The Accrued Interest is the payable or receivable interest on a loan or bond after a period of time.

Download the Excel Template

Download the Template.

Accrued Interest

The formula to calculate the accrued interest is:

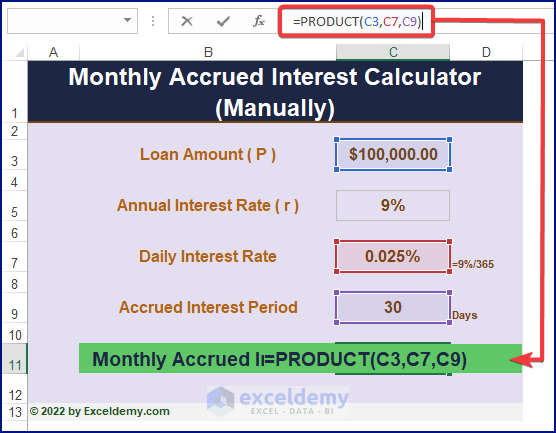

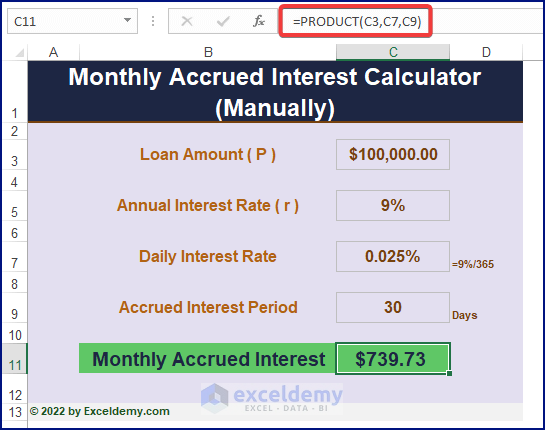

Method 1 – Applying the Accrued Interest Formula

Provide Loan Amount, Annual Interest Rate, and Accrued Interest Period to find the accrued interest amount.

- Enter the formula into any cell.

=PRODUCT(C3,C7,C9)

Formula Breakdown

- Loan Amount or Par Value = C3

- Yearly Interest = C7

- Period of Interest Accrued = C9

- Press ENTER to find the monthly accrued interest on bonds or loans.

