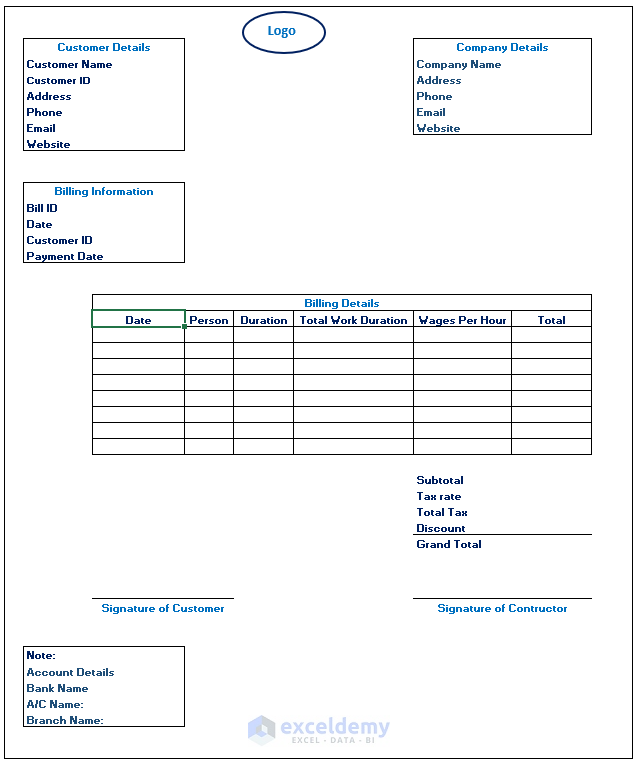

Here’s a template we will make to ensure you can properly bill your customers for the work you do.

Download the Practice Workbook

Download the Excel template and you can use it with minor changes whenever you need to.

Which Things Are Necessary to Make a Labour Contractor Bill Format?

- Bill Number

- Date of Bill

- Company logo

- Contractor’s Company name with contact details

- Client’s Company name with contact details

- Client’s Unique ID

- Subtotal

- Tax rate

- Total Tax on the subtotal

- Discount if announced

- Total after discount and tax

- Date of Payment

- Signature of the Contractor and the Client

Types of Labour Contractor Bill

- Hourly wages based

- Project contact-based

- Daily wages based

- Time-based

- Mixed wages based

How to Make a Basic Format for Labour Contractor Bill in Excel

Step 1 – Add Company Information with the Logo

- Add your company’s logo or design one.

- Add the company contact information like address, phone, email, etc.

- The initial part should look like the following image:

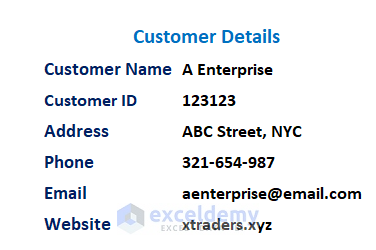

Step 2 – Include the Client’s Details

- Customer details include name, ID, address, mail, etc.

- The primary part of the format will look like below:

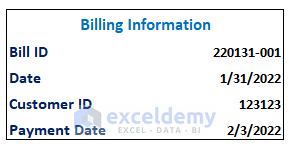

Step 3 – Input Billing Info

This billing information will be made each time to a customer when any task is complete or after a certain time period. Every time Bill ID will change. Also, the payment date will be mentioned in the billing information.

