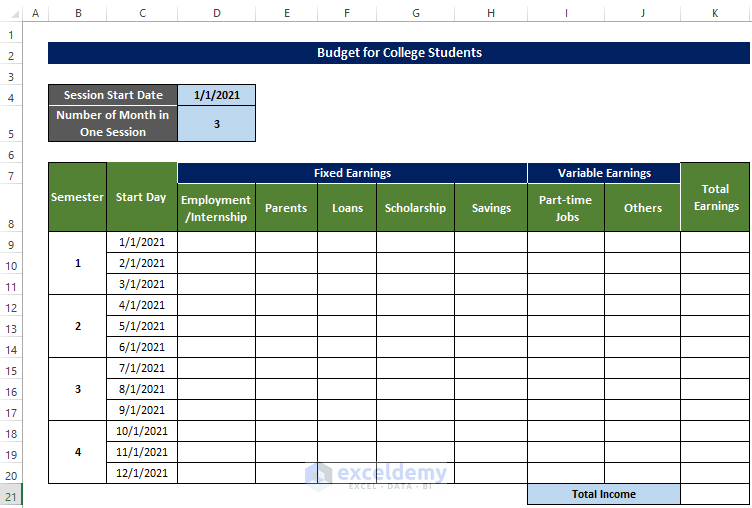

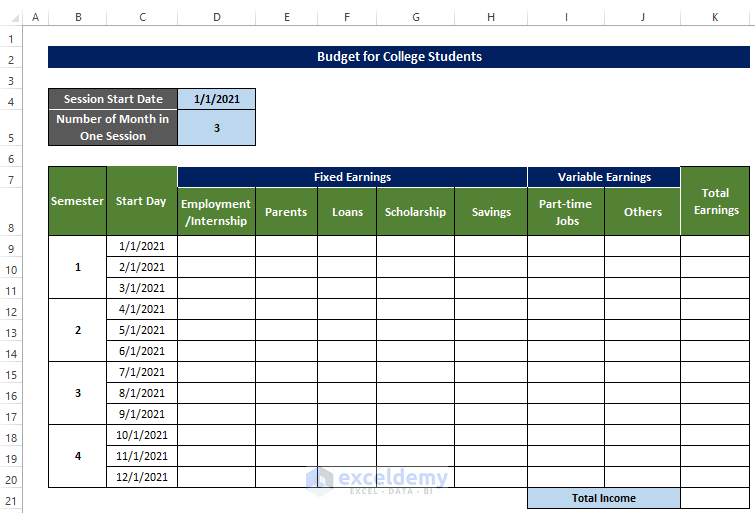

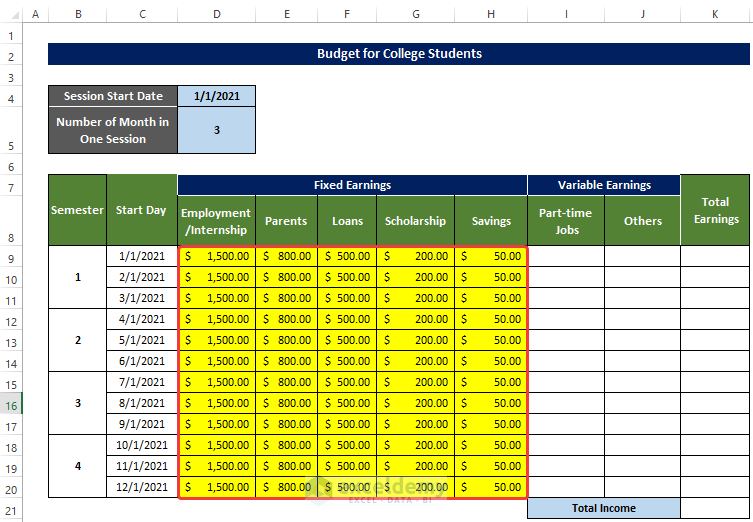

Step 1 – Create an Outline

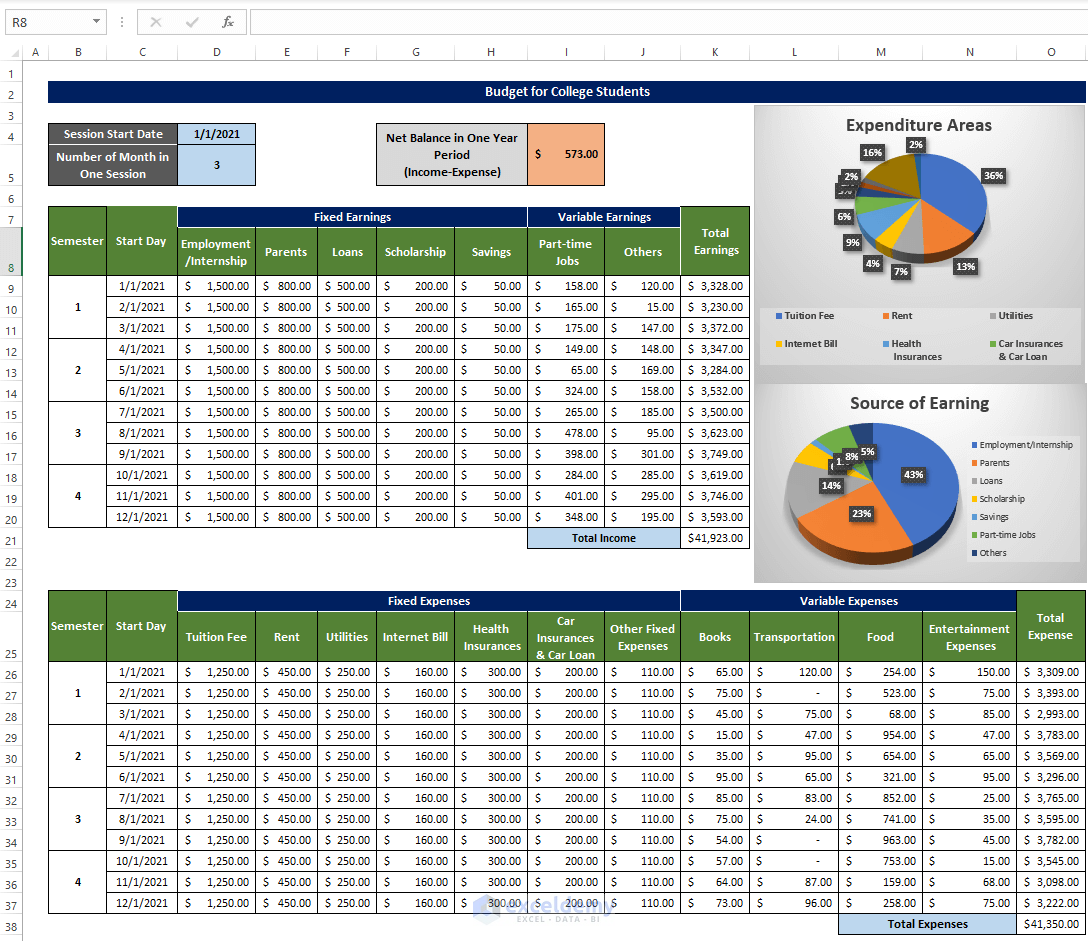

- Create a sample template to enter data.

- Include Fixed Earnings and Variable Earnings.

- Enter Variable fields and Fixed fields.

