It is said that time is equally valued as money. This saying is profoundly true in the case of lending money or borrowing it. Especially, things get worse when the debtor cannot repay the amount to the defendant or the defendant claims unnecessary amounts from the debtor. All these things then go to judicial custody of that certain state or country. Therefore, the term Post-Judgement Interest comes to sort this case benefitting both sides. However, there are some determinants to calculate the post-judgment interest. Microsoft Excel has made this calculation easier for us. In this article, we will create a post-judgment interest calculator in Excel discussing 2 cases.

What Is Post-Judgement Interest?

Post-judgment interest is a type of interest that is calculated and paid by the debtor to the creditor. This interest amount is determined by the difference between the day of judgment and the day of payment.

It is a federal justice system to ensure that the creditor is not losing any cash due to the delayed payment. Also, it is introduced not to punish the debtor but pave a way like compensation to the victim with ease of payments.

Difference Between Pre-Judgement & Post-Judgement Interests

In general, the pre-judgment interest accumulates the amount between the date of filing the case and the day the court makes an order. Therefore, the creditor gets compensation for the loss during that time. Whereas, in the case of post-judgment interest the amount gets quite bigger than the other one. Because post-judgment is considered a longer length of time than pre-judgment. Therefore, it is wise to sort things out during the pre-judgment period to avoid more interest.

Step by Step Process to Create Post-Judgement Interest Calculator in Excel

To create the post-judgment interest calculator in excel we need to know the determinants first. They are as follows:

- Judgment Amount – the amount to pay for court affairs.

- Interest Rate – determined by the Federal Authority.

- Judgment Date – date of judicial decision.

- Writ Date – date of actual payment.

- Interim Days – days between the judgment date and the writ date.

So far, as we know the determinants, let us hop into these simple steps to create a post-judgment interest calculator.

- First, multiply the judgment amount by the post-judgment interest rate.

- Then, divide the result from step one by 365 days per year.

- Lastly, multiply the result from step two by the interim days.

Therefore, we get this mathematical formula to create a post-judgment interest calculator.

2 Cases of Using Post-Judgement Interest Calculator in Excel

The post-judgment interest calculation can result in two scenarios. Either the creditor gets the full debt amount at a time or it is paid in several installments. Based on these cases, the formula gets slightly different from one another. Let us see the calculations based on a case study.

1. Excel Post-Judgement Interest Calculator with Full Payment

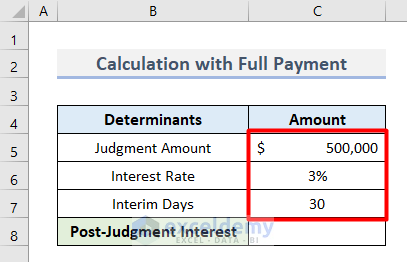

Imagine an investment company that did not receive its expected cash from a dealer for a treasury bill bought on the market which had a maturity of one year. The amount the company should receive was $500,000 which should have been paid 30 days ago. The time of payment was in July. Therefore, based on the Federal Reserve decisions, the interest rate should be 3% as it is during the third quarter.

Now follow these simple steps to create the post-judgment calculator in Excel.

- First, insert the values of determinants in the range C5:C7.

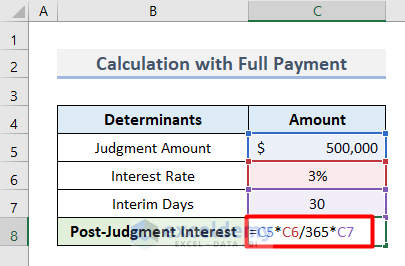

- Now, apply this formula in cell C8.

=C5*C6/365*C7

- Lastly, press Enter.

- That’s it, you will get the post-judgment interest amount to be paid to the investment company.