Read More: How to Create FD Interest Calculator in Excel

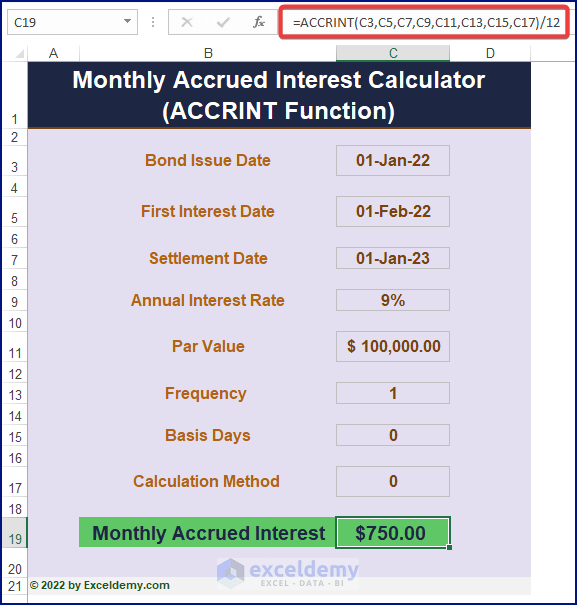

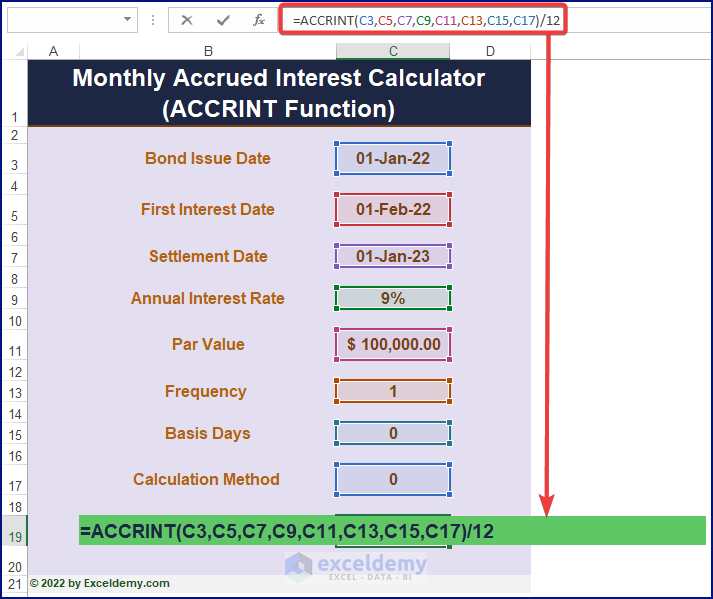

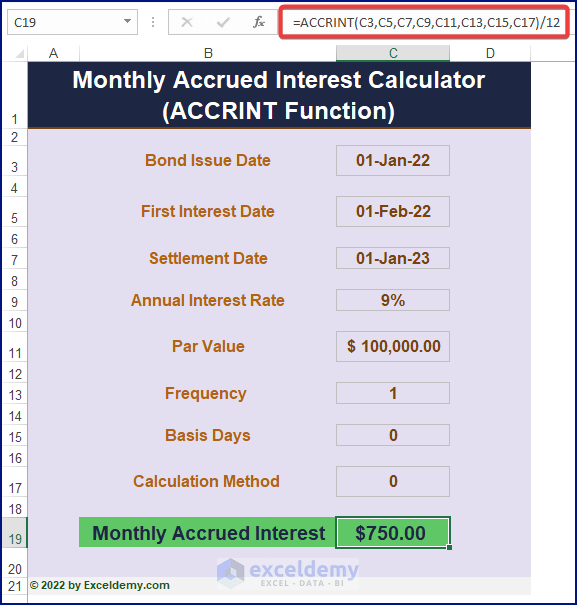

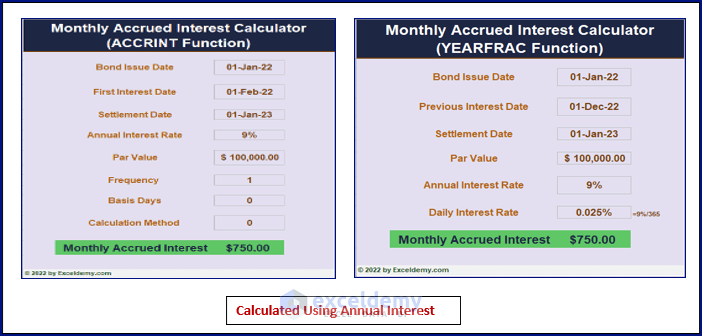

Method 2 – Using the ACCRINT Function

The syntax is:

=ACCRINT(issue, first_interest, settlement, rate, par, frequency, [basis], [calc_method])The Arguments

Issue: The date when a loan or bond is issued.

First_interest: The date of the first interest payment.

Settlement: The end date of the loan.

Rate: Annual or Yearly Interest rate.

Par: The loan amount.

Frequency: The annual number of loan payments. 1 for Annual, 2 for Semi-annual, and 4 for Quarterly payments.

Basis: The basis is set to 0 if the argument is omitted. [Optional]

Calculation_method: It’s either 0 or 1 (calculates accrued interest from the First_interest date to the Settlement date). [Optional]

- Use the formula in a blank cell.

=ACCRINT(C3,C5,C7,C9,C11,C13,C15,C17)/12

- Press ENTER to display the accrued interest.

Read More: How to Make TDS Interest Calculator in Excel

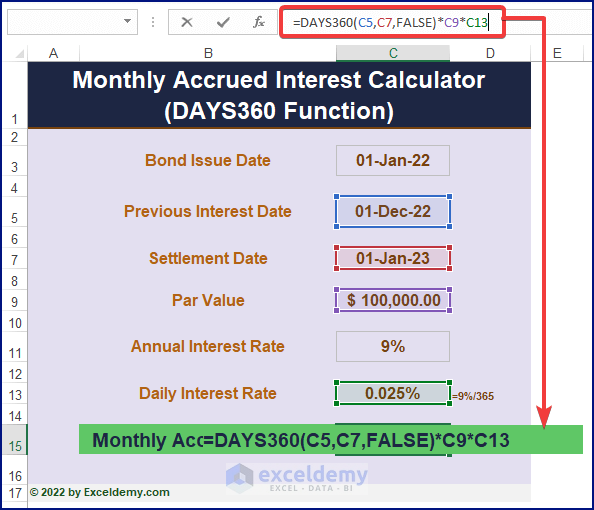

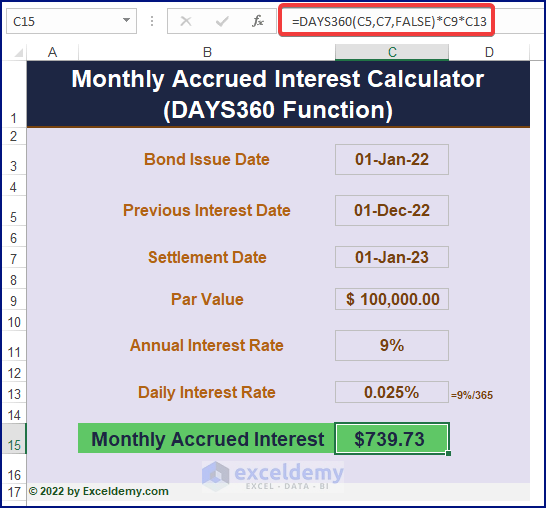

Method 3 – Counting Days Using the DAYS360 Function

The syntax is:

Days360(start_date,end_date,[method])Multiplying the outcome by the Daily Interest Rate and Par Value will return the monthly accrued interest. Make sure the difference between the two dates is one (1) month.