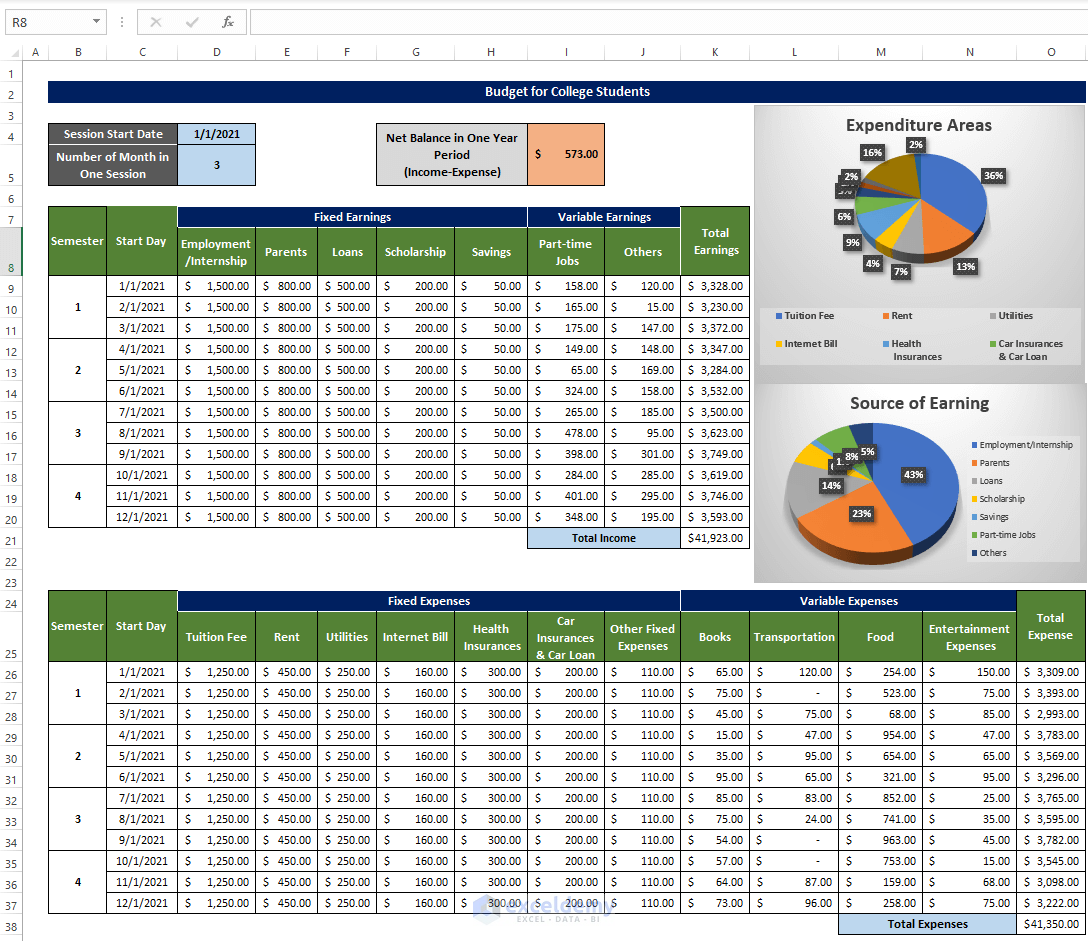

Step 2 – Enter the Fixed Earnings

- Enter fixed earnings:

- Include: Internships, allowances, loans (here 12 months), scholarships and savings.

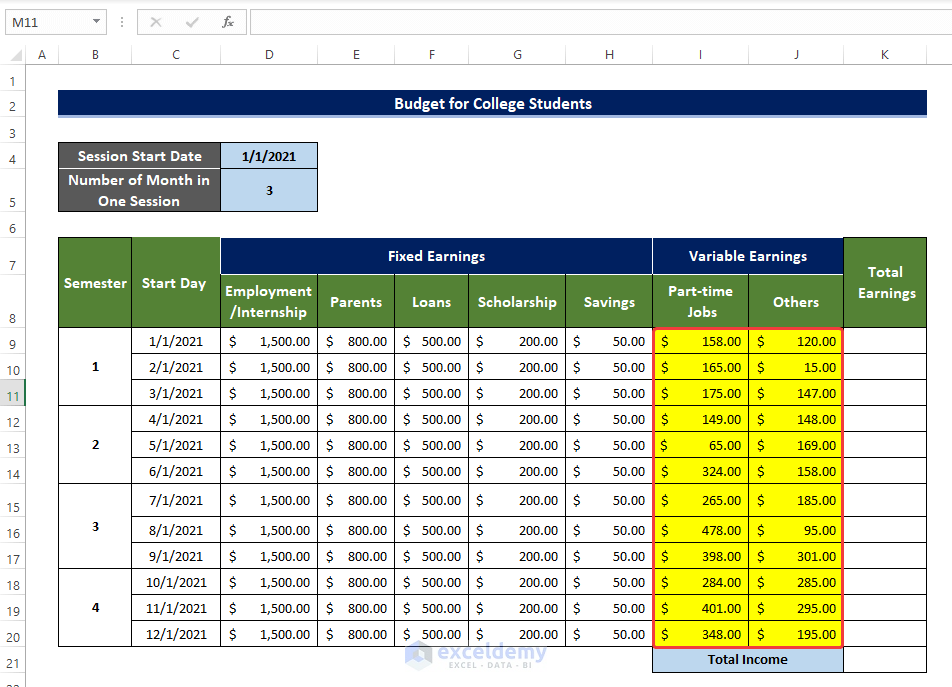

Step 3 – List Variable Earnings

- Include part-time jobs (consider different monthly income).

- Create an Others columns.

