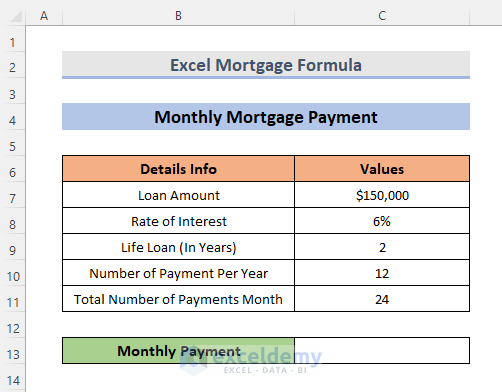

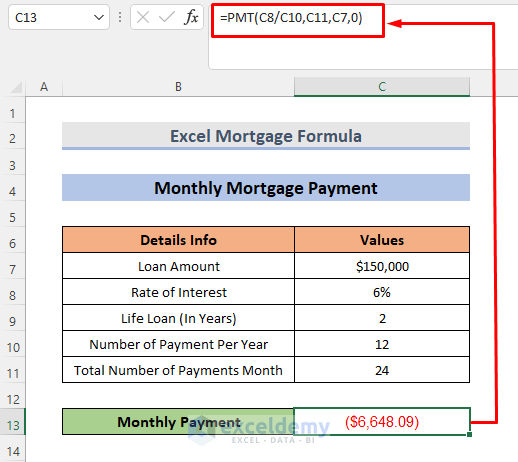

Example 1- Formula to calculate the Monthly Mortgage Payment in Excel

Consider that you want to start a business and take a loan: $150,000 (C7).

The annual interest rate is 6% (C8), the duration is 2 years (C9) and the loan is paid monthly.

STEPS:

- Select a cell to calculate the monthly payment. Here, C13.

- Enter the formula.

=PMT(C8/C10,C11,C7,0)- Press Enter.

- The monthly mortgage payment is displayed.

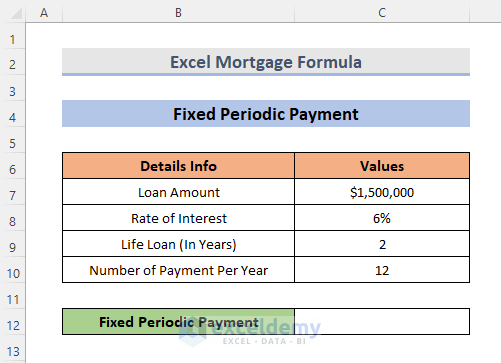

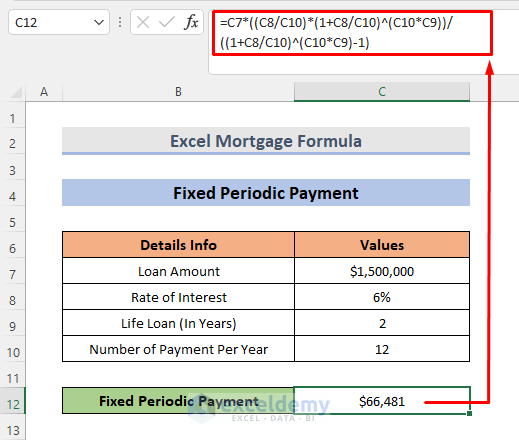

2. Excel Mortgage Formula to calculate the Fixed Periodic Payment

The loan amount is $150,000 (C7).

The annual interest rate is 6% (C8), the duration is 2 years (C9) and the total number of months is 12 (C10).

STEPS:

- Select a cell to calculate the monthly payment. Here, C12.

- The generic formula for a fixed periodic payment is:

=loan amount((rate of interest/number of payment per year)*(1+rate of interest/number of payment per year)^(number of payment per year*life loan))/((1+rate of interest/number of payment per year)^(number of payment per year*life loan)-1)- Enter the formula.

=C7*((C8/C10)*(1+C8/C10)^(C10*C9))/((1+C8/C10)^(C10*C9)-1)- Press Enter.

The fixed periodic payment is displayed.

