What Is an Excel Transport Bill Format?

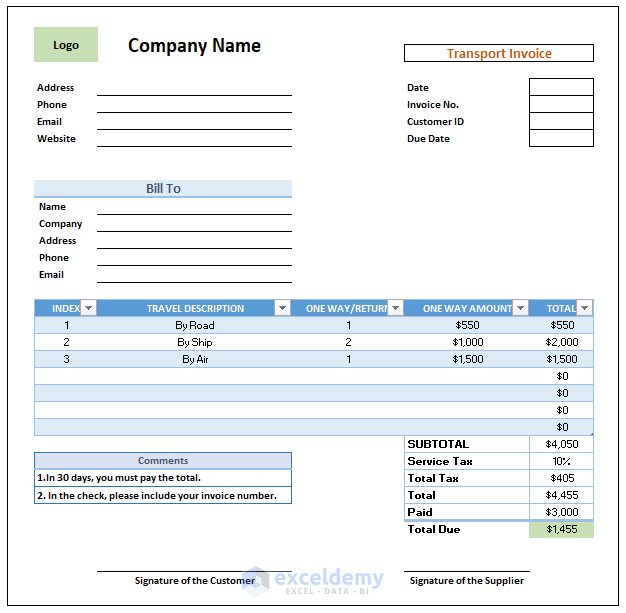

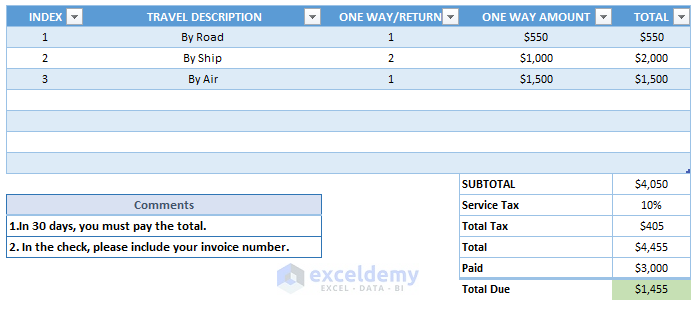

A transport bill is a type of receipt provided by a transport service. The overview of a bill template is in the image below.

Main Details of Transport Bill Format in Excel

- Company Name

- Customer’s Information

- Transport Invoice

- Description of Services

- SUBTOTAL Calculation

4 Steps of Creating a Transport Bill Format in Excel

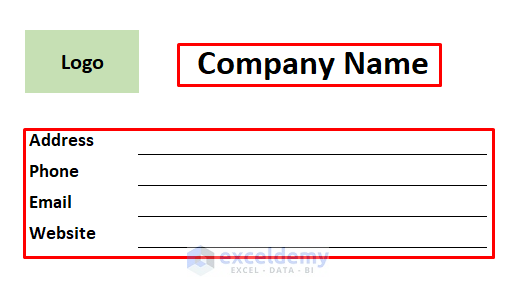

Step 1 – Input the Details of a Company

- Create the segment for Company Name. This section will consist of the Address, Phone, Email, and Website of the company.

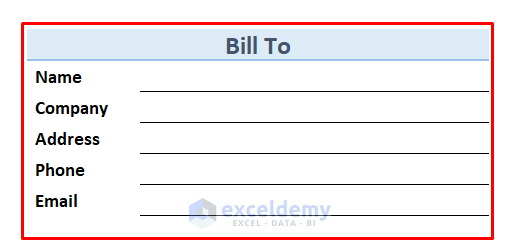

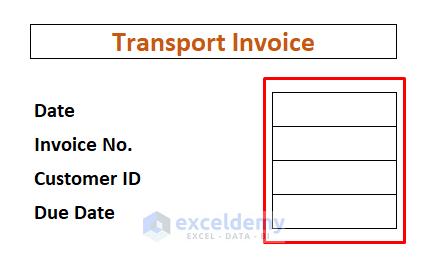

Step 2 – Customer Details in the Transport Bill Format

- Make the Billing section. Input the customer’s details in this section, which will contain the Name, Company, Address, Phone, Email, etc.

- Add the Transport Invoice section. This section contains bookkeeping information.

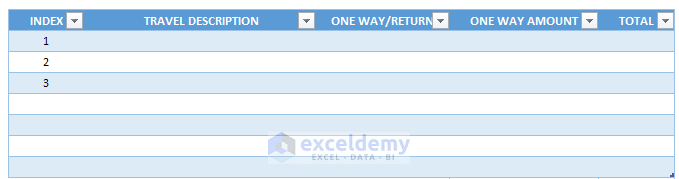

Step 3 – Describe the Services Provided

- We can add different transportation methods in the TRAVEL DESCRIPTION section.

- We have added a numerical value for determining whether the journey is one way or two-way, which correlates to the number of times the cost will be added to the total.

- ONE WAY AMOUNT and the TOTAL transportation cost will be prices.

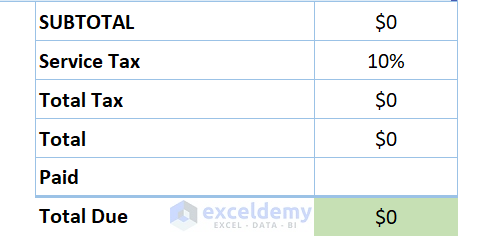

Step 4 – Calculate the SUBTOTAL

- This section contains the Service Tax, Total, and Paid amount.

- We get the information for the Total Due amount from this section.

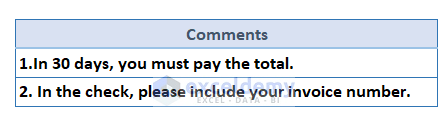

Additional Segments

- Add the Comments section.

- Insert the section to input signatures for suppliers and customers. When the sheet is printed or saved as a PDF, the signatures can be filled in.

Demo Calculations of the Transport Bill Format in Excel

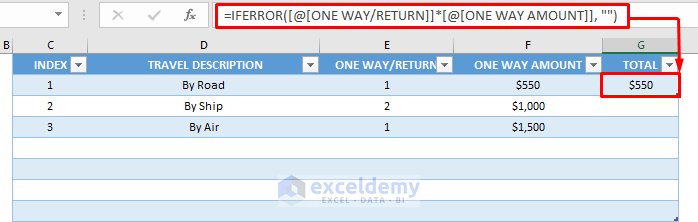

- Insert some values for the transportation details.

- For ONE WAY/RETURN, insert 1 for one way trip and 2 for a return trip.

- Insert the following formula in the first cell of the TOTAL column for calculating the total transportation cost By Road.

=IFERROR([@[ONE WAY/RETURN]]*[@[ONE WAY AMOUNT]], "")- Add the corresponding formula for the other cells in the Total column.

- We get the total transportation cost in the SUBTOTAL section.

- Add the Service Tax to the SUBTOTAL amount to get the actual transportation cost.

- Subtract the paid amount from TOTAL to get the amount of Total Due.

How Does the Formula Work?

- [@[ONE WAY/RETURN]]: This part takes the value 1 under the column ONE WAY/RETURN.

- [@[ONE WAY AMOUNT]]: This part takes the value $550 under the column ONE WAY AMOUNT.

- IFERROR([@[ONE WAY/RETURN]]*[@[ONE WAY AMOUNT]], ” “): Returns the product of ONE WAY/RETURN and ONE WAY AMOUNT. It will return blank if any we any invalid value.

Download the Template