Read More: Create a Simple Interest Loan Calculator with Excel Formula

2. Post-Judgement Interest Calculator with Partial Payment in Excel

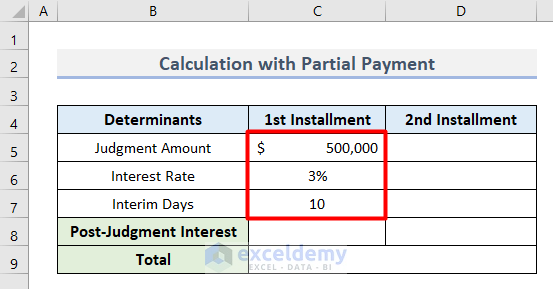

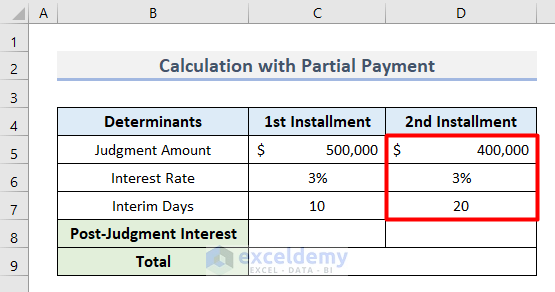

Now, let us consider the same scenario that we discussed earlier. But this time. The debtor paid $100,000 within 10 days of judgment. After that, paid the rest $400,000 in the following 20 days. So we have to consider both these installments to create the post-judgment interest calculator. Let’s see how to do this.

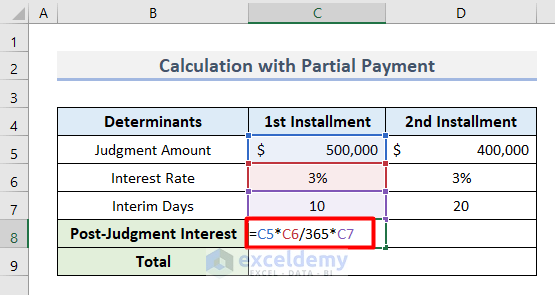

- First, insert the values of determinants for the 1st installment in the cell range C5:C7.

- Then, insert 2nd installment values in the range D5:D7.

- Now, let us calculate the post-judgment interest for the 1st installment with this formula in cell C8 and press Enter.

=C5*C6/365*C7

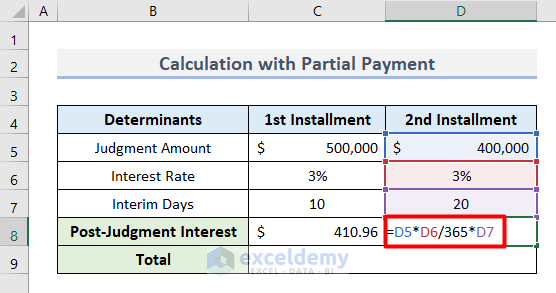

- Afterward, type this formula in cell D8 and hit Enter to find the post-judgment interest amount for the 2nd installment.

=D5*D6/365*D7

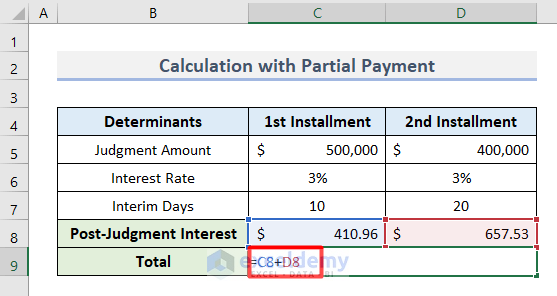

- Lastly, we will combine these two amounts with this formula in cell C9.

=C8+D8

- Finally, press Enter.

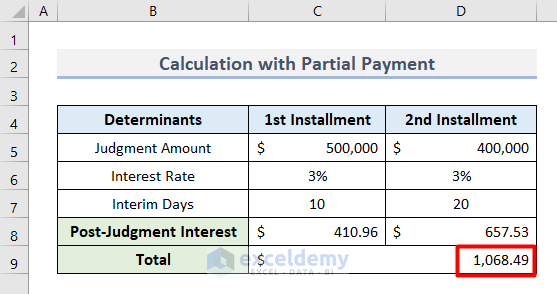

- That’s it, you will find the total amount of post-judgment interest for partial payment.