Similar Readings

- Hotel Bill Format in Excel (Create with Easy Steps)

- Tally Bill Format in Excel (Create with 7 Easy Steps)

- Transport Bill Format in Excel (Create in 4 Simple Steps)

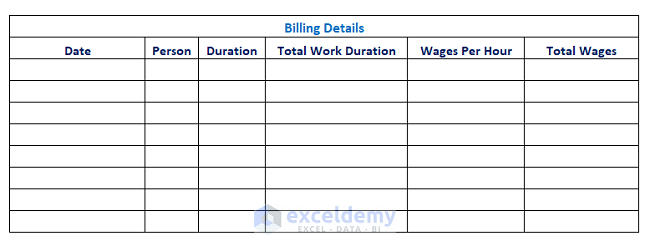

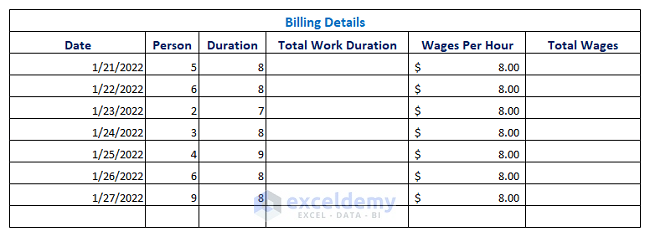

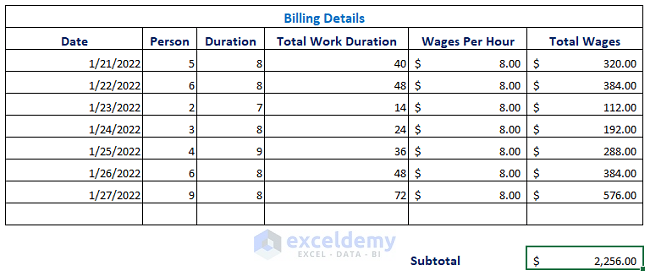

Step 4 – Put Billing Details

Use the following template to insert the information you need to calculate the total costs.

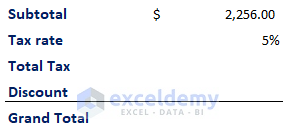

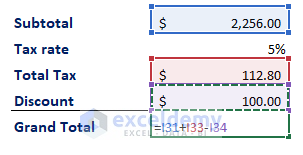

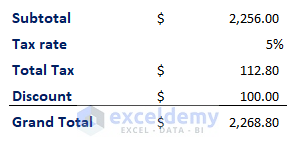

Here is the part that will calculate the total costs passed onto the customer. The subtotal, tax, discount, grand total will be shown here.

Read more: How to Create a Cash Bill Format in Excel (A step-by-step Guideline)

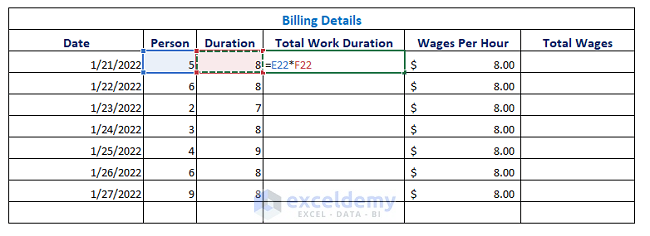

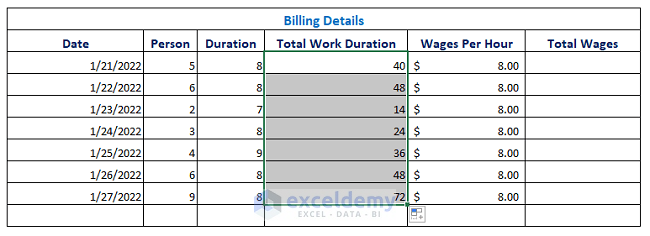

Step 5 – Example of How the Bill Is Calculated

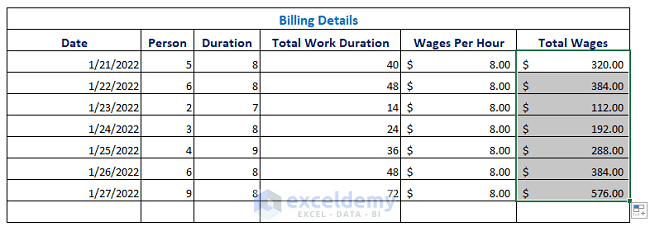

We will calculate the labor bill for 7 days.

- Enter all the data in the format. These are date, person, duration, and wages.

