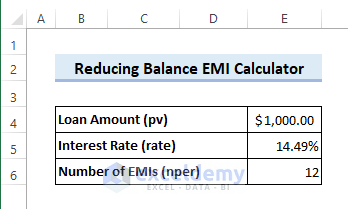

Assume you have secured a loan of $1,000 at the annual rate of 14.49%. You can repay the loan in 12 equated monthly installments (EMI).

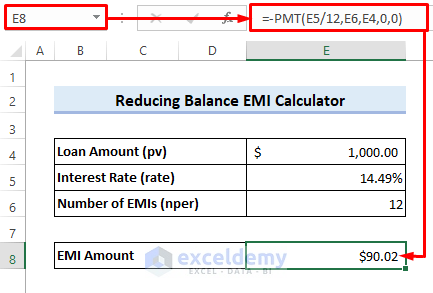

Step 1 – Calculate EMI Amount with PMT Function

- Enter the following formula in cell E8 to estimate the EMI amount. Here the PMT function returns negative numbers. Therefore a negative sign has been used at the beginning of the formula.

=-PMT(E5/12,E6,E4,0,0)

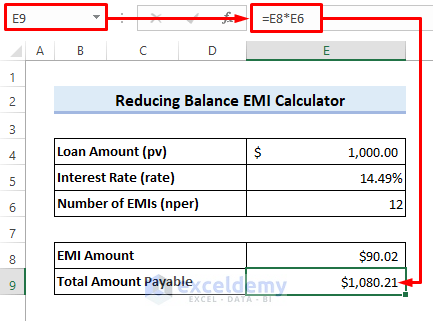

Step 2 – Estimate Total Amount Payable

- Enter the following formula in cell E9 to calculate the total payable amount:

=E8*E6

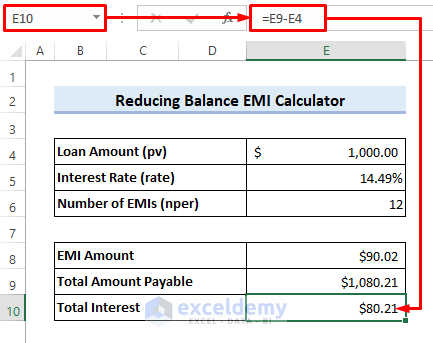

Step 3 – Calculate Total Interest

- Enter the following formula in cell E10 to get the total interest:

=E9-E4

Read More: Home Loan EMI Calculator with Reducing Balance in Excel

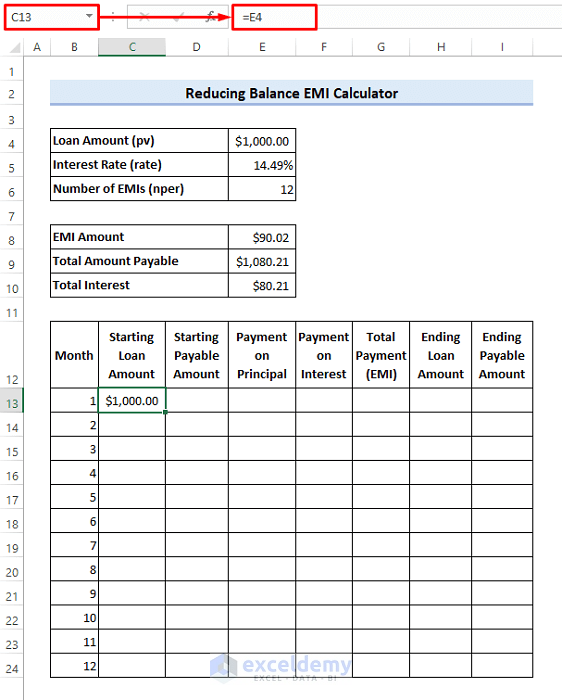

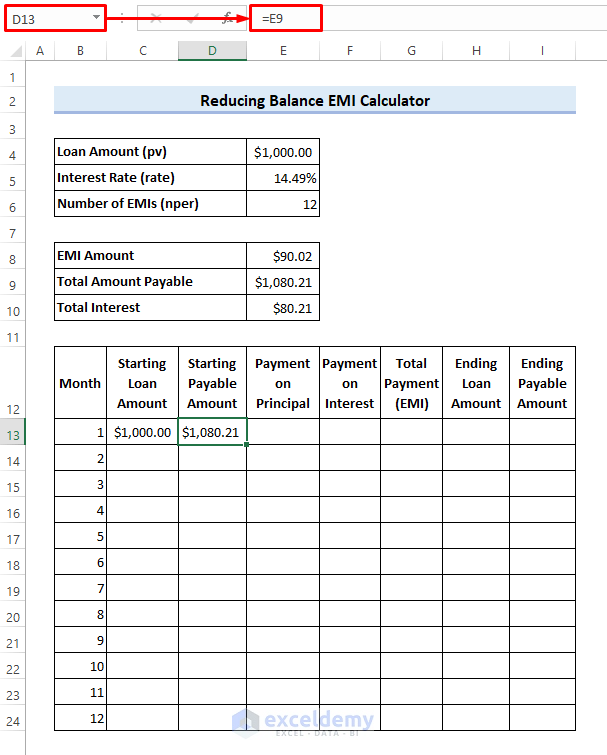

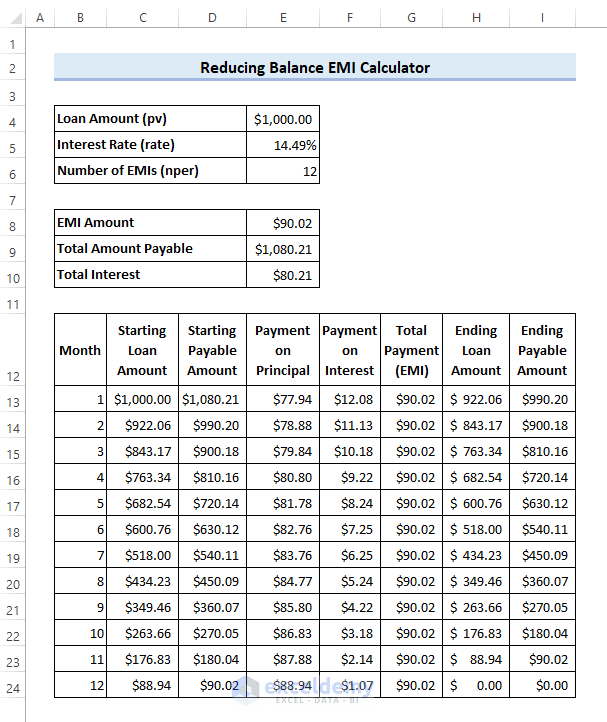

Step 4 – Create a Reducing Balance EMI Table

- Input 1 to 12 in cells B13 to B24, respectively.

- Insert the following formula in cell C13:

=E4- Enter the following formula in cell D13:

=E9

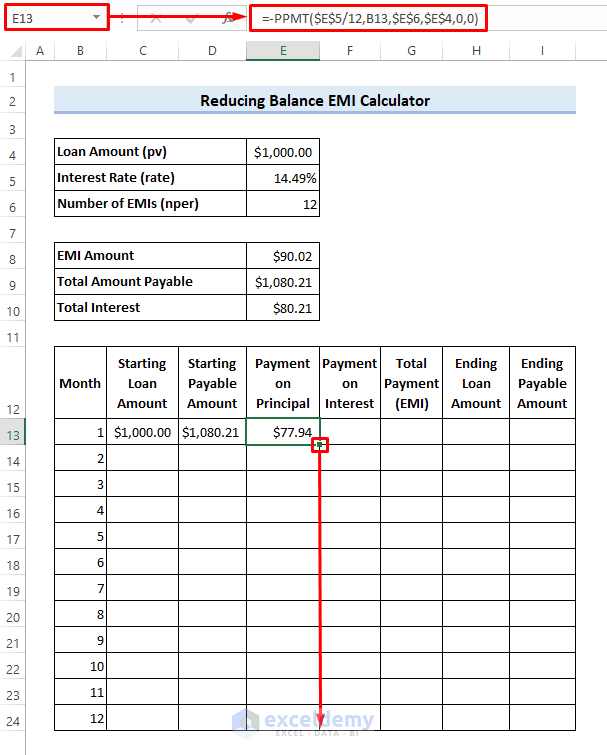

- Apply the following formula in cell E13 to calculate the monthly payment need to be made on the principal loan amount.