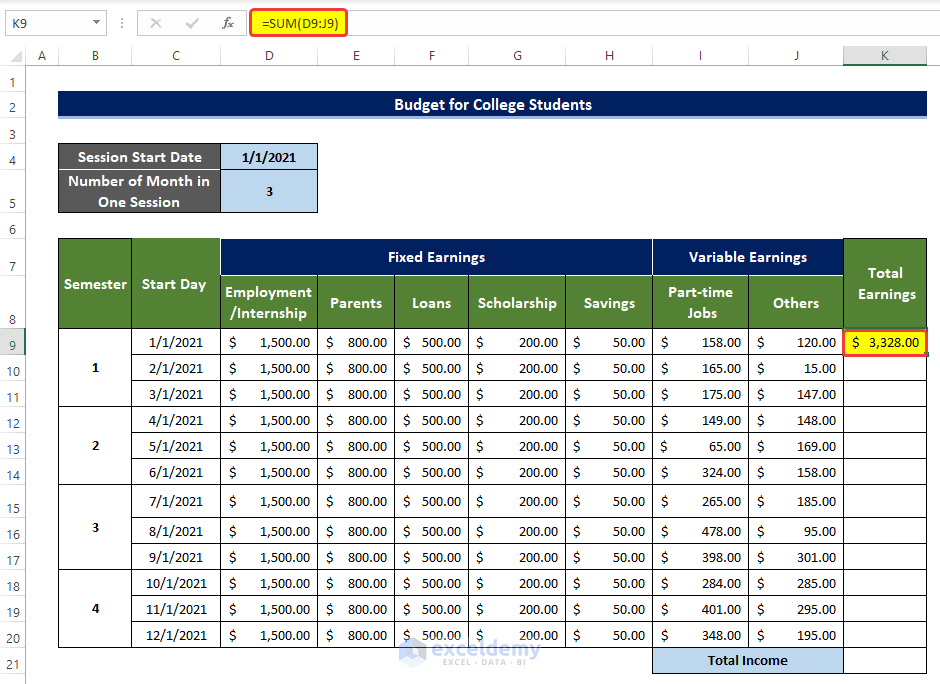

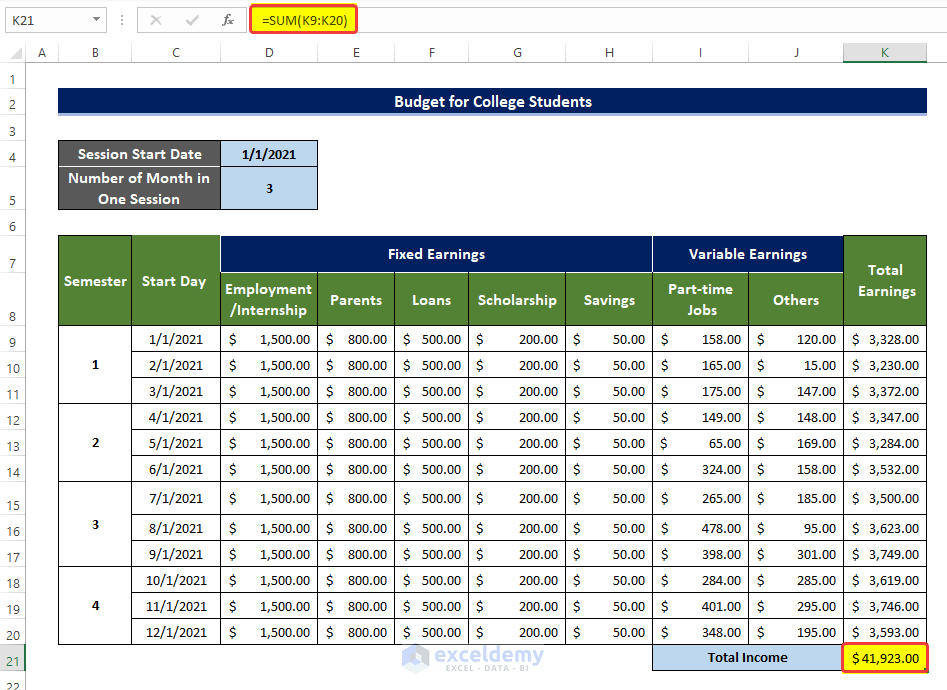

Step 4: Calculate the Total Income

- Select K9 and enter the following formula:

=SUM(D9:J9)

This is the output.

