Excel is the most widely used tool for dealing with massive datasets. We can perform tasks of multiple dimensions in Excel. I will show you how to create a real estate cash flow model in Excel in this article.

Introduction to Cash Flow Statement

A cash flow statement is a financial statement that describes the inflows and outflows of cash over a certain period for a specific organization or company. It usually shows how any change in the balance sheet affects the cash and cash equivalents.

All the inflows a company receives while operating are described in that statement and all the corresponding expenses are also considered throughout a specific period.

The statement provides all the data to visualize the overall profit or loss a company is making. Remarkably, the net amount of cash at the end of the concerning time is the beginning balance for the next period. So, from the statement, the company gets the idea of what approach should be made to overcome the loss and what change should be made to increase the cash every time it runs the operation.

Now, I will discuss how to create a real estate cash flow model in Excel. I have divided the entire process into 8 steps. Let’s see these steps one by one.

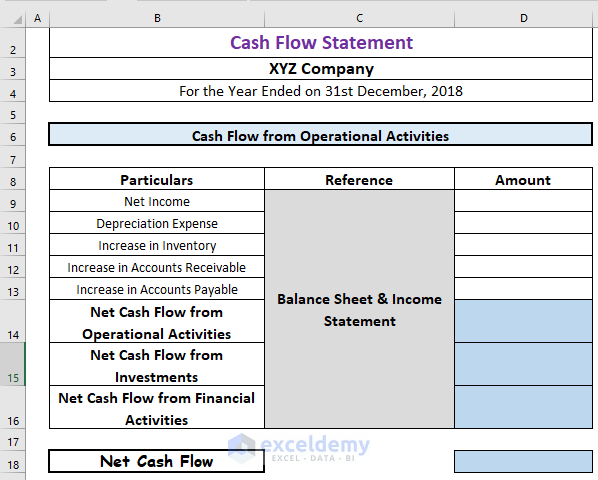

Step 1: Preparing the Required Format to Create a Real Estate Cash Flow Model

The first step is to prepare a format of the cash flow statement.

This is a cash flow statement format. The amounts will be calculated from the balance sheet and the income statement of the company.

Read More: How to Create Investment Property Cash Flow Calculator in Excel

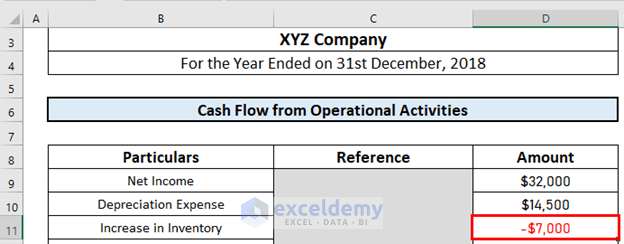

Step 2: Adjusting Depreciation Expense

Now, I will put the amounts one by one. These values will come from financial statements like the balance sheet and the income statement. But here, to keep things simple, I am going to use some random values.

First of all, we will consider the operational activities.

Let’s assume that the net income is $32000 and the depreciation expense is $14,500.

Read More: How to Create Cash Flow Projection Format in Excel

Step 3: Measuring Change in Inventory

Now comes the change in inventory. The increase in inventory is $7,000. Since inventory is an asset, an increase in inventory will outflow the cash. So we have to use a negative sign here.

Read More: How to Create Cash Flow Projection for 12 Months in Excel

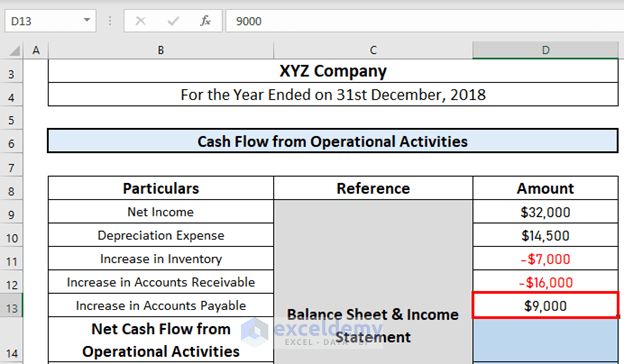

Step 4: Adjusting Accounts Receivable

Now, we have to adjust the accounts receivable. Let’s assume an increase of $16,000. Similar to inventory, accounts receivable are an asset. So, an increase in accounts receivable will outflow the cash.

