You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[Solved] Pricing a bond

- Thread starter Narg

- Start date

The bond matures in 2037 and is callableI have a bond with a floating coupon off sofr. I did to discount the cash flows using a BBB muni curve and a liquidity premium. Since each cash flow is different, I don’t know how to do it. Can any of you help me with the formulae’s or an excel template ? Thanks

Dear NargI have a bond with a floating coupon off sofr. I did to discount the cash flows using a BBB muni curve and a liquidity premium. Since each cash flow is different, I don’t know how to do it. Can any of you help me with the formulae’s or an excel template ? Thanks

Thanks for reaching out and sharing your problem. We have reviewed your requirements. Hopefully, we will develop some helpful formulas; if possible, we will try to provide you with templates.

When we are done, we will let you know. Good luck.

Regards

Lutfor Rahman Shimanto

ExcelDemy

Dear NargI have a bond with a floating coupon off sofr. I did to discount the cash flows using a BBB muni curve and a liquidity premium. Since each cash flow is different, I don’t know how to do it. Can any of you help me with the formulae’s or an excel template ? Thanks

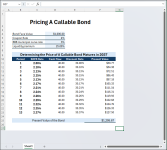

Thanks for your patience! The following Excel file provides a concise overview of the steps needed to use the bond pricing template.

To use the bond pricing template effectively, follow the steps below:

- Input bond details: face value, coupon rate, and maturity date.

- Enter SOFR rate, BBmunicurve rate, and liquidity premium.

- The calculation will automatically be calculated to get the bond price.

- Review results and adjust inputs if needed.

I hope this guide helps you navigate and utilize the bond pricing template effectively. Feel free to reach out if you have any further questions or need additional assistance with your analysis.

Regards

ExcelDemy