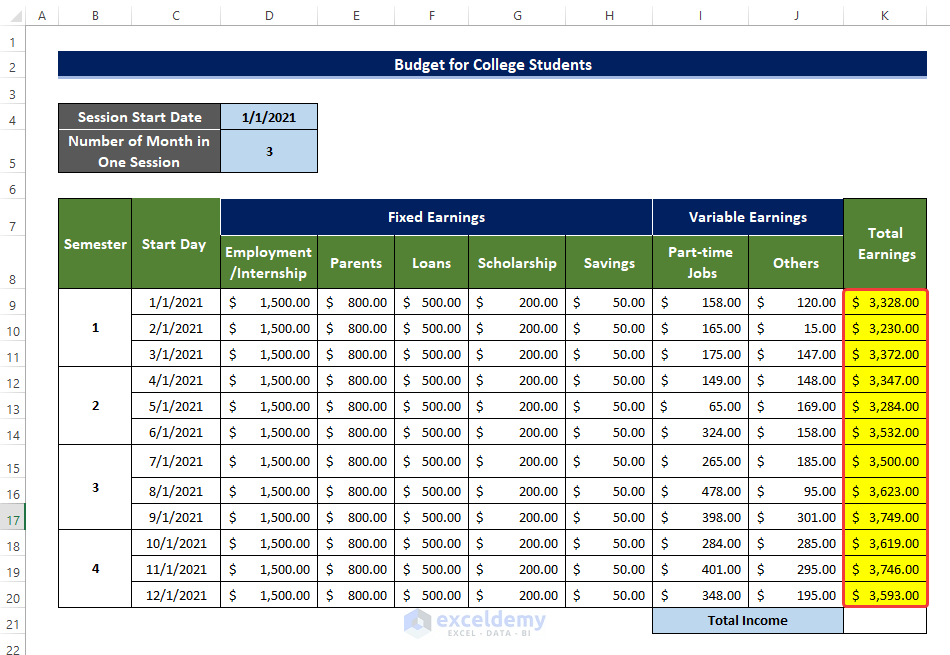

- Drag down the Fill Handle to see the result in the rest of the cells.

This is the output.

- Select K21 and enter the following formula:

=SUM(K9:K20)

This is the output.