=-PPMT($E$5/12,B13,$E$6,$E$4,0,0)- Drag the Fill Handle icon down to cell E24. Here, the PPMT function also returns negative values as it considers the payment as cash outflow.

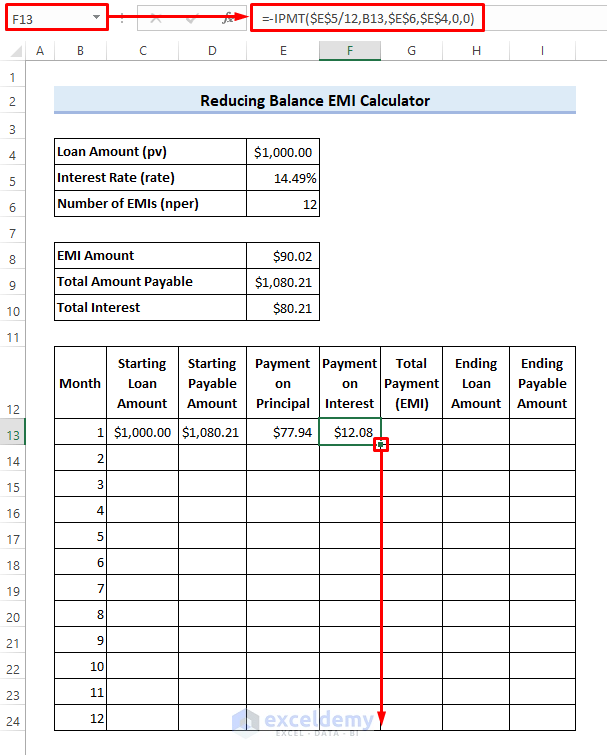

- Enter the following formula in cell F13 to calculate the monthly payment need to be made on the interest:

- Drag the Fill Handle icon down to cell F24. Here, the IPMT function also considers the payments as cash outflow. So a negative sign is used at the beginning to avoid a negative result.

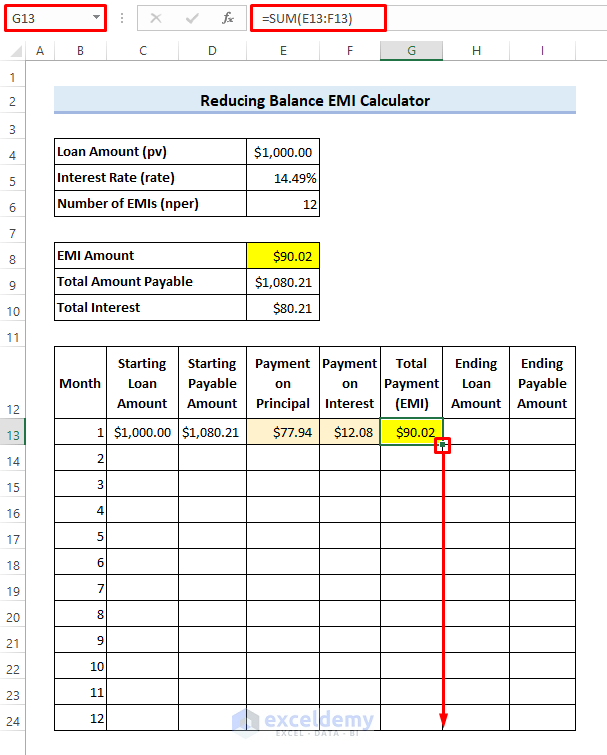

- Enter the following formula in cell G13 to calculate the total monthly payment. You can see that the result is equal to the EMI amount.