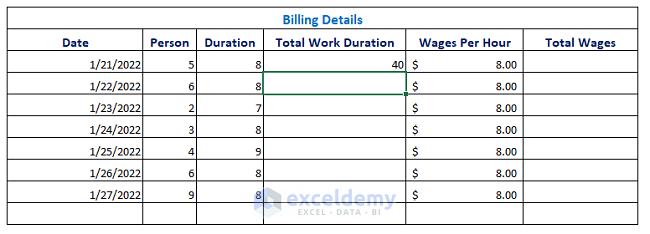

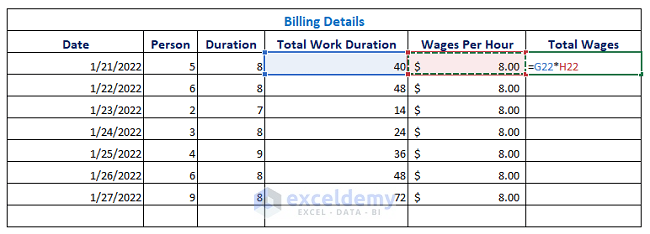

- The formula for Cell G22 (total work duration) will look like this:

=E22*F22

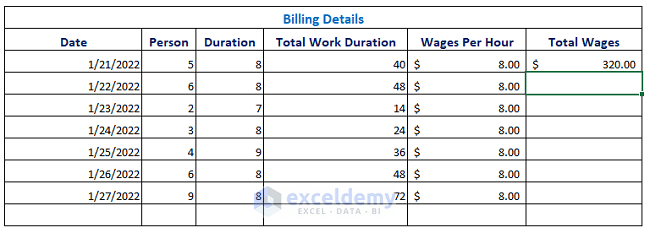

- Press Enter.

- Use the Fill Handle icon towards the last cell to get values for the rest of the cells.

- Calculate the Total Wages for each date by using the following formula in Cell I22:

=G22*H22

- Press Enter to apply the formula.

- Drag the Fill Handle icon to AutoFill.

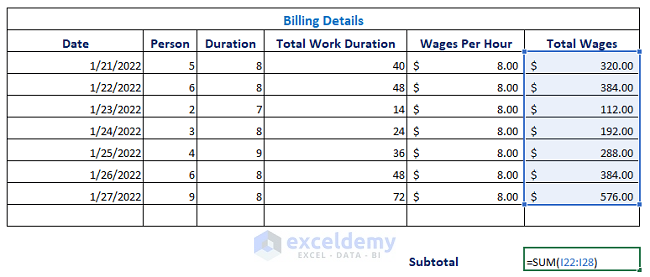

- Sum all the totals and find the Subtotal on Cell I31.

- Press Enter and the sum result will show.

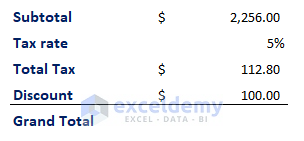

- Insert the standard tax for the work done, such as 5%.

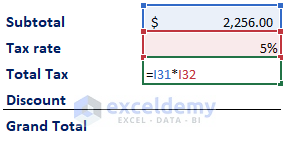

- The Total Tax will be calculated applying the below formula:

=I31*I32

- Press Enter to get the Total Tax.

- Set a custom discount.

- Calculate the Grand Total by applying the below formula:

=I31+I33-I34

- Press Enter to get the Grand Total.

Read more: Tax Invoice Format in Excel (Download the Free Template)

Step 6 – Additional Features of a Bill Format

Contractor authorization is gathered by the signature on the corresponding box.

Customer authorization is gathered by the signature on the corresponding box.

The payment option like bank details can be added to the invoice.

Further Readings

- Invoice Excel Formula

- Create GST Invoice Format in Excel (Step-by-Step Guideline)

- Excel Invoice Tracker (Format and Usage)

This is a great blog post! I have been looking for a template like this for a while. Thank you for sharing!

Hello,

You are most welcome.

Regards

ExcelDemy