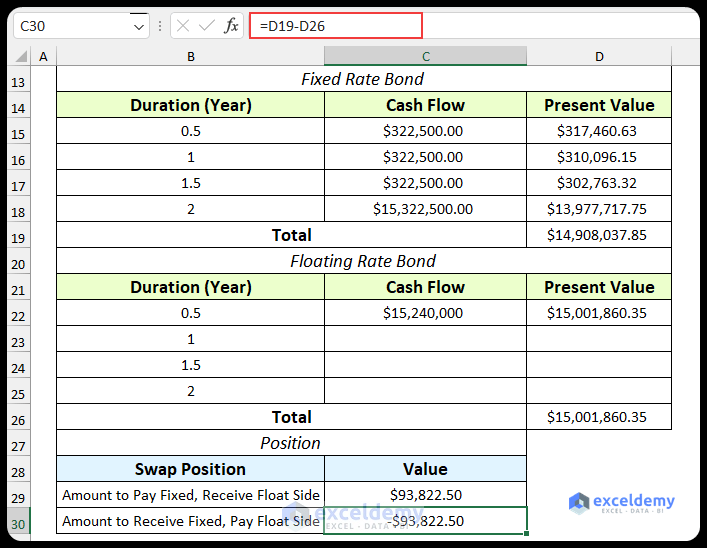

- We will create a table to calculate the present value of the bond based on the fixed interest rate.

- The fourth table will return the present value of the bond based on the floating interest rate.

- The last section finds which party is gaining from this interest rate swap.

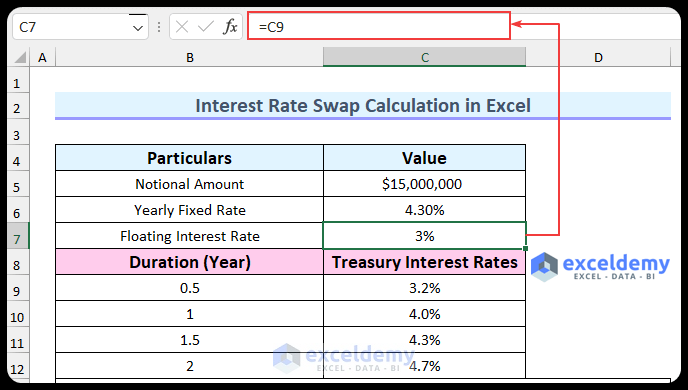

Step 2 – Calculate the Relevant Values

- Input all the relevant values: $15 million for the notional amount and 4.3% for the yearly fixed rate.

- We will assume the floating interest rate is equal to the six-month treasury rate. Link those cells using the formula below.

=C9

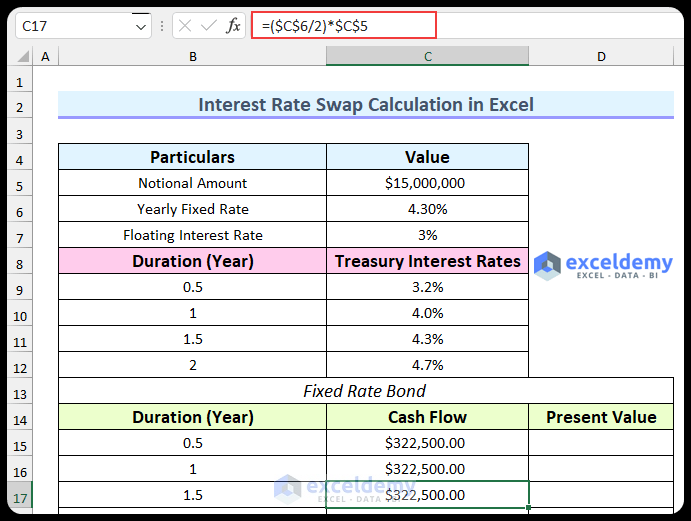

- Use the following formula in the cell range C15:C17.

=($C$6/2)*$C$5

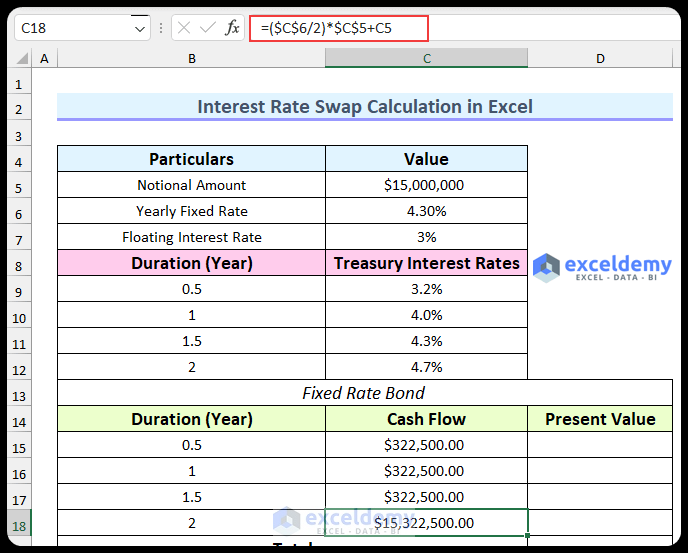

- Use this formula to find the value of the cash flow at maturity.