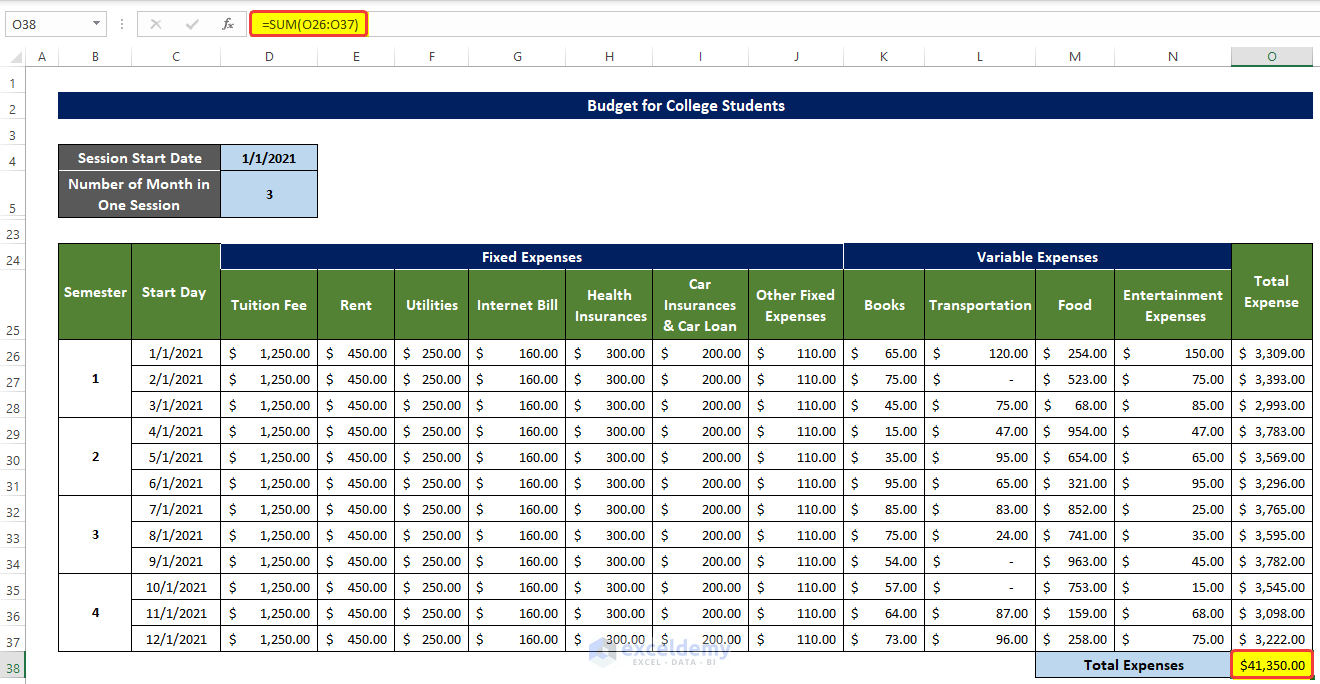

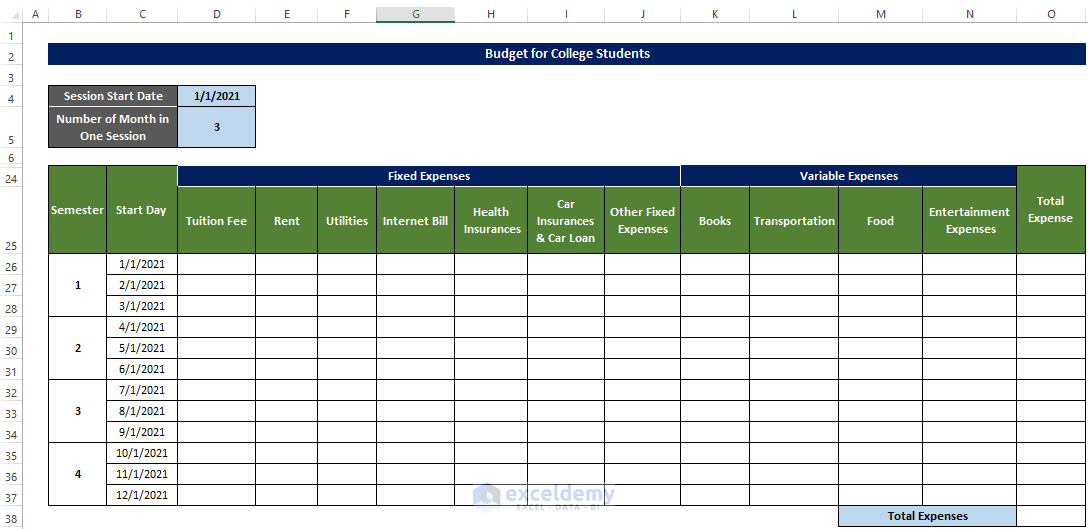

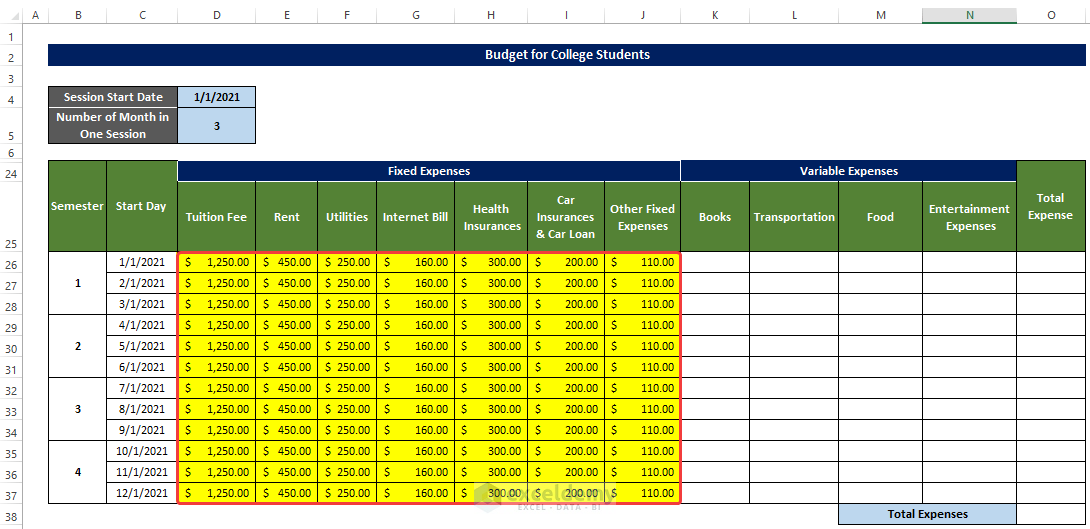

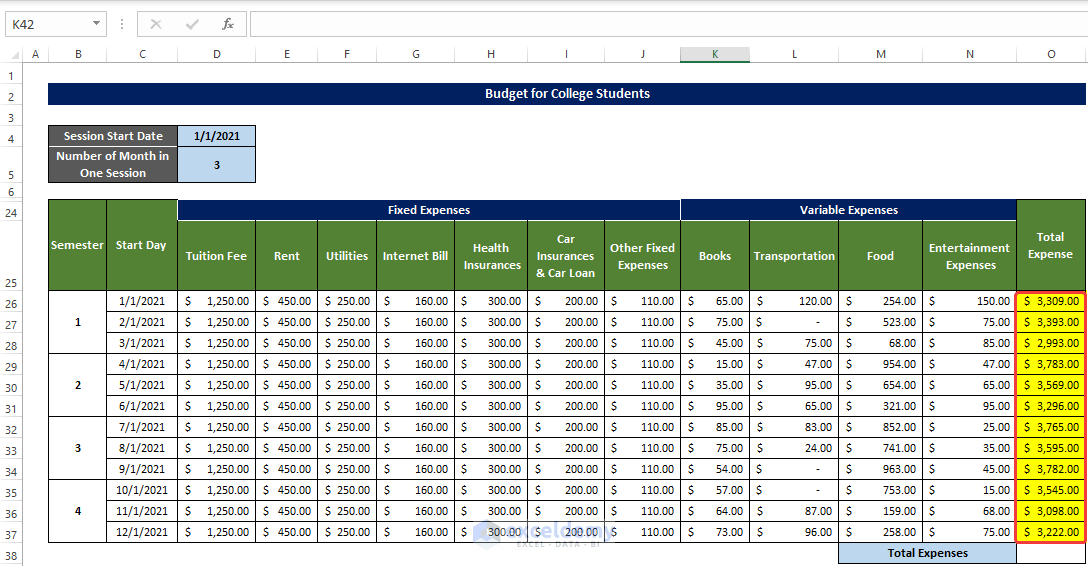

Step 5: Enter Fixed Expenses

- Include Tuition Fees, Rent Utility, Internet Bill, Health Insurance, Car Insurance, and Others in D26:J37.