Step 5: Calculating Change in Accounts Payable

Next, I will calculate the change in accounts payable. This is a liability. That means an increase in accounts payable will increase the cash flow.

Let’s further assume that the increase is $9,000.

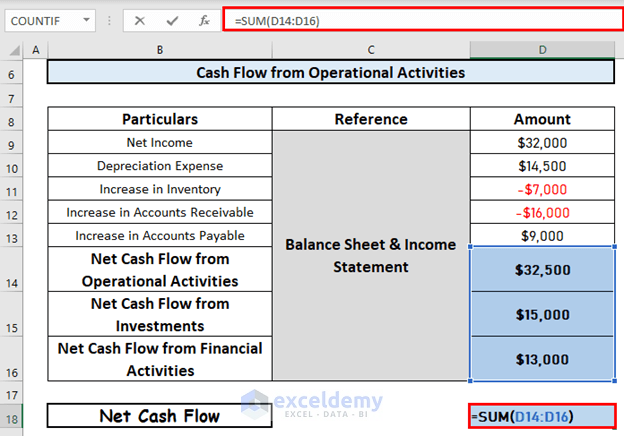

Step 6: Calculating Net Cash Flow from Operational Activities

This time, I will calculate the net cash flow from operational activities. For this, I will use the SUM function.

- Go to D14 and write down the following formula

=SUM(D9:D13)

- After that, press ENTER to get the output.

Step 7: Measuring Cash Flow from Investment and Financial Activities

The next step is to measure the cash flow from the investing and financial activities. This will include all the activities related to finance and investment. These activities vary depending on the nature of the industry and the organization.

Let’s assume that the cash flow from the investing activities is $15,000 and the cash flow from the financial activities is $13,000

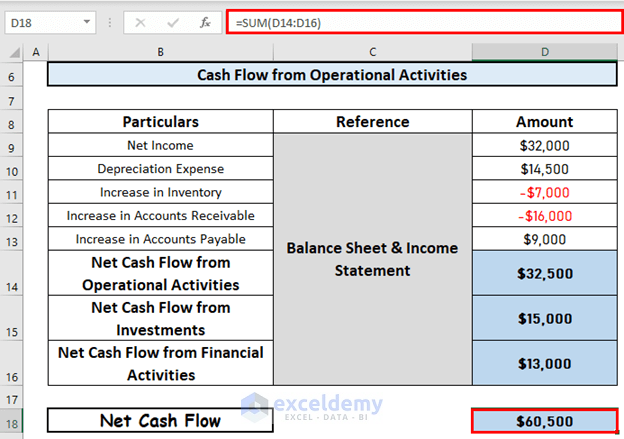

Step 8: Calculating Cash Flow

Finally, I will calculate the net cash flow of the organization for the specific period. This will be the arithmetic sum of the

- Net cash flow from the operating activities.

- Net cash flow from the investing activities.

- Net cash flow from the financial activities.

To calculate it,

- Go to D18 and write down the following formula

=SUM(D14:D16)

- Then, press ENTER to get the output.

Things to Remember

- If an asset increases, cash outflow occurs.

- The information used in cash flow statements comes from the balance sheet and income statements.

Download Practice Workbook

Download this workbook and practice while going through the article.

Conclusion

I have explained how to create a real estate cash flow model in Excel in this article. I hope it helps everyone. If you have any suggestions, ideas, or feedback, please feel free to comment below.

Related Articles

- How to Create a Retirement Cash Flow Calculator in Excel

- How to Make a Restaurant Cash Flow Statement in Excel

<< Go Back to Cash Flow Template | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!