=($C$6/2)*$C$5+C5

- Insert this formula and use the Fill Handle to fill the three cells below.

=C15/(1+C9)^B15

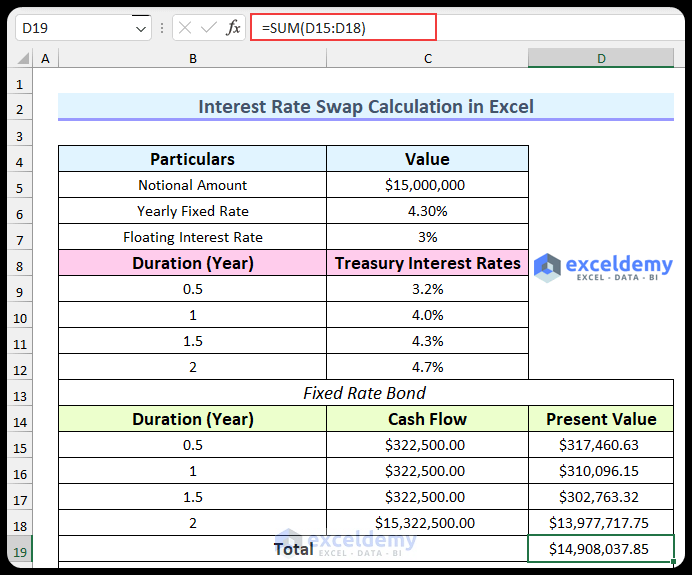

- Use this formula to find the total amount.

=SUM(D15:D18)

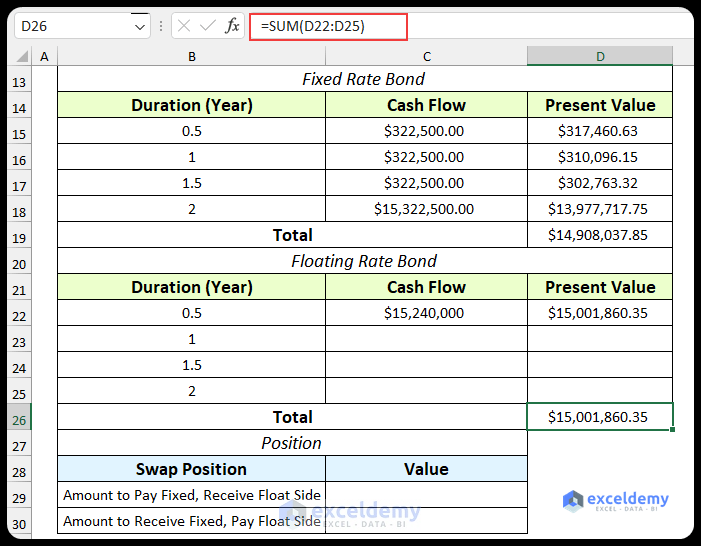

We will use the following formulas to calculate the present value of the floating rate bond.

- Use this formula in cell C22.

=(C7/2)*C5+C5

- Use this formula in cell D22.

=C22/(1+C9)^B22

- Insert this formula in cell D26.

=SUM(D22:D25)

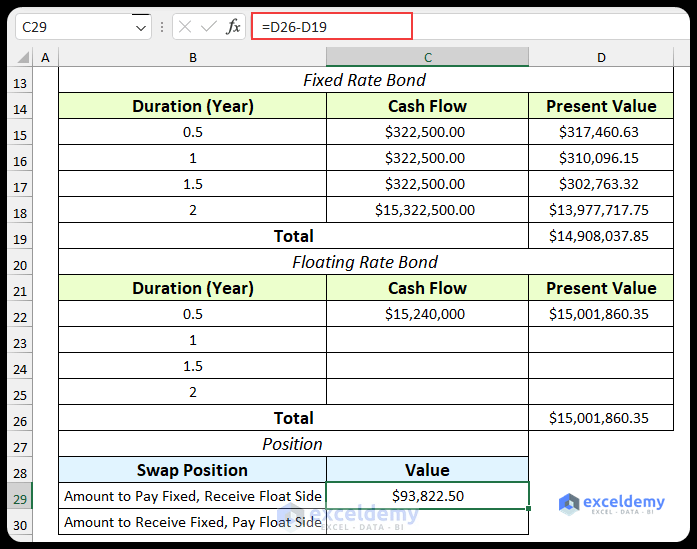

- Insert this formula to find the amount that will be received by the float side.