=SUM(E13:F13)

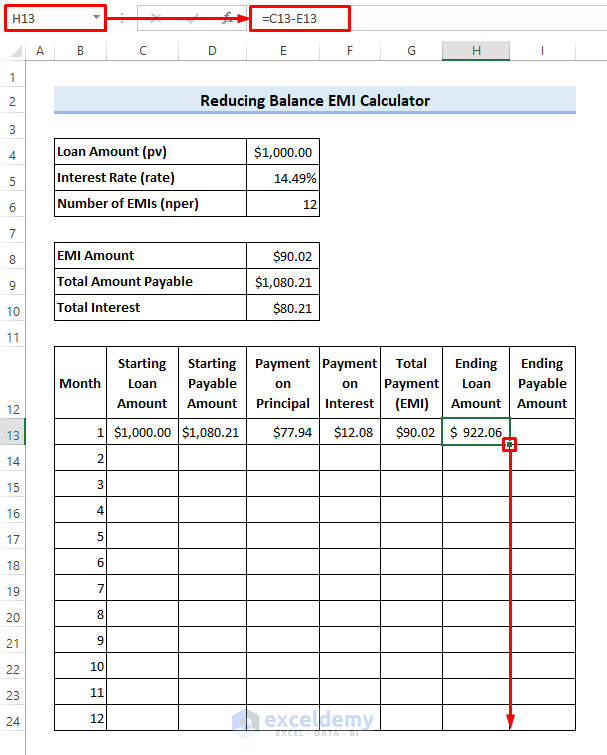

- Enter the following formula in cell H13 to calculate the remaining loan balance at the end of the month, then drag the Fill Handle icon down to cell H24.

=C13-E13

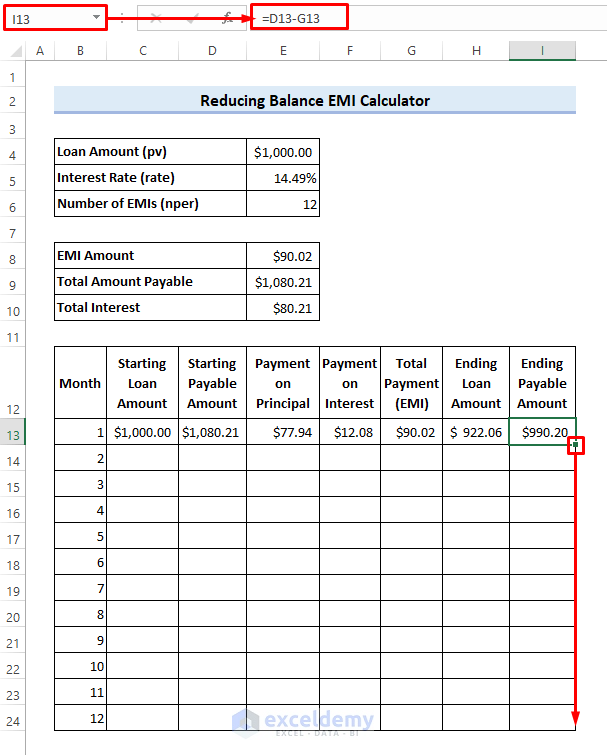

- Enter the following formula in cell I13 to calculate the total amount payable at the end of the month and drag the Fill Handle icon down to cell I24.

