Good day.

Trusting you are well.

Can you please help me with a formula that will calculate tax from the attached table.

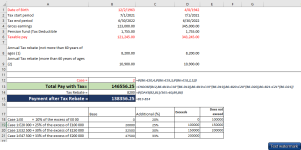

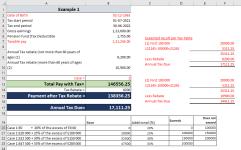

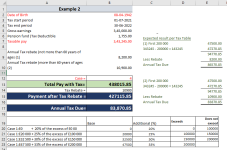

The expected tax deduction is on line 24 of the spreadsheet. However, the formula is supposed to be linked on the table below the example.

The rebate should be dependant on the age. if you are less than 60 years, the rebate is 8200 and if you are above 60 the rebate is 10900. The formula must be able to select the applicable rebate according to age.

Trusting you are well.

Can you please help me with a formula that will calculate tax from the attached table.

The expected tax deduction is on line 24 of the spreadsheet. However, the formula is supposed to be linked on the table below the example.

The rebate should be dependant on the age. if you are less than 60 years, the rebate is 8200 and if you are above 60 the rebate is 10900. The formula must be able to select the applicable rebate according to age.