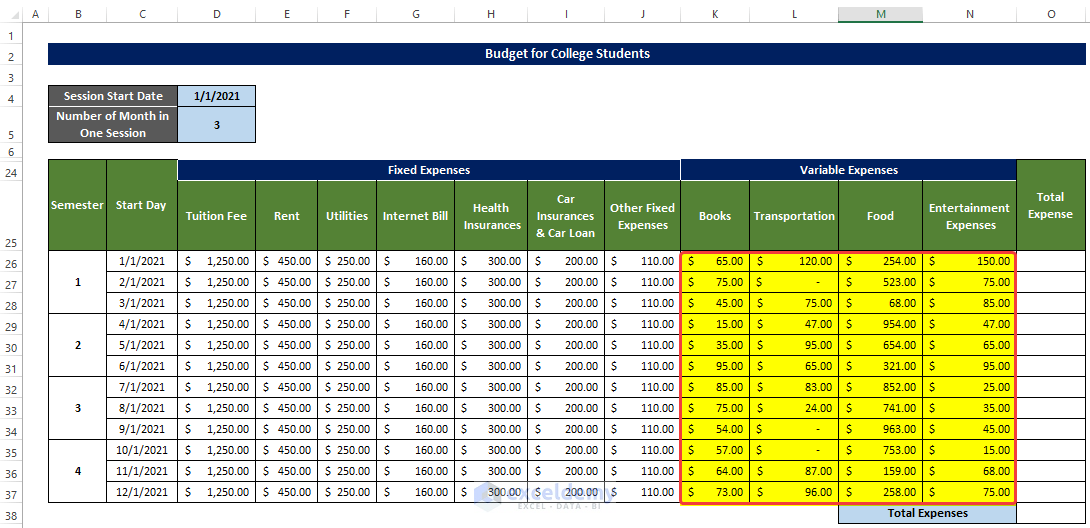

Step 6 – List Variable Expenses

- Include Books, Food, Entertainment and transportation (these expenses need to be updated every month).