=D13-G13

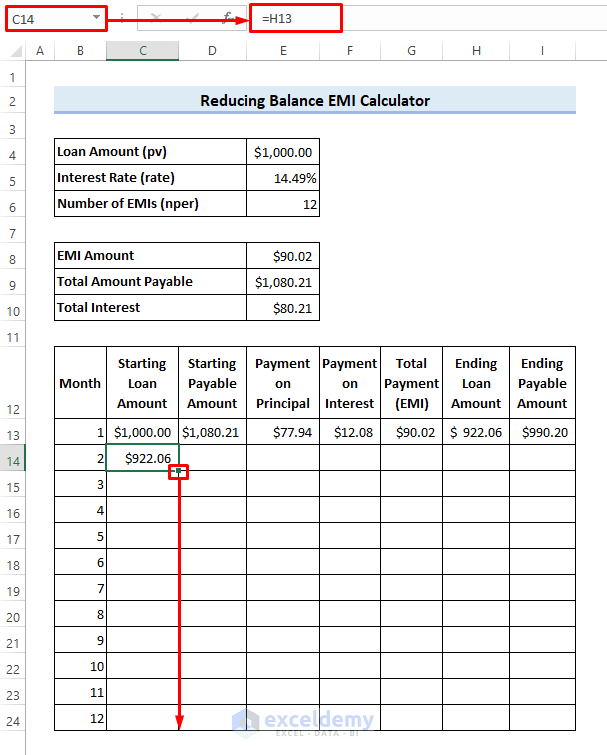

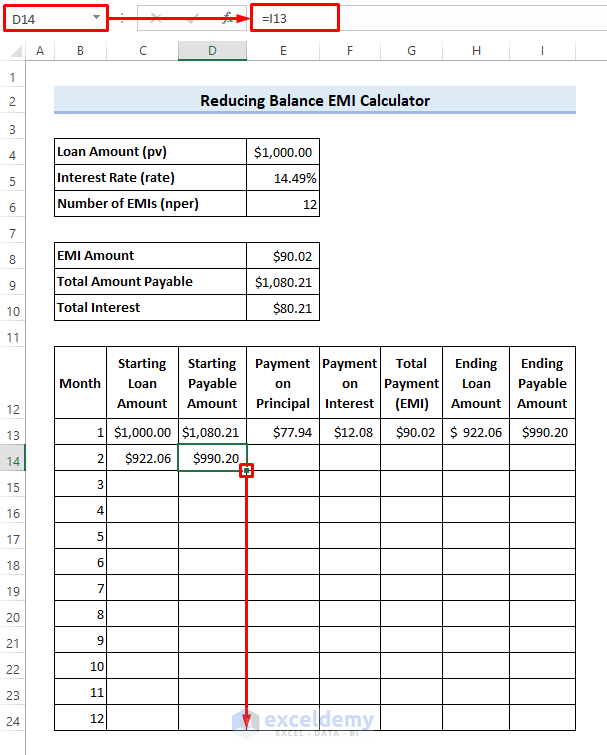

- Enter the following formula in cell C14 and drag the Fill Handle icon down to cell C24:

=H13

- Use the following formula in cell D14 and drag the Fill Handle icon down to cell D24.

=I13

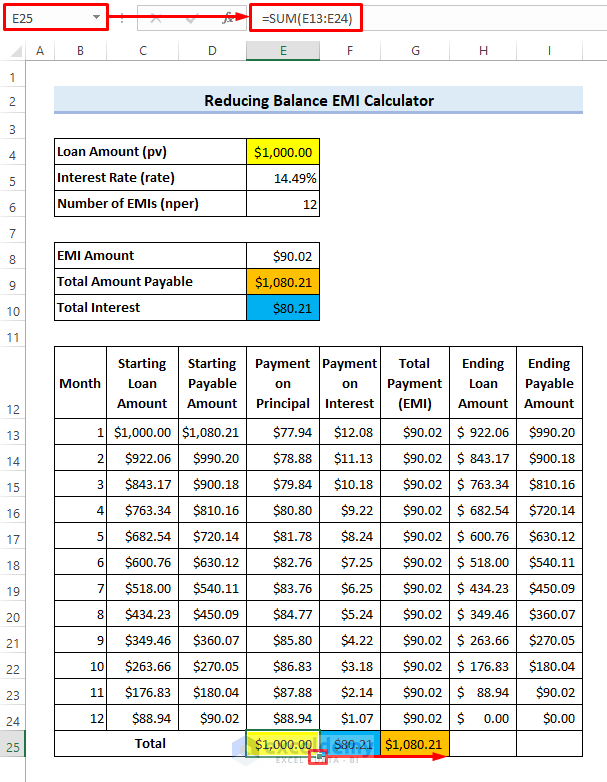

Step 5 – Finalize the EMI Calculator Sheet

- You will see the following result.

- Enter the following formula in cell E25 to verify the results.

=SUM(E13:E24)- Drag the Fill Handle icon to cell G25.

- You will see that the total payment made on the loan, the total payment made on interest, and the total amount payable match the results calculated earlier.

Note:

Don’t forget to use a negative sign before the formulas containing the financial function to avoid any negative results.

Read More: How to Create Reverse EMI Calculator in Excel

Download the Sample Workbook

Related Articles

- Personal Loan EMI Calculator Excel Format

- SBI Home Loan EMI Calculator in Excel Sheet with Prepayment Option

- Create Home Loan EMI Calculator in Excel Sheet with Prepayment Option

- EMI Calculator with Prepayment Option in Excel Sheet

<< Go Back to EMI Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!