Read More: Create Late Payment Interest Calculator- Download for Free

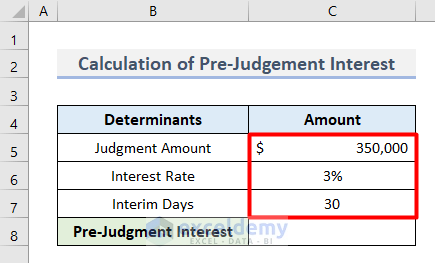

How to Calculate Pre-Judgement Interest in Excel

As we have covered the process to create the post-judgment interest calculator, let us know a bit about pre-judgment interest calculation as well. To illustrate the process, let us consider the similar scenario that we discussed above. But in this case, we will take $350,000 as the judgment amount. Because in the case of pre-judgment interest we do not consider the in costs and judgment interest. Now follow the steps below.

- First, insert the determinant values in the cell range C5:C7.

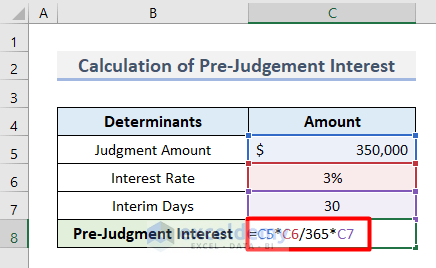

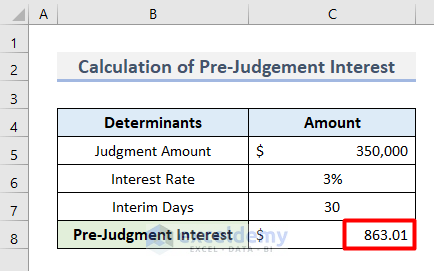

- Then, type this formula in cell C8.

=C5*C6/365*C7

- Finally, hit Enter and you will get the pre-judgment interest amount.

Read More: Make Service Tax Late Payment Interest Calculation in Excel

Download Practice Workbook

Download the worksheet and practice with your required values.

Conclusion

In this article, I tried to cover every detail to create a post-judgment interest calculator in excel with 2 cases. Also discussed calculating pre-judgment interest. Let us know your feedback in the comments section.

Further Readings

- How to Create an Accrued interest calculator in excel

- Create a Monthly Accrued Interest Calculator in Excel

- How to Create FD Interest Calculator in Excel

- How to Make TDS Interest Calculator in Excel

- Create TDS Late Payment Interest Calculator in Excel

- How to Create a Money Market Interest Calculator in Excel

- How to Generate GST Interest Calculator in Excel

<< Go Back to Interest Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!

How would you calculate interest if the judgement was turned into a garnishment?

Hello,

Thanks for reaching out to us.

First, remember that rules and instructions for interest calculation after garnishment order vary among countries and states. Next, post-judgment interest accrues only on the unpaid balance of the judgment.

However, to calculate interest if the judgment was turned into a garnishment, you can follow the steps below.

1. Take your judgment amount and deduct the amount of garnishment.

2. Multiply it by your post-judgment rate (%).

3. Take the total and divide it by 365 (the number of days in a year).

4. With the amount of post-judgment interest per day (in step 3), multiply it by the number of days from your date of judgment to the date you file your execution.

Simply, use the following formula to calculate interest if the judgment was turned into a garnishment:

Interest after Garnishment = (Judgment Amount – Garnished Amount) ( Interest Rate / 365) Interim Days

Thanks again for your thoughtful comments, especially the points you made about garnishment. It adds valuable perspective to our discussion.

Regards,

Abdullah Al Masud,

ExcelDemy Team