- Enter the formula to find the accrued interest.

=DAYS360(C5,C7,FALSE)*C9*C13

- Press ENTER to display the amount.

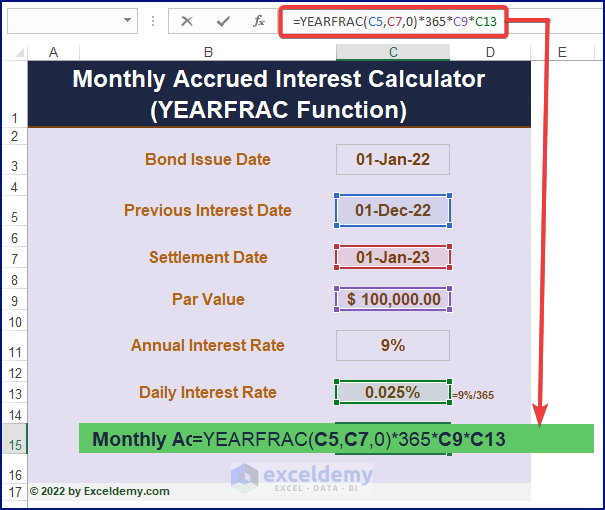

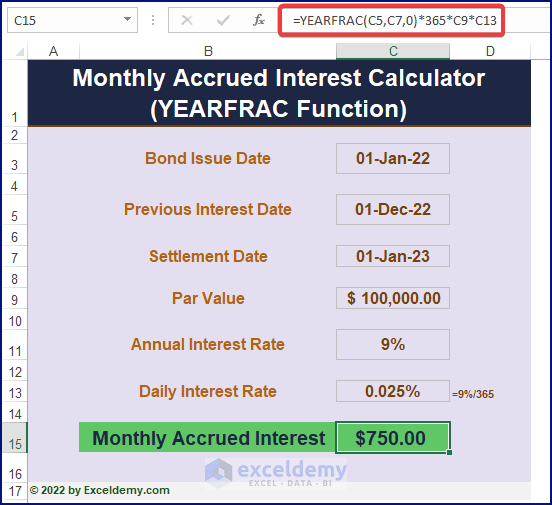

Method 4 – Finding the Year Fraction using the YEARFRAC Function

The syntax of the function is:

YearFrac(start_date, end_date, [basis])The returned value is multiplied by 365, Par Value, and Annual Rate to display the accrued interest. For the monthly accrued interest, the two dates must be one month apart.

- Enter the below formula in a cell.

=YEARFRAC(C5,C7,0)*365*C9*C13

- Press ENTER to display the accrued interest.

Read More: Create Late Payment Interest Calculator- Download for Free

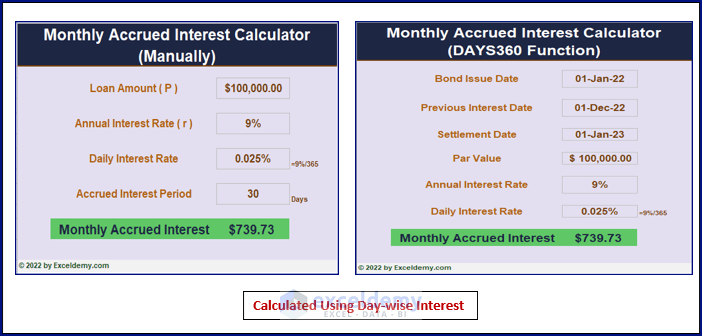

Cross-checking the Accrued Interest Value

Two different values are returned for the monthly accrued interest because two different approaches were used:

a. Daily Interest Rate

It takes the annual interest rate and divides it by 365. This result is multiplied by the Par Value, Daily Interest Rate and 30 (days in a month).

b. Annual Interest Rate

The ACCRINT formula calculates the annual accrued interest and, by dividing it by 12, returns the monthly accrued interest.

Read More: How to Create TDS Late Payment Interest Calculator in Excel

Related Articles

- Create a Post-Judgement Interest Calculator in Excel

- How to Create a Money Market Interest Calculator in Excel

- How to Generate GST Interest Calculator in Excel

- Make Service Tax Late Payment Interest Calculation in Excel

- Create a Simple Interest Loan Calculator with Excel Formula

<< Go Back to Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!