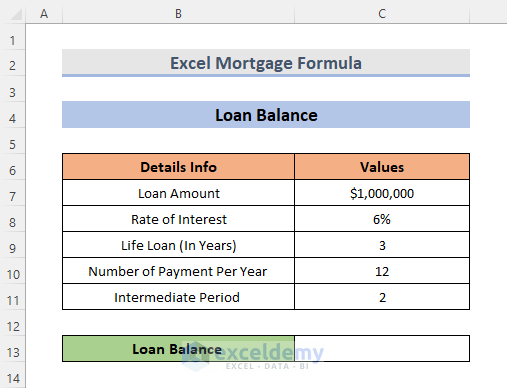

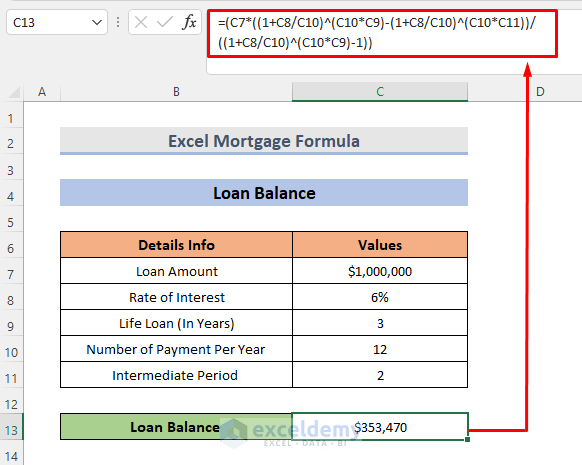

3. Find the Outstanding Loan Balance

To find the outstanding loan balance, slight modifications were made to the dataset: the loan amount was decreased and the duration of the loan increased.

Calculate the outstanding loan amount with one intermediate period.

STEPS:

- Select a cell to see the result. Here, C13.

- The generic formula for a fixed periodic payment is:

=loan amount((rate of interest/number of payment per year)*(1+rate of interest/number of payment per year)^(number of payment per year*life loan))-((1+rate of interest/number of payment per year)^(number of payment per year*life loan)-1))- Enter the formula.

=(C7*((1+C8/C10)^(C10*C9)-(1+C8/C10)^(C10*C11))/((1+C8/C10)^(C10*C9)-1))- Press Enter.

The result is displayed in C13.

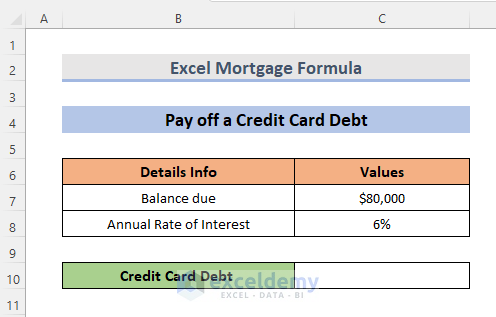

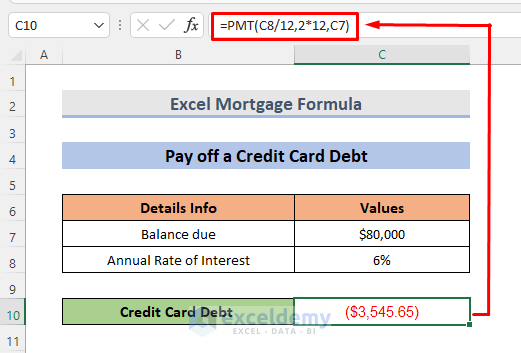

Example 4 – Using a Mortgage Formula to Calculate the Monthly Payments for a Credit Card Debt

Consider the due balance and the annual interest rate in C7 and C8.

STEPS:

- Select C10.

- Enter the following formula:

=PMT(C8/12,2*12,C7)- Press Enter.

This is the output.

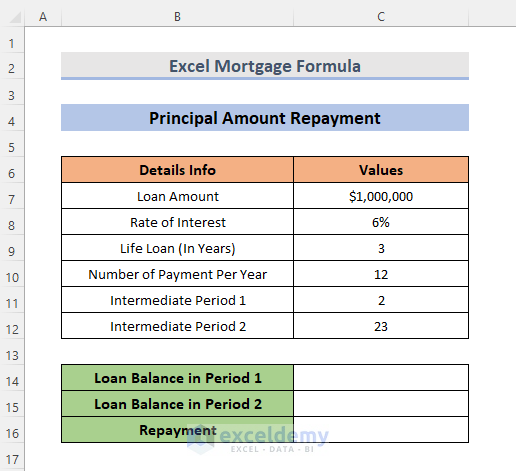

Example 5 – Using an Excel Mortgage Formula to calculate the Principal Amount Repayment in the 24th Month

STEPS:

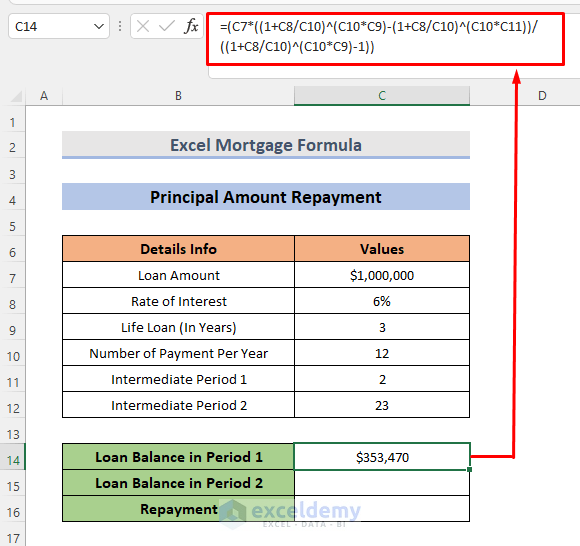

- Calculate the loan balance in period 1. Select C14.

- The generic formula for a fixed periodic payment is:

=loan amount((1+rate of interest/number of payment per year)^(number of payment per year*life loan))-((1+rate of interest/number of payment per year)^(number of payment per year*intermediate period 2))/(((1+rate of interest/number of payment per year)^(number of payment per year*life loan)-1)- Enter the formula:

=(C7*((1+C8/C10)^(C10*C9)-(1+C8/C10)^(C10*C11))/((1+C8/C10)^(C10*C9)-1))

- Press Enter.

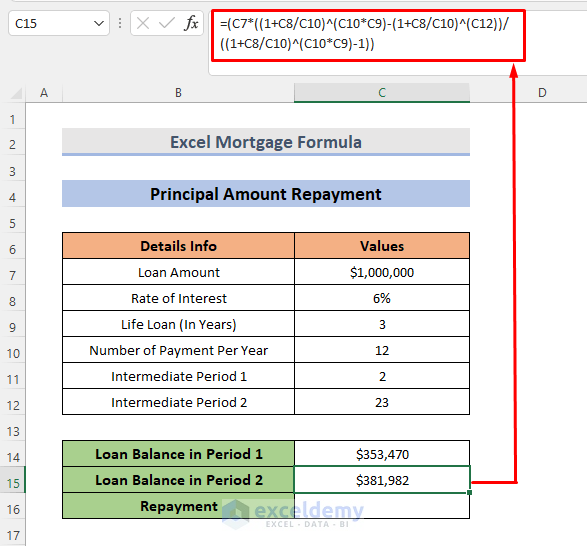

- The generic formula for a fixed periodic payment is:

=loan amount((1+rate of interest/number of payment per year)^(number of payment per year*life loan))-((1+rate of interest/number of payment per year)^(intermediate period 2))/((1+rate of interest/number of payment per year)^(number of payment per year*life loan)-1)- For the loan balance in period 2, the formula is:

=(C7*((1+C8/C10)^(C10*C9)-(1+C8/C10)^(C12))/((1+C8/C10)^(C10*C9)-1))- Press Enter.

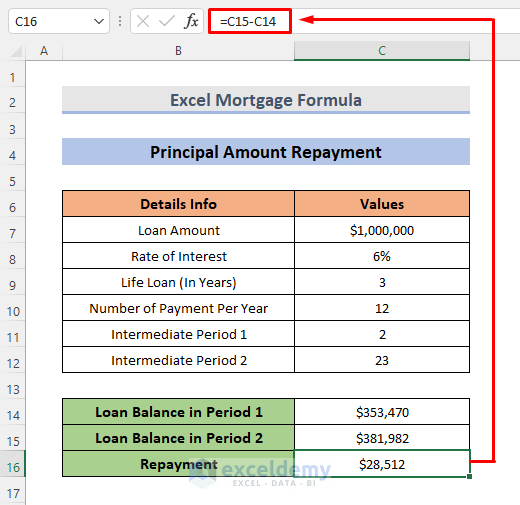

- Subtract the loan balance in period 1 from the loan balance in period 2. The formula will be:

=C15-C14

- Press Enter.

You will see the result.

Download Practice Workbook

Download the workbook and practice.

Excel Mortgage Formula: Knowledge Hub

- How to Use Formula for 30 Year Fixed Mortgage in Excel?

- How to Use Formula for Mortgage Principal and Interest in Excel?

- How to Use Formula for Car Loan Amortization in Excel?

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!