=D26-D19

- Insert this formula to get the amount that will be paid by the float side.

=D19-D26

Read More: How to Calculate Effective Interest Rate On Bonds Using Excel

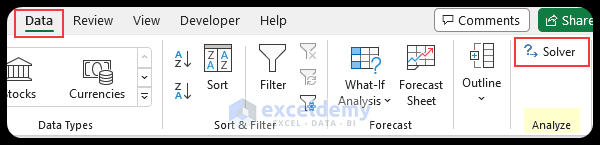

Step 3 – Use the Solver to Find the Equilibrium Fixed Rate

- Enable the Solver Add-in in Excel if needed.

- Select Solver from the Data tab.

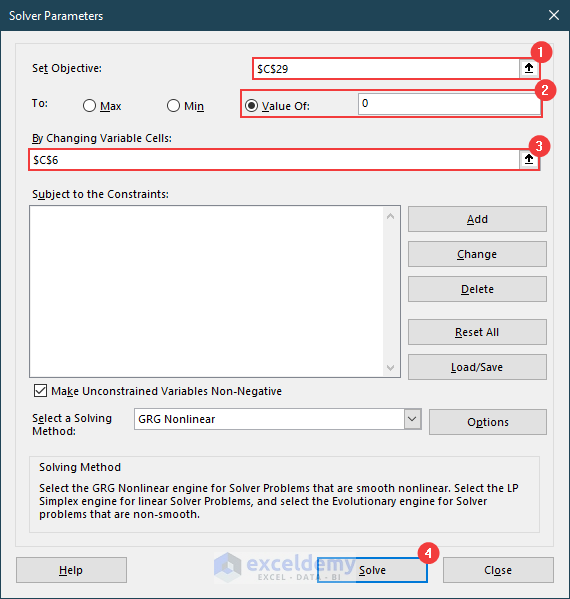

- Use the following conditions.

-

- Set Objective: C29.

- Value Of: 0.

- By Changing Variable Cells: C6.

- Press Solve.

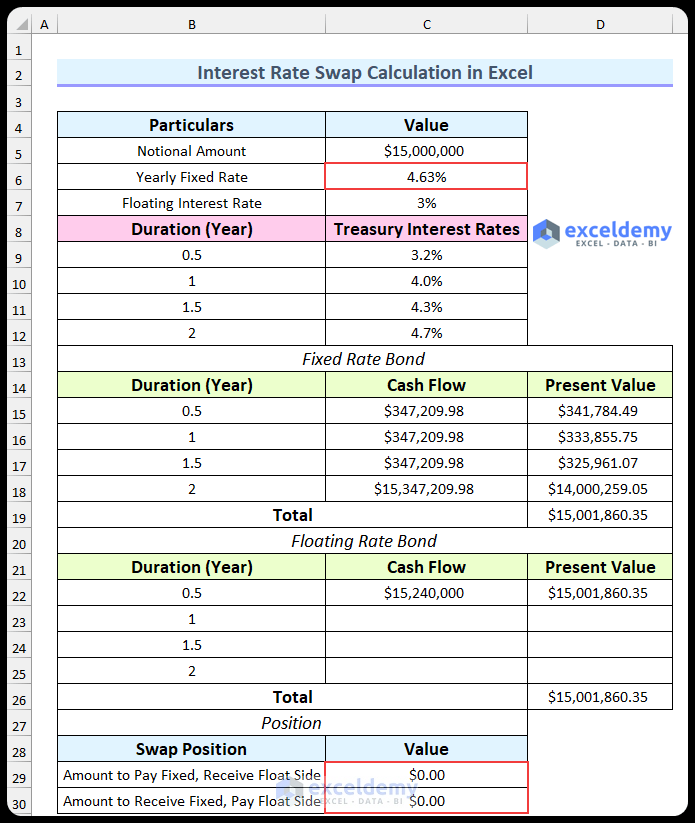

- This will find the yearly fixed rate and put the swap positions as equal for both sides.

- Here is the snapshot of the complete interest rate swap calculation in Excel.

Download the Practice Workbook

Related Articles

- Create Flat and Reducing Rate of Interest Calculator in Excel

- How to Perform Interest Rate Sensitivity Analysis in Excel

<< Go Back to Interest Rate Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!