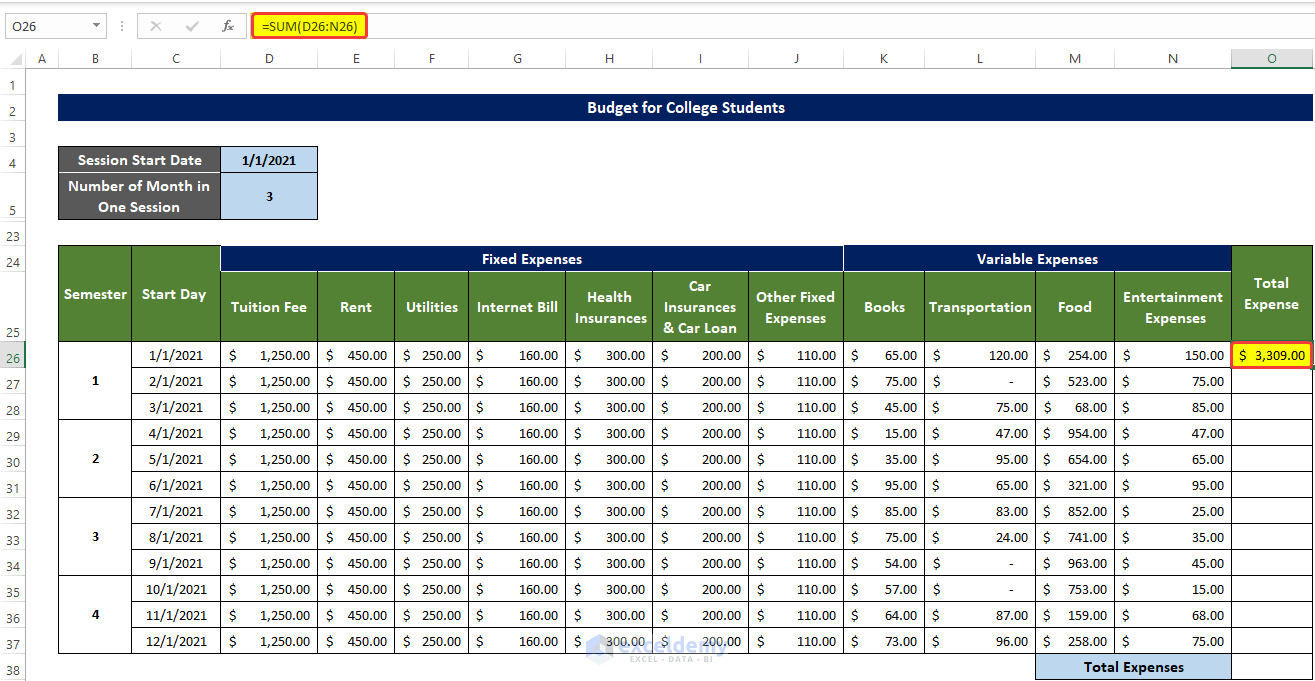

Step 7 – Calculate the Total Expenses

- Select O26 and enter the following formula:

=SUM(D26:N26)

This is the output.

- Drag down the Fill Handle to see the result in the rest of the cells.

This is the output.

- Select O38 and enter the following formula:

=SUM(O26:O37)

- This is the output.

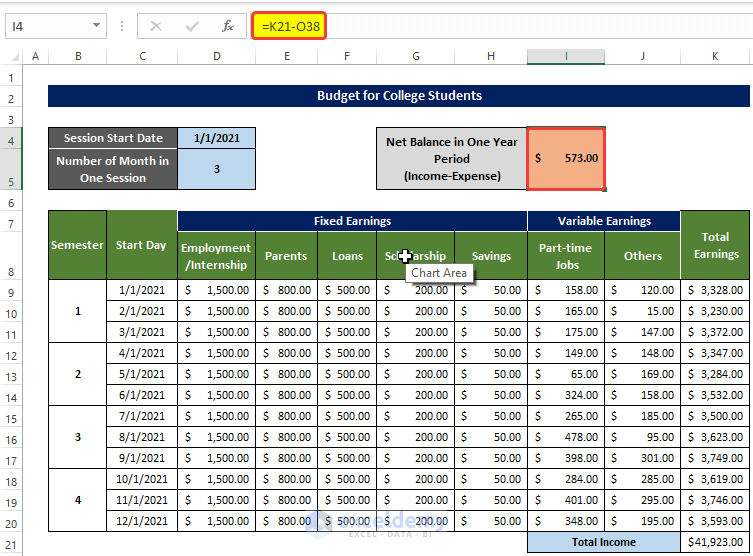

Step 8 – Calculate the Net Balance

- Selected I4 and enter the following formula:

=K21-O38

It Subtracts the Expenses from the Total Earnings.

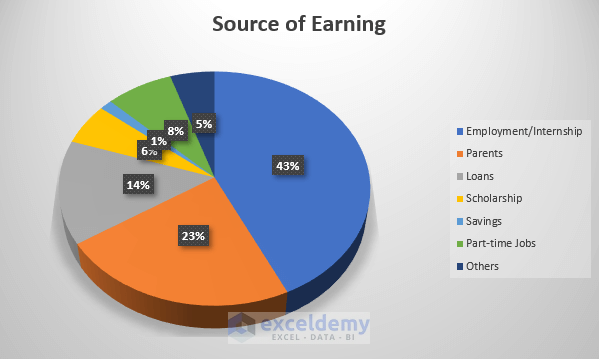

Step 9 – Generate the Final Budget with Charts

The PIe chart below showcases the income:

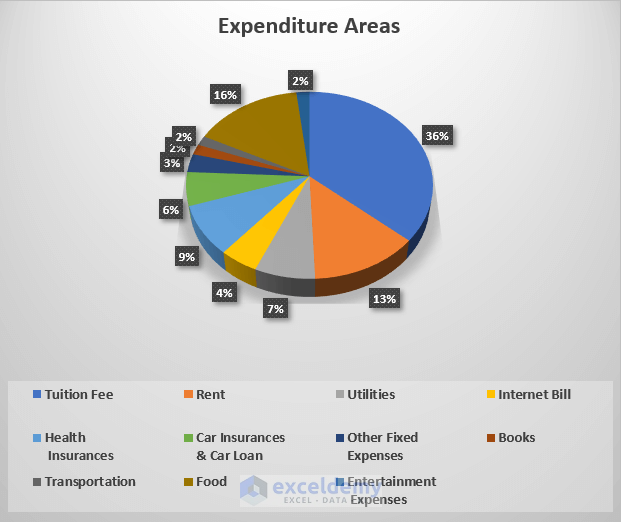

- The chart below showcases Expenses:

This is the final output:

Read More:How to Create a Personal Budget in Excel

Download the practice workbook.

Related Articles

- How to Make a Household Budget in Excel

- How to Make a Wedding Budget in Excel

- How to Make a Family Budget in Excel

<< Go Back To How to Create a Budget in Excel | Excel For Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!